Tata Motos Limited

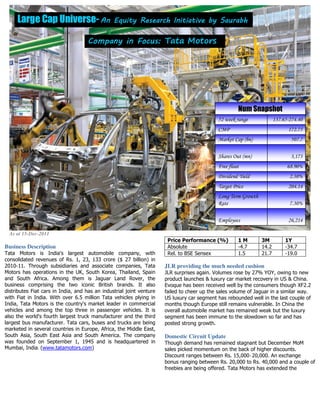

- 1. Large Cap Universe- An Equity Research Initiative by SaurabhAn Equity Research Initiative by SaurabhAn Equity Research Initiative by SaurabhAn Equity Research Initiative by Saurabh Company in Focus:Company in Focus:Company in Focus:Company in Focus: Tata Motors 26,214Employees 7.30% Long Term Growth Rate 204.14Target Price 2.30%Dividend Yield 68.90%Free float 3,173Shares Out (mn) 507.7Market Cap (bn) 172.75CMP 137.65-274.4052 week range Num Snapshot As at 15-Dec-2011 Business Description Tata Motors is India's largest automobile company, with consolidated revenues of Rs. 1, 23, 133 crore ($ 27 billion) in 2010-11. Through subsidiaries and associate companies, Tata Motors has operations in the UK, South Korea, Thailand, Spain and South Africa. Among them is Jaguar Land Rover, the business comprising the two iconic British brands. It also distributes Fiat cars in India, and has an industrial joint venture with Fiat in India. With over 6.5 million Tata vehicles plying in India, Tata Motors is the country's market leader in commercial vehicles and among the top three in passenger vehicles. It is also the world's fourth largest truck manufacturer and the third largest bus manufacturer. Tata cars, buses and trucks are being marketed in several countries in Europe, Africa, the Middle East, South Asia, South East Asia and South America. The company was founded on September 1, 1945 and is headquartered in Mumbai, India. (www.tatamotors.com) Price Performance (%) 1 M 3M 1Y Absolute -4.7 14.2 -34.7 Rel. to BSE Sensex 1.5 21.7 -19.0 JLR providing the much needed cushion JLR surprises again. Volumes rose by 27% YOY, owing to new product launches & luxury car market recovery in US & China. Evoque has been received well by the consumers though XF2.2 failed to cheer up the sales volume of Jaguar in a similar way. US luxury car segment has rebounded well in the last couple of months though Europe still remains vulnerable. In China the overall automobile market has remained weak but the luxury segment has been immune to the slowdown so far and has posted strong growth. Domestic Circuit Update Though demand has remained stagnant but December MoM sales picked momentum on the back of higher discounts. Discount ranges between Rs. 15,000 20,000. An exchange‐ bonus ranging between Rs. 20,000 to Rs. 40,000 and a couple of freebies are being offered. Tata Motors has extended the

- 2. warranty period to two years from 18 months earlier from Dec’11. Whatever scheme comes up, 25% of that cost is borne by the dealer, the rest is borne by Tata Motors. In addition to that the dealer may give Rs. 1,000 2,000 discount more of his‐ own. Dealer margin has been around 3%. In CVs it gained 20 bps market share while Ashok Leyland lost 210 bps. Tata Motors is unlikely to hike prices in Jan’12. However, a leading Business Channel had recently reported that some dealers are falsely communicating to customers that the price hike will take place in Jan’12 in order to pre pone buying and push up sales in Dec’11.‐ Post BS III compliance, they received complaints for 1109 and‐ 407 on the emission norms front. The Company is holding a meeting in Jan’12 to discuss these problems. In LCV space, the demand for Tata Ace has been good however, post Diwali it is witnessing a slight slowdown with the intense competition from Mahindra Maxximo. But, the dealers maintain that though Maximmo is picking up, M&M is not able to eat the share of Tata Motors due to un availability of their‐ spare parts and poor after sales service. Market Share trends Source: SIAM 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% M S ILH yundai Tata M otors Ford G M VW H ondaToyotaO thers Passenger Cars Passenger Car category is expected to grow by 4-6% in 2011-12. Commercial Vehicles Tata Motors, 59%Ashok Leyland, 10.30% M&M, 18% Others, 12.80% The overall Indian CV segment is poised to grow by 13- 15% in 2011-12. Peer Comparison Field Tata Motors Bajaj Auto M&M Hero MotoCorp Maruti Suzuki Revenue Growth 33.09 38.86 28.06 22.13 24.40 EBITDA Margin 13.66 20.37 20.53 13.51 9.45 Net Income (in billion INR) 92.74 34.55 30.80 19.28 23.82 1 Year EPS Growth 218.90 116.66 18.59 -13.62 -9.23 P/E 5.91 13.50 12.96 19.17 11.71 Price/Book Value 4.13 8.81 2.88 10.74 2.55 RoE 67.75 91.83 25.20 60.05 17.99 Dividend Yield 2.30 2.48 1.51 5.67 0.78 EV/EBITDA 8.73 13.35 11.78 11.13 13.79 Beta 1.40 0.84 1.07 0.68 0.82 Wealth destroyer in short run Rs 100 invested last year is worth 65.25 82.73 80.60 0.00 20.00 40.00 60.00 80.00 100.00 TataMotor s BSE AutoIndex BSE Sensex But a promising value creator in the medium term Rs 100 invested 3 years back is worth 545.84 339.84 161.40 0.00 200.00 400.00 600.00 Tata Motors BSE Auto Index BSE Sensex

