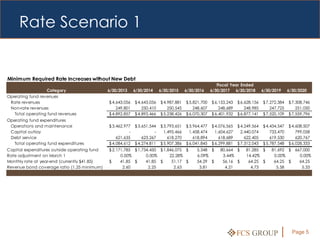

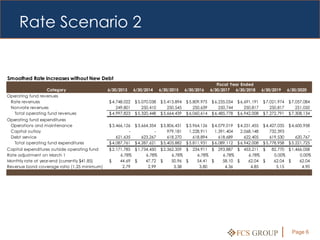

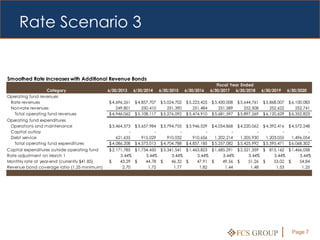

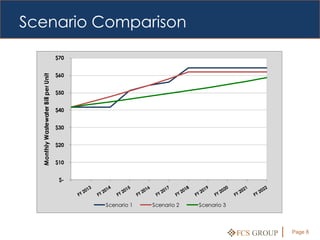

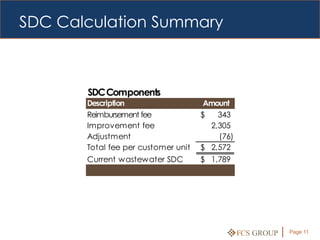

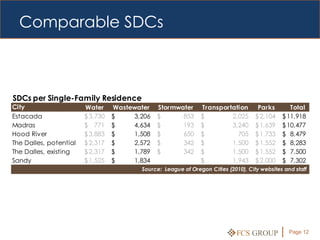

The document discusses financial planning for the City of The Dalles wastewater system. It presents three rate scenarios to generate sufficient revenue through 2023. Scenario 1 requires large periodic rate increases. Scenario 2 smooths increases to 6.78% annually. Scenario 3 adds debt and increases rates 3.44% annually. It also recommends increasing system development charges from $1,789 to $2,572 per customer to fund capital improvements from new development.