税务达人 (捐赠扣税)

•Download as ODT, PDF•

0 likes•259 views

马来西亚税法,除了个人减免之外,还可以获得捐赠的扣税,怎样和该如何扣税。一起来探讨吧!

Report

Share

Report

Share

Recommended

More Related Content

More from B.H. Loh & Associates

More from B.H. Loh & Associates (20)

Winding up of a company and Limited Liability Partnership (LLP)

Winding up of a company and Limited Liability Partnership (LLP)

Setting Up A Foreign Limited Liability Partnership (Foreign LLP)

Setting Up A Foreign Limited Liability Partnership (Foreign LLP)

税务达人 (捐赠扣税)

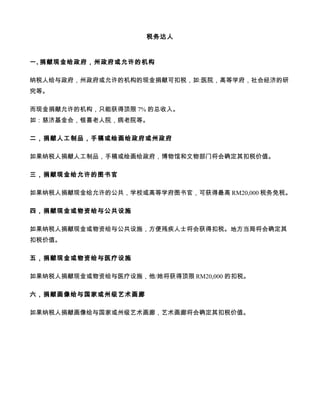

- 1. 税务达人 一, 捐献现金给政府,州政府或允许的机构 纳税人给与政府,州政府或允许的机构的现金捐献可扣税,如:医院,高等学府,社会经济的研 究等。 而现金捐献允许的机构,只能获得顶限7% 的总收入。 如:慈济基金会,银喜老人院,病老院等。 二,捐献人工制品,手稿或绘画给政府或州政府 如果纳税人捐献人工制品,手稿或绘画给政府,博物馆和文物部门将会确定其扣税价值。 三,捐献现金给允许的图书官 如果纳税人捐献现金给允许的公共,学校或高等学府图书官,可获得最高RM20,000税务免税。 四,捐献现金或物资给与公共设施 如果纳税人捐献现金或物资给与公共设施,方便残疾人士将会获得扣税。地方当局将会确定其 扣税价值。 五,捐献现金或物资给与医疗设施 如果纳税人捐献现金或物资给与医疗设施,他/她将获得顶限RM20,000 的扣税。 六,捐献画像给与国家或州级艺术画廊 如果纳税人捐献画像给与国家或州级艺术画廊,艺术画廊将会确定其扣税价值。