- 3. Volume Growth Status Tata Motors, country’s largest auto maker, reported 35% jump in its global vehicle sales in November, with its luxury Jaguar Land Rover unit reporting a 27% rise in sales at 29,183 over the same period. In November period, it sold 108,028 vehicles. The auto major has witnessed an increase of 40.64% in its total vehicle sales during November, 2011, at 76,823 units against 54,622 units in the same month last year. However, domestic sales of passenger vehicles stood at 27,737 units in November, up 80.81% from 15,340 units in the same month last year. TTM Volatility on bourses Courtesy: Bloomberg Possible Upside Movement-Factors • Land Rover volume run-rate has increased to a large extent post launch of Evoque. Strong performance of Evoque in US, European & Chinese market is expected to continue in 2012. • Positive Currency movement for JLR- A rising USD against GBP & EUR is in the favour for JLR. That’s because a major portion of JLR’s revenue is denominated in USD while a big chunk of its costs are denominated in GBP & EUR. That said, Forex movement often acts like a see-saw, contra movements in currencies can turn the table against JLR, though it’s not expected in the near term. • Top line in Indian markets to grow on the back of new product launches in 2012 across several segments. Two new bus models are expected in the next couple of months. Existing Nano Upgrade & a new diesel variant has been proposed for the next year. Many SUV buffs have been eagerly waiting for the upcoming Auto Expo when the company will unveil the new Safari model. Even in MHCV category, a couple of products have been in the pipeline for a long time. In recent years, this segment has turned out to be a Cash cow for Tata Motors. • Limited Insulation from Input corner- Aluminum & Steel prices have corrected by 18% & 17% Year to date respectively. Together both form a major portion of raw material consumption in the manufacturing process. • Improved brand image in the Passenger Car segment- Tata Motors have come a long way since the launch of their first Indica model. Their alliance with Fiat for new Diesel technology has paid off well. Product performance has improved significantly. Though they still remain the preferred choice for Fleet owners (Cab industry) but retail customers have also started showing interest in their offerings especially post Indica Vista & Manza launch. Both products have been received well in the market. Key Concern/Risk • Proposed Tax on Diesel Vehicles- A leading English daily had recently reported that the Indian Govt. is considering an additional excise tax on Diesel cars. If it really happens, it could adversely impact Tata Motors sales across all segments as historically Diesel powered models have been it’s strength area. • Increased competition in Passenger & Utility Vehicles business- In the last 5-6 years, almost all Global Auto majors have entered the Indian Small car & UV space with various offerings as the Total pie has grown to a mammoth size. As a result of this, Indian consumers have been pampered with too many choices. This customer delight has now become a nightmare for Automobile firms. The market is very demanding, Product & Service expectations have increased manifolds due to rise in competition. Adding value to firm’s offerings without impacting costs is the new challenge which is only going to get worse in the future. These factors can impact future margins. Even its Nano bet didn’t deliver on market expectations. • Rise in Interest rates- In the last one year RBI has increased key interest rates on more than five occasions. High consumer interest rates impact revenues especially in the CV space because a major portion of sales are routed via Auto loans. • High Debt- Since the acquisition of JLR, it’s debt has remained quite high compared to its peers. Debt to Equity Ratio 0.95 1.33 5.89 4.28 1.71 0 1 2 3 4 5 6 7 2007 2008 2009 2010 2011 Year No.oftimes Valuation Over the last 6 years, Tata Motors has paid out only 20% of its net profit as dividend to its shareholders. The balance of 80%, it has invested back in its business, on which it has earned a very high 25% average return every year. The company is currently struggling with the problems of stagnant domestic demand, increasing interest rates and high debt. Looking at its historical performance and future prospects I expect Tata Motors to grow its EPS by 16% CAGR in the next 5 years on the back of economic revival, new product launches, diesel technology edge, increasing per capita income and geographical diversification.

