Solar plays Russian roulette

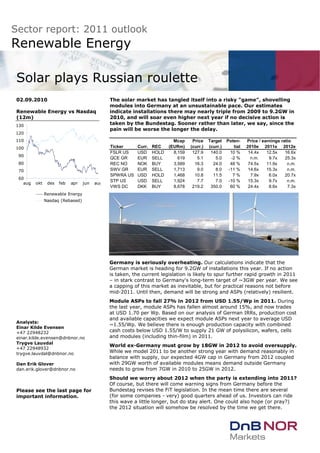

- 1. Sector report: 2011 outlook Renewable Energy Solar plays Russian roulette Renewable Energy 02.09.2010 Renewable Energy vs Nasdaq (12m) 60 70 80 90 100 110 120 130 aug okt des feb apr jun aug Renewable Energy Nasdaq (Rebased) Analysts: Einar Kilde Evensen +47 22948232 einar.kilde.evensen@dnbnor.no Trygve Lauvdal +47 22948932 trygve.lauvdal@dnbnor.no Dan Erik Glover dan.erik.glover@dnbnor.no Please see the last page for important information. The solar market has tangled itself into a risky "game", shovelling modules into Germany at an unsustainable pace. Our estimates indicate installations there may nearly triple from 2009 to 9.2GW in 2010, and will soar even higher next year if no decisive action is taken by the Bundestag. Sooner rather than later, we say, since the pain will be worse the longer the delay. Mcap Price Target Poten- Price / earnings ratio Ticker Curr. REC (EURm) (curr.) (curr.) tial 2010e 2011e 2012e FSLR US USD HOLD 8,159 127.9 140.0 10 % 14.4x 12.5x 16.6x QCE GR EUR SELL 619 5.1 5.0 -2 % n.m. 9.7x 25.3x REC NO NOK BUY 3,589 16.3 24.0 48 % 74.5x 11.9x n.m. SWV GR EUR SELL 1,713 9.0 8.0 -11 % 14.6x 15.3x n.m. SPWRA US USD HOLD 1,468 10.8 11.5 7 % 7.9x 6.0x 20.7x STP US USD SELL 1,924 7.7 7.0 -10 % 15.3x 9.7x n.m. VWS DC DKK BUY 8,678 219.2 350.0 60 % 24.4x 8.6x 7.3x Germany is seriously overheating. Our calculations indicate that the German market is heading for 9.2GW of installations this year. If no action is taken, the current legislation is likely to spur further rapid growth in 2011 – in stark contrast to Germany's long-term target of ~3GW per year. We see a capping of this market as inevitable, but for practical reasons not before mid-2011. Until then, demand will be strong and ASPs (relatively) resilient. Module ASPs to fall 27% in 2012 from USD 1.55/Wp in 2011. During the last year, module ASPs has fallen almost around 15%, and now trades at USD 1.70 per Wp. Based on our analysis of German IRRs, production cost and available capacities we expect module ASPs next year to average USD ~1.55/Wp. We believe there is enough production capacity with combined cash costs below USD 1.55/W to supply 21 GW of polysilicon, wafers, cells and modules (including thin-film) in 2011. World ex-Germany must grow by 18GW in 2012 to avoid oversupply. While we model 2011 to be another strong year with demand reasonably in balance with supply, our expected 4GW cap in Germany from 2012 coupled with 29GW worth of available modules means demand outside Germany needs to grow from 7GW in 2010 to 25GW in 2012. Should we worry about 2012 when the party is extending into 2011? Of course, but there will come warning signs from Germany before the Bundestag revises the FiT legislation. In the mean time there are several (for some companies - very) good quarters ahead of us. Investors can ride this wave a little longer, but do stay alert. One could also hope (or pray?) the 2012 situation will somehow be resolved by the time we get there.

