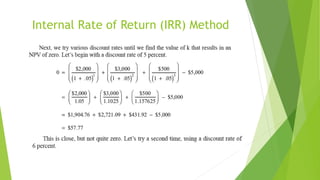

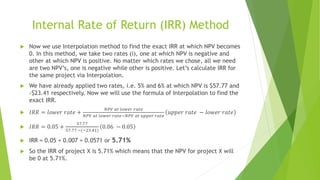

The document discusses capital budgeting techniques, including methods like payback period, discounted payback, net present value (NPV), profitability index, internal rate of return (IRR), and modified internal rate of return (MIRR). It outlines the importance of these tools for financial managers to evaluate and select investment projects, emphasizing their role in assessing project risks and returns. Additionally, the document highlights the strengths and limitations of each method, guiding decision-making in project approvals.