How Much of a Threat is Deflation?

- 1. 6363 Woodway Dr. Suite 870 Houston, TX 77057 Phone: 713-‐244-‐3030 Fax: 713-‐513-‐5669 Securities are offered through RAYMOND JAMES FINANCIAL SERVICES, INC. Member FINRA / SIPC Green Financial Group An Independent Firm Weekly Commentary by Dr. Scott Brown How Much Of A Threat Is Deflation? August 16 – August 20, 2010 The Federal Open Market Committee voted to maintain the level of credit easing last week, which was an increase relative to the status quo. Specifically, the FOMC decided to reinvest principal payments from its holdings of agency debt and agency mortgage-backed securities in long-term Treasury securities – which will keep the level of its security holdings steady over time. By itself, the Fed’s decision is not a major move. Long-term interest rates were already very low. More importantly, the move signals that the Fed could do more if needed. The Fed’s action was almost certainly made to fend off the risk of a deflationary spiral, but how much of a risk is deflation?

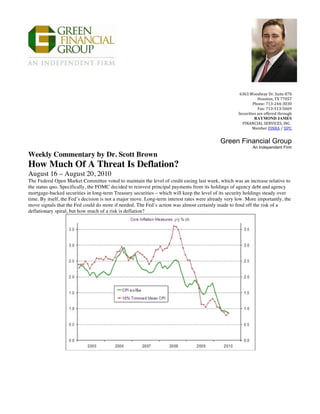

- 2. Core inflation has trended lower over the last several months. This is disinflation (a declining inflation rate). If it continues, disinflation will eventually lead to deflation (a negative inflation rate or, equivalently, a decline in the general price level). Note that over any particular time interval, some prices will be rising faster than others. As the overall inflation rates gets closer to zero, more prices are likely to be falling. More than a third of the CPI was down over the 12 months ending in July. Not all deflations are bad. Increased efficiencies and strong productivity growth could push prices lower. What we worry about is deflation caused by insufficient demand. Deflations tend to paralyze economic activity. Consumers don’t want to buy, since things will be cheaper next month. Businesses have less incentive to make capital expenditures, since they’re less likely to get a return on their investment. Weaker growth then leads to even lower prices – you’re in a deflationary spiral. How does the inflation process work? There is no long-term trade off between unemployment (or the output gap, the difference between actual and potential GDP) and inflation, but excess capacity should put downward pressure on inflation over time (conversely, pushing the growth rate beyond its potential should lift inflation over time). As long as the output gap persists, inflation should be trending lower. However, inflation expectations also play an important role. In the Great Inflation of the 1970s and early 1980s, inflation expectations were rising. The Volcker Fed engineered a recession to bring inflation expectations down. Inflation expectations

- 3. act as a base for the inflation rate. The inflation rate could be higher or lower, but won’t deviate too much from expectations if those expectations are sufficiently well anchored. Yet, over time, if actual inflation continues to deviate from expectations, those expectations are likely to change. Most gauges of inflation expectations, whether through surveys or through market-based measures, have remained relatively steady. The Philadelphia Fed’s quarterly Survey of Professional Forecasters includes a 10-year CPI forecast. This long-term inflation estimate has bunched closely to 2.5% since 1998, but dipped to 2.4% in the first and second quarter of this year and hit 2.3% in the latest survey (for 3Q10). Outright deflation is not likely, but it could result from a more substantial downturn in the overall economy. The Fed’s latest move should prevent the economy from weakening a lot more.