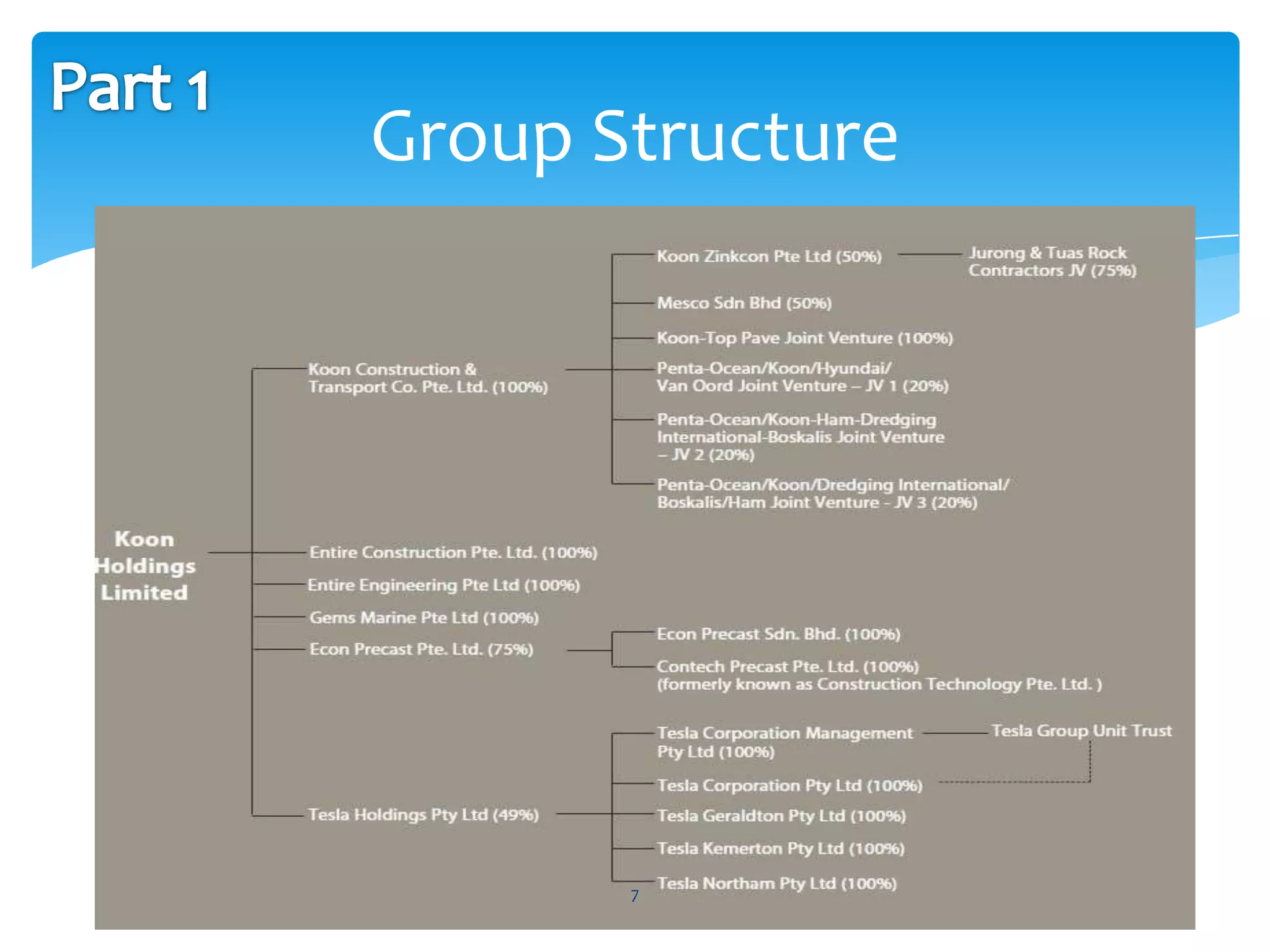

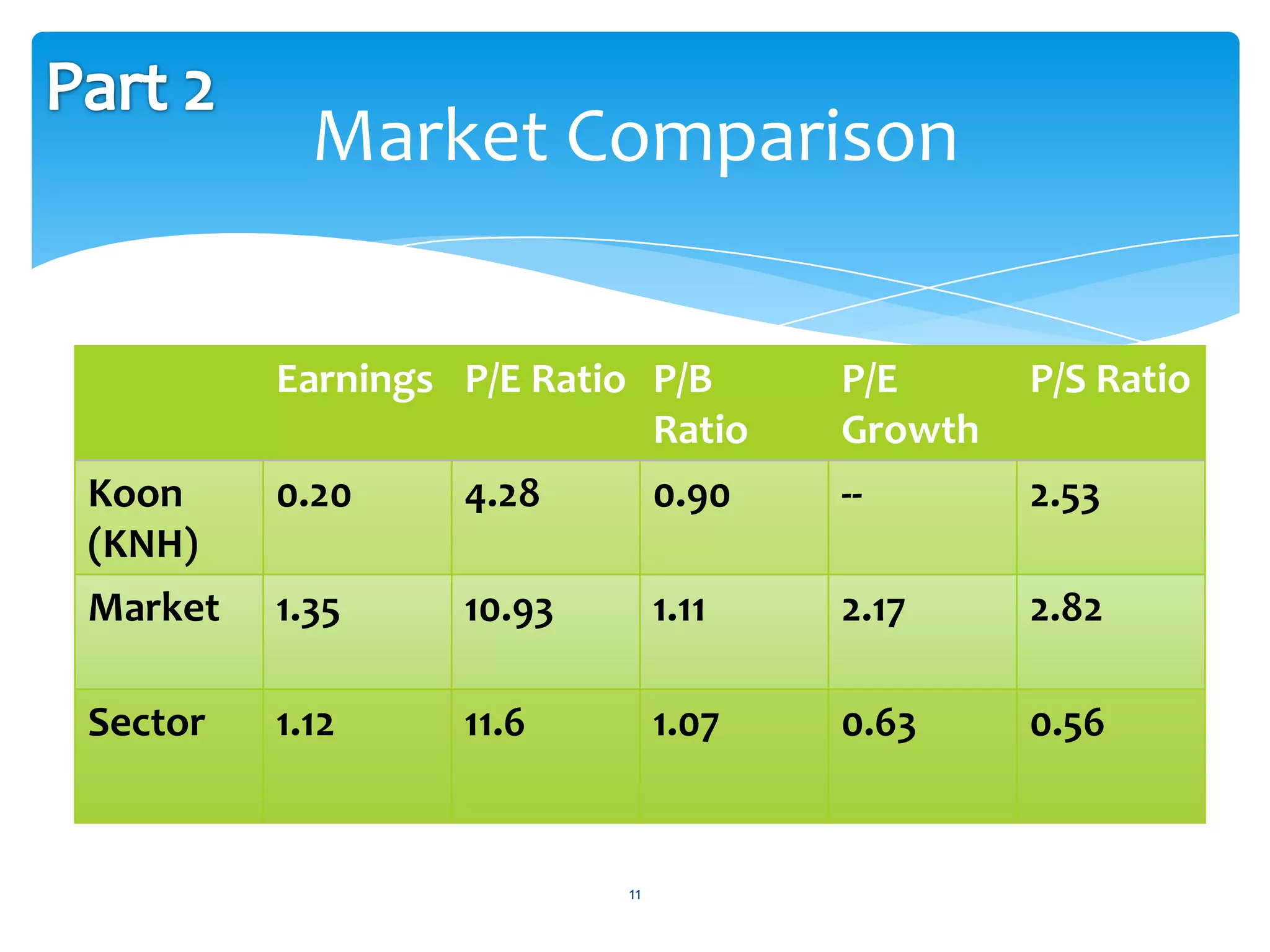

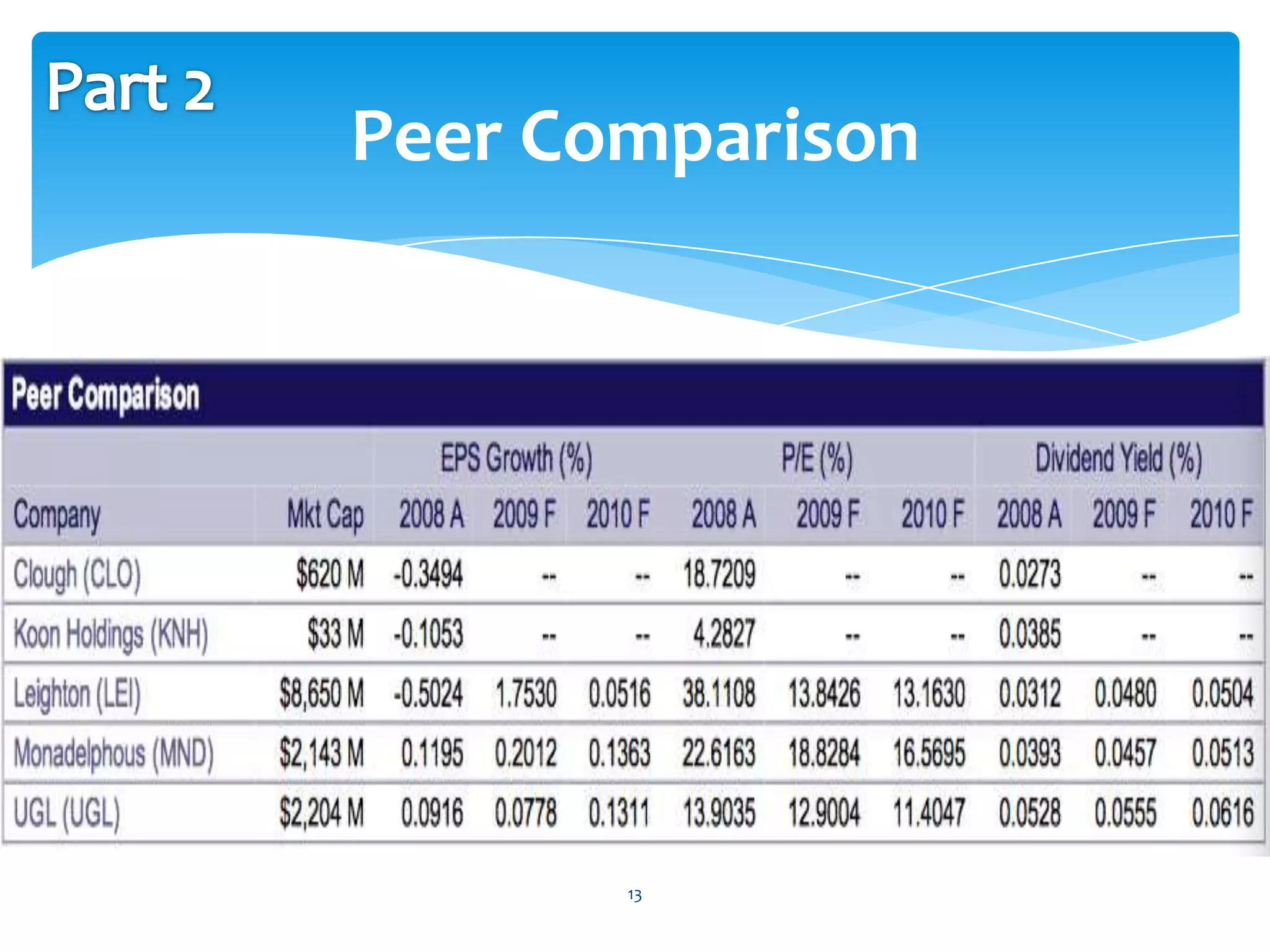

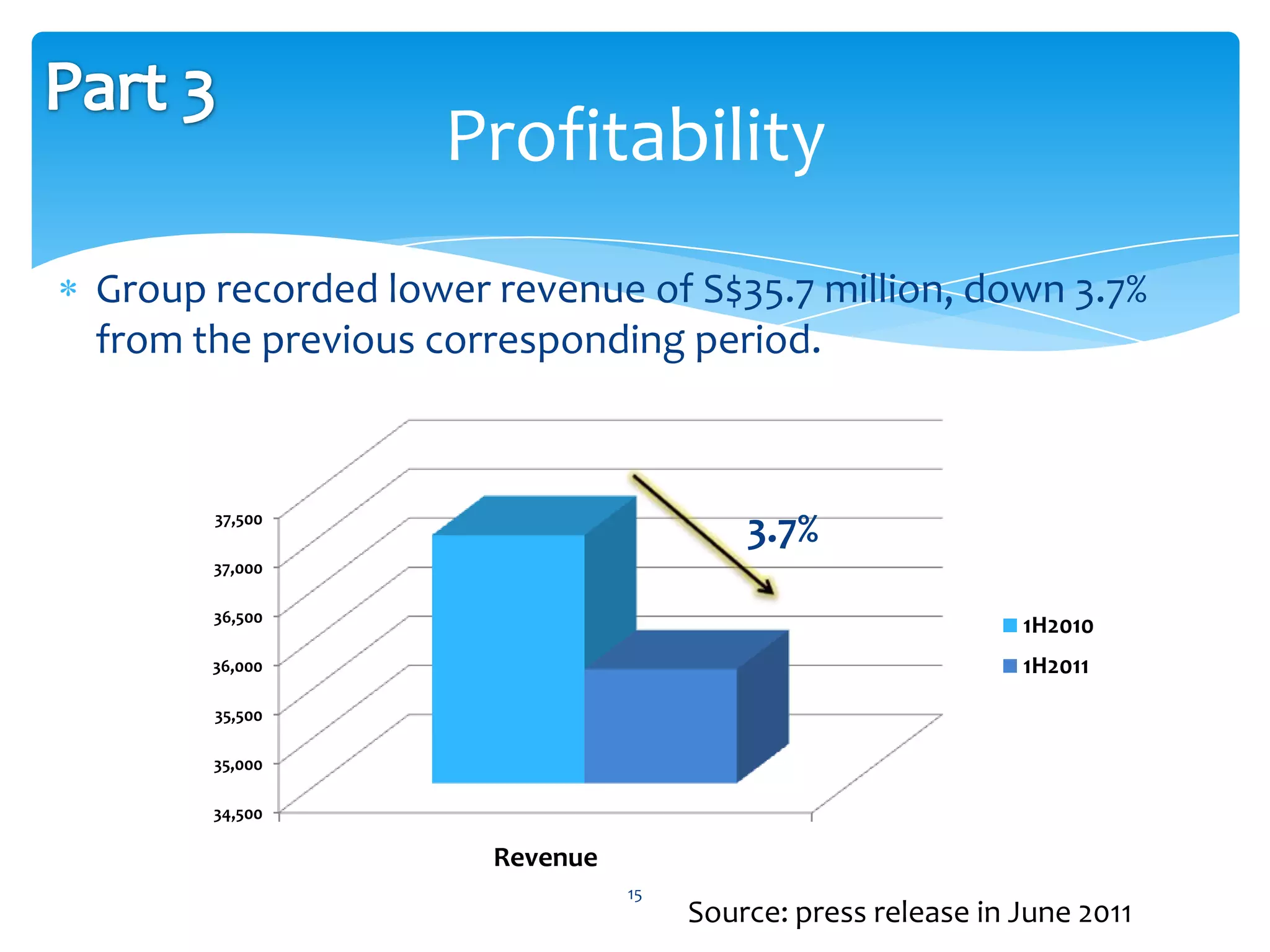

