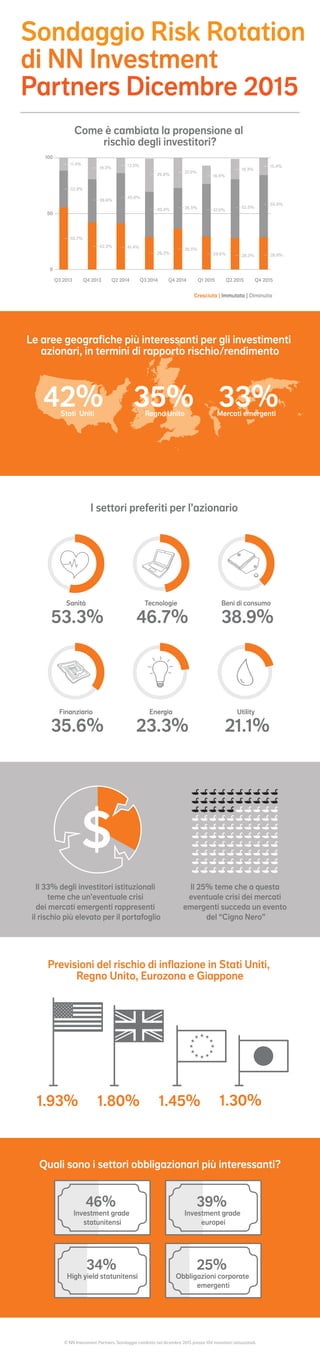

[IT] Infographic / Sondaggio Risk Rotation / Dicembre 2015

- 1. 42% 35% 33%Mercati emergentiRegno UnitoStati Uniti Q3 2013 Q4 2013 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q4 2015 Cresciuta | Immutata | Diminuita 0 50 100 Come è cambiata la propensione al rischio degli investitori? I settori preferiti per l’azionario Previsioni del rischio di inflazione in Stati Uniti, Regno Unito, Eurozona e Giappone Sanità 53.3% Tecnologie 46.7% Beni di consumo 38.9% Finanziario 35.6% Utility 21.1% Energia 23.3% Il 33% degli investitori istituzionali teme che un’eventuale crisi dei mercati emergenti rappresenti il rischio più elevato per il portafoglio Il 25% teme che a questa eventuale crisi dei mercati emergenti succeda un evento del “Cigno Nero” 1.80%1.93% 1.45% 1.30% Sondaggio Risk Rotation di NN Investment Partners Dicembre 2015 © NN Investment Partners. Sondaggio condotto nel dicembre 2015 presso 104 investitori istituzionali. Le aree geografiche più interessanti per gli investimenti azionari, in termini di rapporto rischio/rendimento Quali sono i settori obbligazionari più interessanti? 46% Investment grade statunitensi 34% High yield statunitensi 39% Investment grade europei 25% Obbligazioni corporate emergenti 55.7% 32.9% 11.4% 42.2% 38.6% 19.3% 41.4% 45.0% 13.5% 29.2% 40.4% 29.8% 36.5% 36.5% 27.0% 29.6% 47.0% 16.5% 28.3% 52.5% 18.3% 28.8% 55.8% 15.4%