How does GST Affect Real Estate Agents in Malaysia

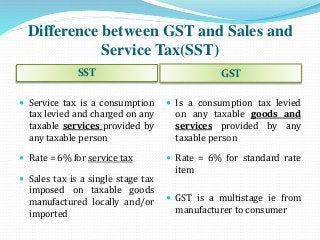

- 1. Difference between GST and Sales and Service Tax(SST) SST GST Service tax is a consumption tax levied and charged on any taxable services provided by any taxable person Rate = 6% for service tax Sales tax is a single stage tax imposed on taxable goods manufactured locally and/or imported Is a consumption tax levied on any taxable goods and services provided by any taxable person Rate = 6% for standard rate item GST is a multistage ie from manufacturer to consumer

- 2. Difference between GST and Sales and Service Tax(SST) SST GST Rate of tax = 5% to 10% for sales tax Threshold varies from RM0 to RM3million for Service tax and RM100,000 for Sales tax Single stage Rate of tax = 3 types i) Zero rated (0%) ii) Exempted iii) Standard rated (6%) Threshold is RM500,000 Multistage

- 3. Difference between GST and Sales and Service Tax(SST) SST GST Service tax is due when payment is received for taxable services rendered If payment is not received within 12 calendar months from the date of issuance of invoice, the tax is due on the day immediately after the expiry of the 12 months period. Is due on accrual basis and is payable to the Custom at the end of the following month after the end of the taxable period.

- 4. Difference between GST and Sales and Service Tax(SST) SST GST Taxable period = Two calendar months Can claim bad debts relief if debtors failed to pay after one year only for service tax Taxable period :- i) Monthly= For Turnover exceeding RM5million ii) Quarterly= For Turnover less than RM5million Can claim bad debts relief if debtors failed to pay after 6 months

- 5. Difference between GST and Sales and Service Tax(SST) SST GST Cannot claim input tax as this is single stage system Cannot claim refund Only apply to limited professional services and industries Can claim input tax if goods supplied is Zero rated or Standard rated Can claim refund if input tax is more than output tax Apply to any goods and services where the threshold is met

- 6. Impact on Real Estate Agents Estate Agent a person licensed under Part VA of the Valuers, Appraisers and Estate Agent Act 1981 an Authority of Practice has been issued by the Board of Valuers, Appraisers & Estate Agents under Section 16 of such Act provides services as he acts as a go-between for the owner and the buyer assisting with their negotiations to reach an agreed sales price for the property continue to follow up with the owner until the property is legally transferred to the new owner Such services = taxable supplies regardless whether the property are commercial or non-commercial

- 7. Impact on Real Estate Agents Estate agents, negotiators or brokers receives a payment known as a Commission from the owner Have to charge GST on the fee or commission in relation to a property located in Malaysia If property is located outside Malaysia = zero rated

- 8. Impact on Real Estate Agents Disbursements does not constitute a supply and is not subject to GST provided the following circumstances are met:- made by the person as an agent on behalf of the client client actually received the goods & services client is the person responsible to pay payment is authorised by the client client knew that the goods & services paid for is provided by third party payment is itemised the person claims the exact amount from the client payment is clearly additional to the supplies the person makes to the client

- 9. Impact on Real Estate Agents Reimbursements refer to the recovery of an expense that you incur as a principal from another party may be subjected to GST if it is a consideration for a supply of goods or services Eg. telephone, telex, postage, advertising, stationery ,travelling and accommodation GST registered valuer, appraisers of an estate agents are entitled to claim input tax incurred for the reimbursement

- 10. Impact on Real Estate Agents Tax Invoice Section 33 of the Goods and Services Act 2014 every registered person who make any taxable supply of goods & services in the course of furtherance of business in Malaysia to issue a tax invoice within 21 days from the time of supply

- 11. Impact on Real Estate Agents Example: For real estate agent, where sale of property requires consent from the State Government, the time of supply starts when the consent is given. Tax invoice is issued only within 21 days from the date of consent.

- 12. Impact on Negotiators • Negotiators To register & charge GST if: Income > RM500,000 Is on contract for services

- 13. Impact on Real Estate Agents • What constitute taxable turnover? All fees Additional fee incurred by valuer ,appraisers/estate agents (excluding disbursements) Deemed supplies Eg. private use of business assets and disposal of business gifts, excluding disposal of capital assets Private use means any amount exceeding RM500

- 14. Impact on Real Estate Agents • However, Real estate agent involved in business and selling properties or renting out their own property, the taxable supplies will include: Fees Selling price of commercial properties held as trading stock Rental received from commercial properties

- 15. Transitional Provision GST is payable on supplies of goods and services made on or after 1 April 2015 If there is a continuous supply of services spanning the GST commencement: Portion of supply made before 1 April 2015 = not subject to GST Portion of supply made on/after 1 April 2015 = subject to GST

- 16. Transitional Provision For Estate Agent: must apportion their services and charge accordingly GST is only chargeable for such services rendered after GST implementation (1 April 2015) Apportionment can be by way of time spent or transaction of the services Example: If the rental of a shop starts from 15 March 2015 to 14 April 2015, only the portion of rental from 1 April to 14 April 2015 is subject to GST.