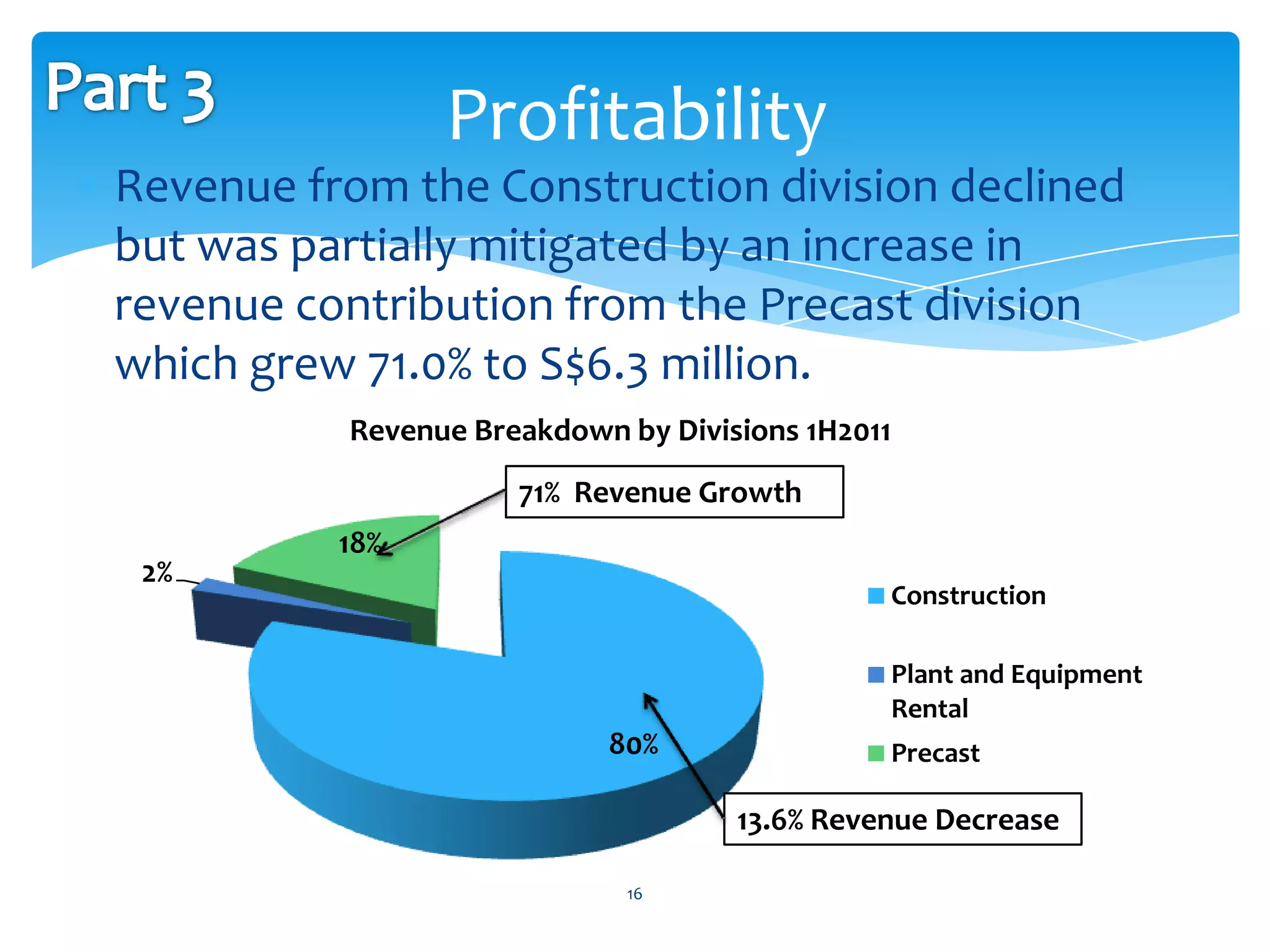

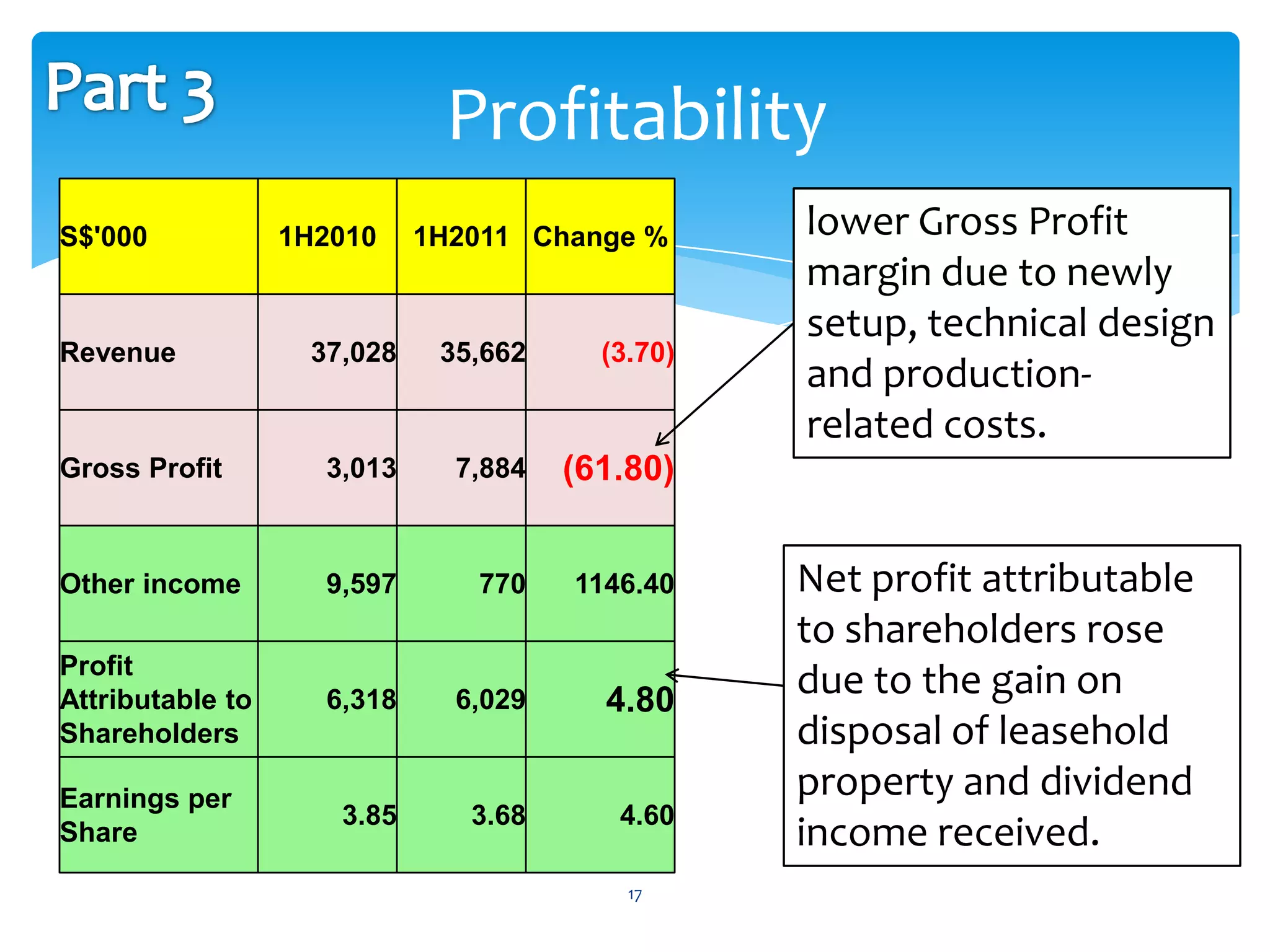

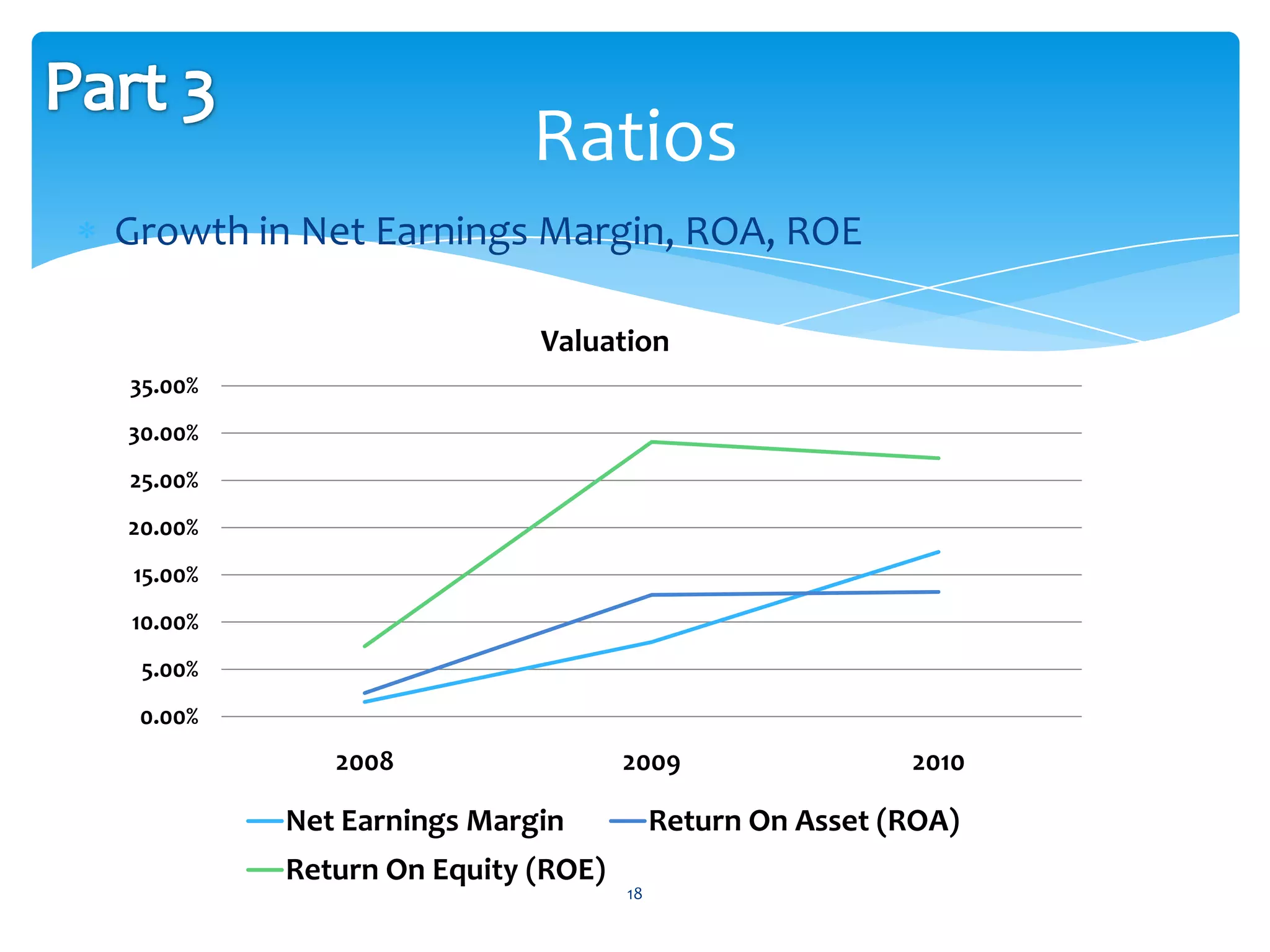