- 4. Price, Financials & Ratios History 2005 2006 2007 2008 2009 2010 2011 5Yr Avg 29.3% 37.9% -17.6% -77.9% 398.3% 64.8% -33.9% Price Change 81.1% -13.1% -8.8% -64.7% -25.4% 317.3% 47.4% -11.1% +/- India SENSEX 53.1% -27.7% 7.5% -17.0% -29.2% 199.4% 35.9% -25.1% +/- Industry 39.3% 0.0% 1.6% 2.0% 5.1% 1.6% 1.4% 2.3% Div Yield 2.4% 3/06 3/07 3/08 3/09 3/10 3/11 3/12E 5Yr CAGR 231.5 314.0 342.8 699.0 977.2 1,284.5 1,448.2 Sales 40.9% 24.1 30.1 28.1 10.3 70.9 166.9 178.6 EBITDA 47.2% 17.9 23.2 20.3 -14.8 32.0 120.4 122.4 EBIT 46.4% 17.3 21.7 21.7 -25.1 25.7 92.7 87.9 Net Inc 39.9% -- -- -- -11.34 8.89 29.13 27.38 EPS (Dil) -- 2.52 2.91 2.91 1.20 3.00 4.00 -- Divs PS 9.7% -- -- -- 2.2 2.9 3.2 -- Shs Out (Dil) -- 31.02 38.81 43.70 20.51 29.27 59.96 80.37 Bk PS 14.1% 13.9 11.5 38.3 41.2 87.4 109.5 -- Cash & ST Inv 51.2% 185.6 252.2 359.0 741.3 871.0 1,012.9 623.5 Assets 40.4% 28.6 39.5 8.5 -148.1 -113.7 -63.3 -- Wk Cap -- 27.1 38.7 63.1 185.1 217.2 224.1 -- LT Debt 52.6% -0.6 -11.6 48.0 -12.9 67.5 91.8 160.9 Net Op CF -- -12.6 -27.6 -52.8 -99.7 -84.8 -81.2 -121.7 Cap Ex 45.2% -18.5 -45.0 -11.7 -119.2 -20.7 0.6 18.8 FCF -- 3/06 3/07 3/08 3/09 3/10 3/11 3/12E 5Yr Avg 12.7% 13.8% 12.8% 11.8% 10.7% 19.1% -- Gross Margin 13.6% 10.4% 9.6% 8.2% 1.5% 7.3% 13.0% 12.3% EBITDA Margin 7.9% 7.7% 7.4% 5.9% -2.1% 3.3% 9.4% 8.5% EBIT Margin 4.8% 7.5% 6.9% 6.3% -3.6% 2.6% 7.2% 6.1% Net Margin 3.9% 10.2% 9.9% 7.1% -4.6% 3.2% 9.8% 14.1% ROA 5.1% 32.8% 31.3% 26.4% -35.8% 37.5% 67.3% 34.1% ROE 25.4% 1.4 1.4 1.1 1.3 1.2 1.4 2.3 Asset Turn 1.3 3.0 3.3 4.1 14.0 10.4 5.3 2.3 Assets/Equity 7.4 7.82 14.05 10.32 29.57 40.20 49.00 -- Sales/Emp 28.63 74.7 91.4 103.6 57.5 50.9 45.5 -- DSO 69.8 102.5 84.7 108.2 90.9 108.4 104.7 -- DPO 99.4 1.3 1.3 1.0 0.7 0.8 0.9 -- Current Ratio 0.9 1.0 1.0 0.8 0.4 0.5 0.6 -- Quick Ratio 0.7 35.5 48.6 57.1 86.8 80.7 63.1 -- TDebt%Cap 67.3 55.1 94.6 133.2 659.4 419.1 171.0 -- TDebt%TEQ 295.4 16-Dec-2011, © Saurabh 2011 (Saurabh Kumar| kaashyap.saurabh@gmail.com| +91-8374109195) Disclaimer- Due diligence has been exercised in checking the authenticity of all figures mentioned in this report. But that does not guarantee its accuracy or completeness. The recipient of this material should rely on his/her own judgment and take prudent decision before acting on the above piece of information.