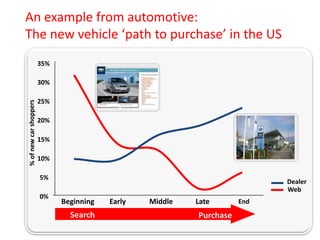

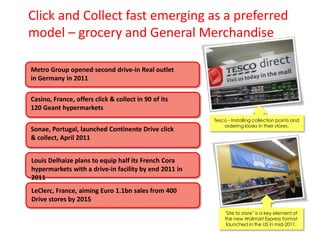

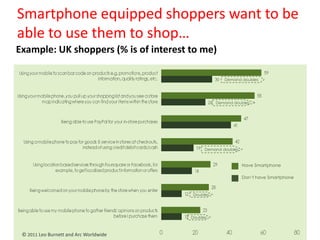

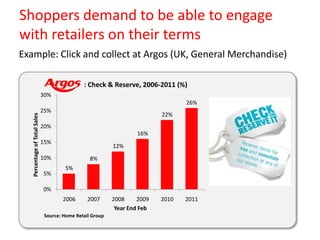

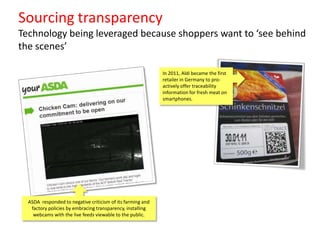

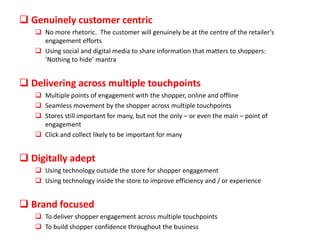

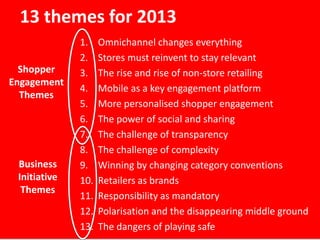

The document outlines 13 themes for retailers in 2013, focusing on omnichannel retailing, reinventing physical stores, the rise of non-store formats, using mobile and social media for personalized engagement, managing transparency and complexity across channels, developing strong retailer brands, addressing societal responsibilities, and the risks of not adapting to changes in the retail environment. Key themes include leveraging data and technology to provide a seamless shopping experience across online and offline channels, reimagining physical stores, harnessing social sharing, and delivering more customized and localized experiences.