- 2. Sector report > Renewable Energy DnB NOR Markets – 2 02.09.2010 Table of contents 1. EXECUTIVE SUMMARY 6 1. 2011 ANOTHER RECORD, BUT UNSUSTAINABLE – 2012 TO FACE SEVERE OVERSUPPLY 6 2. MODULE ASPS SLIPPING TO EUR 1.20-1.25/W IN 2011, BUT BRACE FOR 2012 6 3. GERMANY NEEDS TO INTRODUCE CAP – SOON! 6 4. WIND – GROWTH SLOWING IN 2010, CAGR OF 10% EXPECTED NEXT FIVE YEARS 8 5. INVESTMENT STRATEGY 8 2. ELECTRICITY MARKET OUTLOOK 9 MACRO BACKDROP: MODEST RECOVERY 9 ELECTRICITY DEMAND GROWTH HAS HISTORICALLY BEEN RESILIENT VS MACRO 10 DEMAND GROWTH IS VULNERABLE, BUT AGING PLANTS MUST STILL BE RETIRED 12 ENERGY SUPPLY: CURRENT NEW-BUILD PACE IS INSUFFICIENT 13 NUCLEAR: PHASING OUT OR NEW DAWN? 15 ENERGY SECURITY REMAINS A SIGNIFICANT DRIVER OF RENEWABLE ENERGY 17 ELECTRICITY PRICES LIKELY TO RISE 19 ELECTRICITY MARKETS ARE VERY HETEROGENOUS 21 3. ESTIMATING COST OF NEW ELECTRICITY PRODUCTION (LCOE) 22 WHAT IS LCOE AND WHY DO WE NEED IT? 22 KEY FINDINGS: WIND CAN COMPETE WITHOUT SUBSIDIES 22 LCOE: SENSITIVE TO THE DIFFERENT COST PARAMETERS 22 PROS AND CONS OF THE DIFFERENT TECHNOLOGIES 22 WIND – ONSHORE 24 WIND - OFFSHORE 25 SOLAR - PV 26 NUCLEAR 27 HYDRO 28 NATURAL GAS 29 COAL 30 DISCOUNT RATE SENSITIVITIES 31 4. POLITICAL FRAMEWORK 32 HOW EXPENSIVE ARE RENEWABLE ENERGY SUBSIDIES REALLY? 32 OVERVIEW OF WORLD SUBSIDIES FOR SOLAR AND WIND 33 OBJECTIVE OF POLICIES 1: REDUCING THE DEPENDENCE ON FOSSIL FUELS 33 OBJECTIVE OF POLICIES 2: REDUCING GREENHOUSE-GAS EMISSIONS 35 US POLICIES: AMBITIOUS TARGETS, LOW FIT RATES 36 GERMANY: LUCRATIVE TARIFFS SPURRING RAPID BUT UNSUSTAINABLE GROWTH 37 GERMANY: WHY A CAP IS INEVITABLE 38 DEMAND - EUROPE: EMERGING SOLAR MARKETS 40 ASIA: A POLICY CHANGE CAN RESULT IN A SOLAR BOOM 40 WIND POWER: OFFSHORE BECOMING CLOSE TO COST COMPETITIVE 41 5. SOLAR COST AND PRICES 43 SUMMARY: MARGIN COMPRESSION CONTINUES 43 POLYSILICON: DIFFICULT, IF NOT IMPOSSIBLE, TO SEE PRICES NOT FALLING 44 WAFERS: NO LONG-TERM BOTTLENECK 46 CELL AND MODULE – NO BOTTLENECKS IN SIGHT 46 PROJECT COSTS: NO LONG-TERM BOTTLENECK 47 COST OUTLOOK THROUGH THE VALUE CHAIN IN 2011 48 DEMAND VS SUPPLY: OVERSUPPLY LOOMING FOR 2011 49

- 3. Sector report > Renewable Energy DnB NOR Markets – 3 02.09.2010 6. WIND INDUSTRY 51 SUMMARY: SIGNIFICANT GROWTH POTENTIAL NEXT DECADE 51 INDUSTRY STRUCTURE: INCREASINGLY DIVERSIFIED 53 GEOGRAPHICAL PRESENCE 54 FURTHER CONSOLIDATION LIKELY 54 WIND OFFERS COMPETITIVE COST OF (UN-SUBSIDISED) ELECTRICITY 55 KEY MARKETS: EUROPE, THE AMERICAS AND ASIA/PACIFIC 56 7. ELECTRICAL CARS – A (SMALL) PIECE OF THE PUZZLE 65 EVS ARE SOON BECOMING COST COMPETITIVE 65 BATTERY COST IS THE KEY ISSUE FOR (PH)EVS 66 IMPACT ON ELECTRICITY DEMAND 67 8. VALUATION SUMMARY 69 SHARE PRICE DEVELOPMENT 69 HISTORICAL 1-YEAR FORWARD MULTIPLES 70 PEER GROUP MULTIPLES 74 EPS REVISION TABLES 76 9. APPENDIX 77 A1: TOP 10 PRODUCERS: POLY, WAFERS, CELLS AND MODULES 77 A2: SOLAR TECHNOLOGY BASICS: TWO ROUTES TO HARNESS ENERGY FROM THE SUN 77 A3: SOLAR AND PV VALUE CHAIN 78 A4: WHAT IS A "SMART GRID"? 78 A5: US STATE AND LOCAL SUBSIDIES FOR RENEWABLE ENERGY 80 A6: GLOSSARY, RENEWABLE ENERGY TERMS AND EXPRESSIONS 81 10. COMPANY COVERAGE 83 FIRST SOLAR 84 Q-CELLS 88 RENEWABLE ENERGY CORP. 91 SOLARWORLD 100 SUNPOWER 103 SUNTECH POWER 106 VESTAS WIND SYSTEMS 109