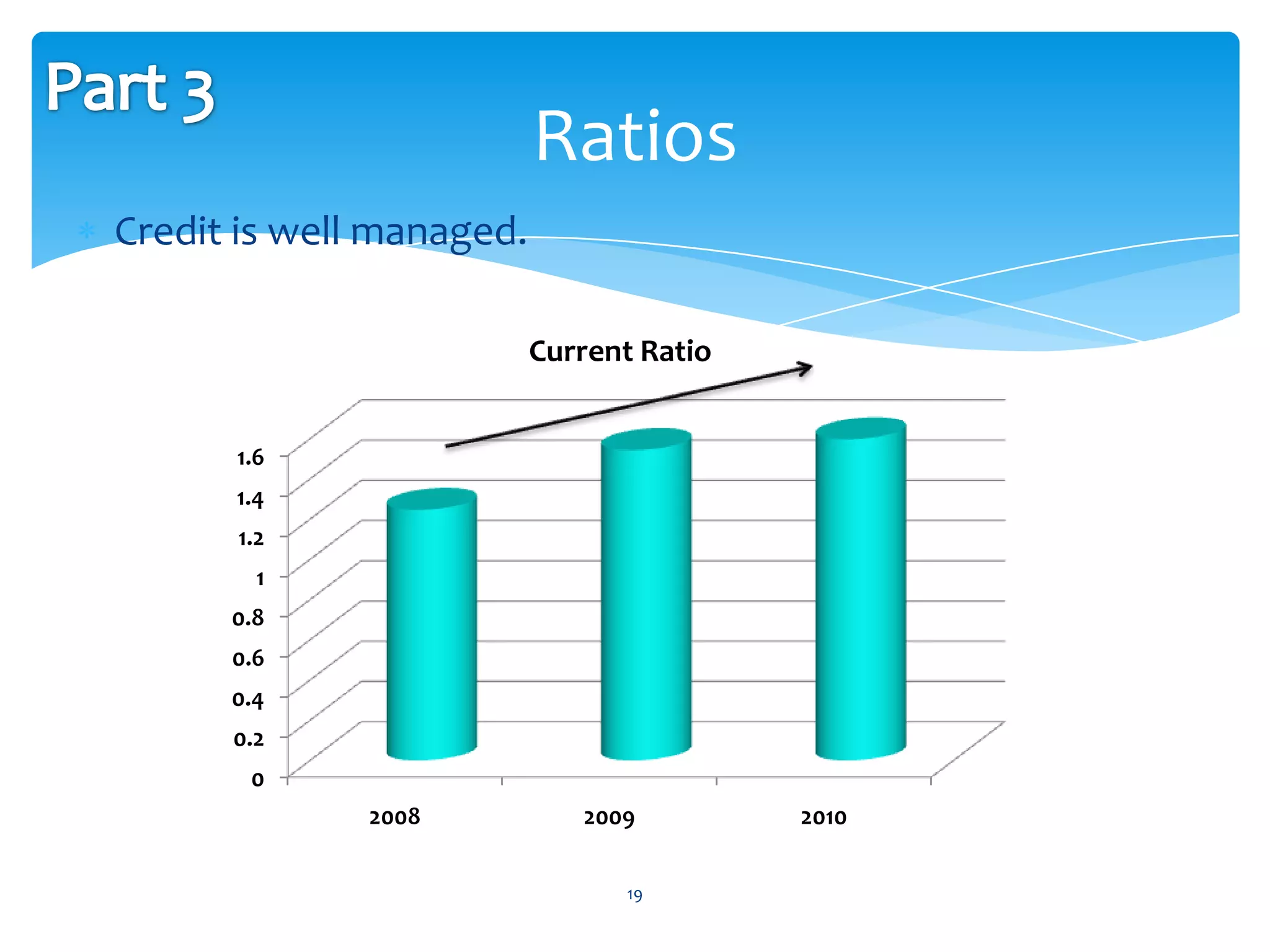

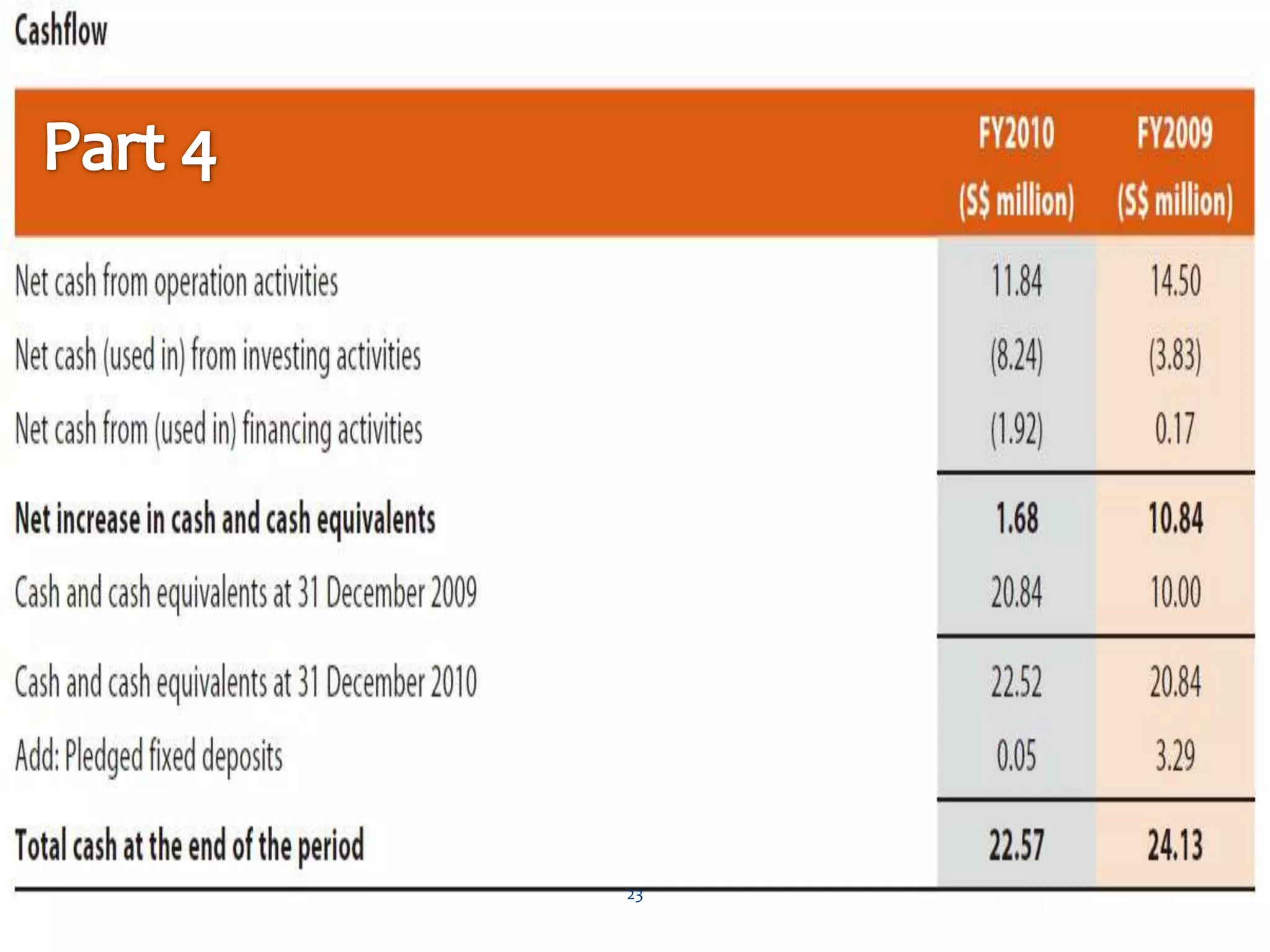

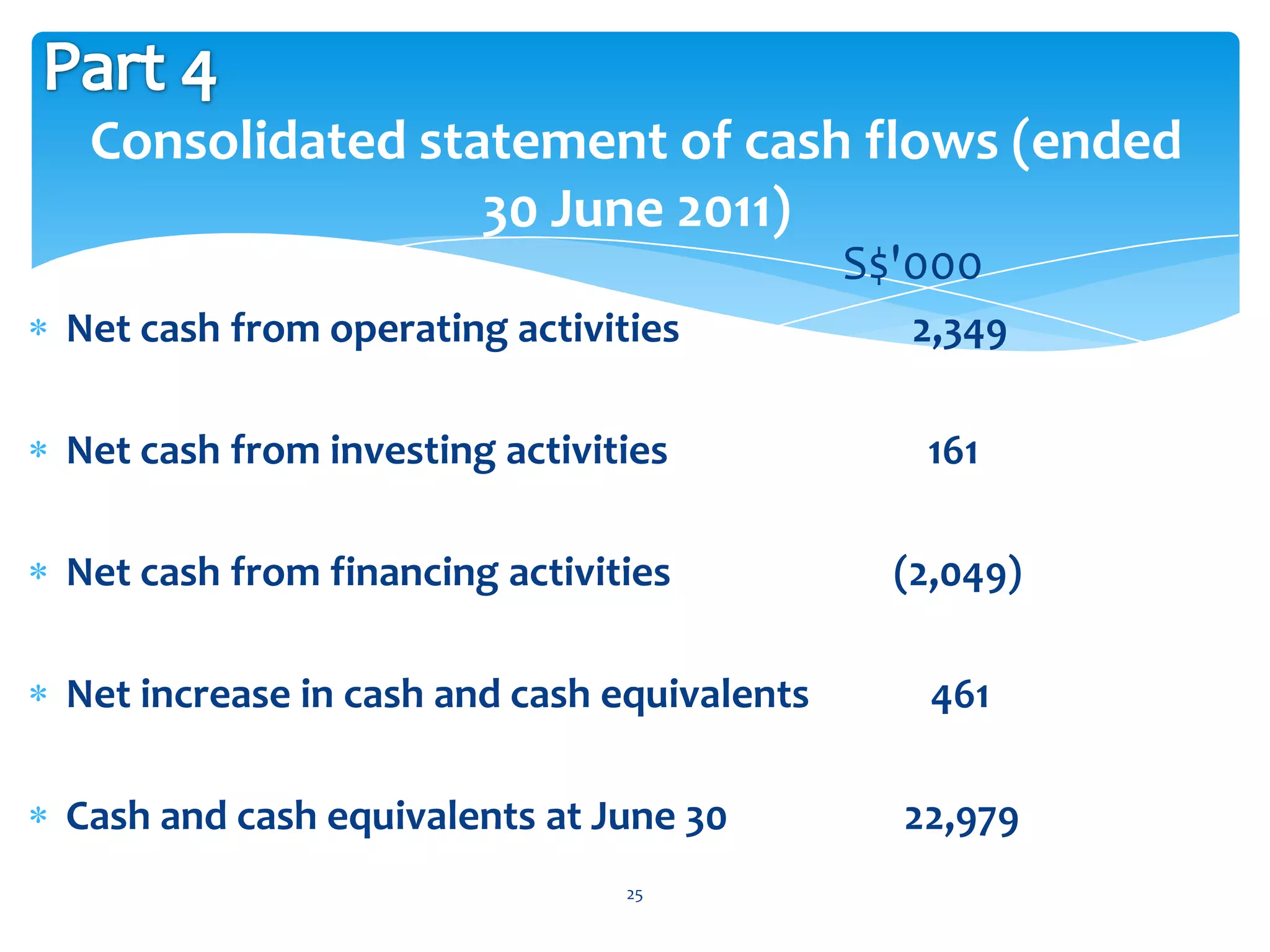

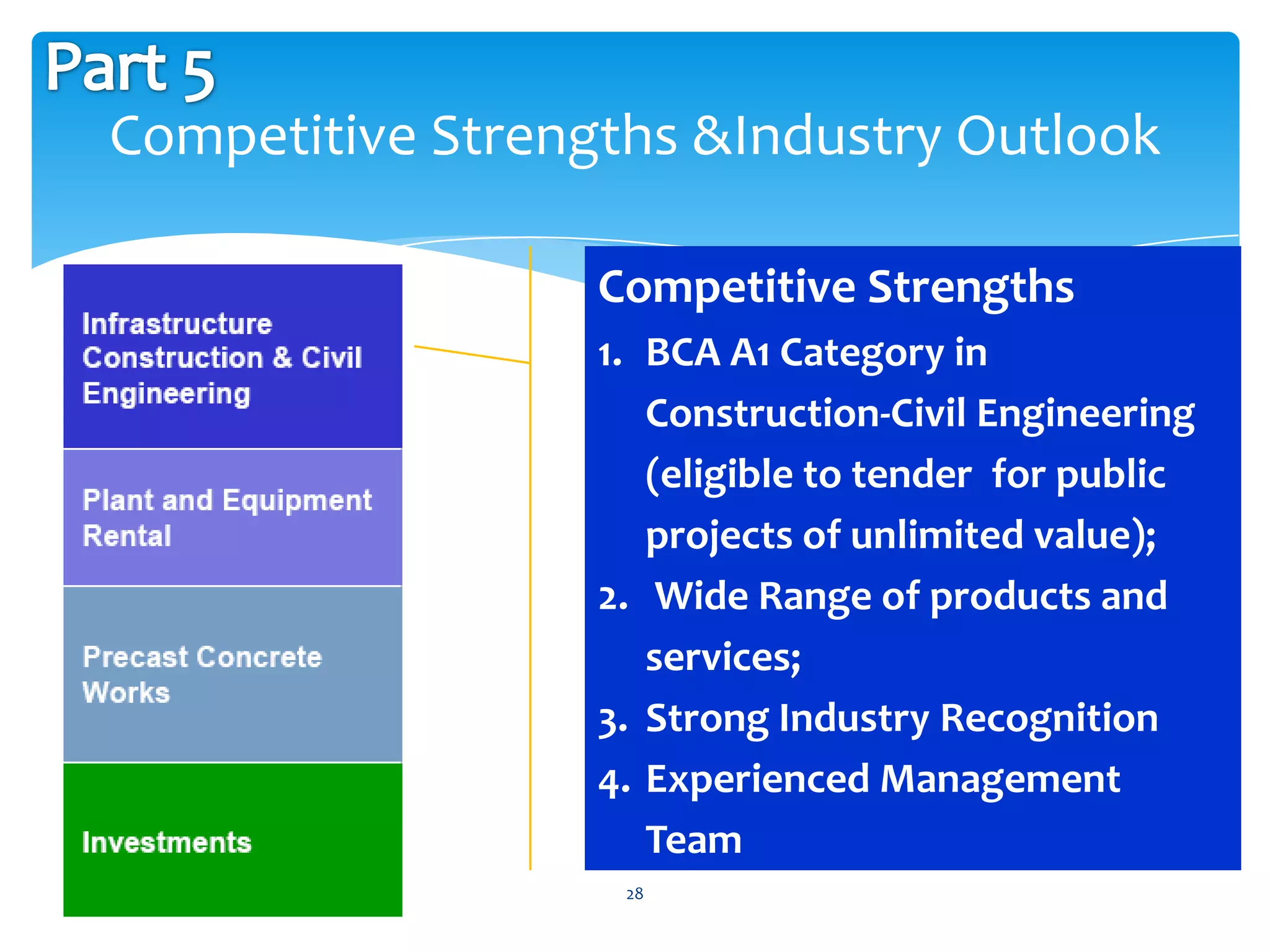

