EquityLock Protection For Existing Homeowners

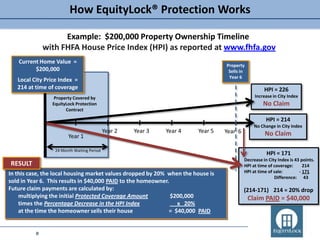

- 1. How EquityLock® Protection Works Example: $200,000 Property Ownership Timeline with FHFA House Price Index (HPI) as reported at www.fhfa.gov Current Home Value = Property $200,000 Sells in Year 6 Local City Price Index = 214 at time of coverage HPI = 226 Property Covered by Increase in City Index EquityLock Protection No Claim Contract HPI = 214 No Change in City Index Year 2 Year 3 Year 4 Year 5 Year 6 No Claim Year 1 24 Month Waiting Period HPI = 171 Decrease in City Index is 43 points. RESULT HPI at time of coverage: 214 In this case, the local housing market values dropped by 20% when the house is HPI at time of sale: - 171 Difference: 43 sold in Year 6. This results in $40,000 PAID to the homeowner. Future claim payments are calculated by: (214-171) 214 = 20% drop multiplying the initial Protected Coverage Amount $200,000 Claim PAID = $40,000 times the Percentage Decrease in the HPI Index _ x 20% at the time the homeowner sells their house = $40,000 PAID PROPRIETARY AND CONFIDENTIAL 0 0

- 2. EquityLock Protection Examples In 2012, Mr. Jones purchases a home for $300,000 and an EquityLock Protection contract for $5,700 (1.90% of the home price). The local House Price Index at the time is 100. In 2015, Mr. Jones sells the home under one of the following potential scenarios: Scenario 1 Scenario 2 Scenario 3 Initial Value at Beginning of Protection Contract $ 300,000 $ 300,000 $ 300,000 Property Value When Sold Years Later $ 350,000 $ 250,000 $ 325,000 Property Value Difference $ 50,000 $ (50,000) $ 25,000 We will House Price Index at Beginning of Contract 100 100 100 pay claims HPI When Property is Sold 105 80 90 regardless % Difference in HPI (Maximum Allowed is 20%) 5.0% -20.0% -10.0% of the Initial Value at Beginning of Protection Contract $ 300,000 $ 300,000 $ 300,000 property’s Multiplied by Difference in HPI 5.0% -20.0% -10.0% sales price = Claim Paid by EquityLock Solutions $ - $ 60,000 $ 30,000 in the Property Value Difference $ 50,000 $ (50,000) $ 25,000 future! Net Benefit to Property Owner $ 50,000 $ 10,000 $ 55,000 It’s About The INDEX - Not The Individual Property’s Resale Value PROPRIETARY AND CONFIDENTIAL 1 1

- 3. Your Options to Purchase EquityLock® Protection OPTION EXAMPLES Property Protection Value = $300,000 EquityLock Protection Contract Rate = 2.10% 1. Pay the total amount of EquityLock Protection Total Protection Cost = $ 6,300 with a one-time payment. 2. Pay the total amount with 12 equal monthly Payments for 12 Months = $ 525 installments. No Interest. No Credit Check. Monthly payments for 60 3. Finance the total amount through Prentice Acceptance months at 9.98% through Corporation for 18 to 60 months at 9.98% fixed Prentice Acceptance Corp. = $ 126.36* APR, with automatic approval* for a limited time. *Estimate. Required $350 down *A credit check is required. payment deducted from total protection cost of $6,300. 4. Add EquityLock Protection to your existing mortgage payment at your current mortgage rate. EquityLock monthly payment added to your mortgage payment Financing can be up to 60 months and requires prior for 60 months assuming approval by your mortgage servicing company or current 4.25% APR on your mortgage = $ 116.74 lender. PROPRIETARY AND CONFIDENTIAL 2

- 4. How is Your Protected Coverage Amount Determined? Values are specified by you and can be based on your: Home sales price Tax assessed value Mortgage amount Down payment or equity amount Any value you choose up to $2 million* * Amounts above $2 million require additional underwriting No Need To Validate Property Values PROPRIETARY AND CONFIDENTIAL 3

