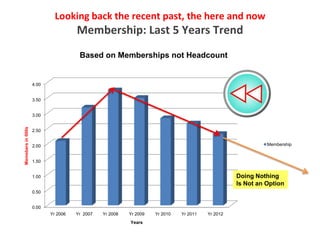

HGS The Way Forward Reversing the Curve

- 1. Looking back the recent past, the here and now Membership: Last 5 Years Trend Based on Memberships not Headcount 4.00 3.50 3.00 Memebers in 000s 2.50 2.00 Membership 1.50 1.00 Doing Nothing Is Not an Option 0.50 0.00 Yr 2006 Yr 2007 Yr 2008 Yr 2009 Yr 2010 Yr 2011 Yr 2012 Years

- 2. Financial Trends: Last 5 Years Cause and Effect 120.00 100.00 * Only 1 Core Cost Capable of Substantial reduction -The Journal 80.00 60.00 Total Income 40.00 Total Costs Net Surplus Total Net Reserves 20.00 0.00 Doing Nothing Yr 2006 Yr 2007 Yr 2008 Yr 2009 Yr 2010 Yr 2011 Yr 2012 Is Not an Option Year -6 Year -5 Year -4 Year -3 Year -2 Year -1 Year 0 -20.00 • Reduced Revenue -reflects reduced Membership -40.00 •Costs increasing in excess of Revenue •Eating into reserves since 2008 •Year on Year we are making a Loss Ann-Marie Shearer Treasurer 3 of 6

- 3. The Good News - The Way Forward Membership: Steady Improvement Reverse the Curve Members 4.00 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 Yr 2006 Yr Yr 2008 2007 Yr 2009 Yr 2010 Yr 2011 Yr 2012 Yr 2013 Yr 2014 Yr 2015 Yr 2016 Yr 2017 Yr 2006 Yr 2007 Yr 2008 Yr 2009 Yr 2010 Yr 2011 Yr 2012 Yr 2013 Yr 2014 Yr 2015 Yr 2016 Yr 2017 Membership 2.10 3.18 3.74 3.49 2.84 2.66 2.32 2.44 2.66 2.66 2.82 2.96

- 4. The Way Forward Reversing the Trend, Reducing Journal Costs over 3 Years Increasing Membership 120.00 100.00 80.00 The Way Forward -Reversing The Curve 60.00 Axis Title 40.00 20.00 0.00 -20.00 -40.00 Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr Yr 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Total Net Reserves 79.68 89.41 97.39 93.94 90.76 71.12 52.91 47.70 49.96 66.01 84.08 104.26 Total Income 38.64 59.38 70.78 59.03 53.99 53.84 46.79 57.83 61.49 61.49 63.50 65.61 Total Costs 41.12 49.65 60.86 62.47 57.17 73.46 65 63.04 59.23 45.43 45.43 45.43 Net Surplus -2.48 9.73 9.92 -3.44 -3.18 -19.62 -18.21 -5.21 2.26 16.06 18.07 20.18