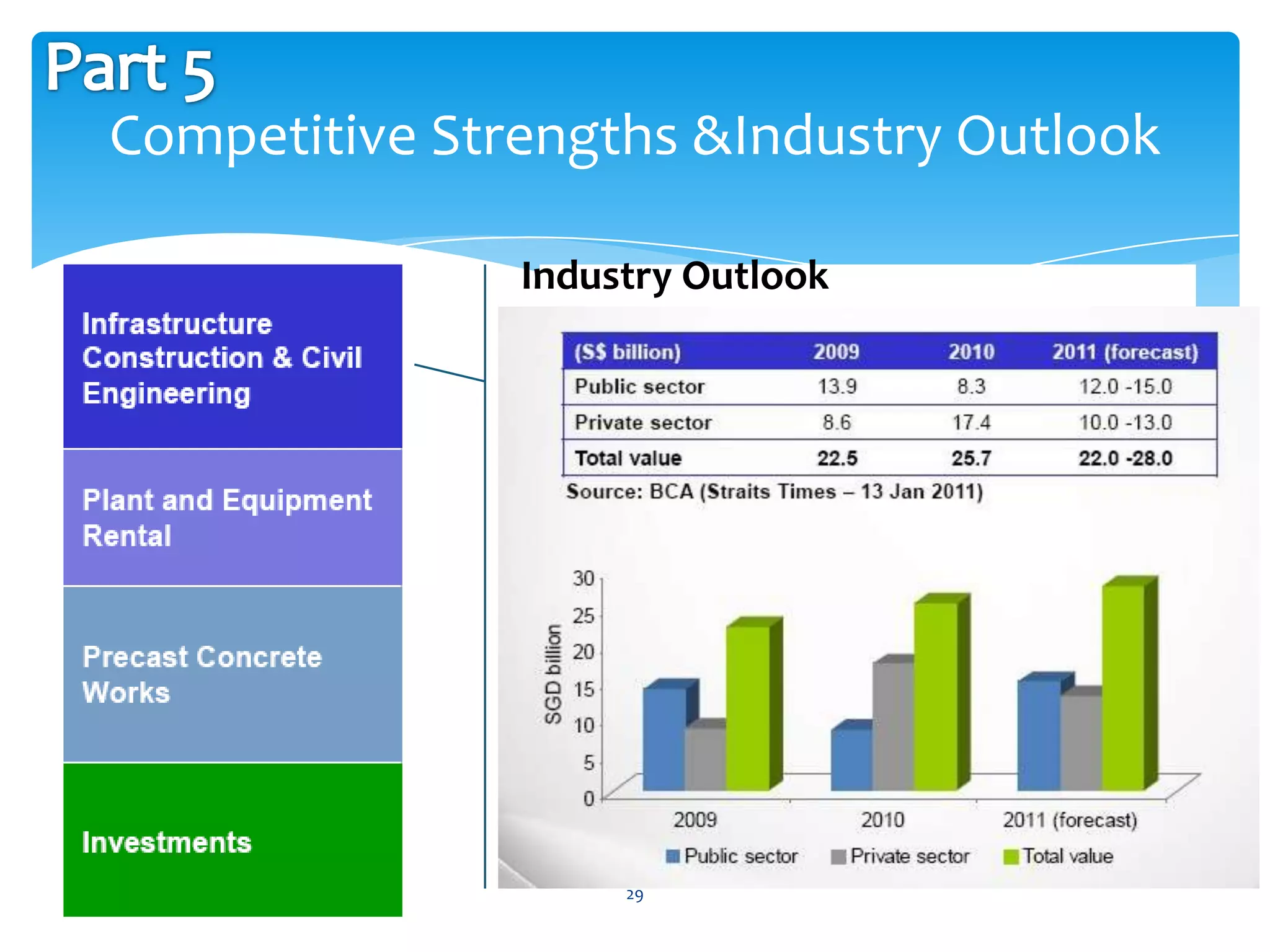

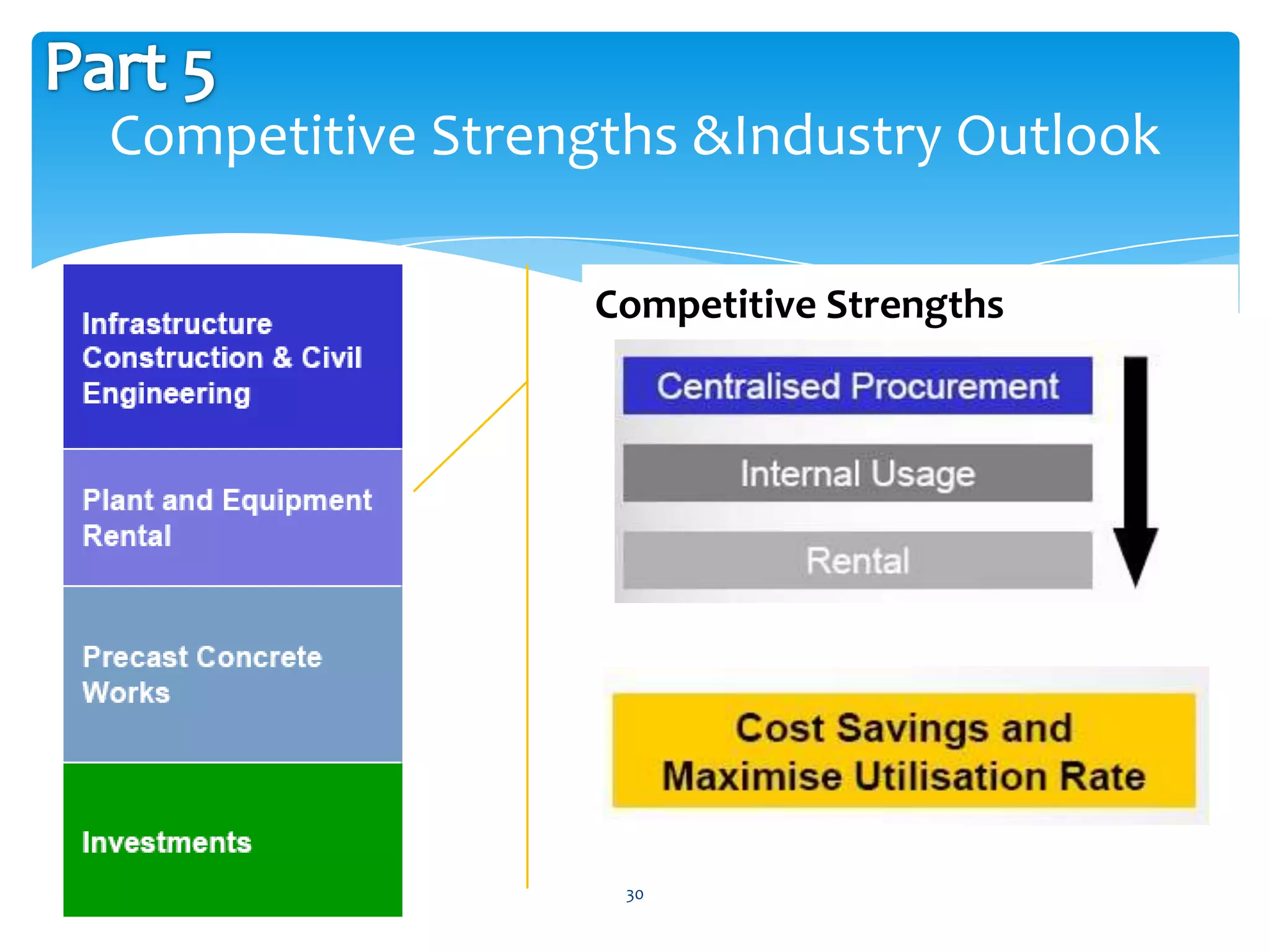

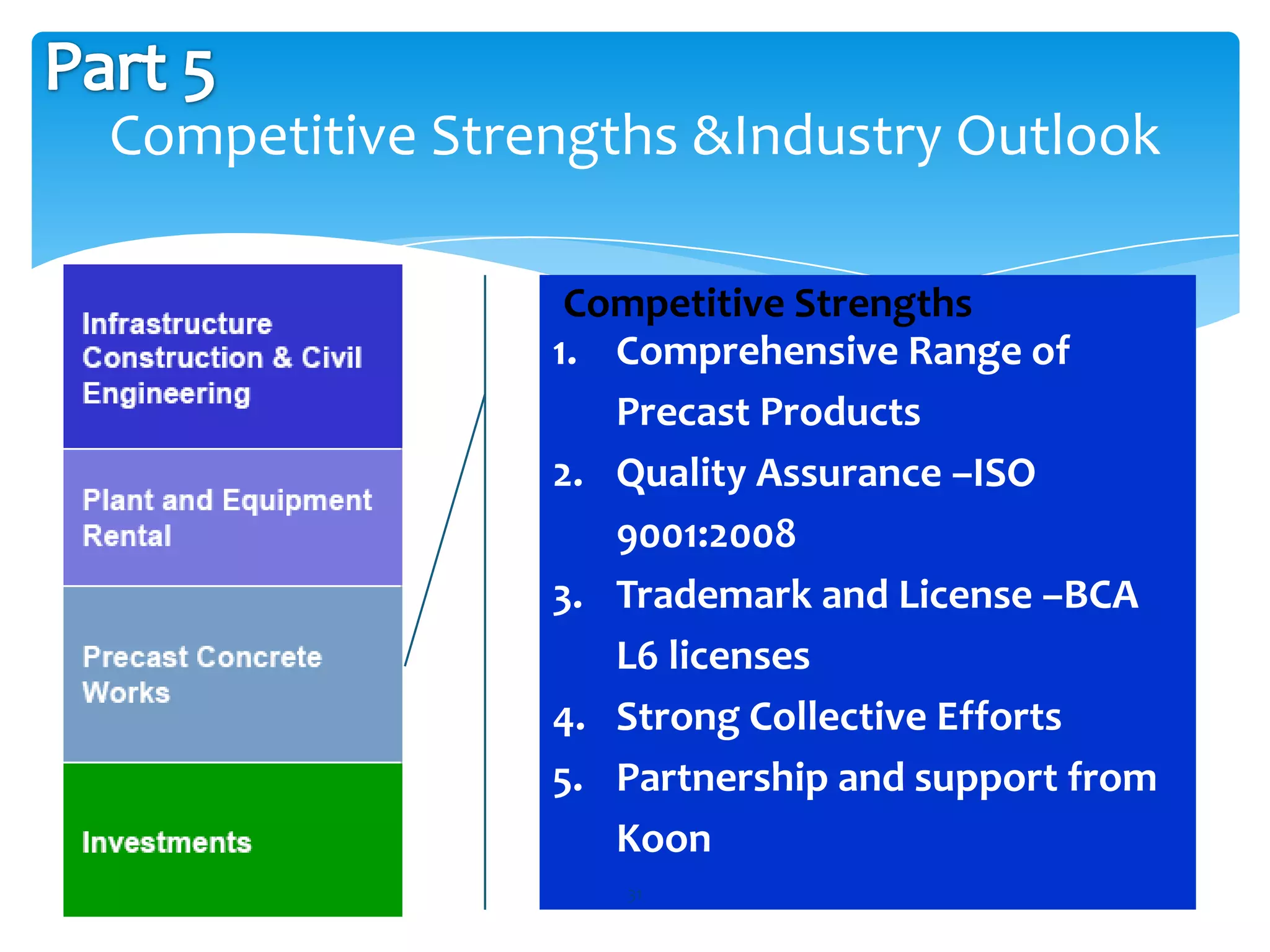

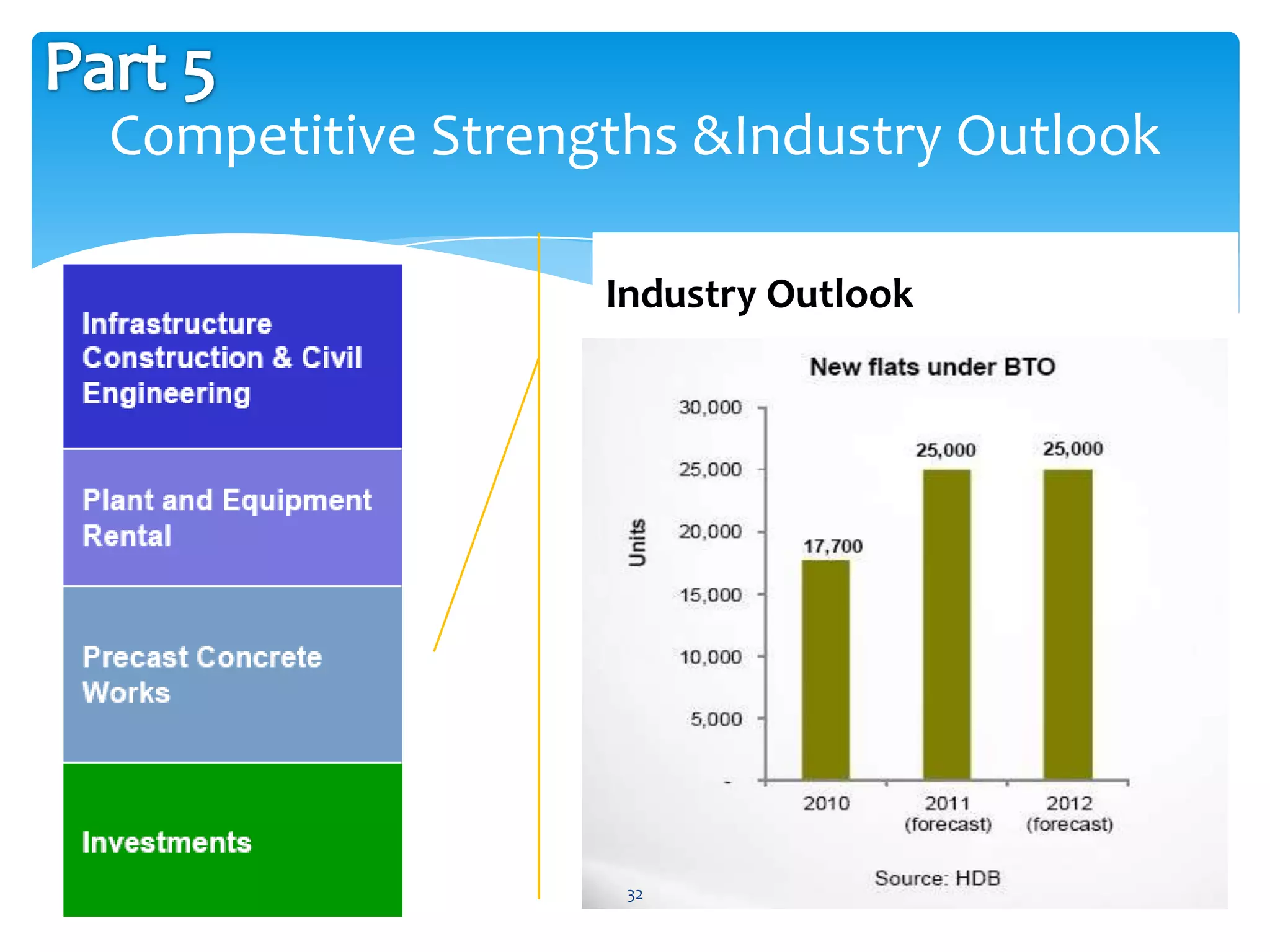

