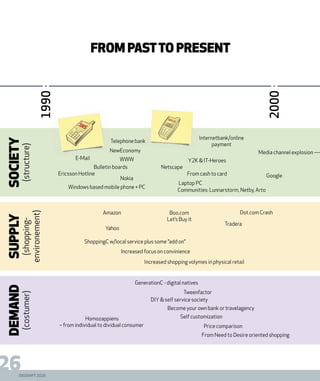

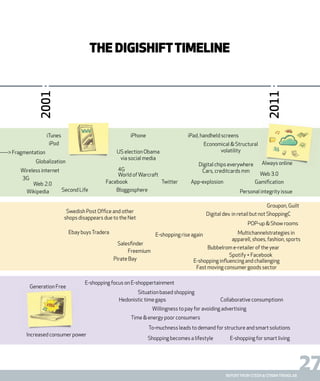

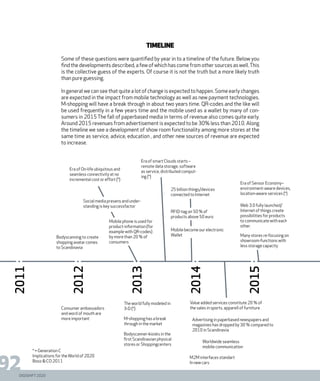

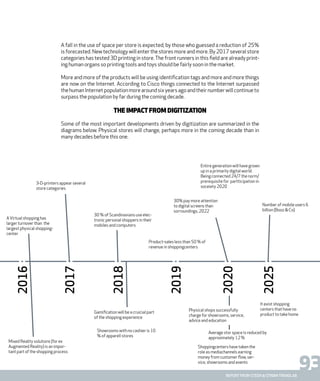

This document provides an introduction and background for the fourth report from Steen & Strøm's TrendLab. TrendLab gathers experts to discuss future trends in retail and shopping to help companies prepare. Previous reports focused on consumer behavior, major shifts impacting retail, and the customer experience. This report examines how digital channels will shape future retail and shopping centers. It aims to predict development to 2020 by involving internal and external experts. The introduction emphasizes the need to systematically monitor trends to develop "future sense" and prepare organizations for increasing complexity.