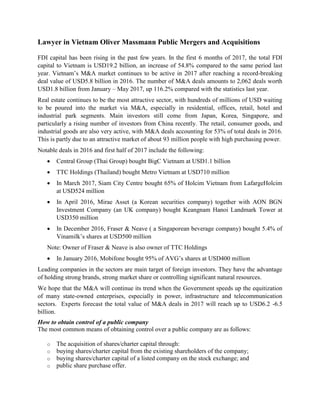

Lawyer in Vietnam Oliver Massmann Public Mergers and Acquisitions

- 1. Lawyer in Vietnam Oliver Massmann Public Mergers and Acquisitions FDI capital has been rising in the past few years. In the first 6 months of 2017, the total FDI capital to Vietnam is USD19.2 billion, an increase of 54.8% compared to the same period last year. Vietnam’s M&A market continues to be active in 2017 after reaching a record-breaking deal value of USD5.8 billion in 2016. The number of M&A deals amounts to 2,062 deals worth USD1.8 billion from January – May 2017, up 116.2% compared with the statistics last year. Real estate continues to be the most attractive sector, with hundreds of millions of USD waiting to be poured into the market via M&A, especially in residential, offices, retail, hotel and industrial park segments. Main investors still come from Japan, Korea, Singapore, and particularly a rising number of investors from China recently. The retail, consumer goods, and industrial goods are also very active, with M&A deals accounting for 53% of total deals in 2016. This is partly due to an attractive market of about 93 million people with high purchasing power. Notable deals in 2016 and first half of 2017 include the following: Central Group (Thai Group) bought BigC Vietnam at USD1.1 billion TTC Holdings (Thailand) bought Metro Vietnam at USD710 million In March 2017, Siam City Centre bought 65% of Holcim Vietnam from LafargeHolcim at USD524 million In April 2016, Mirae Asset (a Korean securities company) together with AON BGN Investment Company (an UK company) bought Keangnam Hanoi Landmark Tower at USD350 million In December 2016, Fraser & Neave ( a Singaporean beverage company) bought 5.4% of Vinamilk’s shares at USD500 million Note: Owner of Fraser & Neave is also owner of TTC Holdings In January 2016, Mobifone bought 95% of AVG’s shares at USD400 million Leading companies in the sectors are main target of foreign investors. They have the advantage of holding strong brands, strong market share or controlling significant natural resources. We hope that the M&A will continue its trend when the Government speeds up the equitization of many state-owned enterprises, especially in power, infrastructure and telecommunication sectors. Experts forecast the total value of M&A deals in 2017 will reach up to USD6.2 -6.5 billion. How to obtain control of a public company The most common means of obtaining control over a public company are as follows: o The acquisition of shares/charter capital through: o buying shares/charter capital from the existing shareholders of the company; o buying shares/charter capital of a listed company on the stock exchange; and o public share purchase offer.

- 2. o Through a merger. The 2014 Law on Enterprises sets out the procedures for company mergers by way of a transfer of all lawful assets, rights, obligations and interests to the merged company, and for the simultaneous termination of the merging companies. o Through the acquisition of assets. There are restrictions on the purchase of shares/charter capital of local companies by foreign investors in certain sensitive sectors. In addition, the law is silent on merger or assets acquisition (e.g., business spin-off) transactions where a foreign investor is a party. Regarding other assets acquisition transactions, if the asset is a real property, foreign ownership right will be restricted according to real estate laws. Securities of public companies must be registered and deposited at the Vietnam Securities Depository Centre before being traded. Depending on the numbers of shares purchased, an investor can become a controlling shareholder. Under the Vietnam Law on Securities, a shareholder that directly or indirectly owns 5% or more of the voting shares of an issuing organization is a major shareholder. Any transactions that result in more than 10% ownership of the paid-up charter capital of the securities company must seek approval of the State Securities Commission (SSC). What a bidder generally questions before making a bid Before officially contacting the potential target, the bidder conducts a preliminary assessment based on publicly available information. The bidder then contacts the target, expresses its intention of buying shares/subscribing for its shares and the parties sign a confidentiality agreement before the due diligence process. The confidentiality agreement basically includes confidentiality obligations in performing the transaction. The enforcement of confidentiality agreements by courts in Vietnam remains untested. A bidder's legal due diligence usually covers the following matters: Corporate details of the target and its subsidiaries, affiliates and other companies that form part of the target. Contingent liabilities (from past or pending litigation). Employment matters. Contractual agreements of the target. Statutory approvals and permits regarding the business activities of the target. Insurance, tax, intellectual property, debts, and land-related issues. Anti-trust, corruption and other regulatory issues. Restrictions on shares transfer of key shareholders Founding shareholders can only transfer their shares to other founding shareholders of the company within three years from the issuance of the Enterprise Registration Certificate. After then, the shares can be transferred freely. An internal approval of the general meeting of shareholders is always required if: The company increases its capital by issuing new shares.