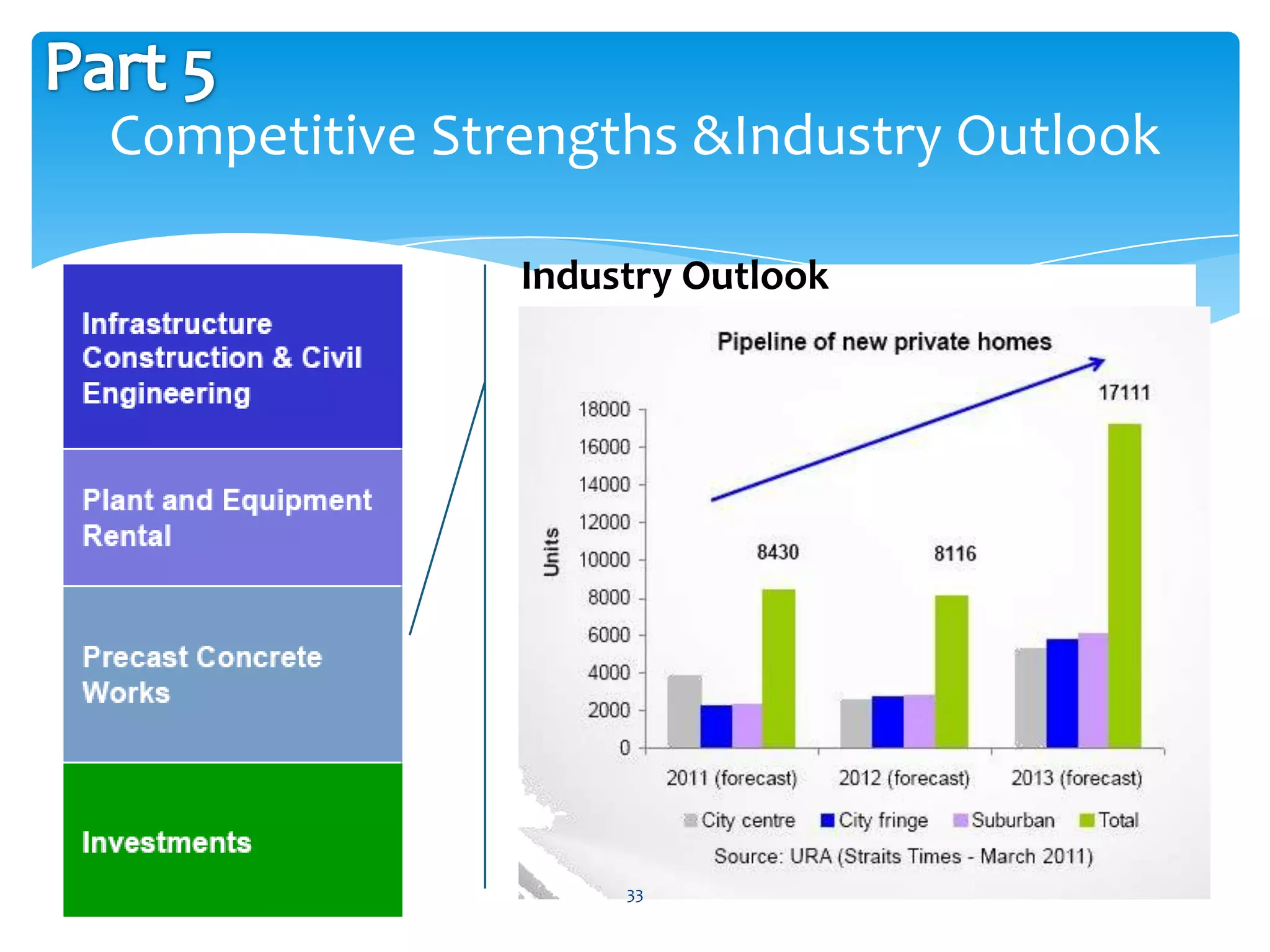

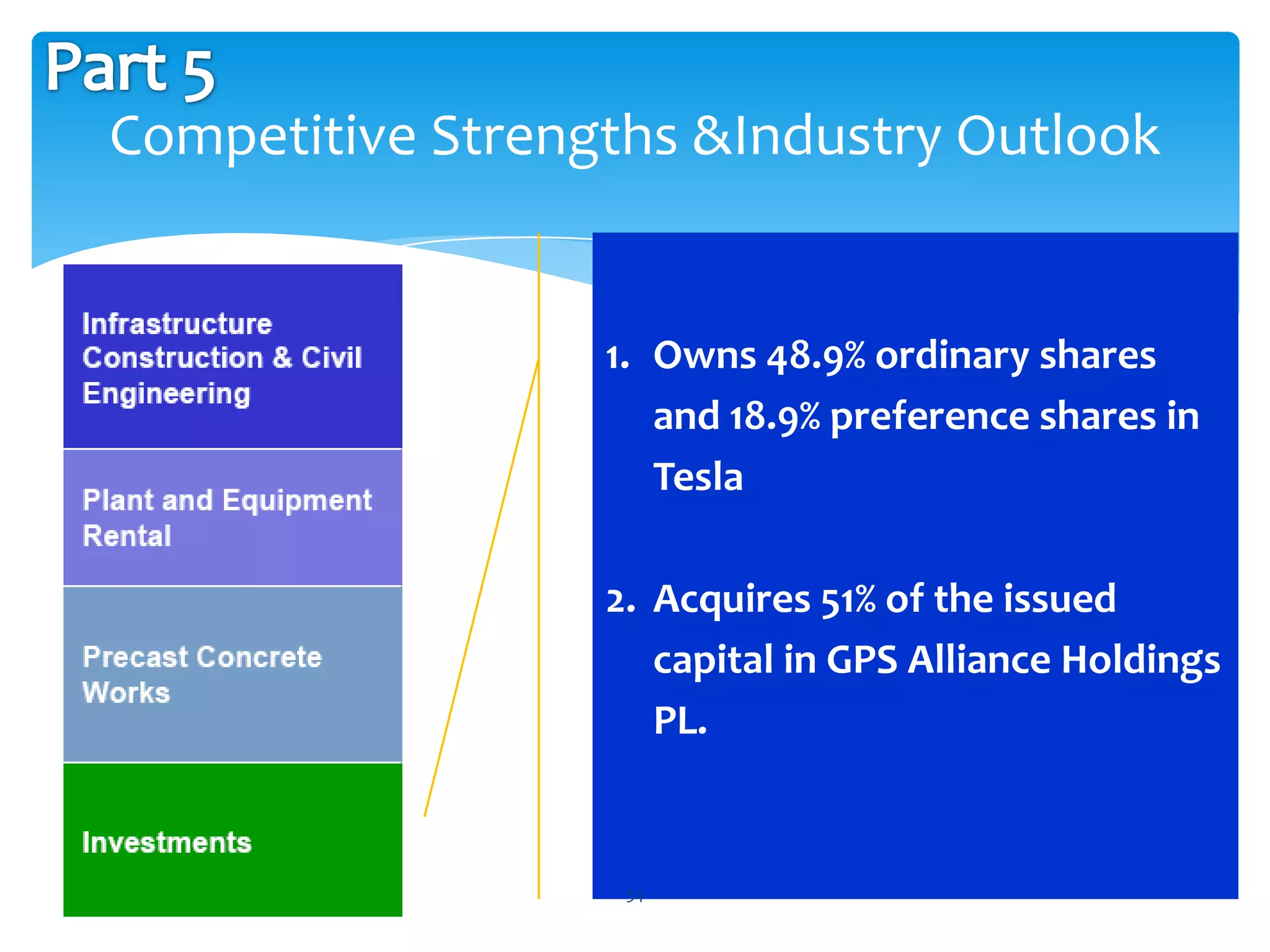

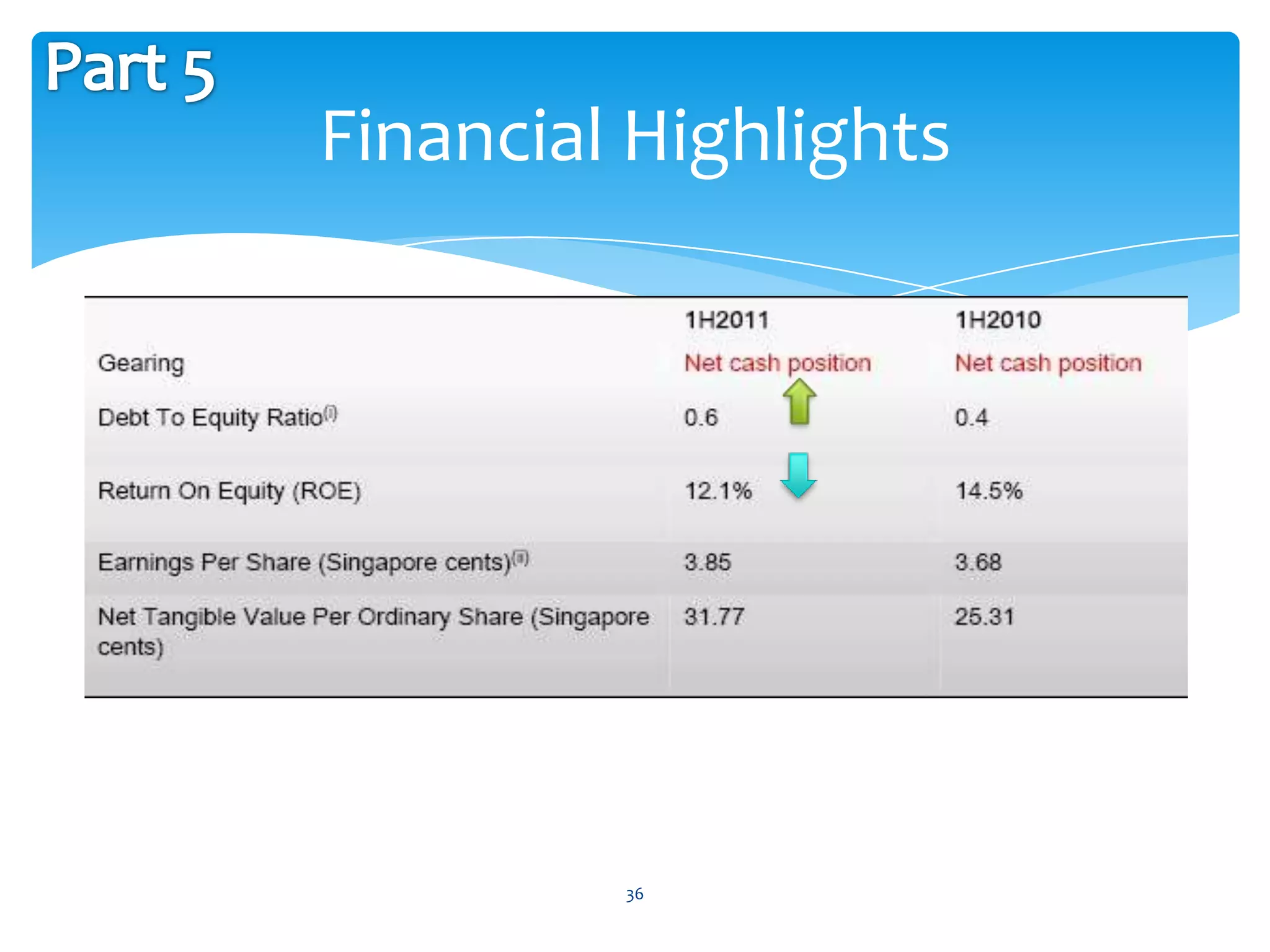

The document discusses Koon Holdings Limited, a Singapore-based investment holding company with expertise in infrastructure construction, plant and equipment rental, and precast concrete works. It provides an overview of Koon's financial performance, industry and competitors, as well as recommendations to leverage its competitive strengths such as an experienced management team and wide range of products and services to capitalize on industry opportunities like upcoming public construction projects.