- 4. Sector report > Renewable Energy DnB NOR Markets – 4 02.09.2010 Table of exhibits EXHIBIT 1-1: ASP PROJECTIONS 2010-2012E............................................... 6 EXHIBIT 1-2: GERMAN SOLAR INSTALLATIONS (TWO SCENARIOS) ........................... 7 EXHIBIT 1-3: ELECTRICITY FROM PV VS GERMAN ELECTRICITY DEMAND .................... 7 EXHIBIT 2-1: KEY MACRO ASSUMPTIONS: GDP GROWTH ..................................... 9 EXHIBIT 2-2: GERMAN ELECTRICITY DEMAND VS GDP 1952-2010E ......................10 EXHIBIT 2-3: ELECTRICITY DEMAND BY REGION...............................................11 EXHIBIT 2-4: MWH/CAPITA AND POPULATION GROWTH .....................................11 EXHIBIT 2-5: ANNUAL ELECTRICITY USE PER CAPITA..........................................12 EXHIBIT 2-6: OECD ELECTRICITY USAGE INDICATORS.......................................13 EXHIBIT 2-7: EUROPE HAS AN AGE PROBLEM ..................................................14 EXHIBIT 2-8: EUROPEAN THERMAL POWER CAPACITY TRENDS 1960-2010................14 EXHIBIT 2-9: THE 439 OPERATING NUCLEAR POWER PLANTS WORLDWIDE .................15 EXHIBIT 2-10: 31 CAPACITY OF NUCLEAR PLANTS UNDER CONSTRUCTION .................16 EXHIBIT 2-11: HOW SAFE AND RELIABLE IS REALLY NUCLEAR?..............................17 EXHIBIT 2-12: ENERGY SECURITY AND OIL SUPPLY “DEFICITS”..............................18 EXHIBIT 2-13: THE MARGINAL PLANT PRINCIPLE IN GERMANY...............................19 EXHIBIT 2-14: COST OF NEW ELECTRICITY PRODUCTION BY SOURCE .......................20 EXHIBIT 2-15: ELECTRICITY SUPPLY 2008 BY MARKET AND SOURCE .......................20 EXHIBIT 2-16: COST BREAK DOWN FOR A GERMAN KWH (23.69 EURC/KWH) ..........21 EXHIBIT 3-1: COST OF NEW ELECTRICITY PRODUCTION FROM ONSHORE WIND .............24 EXHIBIT 3-2: COST OF NEW ELECTRICITY PRODUCTION FROM OFFSHORE WIND ............25 EXHIBIT 3-3: COST OF NEW ELECTRICITY PRODUCTION FROM PV ...........................26 EXHIBIT 3-4: COST OF NEW ELECTRICITY PRODUCTION FROM NUCLEAR.....................27 EXHIBIT 3-5: COST OF NEW ELECTRICITY PRODUCTION FROM HYDRO .......................28 EXHIBIT 3-6: COST OF NEW ELECTRICITY PRODUCTION FROM NATURAL GAS ...............29 EXHIBIT 3-7: COST OF NEW ELECTRICITY PRODUCTION FROM COAL .........................30 EXHIBIT 3-8: DISCOUNT RATE IMPACT ON TOTAL GENERATION COST .......................31 EXHIBIT 4-1: NON-OECD ENERGY SUBSIDIES ...............................................32 EXHIBIT 4-2: CURRENT SOLAR FEED-IN TARIFFS IN KEY COUNTRIES 2010 ..............33 EXHIBIT 4-3: OPEC NET OIL EXPORT REVENUES..............................................34 EXHIBIT 4-4: THE STRAIT OF HORMUZ ........................................................34 EXHIBIT 4-5: REQUIRED FALL IN GHG EMISSIONS ...........................................35 EXHIBIT 4-6: US RENEWABLE PORTFOLIO STANDARDS (RPS) .............................36 EXHIBIT 4-7: GERMAN TARIFFS AND PV INSTALLATIONS.....................................37 EXHIBIT 4-8: SURCHARGES TO GERMAN RATEPAYERS