- 17. MARGIN SCHEME (MS) Why Margin Scheme? Normal rules, GST is charged on full value of taxable supplies Example: Used car bought from an individual, and then sold to another person. To avoid double taxation for taxable persons who acquire second-hand goods where no tax was previously charged on the acquisition.

- 18. MARGIN SCHEME (MS) How GST being impose under Normal rules? Selling price Selling price RM45,000 No GST RM50,000 *GST 6%=RM3,000 *GST= RM50,000 x 6%= RM3,000.00 Individual Second hand Dealer Individual Registered person Unregistered person

- 19. MARGIN SCHEME (MS) How GST being impose under Margin scheme? GST will be charged based on the margin i.e. the difference between selling price and the purchase price of the prescribed second hand goods If there is a difference (excess), the GST is to be treated inclusive in the consideration If there is no excess, then there is no GST due and payable

- 20. MARGIN SCHEME (MS) How GST being impose under Margin scheme? Used goods must be acquired by the MS participants where no GST chargeable on the acquisitions Selling price Selling price RM45,000 No GST RM50,000 *GST 6%=RM283.01 *Margin=RM5,000.00 (RM50,000 – RM45,000) GST=RM5,000 x 6/106 = RM283.01 Individual Second hand Dealer Individual Registered person Unregistered person

- 21. MARGIN SCHEME (MS) How GST being impose under Margin scheme? GST on Margin can also be imposed by approved person under MS to the other MS participants Selling price Selling price Selling price RM45,000 No GST RM50,000 *GST 6%=RM283.01 RM55,000 *GST 6%=RM283.01 *GST 6%=RM283.01 Individual Second hand Dealer (MS) IndividualSecond hand Dealer (MS) Individual

- 22. MARGIN SCHEME (MS) Section 60 - Relief for Second Hand Goods Selling Price RM50,000 (inclusive of GST) Cost Price RM45,000 Gross Margin RM5,000 [RM50,000 – RM45,000] GST RM283.01 [RM5,000 x 6/106] (not to be shown on invoice) Value of the car RM49,716.99 [RM50,000 – RM283.01] (Selling price less GST) Output tax RM283.01 Input tax RM0.00 (no input tax claimable as no tax invoice is issued by the seller) Net GST RM283.01

- 23. MARGIN SCHEME (MS) Goods eligible for the relief are as follows: used motor vehicle after the implementation of GST and include used motor vehicle which is subject to sales tax whether on locally manufactured vehicle or importation Taxable supply of land and property (Commercial and Industrial) acquired after the implementation of GST

- 24. MARGIN SCHEME (MS) Who is eligible for the scheme? Any registered person who is involved in the business buying and selling of second-hand motor vehicles or real properties Eg. Second hand car dealers and Real estate agents

- 25. MARGIN SCHEME (MS) How Margin Scheme Operates? Sales transaction to MS registrant Seller Buyer Individual Non-registrant MS registrant MS registrant GST registrant Scenario 1 A buyer who is GST MS registrant can purchase eligible goods from individual, non-registrant, GST MS registrant or GST registrant. No tax invoice is issued by the seller (i.e.GST is not chargeable on the sale). No input tax to be claimed by the buyer. The buyer will then have the choice whether he wants to apply the margin scheme or not when he sells the goods.

- 26. MARGIN SCHEME (MS) Requirement under the Margin Scheme: Taxable person needs to apply for this scheme using the special form Approval under this scheme is not subject to renewal The goods is allowed to be transacted under margin scheme with acquisition made from:- Individual Non-registrant Registrant as regard to goods which fall under the block input tax Registrant person approved under the Margin Scheme (MS)

- 27. MARGIN SCHEME (MS) Requirement under the Margin Scheme: No tax invoice to be issued under this scheme and it is an offence under Sec.33(8) If the buyer is a registered person, he is not entitled to claim the input tax incurred on the acquisition Approved person has an option whether to impose GST based on margin or according to the normal rules but needs to issue tax invoice on the supply

- 28. MARGIN SCHEME (MS) Sales transaction by MS registrant Seller Buyer GST MS registrant individual non-registrant GST MS registrant GST registrant Scenario 2: The seller can opt whether he wants to apply the margin scheme or not when he sells the goods. If the seller sells the goods using margin scheme, he will issue a normal invoice and account for output tax based on the margin.

- 29. We are an Approved Auditors under Companies Act 1965 established in 1996 and Licensed Tax Agent under Section 153(3) of the Income Tax Act 1967 and GST Tax Agent under Section 170 of Goods and Service Tax Act 2014. Services provided:- Auditing Income Tax compliance Income Tax planning Accounting Company secretarial GST application GST returns GST planning & advisory GST training

- 30. C-6-5 Megan Avenue 1, 189 Jalan Tun Razak 50400 Kuala Lumpur Tel : 03-21660198 / Fax : 03-21662198 Email : kinfongc@gmail.com Should you have any enquiries, please do not hesitate to contact us