Intuit News Alert- DTAA and IPPA between Mauritius and Kenya

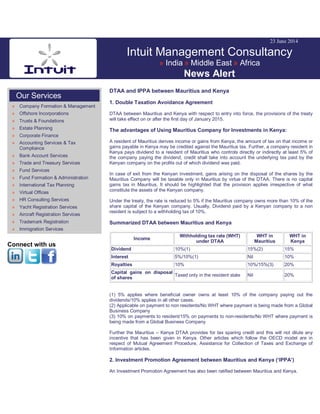

- 1. 23 June 2014 Intuit Management Consultancy » India » Middle East » Africa News Alert Our Services » Company Formation & Management » Offshore Incorporations » Trusts & Foundations » Estate Planning » Corporate Finance » Accounting Services & Tax Compliance » Bank Account Services » Trade and Treasury Services » Fund Services » Fund Formation & Administration » International Tax Planning » Virtual Offices » HR Consulting Services » Yacht Registration Services » Aircraft Registration Services » Trademark Registration » Immigration Services Connect with us DTAA and IPPA between Mauritius and Kenya 1. Double Taxation Avoidance Agreement DTAA between Mauritius and Kenya with respect to entry into force, the provisions of the treaty will take effect on or after the first day of January 2015. The advantages of Using Mauritius Company for Investments in Kenya: A resident of Mauritius derives income or gains from Kenya, the amount of tax on that income or gains payable in Kenya may be credited against the Mauritius tax. Further, a company resident in Kenya pays dividend to a resident of Mauritius who controls directly or indirectly at least 5% of the company paying the dividend, credit shall take into account the underlying tax paid by the Kenyan company on the profits out of which dividend was paid. In case of exit from the Kenyan investment, gains arising on the disposal of the shares by the Mauritius Company will be taxable only in Mauritius by virtue of the DTAA. There is no capital gains tax in Mauritius. It should be highlighted that the provision applies irrespective of what constitute the assets of the Kenyan company. Under the treaty, the rate is reduced to 5% if the Mauritius company owns more than 10% of the share capital of the Kenyan company. Usually, Dividend paid by a Kenyan company to a non resident is subject to a withholding tax of 10%. Summarized DTAA between Mauritius and Kenya Income Withholding tax rate (WHT) under DTAA WHT in Mauritius WHT in Kenya Dividend 10%(1) 15%(2) 15% Interest 5%/10%(1) Nil 10% Royalties 10% 10%/15%(3) 20% Capital gains on disposal of shares Taxed only in the resident state Nil 20% (1) 5% applies where beneficial owner owns at least 10% of the company paying out the dividends/10% applies in all other cases. (2) Applicable on payment to non residents/No WHT where payment is being made from a Global Business Company (3) 10% on payments to resident/15% on payments to non-residents/No WHT where payment is being made from a Global Business Company Further the Mauritius – Kenya DTAA provides for tax sparing credit and this will not dilute any incentive that has been given in Kenya. Other articles which follow the OECD model are in respect of Mutual Agreement Procedure, Assistance for Collection of Taxes and Exchange of Information articles. 2. Investment Promotion Agreement between Mauritius and Kenya (‘IPPA’) An Investment Promotion Agreement has also been ratified between Mauritius and Kenya.

- 2. The objective of the Investment Promotion Agreement is to encourage and protect investments between the two countries. The date the IPPA will start being effective is yet to be specified by the Minister. Intuit Research Team Intuit Management Consultancy India Tel: +91 9840708181 Fax: +91 44 42034149 Dubai Tel: +971 4 3518381 Fax: +971 4 3518385 Email: newsletter@intuitconsultancy.com www.intuitconsultancy.com If you wish to unsubscribe please email us Disclaimer: The content of this news alert should not be constructed as legal opinion. This news alert provides general information at the time of preparation. This is intended as a news update and Intuit neither assumes nor responsible for any loss. This is not a spam mail. You have received this, because you have either requested for it or may be in our Network Partner group.