RISING FAST .........................38 EXHIBIT 4-9: GERMAN SOLAR INSTALLATIONS (TWO SCENARIOS) ..........................39 EXHIBIT 4-10: ELECTRICITY FROM PV VS GERMAN ELECTRICITY DEMAND..................39 EXHIBIT 4-11: CURRENT WIND FEED-IN TARIFFS IN KEY COUNTRIES .....................42 EXHIBIT 5-1: MAIN ASSUMPTIONS SOLAR .....................................................43 EXHIBIT 5-2: ASP ESTIMATES FOR 2011 AND 2012........................................43 EXHIBIT 5-3: FORWARD ASP SUMMARY .......................................................44 EXHIBIT 5-4: SILICON SUPPLY 2006 – 2012E...............................................45 EXHIBIT 5-5: SILICON SPOT PRICE .............................................................46 EXHIBIT 5-6: PRODUCTION ESTIMATES THROUGH THE PV VALUE CHAIN....................47 EXHIBIT 5-7: PROJECT COSTS 2007 – 2010 ................................................47 EXHIBIT 5-8: UNIT (FULLY LOADED) COST OVERVIEW AND COST TARGETS .................48 EXHIBIT 5-9: VERTICAL INTEGRATION AND MARGIN IMPLICATIONS..........................48 EXHIBIT 5-10: WORLD SOLAR MODEL (SIMPLIFIED)..........................................49 EXHIBIT 5-11: WORLD PV DEMAND 2004 – 2012E ........................................50 EXHIBIT 6-1: MAIN ASSUMPTIONS WIND ......................................................51 EXHIBIT 6-2: YEARLY WIND INSTALLATIONS...................................................51 EXHIBIT 6-3: WIND AS PERCENTAGE OF ELECTRICITY CONSUMPTION .......................52 EXHIBIT 6-4: WIND TURBINE MANUFACTURER MARKET SHARE ...............................53 EXHIBIT 6-5: MARKET SHARE DEVELOPMENT ..................................................53 EXHIBIT 6-6: TOP 3 PLAYERS IN TOP 10 MARKETS (2009) .................................54 EXHIBIT 6-7: ESTIMATED WIND FARM PROJECT COST.........................................55 EXHIBIT 6-8: COST OF NEW ELECTRICITY PRODUCTION FROM ONSHORE WIND .............56

- 5. Sector report > Renewable Energy DnB NOR Markets – 5 02.09.2010 EXHIBIT 6-9: ANNUAL AND ACCUMULATED INSTALLATIONS IN EUROPE .....................57 EXHIBIT 6-10: NET INCREASE/DECREASE IN POWER CAPACITY EU 2000-2008..........57 EXHIBIT 6-11: NATIONAL RENEWABLE ENERGY PLANS (SUBMITTED)........................58 EXHIBIT 6-12: ANNUAL AND ACCUMULATED INSTALLATIONS IN THE AMERICAS ............58 EXHIBIT 6-13: WIND INSTALLATIONS IN THE UNITED STATES ..............................59 EXHIBIT 6-14: US SUPPLY CURVE FOR WIND ENERGY (EXCL. CONNECTION) ...............60 EXHIBIT 6-15: US SUPPLY CURVE FOR WIND ENERGY (INCL. CONNECTION) ...............60 EXHIBIT 6-16: ANNUAL AND ACCUMULATED INSTALLATIONS IN ASIA/PASIFIC.............61 EXHIBIT 6-17: ANNUAL AND ACCUMULATED INSTALLATIONS IN ROW ......................62 EXHIBIT 6-18: ANNUAL AND ACCUMULATED INSTALLATIONS OFFSHORE ....................62 EXHIBIT 6-19: INSTALLED AND PLANNED OFFSHORE WIND CAPACITY IN UK ...............63 EXHIBIT 6-20: PLANNED OFFSHORE CAPACITY BY MARKETS..................................64 EXHIBIT 6-21: HYWIND, WORLD'S FIRST FLOATING WIND TURBINE.........................64 EXHIBIT 7-1: EVS THEN AND NOW .............................................................65 EXHIBIT 7-2: US CAR COSTS, 2011E .........................................................66 EXHIBIT 7-3: US DRIVING PATTERNS ..........................................................67 EXHIBIT 7-4: ELECTRICITY DEMAND IMPACT FROM MORE (PH)EVS.........................67 EXHIBIT 7-5: NEW EV AND PHEV MODELS ...................................................68 EXHIBIT 8-1: SOLAR SHARE PRICE DEVELOPMENT SINCE 2009 .............................69 EXHIBIT 8-2: WIND SHARE PRICE DEVELOPMENT SINCE 2009 ..............................69 EXHIBIT 8-3: FIRST SOLAR – HISTORICAL 1-YEAR FWD MULTIPLES ........................70 EXHIBIT 8-4: Q-CELLS – HISTORICAL 1-YEAR FWD MULTIPLES .............................70 EXHIBIT 8-5: REC – HISTORICAL 1-YEAR FWD MULTIPLES..................................71 EXHIBIT 8-6: SOLARWORLD – HISTORICAL 1-YEAR FWD MULTIPLES .......................71 EXHIBIT 8-7: SUNPOWER – HISTORICAL 1-YEAR FWD MULTIPLES ..........................72 EXHIBIT 8-8: SUNTECH POWER – HISTORICAL 1-YEAR FWD MULTIPLES....................72 EXHIBIT 8-9: VESTAS – HISTORICAL 1-YEAR FWD MULTIPLES ..............................73 EXHIBIT 8-10: WIND PEER GROUP MULTIPLES ................................................74 EXHIBIT 8-11: SOLAR PEER GROUP MULTIPLES ...............................................75 EXHIBIT 8-12: WIND EPS REVISIONS.........................................................76 EXHIBIT 8-13: SOLAR EPS REVISIONS........................................................76 EXHIBIT 9-1: TOP 10 PRODUCERS: POLY, WAFERS, CELLS AND MODULES .................77 EXHIBIT 9-2: THE WAYS TO CAPTURE ENERGY AND MAKE ELECTRICITY FROM THE SUN ....78 EXHIBIT 9-3: THE PV VALUE CHAIN............................................................78 EXHIBIT 9-4: SMART GRID LAYOUT.............................................................79 EXHIBIT 9-5: THE MYRIAD OF US INCENTIVES FOR RENEWABLE ENERGY ...................80 EXHIBIT 10-1: FSLR: MANUFACTURING COST TARGET BELOW 0.6 USD/W..............85 EXHIBIT 10-2: FSLR: MANUFACTURING COST TARGET BELOW 0.6 USD/W..............85 EXHIBIT 10-3: FSLR: BOS COST TARGET BELOW 1 USD/W...............................85 EXHIBIT 10-4: FSLR: ESTIMATE CHANGES ...................................................86 EXHIBIT 10-5: FSLR: QUARTERLY ESTIMATES ...............................................86 EXHIBIT 10-6: NEW ESTIMATES: YEARLY......................................................89 EXHIBIT 10-7: QUARTERLY ESTIMATES ........................................................89 EXHIBIT 10-8: NEW ESTIMATES: YEARLY......................................................92 EXHIBIT 10-9: QUARTERLY ESTIMATES ........................................................93 EXHIBIT 10-10: SOTP - VALUATION SUMMARY...............................................94 EXHIBIT 10-11: SOTP - ASSUMPTIONS.......................................................95 EXHIBIT 10-12: SOTP - BEAR CASE ..........................................................96 EXHIBIT 10-13: SOTP - BASE CASE ..........................................................97 EXHIBIT 10-14: SOTP - BULL