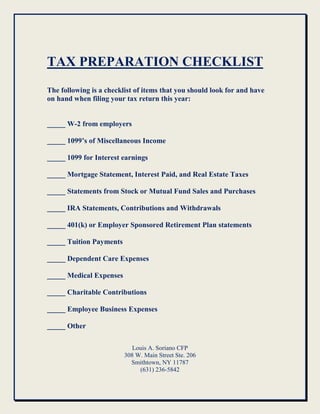

This tax preparation checklist outlines documents needed to file taxes, including W-2s, 1099s for interest and miscellaneous income, mortgage and investment statements, retirement plan statements, receipts for tuition, medical costs, donations, and business expenses. It provides contact information for a certified financial planner who can assist with tax filing.