- 5. Population % Change In HPI Current HPI MSA State HPI Peak Rank 30 13 Las Vegas-Paradise, NV Riverside-San Bernardino-Ontario, CA NV CA Since Peak -60.24% -48.60% 1Q 2012 101.73 168.33 256.52 327.48 Top 50 Cities in 14 26 24 Phoenix-Mesa-Glendale, AZ Orlando-Kissimmee-Sanford, FL Sacramento-Arden-Arcade-Roseville, CA AZ FL CA -48.00% -47.02% -46.66% 152.94 149.29 155.03 294.23 281.78 290.62 Population Ranking & 8 19 12 Miami-Miami Beach-Kendall, FL (MSAD) Tampa-St. Petersburg-Clearwater, FL Detroit-Livonia-Dearborn, MI (MSAD) FL FL MI -45.69% -41.71% -38.23% 185.6 169.11 116.7 341.75 290.12 188.92 % Change in House 40 2 17 Jacksonville, FL Los Angeles-Long Beach-Glendale, CA (MSAD) San Diego-Carlsbad-San Marcos, CA FL CA CA -34.58% -33.90% -33.51% 175.8 222.61 214.06 268.73 336.76 321.95 Price Index 3 Chicago-Joliet-Naperville, IL (MSAD) IL -24.99% 152.51 203.34 15 Seattle-Bellevue-Everett, WA (MSAD) WA -24.88% 198.52 264.27 31 San Jose-Sunnyvale-Santa Clara, CA CA -24.69% 238.78 317.08 16 Minneapolis-St. Paul-Bloomington, MN-WI MN WI -24.16% 176.73 233.04 23 9 Portland-Vancouver-Hillsboro, OR-WA Atlanta-Sandy Springs-Marietta, GA OR WA GA -23.46% -23.43% 185.3 140.46 242.09 183.43 These large cities have 38 11 Providence-New Bedford-Fall River, RI-MA San Francisco-San Mateo-Redwood City, CA (MSAD) RI MA CA -23.14% -22.26% 197.95 235.59 257.53 303.04 experienced the largest value 7 Washington-Arlington-Alexandria, DC-VA-MD-WV (MSAD) DC VA MD WV -22.23% 218.05 280.37 20 Baltimore-Towson, MD MD -20.38% 201.82 253.48 declines over the last few 48 Salt Lake City, UT UT -19.58% 176.5 219.46 44 36 Richmond, VA Virginia Beach-Norfolk-Newport News, VA-NC VA VA NC -17.63% -17.43% 181.7 210.29 220.58 254.67 years . 28 Cleveland-Elyria-Mentor, OH OH -16.15% 126.75 151.17 1 New York-White Plains-Wayne, NY-NJ (MSAD) NY NJ -16.09% 227.99 271.7 10 33 Boston-Quincy, MA (MSAD) Charlotte-Gastonia-Rock Hill, NC-SC MA NC SC -15.20% -14.26% 230.71 155.76 272.05 181.66 If you need to sell your home 41 Memphis, TN-MS-AR TN MS AR -12.48% 138.47 158.21 39 Milwaukee-Waukesha-West Allis, WI WI -11.99% 166.41 189.1 in the next few years, will it be 45 Hartford, CT CT -11.48% 173.95 196.51 50 Birmingham-Hoover, AL AL -10.81% 160.12 179.53 worth what it is today? 5 Philadelphia, PA (MSAD) PA -9.90% 197.35 219.04 29 Kansas City, MO-KS MO KS -9.90% 161.78 179.56 18 St. Louis, MO-IL MO IL -9.60% 169.51 187.51 47 46 Raleigh-Cary, NC New Orleans-Metairie-Kenner, LA NC LA -8.35% -8.18% 154.78 191.82 168.89 208.92 EquityLock Protection 27 32 Cincinnati-Middletown, OH-KY-IN Columbus, OH OH KY IN OH -8.18% -8.10% 145.58 144.1 158.56 156.81 gives you 37 Nashville-Davidson--Murfreesboro--Franklin, TN TN -7.69% 174.56 189.1 21 Denver-Aurora-Broomfield, CO CO -5.88% 187.81 199.54 property value peace of mind. 34 Indianapolis-Carmel, IN IN -5.29% 140.73 148.59 4 Dallas-Plano-Irving, TX (MSAD) TX -4.06% 162.57 169.45 42 Louisville-Jefferson County, KY-IN KY IN -4.06% 163.73 170.65 25 San Antonio-New Braunfels, TX TX -2.80% 172.26 177.22 6 Houston-Sugar Land-Baytown, TX TX -1.74% 187.13 190.45 35 Austin-Round Rock-San Marcos, TX TX -1.65% 199.18 202.52 43 Oklahoma City, OK OK -1.13% 176.41 178.42 PROPRIETARY AND CONFIDENTIAL 22 Pittsburgh, PA PA -0.07% 167.13 168.32 49 Buffalo-Niagara Falls, NY NY 0.00% 151.73 151.73 4

- 6. Summary of EquityLock Protection Terms Feature Description Current property value (or more), purchase price, mortgage amount, down payment, Protected Coverage existing equity - Consumer determines property coverage amount of contract. Coverage Period Standard contract is for 15 years. Waiting Period No claims are eligible for payment within the first 24 months of contract. Claim Terms Property sales require an “arm’s-length” transaction to an unrelated party. Coverage Standard contract maximum claim is 20% of contract amount. Property Types Primary residences, second homes, non-owner occupied and multi-family up to 49 units. Pricing is based on property and loan factors including; homeowner probability of Pricing Factors mobility, loan status, property type, property value, occupancy type (rent, lease to own, owner occupied…) and geography. Foreclosures are not eligible for EquityLock Protection. EquityLock Protection is available Limitations for short sales, subject to lender approval. Consumer direct pricing is between 1.50% - 3.00% based on pricing factors above for Pricing Terms existing homeowners. Financing is available and can be added to existing mortgage payments with lender approval. Administrator Willis Group Holdings PLC Additional Information Sample contract and pricing plans available upon request. PROPRIETARY AND CONFIDENTIAL 5