CASE...........................................................98 EXHIBIT 10-15: NEW ESTIMATES: YEARLY ..................................................101 EXHIBIT 10-16: QUARTERLY ESTIMATES ....................................................101 EXHIBIT 10-17: NEW ESTIMATES: YEARLY ..................................................104 EXHIBIT 10-18: QUARTERLY ESTIMATES ....................................................104 EXHIBIT 10-19: NEW ESTIMATES: YEARLY ..................................................107 EXHIBIT 10-20: QUARTERLY ESTIMATES ....................................................107 EXHIBIT 10-21: VWS: CHANGES TO ESTIMATES ..........................................110 EXHIBIT 10-22: VWS: QUARTERLY ESTIMATES ............................................110 EXHIBIT 10-23: VWS: BACKLOG ...........................................................110

- 6. Sector report > Renewable Energy DnB NOR Markets – 6 02.09.2010 1. Executive summary 1. 2011 another record, but unsustainable – 2012 to face severe oversupply In last year's report (published 29 Sept 2009), we predicted that 2010 would be a year of oversupply in the module market. What we overestimated was Germany's willingness to cut FiTs decisively (we expected up to 25% reduction), thereby underestimating the resulting demand following a smaller FiT reduction. In 2011, we see Germany becoming a 10-12GW market, if nothing is done to the existing legislation. However, for reasons we explain inside this report, Germany needs to reduce annual installations to (or preferably below) 5GW as soon as possible. Based on our estimate of Germany growing to 11.2GW in 2011, a 4GW cap imposed from 1 Jan 2012 translates into a demand reduction for the PV industry of 7.2GW YoY. Coupled with around 7 GW of new supply in 2012, that means 14 GW without a "home", spelling "buyers' market" in capital letters with correspondingly falling ASPs to marginal production costs. The later the cap comes, the lower it must be, for reasons we explain from page 38 in Chapter 4 and in point 3 below. 2. Module ASPs slipping to EUR 1.20-1.25/W in 2011, but brace for 2012 The strong demand from Germany is going to prevent prices from falling in spite of the significant supply growth in 2011. As shown in Exhibit 1-1 below, we see module ASPs down 12% and silicon down 11% in 2011, to levels where top tier cost producers enjoy super profits. However, the tide will turn in 2012 at the latest, when Germany either imposes a cap or reduces their FiT by the scheduled, max rate of 21% (see Exhibit 4-7). Unless new markets "magically" appear, with similar or higher paying propensities as German PV system buyers, prices must fall. A lot. It will be painful, with the marginal producers just breaking even at the EBITDA level. But even at these low levels, Chinese cost leaders will generate decent profits. Exhibit 1-1: ASP projections 2010-2012e (Estimated yearly ASPs) (YoY change) Product Unit 2010 2011e 2012e 2011e 2012e Silicon USD/kg 55.9 49.6 38.1 -11 % -23 % Wafer USD/Wp 0.90 0.78 0.58 -14 % -26 % Cell USD/Wp 1.32 1.13 0.84 -15 % -26 % Module USD/Wp 1.75 1.55 1.13 -12 % -27 % Silicon EUR/kg 43.3 39.7 30.5 -8 % -23 % Wafer