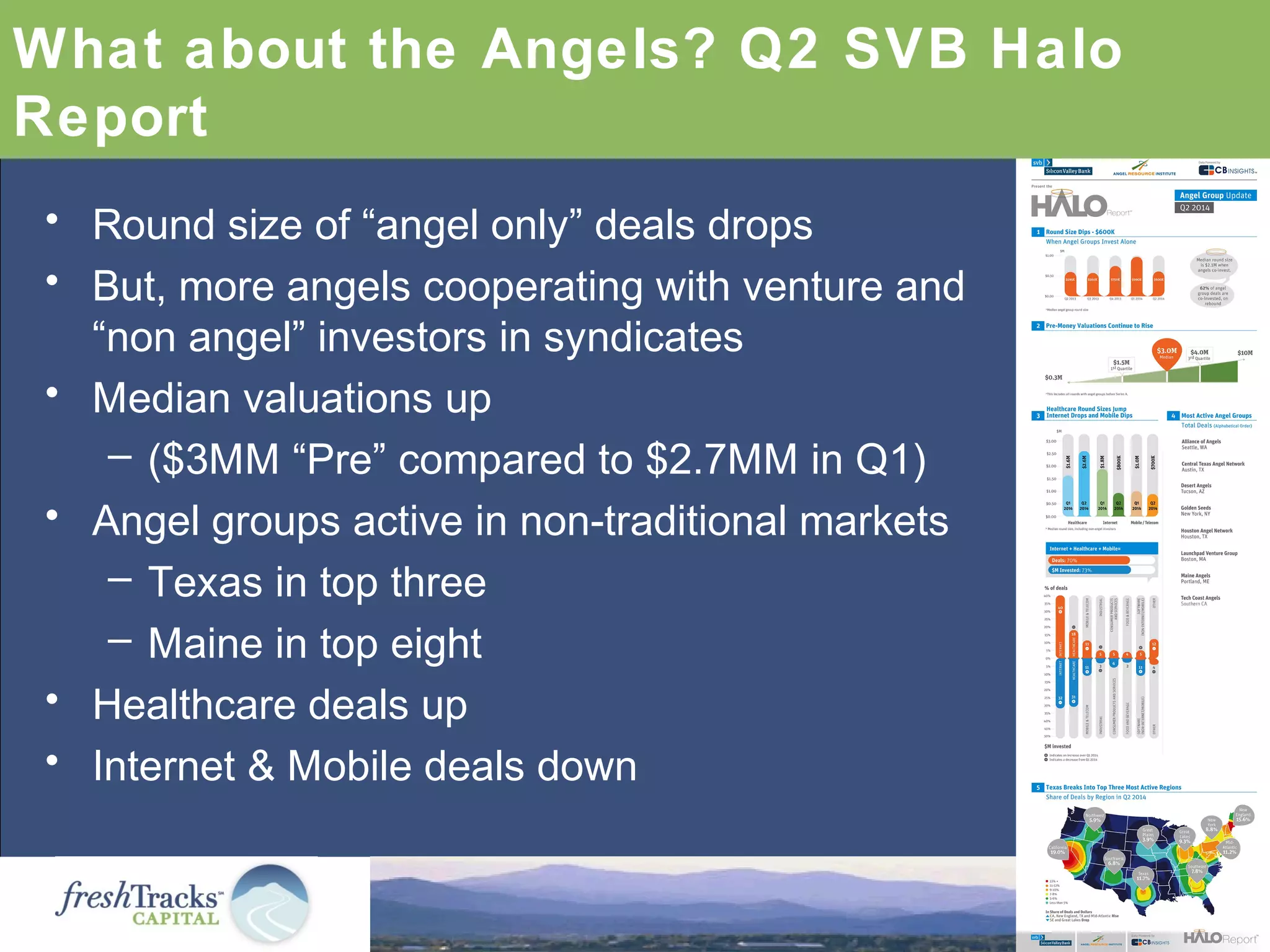

FreshTracks Capital, established in 2000 and based in Vermont, has raised three funds and invested in 30 companies to date. The document highlights trends in venture capital funding, particularly in Vermont, where funding per capita remains below average but shows positive growth. Various local companies and developments, including significant deals and emerging businesses, are also noted alongside national VC trends and alternative funding methods.