- 3. There is any share transfer of the founding shareholders within the above three-year period. If the sale and purchase is a direct agreement between the company and the seller in relation to an issuance of shares, the selling price must be lower than the market price at the time of selling, or in the absence of a market price, the book value of the shares at the time of the approval plan to sell the shares. In addition, the selling price to foreign and domestic buyers must be the same. When a tender offer is required A tender offer is required in the following cases: Purchase of a company's circulating shares that results in a purchaser, with no shareholding or less than a 25% shareholding, acquiring a 25% shareholding or more. Purchase of a company's circulating shares that results in a purchaser (and affiliated persons of the purchaser), with a 25% or more shareholding, acquiring a further 10% or more of circulating shares of the company. Purchase of a company's circulating shares that results in a purchaser (and affiliated persons of the purchaser), with a 25% shareholding or more, acquiring a further 5% up to 10% of currently circulating shares of the company within less than one year from the date of completion of a previous offer. There is no guidance on building a stake by using derivatives. In addition, the bidder cannot purchase shares or share purchase rights outside the offer process during the tender offer period. The bidder must publicly announce the tender offer in three consecutive editions of one electronic newspaper or one written newspaper and (for a listed company only) on the relevant stock exchange within seven days from the receipt of the State Securities Commission's (SSC's) opinion regarding the registration of the tender offer. The tender offer can only be implemented after the SSC has provided its opinion, and following the public announcement by the bidder. Making the bid public The offer timetable is as follows: The bidder prepares registration documents for its public bid to purchase shares. The bidder sends the bid registration documents to the SSC for approval and, at the same time, sends the registration documents to the target. The SSC reviews the tender documents within seven days. The board of the target must send its opinions regarding the offer to the SSC and the shareholders of the target within 14 days from receipt of the tender documents. The bid is announced in the mass media (although this is not a legal requirement). The length of the offer period is between 30 and 60 days. The bidder reports the results of the tender to the SSC within 10 days of completion. Companies operating in specific sectors (such as banking, insurance, and so on) can be subject to a different timetable. Offer conditions

- 4. A takeover offer usually contains the following conditions: The terms and conditions of the offer apply equally to all shareholders of the target. The relevant parties are allowed full access to the tender information. The shareholders have full rights to sell the shares. Applicable laws are fully respected. An offer can also be subject to conditions precedent. Conditions precedent are set out in the share sale and purchase agreement or the capital contribution transfer agreement. There is no specific restriction on conditions precedent other than the requirement that they cannot be contrary to law and conflict with social ethics (although the legal definition of social ethics is unclear). The most common conditions precedent are: Amendments to the charter/relevant licence of the target. Obtaining necessary approvals to conduct the transaction. Changes to the target's management body. Payment of the contract price will only be made after the conditions precedent are met. Employee consultation There is no requirement under Vietnamese law that the employees must be consulted about the offer. However, if a layoff is to be conducted, the employer must: Prepare a labour usage plan. Consult with the employee representative. Notify the competent labour authority on the implementation of the labour usage plan. When a tender offer is required? A tender offer is required in the following cases: Purchase of a company's circulating shares that results in a purchaser, with no shareholding, or less than a 25% shareholding, acquiring a 25% shareholding. Purchase of a company's circulating shares that results in a purchaser (and affiliated persons of the purchaser), with a 25% or more shareholding, acquiring a further 10% or more of circulating shares of the company. Purchase of a company's circulating shares that results in a purchaser (and affiliated persons of the purchaser), with a 25% shareholding or more, acquiring a further 5% up to 10% of currently circulating shares of the company within less than one year from the date of completion of the previous offer. Form of consideration and minimum level of consideration Under Vietnamese law, shares can be purchased by offering cash, gold, land use rights, intellectual property rights, technology, technical know-how or other assets. In practice, acquisitions are most commonly made for cash consideration. In cases of full acquisition of state-owned enterprises, the first payment for the share purchase must not be less than 70% of the value of such shares, with the remaining amount being paid within 12 months.

