Review Of Our Rental Property Software

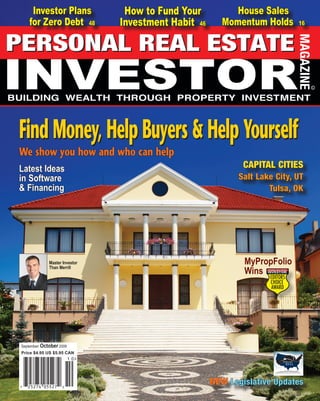

- 1. Investor Plans How to Fund Your House Sales for Zero Debt 48 Investment Habit 46 Momentum Holds 16 Find Money, Help Buyers & Help Yourself We show you how and who can help Latest Ideas CAPITAL CITIES in Software Salt Lake City, UT & Financing Tulsa, OK Master Investor MyPropFolio Wins Than Merrill September/ October 2009 Price $4.95 US $5.95 CAN www.PersonalRealEstateInvestorMag.com NEW Legislative Updates 1 September - October 2009 . Personal Real Estate Investor

- 2. INVESTOR STRATEGIES 0 Using Interest Math to Ensure the Wealth Effect Works For You Road Map to Zero Debt By Andrew Waite stand how to apply payments intel- am making it work for me to get more ligently to reduce interest with the equity in my investments earlier. I Howard Walton is a bus driver greatest effect,” said Easley. “The soon- expect to pay off most of these loans for the Regional Transit Authority in er money is applied to principal, and in 15 years with rent proceeds. Then, Euclid, Ohio. At 50 years young, and not interest, the sooner the mortgage it can be almost pure positive cash the prospect of working another 10 balance, and thus interest due, drops. flow.” years, Walton worked out that if he Understanding how to emphasize After using this for just two months, wanted to have a comfortable retire- Mortgage A versus Mortgage B can major principal reductions have not yet ment, he would need more income massively reduce interest obligations.” arrived; but Walton can already see an than his pension and social security Without seeing the overall pay- impact through dynamically applying could provide. His solution: rental real ment effect, Walton would not get the current cash, as well as a clearer path estate. most from his payments. to a more stable retirement income and That was the good news. Now a debt-free asset base. Walton finds that managing the financ- INTEREST INTELLIGENCE ing he needs to borrow, buy, rent, and The solution Easley proposed to WHO CAN HELP debt service some 12 separate proper- Walton was using the latest version Diana Easley is a triple threat. ties is a significant task. “These num- of the United First Financial Money She was a loan officer, so she under- bers can be put on spreadsheets,” says Merge Account™. This system man- stands the mortgage business well. Walton. “But this does little beyond ages multiple mortgages for multiple She is a board member at The Greater laying out the extent of the debt.” properties. Cincin nati Real Estate Investors Enter Diana Easley, a board mem- Version 4.2 of the Money Merge Association, and an investor. She is ber of the Greater Cincinnati Real Account was tested with investors for also a successful United First Financial Estate Investors Association, a former six months before it was released in agent who specializes in understand- mortgage broker and now a United Q’4 2008. ing how the Money Merge Account™ First Financial agent. As an investor “This is a great for investors as it can help buy-and-hold investors and former loan officer, Easley fully allows me to shoot for another goal achieve more equity, earlier, in multi- understands the mortgage manage- beyond just investing,” says Walton. property portfolios. ment issues facing active real estate “The way the real estate financing cri- investors, particularly those following sis was going and bank reactions to a buy-and-hold strategy. toxic loans and underwriting lapses, RESOURCES this could have become an issue for SPREADSHEETS ALIVE me. By using Money Merge I can see Investor Specific “The biggest issue for me was figur- the big picture and where to best apply Diana Easley ing out the money flow,” said Walton. payments and manage interest. With United First Financial independent agent “Where it came from and where it the Money Merge tools and software I befreeoffinance@yahoo.com went, especially when it came to pay- can see ‘my road map to zero.’” 513-403-2068 ing each of the separate mortgages for Walton will retire at 60. “At 50, and each of the 12 properties I own with looking at 30 years of mortgage pay- Other Money Merge Account™ inquiries various banks as my lenders.” ments, I could not see real equity till United First Financial “Without each mortgage consid- late in my life,” says Walton, “but now www.u1stfinancial.com ered as part of a complete picture, it that I better understand how financ- was impossible for Walton to under- ing works for the financial industry, I 48 September - October 2009 . Personal Real Estate Investor www.PersonalRealEstateInvestorMag.com