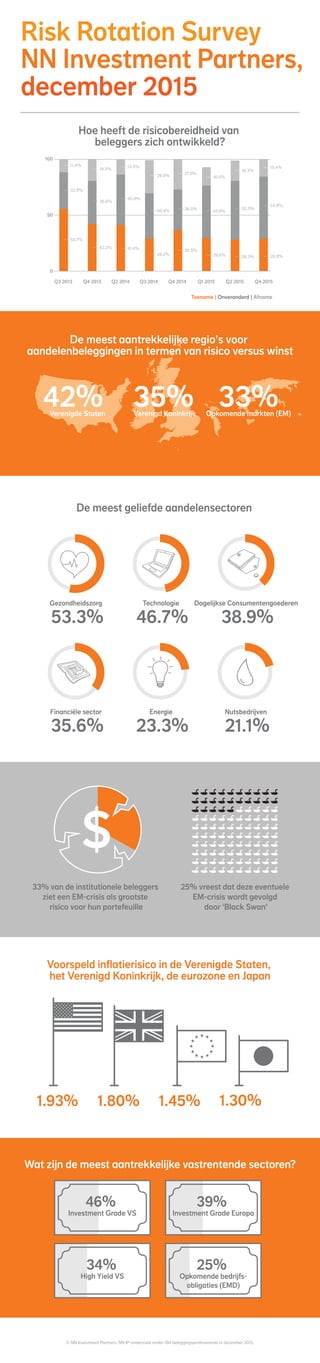

[NL] Infografics / Risk Rotation Survey / December 2015

- 1. 42% 35% 33%Opkomende markten (EM)Verenigd KoninkrijkVerenigde Staten Q3 2013 Q4 2013 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q4 2015 Toename | Onveranderd | Afname 0 50 100 Hoe heeft de risicobereidheid van beleggers zich ontwikkeld? De meest geliefde aandelensectoren Voorspeld inflatierisico in de Verenigde Staten, het Verenigd Koninkrijk, de eurozone en Japan Gezondheidszorg 53.3% Technologie 46.7% Dagelijkse Consumentengoederen 38.9% Financiële sector 35.6% Nutsbedrijven 21.1% Energie 23.3% 33% van de institutionele beleggers ziet een EM-crisis als grootste risico voor hun portefeuille 25% vreest dat deze eventuele EM-crisis wordt gevolgd door ‘Black Swan’ 1.80%1.93% 1.45% 1.30% Risk Rotation Survey NN Investment Partners, december 2015 © NN Investment Partners. NN IP-onderzoek onder 104 beleggingsprofessionals in december 2015. De meest aantrekkelijke regio’s voor aandelenbeleggingen in termen van risico versus winst Wat zijn de meest aantrekkelijke vastrentende sectoren? 46% Investment Grade VS 34% High Yield VS 39% Investment Grade Europa 25% Opkomende bedrijfs- obligaties (EMD) 55.7% 32.9% 11.4% 42.2% 38.6% 19.3% 41.4% 45.0% 13.5% 29.2% 40.4% 29.8% 36.5% 36.5% 27.0% 29.6% 47.0% 16.5% 28.3% 52.5% 18.3% 28.8% 55.8% 15.4%