- 5. In transactions involving auctions of shares by state-owned enterprises, the purchaser must make a deposit of 10% of the value of the shares registered for subscription based on the reserve price at least five working days before the auction date included in the target company's rule. Additionally, the purchaser must transfer the entire consideration for the shares into the bank account of the body conducting the auction within ten working days of the announcement of the auction results. In the case of a public tender offer, the payment and transfer of shares via a securities agent company appointed to act as an agent for the public tender offer must comply with Decree 58/2012/ND-CP. Delisting a company If a company seeks voluntarily de-listing, it must submit an application for de-listing that includes the following documents: A request for de-listing. For a joint stock company: o the shareholders' general meeting approval of de-listing of the stock; o the board of directors' approval of de-listing of bonds; and o the shareholders' general meeting approval of de-listing of convertible bonds. The members' council (for a multi-member limited liability company) or the company's owner (for a single member limited liability company) approval of de-listing of bonds. For a securities investment fund, the investors' congress approval of de-listing of the fund's certificate. For a public securities investment company, the shareholders' general meeting approval of stock de-listing. A listed company can only de-list its securities if de-listing is approved by a decision of the general meeting of shareholders passed by more than 50% of the voting shareholders who are not major shareholders. If a company voluntarily de-lists from the Hanoi Stock Exchange or Ho Chi Minh Stock Exchange, the application for de-listing must also include a plan to deal with the interests of shareholders and investors. The Hanoi Stock Exchange or Ho Chi Minh Stock Exchange must consider the request for de-listing within ten and 15 days from the receipt of a valid application, respectively. Transfer duties payable on the sale of shares in a company Depending on whether the seller is an individual or a corporate entity, the following taxes will apply: Capital gains tax. Capital gains tax is a form of income tax that is payable on any premium on the original investor's actual contribution to capital or its costs to purchase such capital. Foreign companies and local corporate entities are subject to a corporate

- 6. income tax of 20%. However, if the assets transferred are securities, a foreign corporate seller is subject to corporate income tax of 0.1% on the gross transfer price. Personal income tax. If the seller is an individual resident, personal income tax will be imposed at the rate of 20% of the gains made, and 0.1% on the sales price if the transferred assets are securities. An individual tax resident is defined as a person who: o stays in Vietnam for 183 days or longer within a calendar year; o stays in Vietnam for a period of 12 consecutive months from his arrival in Vietnam; o has a registered permanent residence in Vietnam; or o rents a house in Vietnam under a lease contract of a term of at least 90 days in a tax year. If the seller is an individual non-resident, he is subject to personal income tax at 0.1% on the gross transfer price, regardless of whether there is any capital gain. Payment of the above transfer taxes is mandatory in Vietnam. Regulatory approvals The investor will need to register the capital contribution and purchase of shares if either: The target is operating in one of the 267 conditional sectors referred to in the 2015 Investment Law. The capital contribution and purchase of shares results in foreign investors owning 51% or more of the target's charter capital (in particular, from below 51% to more than 51% and from 51% to above 51%). The local Department of Planning and Investment where the target is located must issue its final approval within 15 days from the receipt of a valid registration application. However, in practice, this procedure can take several months due to the workload of certain central authorities and the lack of clear guidance documents. Therefore, the registration requirement can cause substantial delays to the whole M&A process. In other cases, the target company only needs to register change of membership / shareholders at the Business Registration Division. Restrictions on repatriation of profits and/ or foreign exchange rules for foreign companies If the target company in Vietnam already has an investment registration certificate, it must open a direct investment capital account at a licensed bank in Vietnam. Payment for a share purchase by a foreign investor must be conducted through this account. The account can be denominated in Vietnamese dong or a foreign currency. In addition, if the foreign investor is an offshore investor, it will also need to open a capital account at a commercial bank operating in Vietnam to carry out the payment on the seller's account and receive profits. If the target company in Vietnam does not have an investment registration certificate, the foreign investor will need to open an indirect investment capital account for payment to the seller and remittance of profits. ***

- 7. Please do contact the author Dr. Oliver Massmann under omassmann@duanemorris.com if you have any questions on the above. Dr. Oliver Massmann is the General Director of Duane Morris Vietnam LLC.