EUR/Wp 0.70 0.62 0.46 -11 % -26 % Cell EUR/Wp 1.02 0.90 0.67 -12 % -26 % Module EUR/Wp 1.36 1.24 0.90 -9 % -27 % * EURUSD 1.290 1.250 1.250 Source: DnB NOR Markets Equity Research 3. Germany needs to introduce cap – SOON! In 2009, a record amount of 3.8 GW new capacity was installed, beating even the most bullish forecasts. Almost 83,000 individual solar systems with a total capacity of 2.3 GW were registered in the fourth quarter alone. This year, installations are set to grow at an even higher rate nearly tripling to 9.2 GW. This enormous growth is rapidly becoming a headache for both German ratepayers (who are funding the subsidies) and utilities (who are required

- 7. Sector report > Renewable Energy DnB NOR Markets – 7 02.09.2010 to absorb all the electricity coming from the PV systems). Exhibit 1-2 below shows two scenarios of growth in the German market. One with 5% annual growth after our 10-12 GW in 2011, and the other with a 4GW cap from 1 Jan 2012. Couple this with Exhibit 4-10, and you clearly see the challenges to the German grid even with an (for the PV industry) aggressive 4GW cap from as early as 2012. Exhibit 1-2: German solar installations (two scenarios) The German market by month in 2009 Monthly German installations 2009 0 400 800 1,200 1,600 Jan Mar May Jul Sep Nov Inst. (MW) German PV market projections 159,697 41,785 66,025 34,025 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 20,000 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Estimates Newinstallations(MWp) 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 180,000 Aggregatedinstallations(MWp) Aggregated EoY (5% growth after 2011) Aggregated EoY (w/ 4GW/yr cap in 2012) New installations (5% growth after 2011) New installations (w/ 4GW/yr cap in 2012) Source: DnB NOR Markets Equity Research Our 5% growth scenario means that on a beautiful sunny day across the whole of Germany in July, solar would completely inundate the German grid with electricity. And even in 2012, solar could supply 40-50% of demand at peak production. This is a big concern. Exhibit 1-3: Electricity from PV vs German electricity demand In 2012, with 4GW cap Germany: July weekday electricity demand and 34 GWp solar 0 10 20 30 40 50 60 70 80 90 0:00 1:00 2:00 3:00 4:00 5:00 6:00 7:00 8:00 9:00 10:00 11:00 12:00 13:00 14:00 15:00 16:00 17:00 18:00 19:00 20:00 21:00 22:00 23:00 0:00 GWp 0 % 10 % 20 % 30 % 40 % 50 % 60 % 70 % 80 % 90 % PVshareoftotalproduction/demand Supply, other plants Supply, PV (34 GW) Total demand PV share (right scale) In 2012, without cap Germany: July weekday electricity demand and 42 GWp solar 0 10 20 30 40 50 60 70 80 90 0:00 1:00 2:00 3:00 4:00 5:00 6:00 7:00 8:00 9:00 10:00 11:00 12:00 13:00 14:00 15:00 16:00 17:00 18:00 19:00 20:00 21:00 22:00 23:00 0:00 GWp 0 % 10 % 20 % 30 % 40 % 50 % 60 % 70 % 80 % 90 % PVshareoftotalproduction/demand Supply, other plants Supply, PV (42 GW) Total demand PV share (right scale) In 2020, with 4GW cap Germany: July weekday electricity demand and 66 GWp solar 0 10 20 30 40 50 60 70 80 90 0:00 1:00 2:00 3:00 4:00 5:00 6:00 7:00 8:00 9:00 10:00 11:00 12:00 13:00 14:00 15:00 16:00 17:00 18:00 19:00 20:00 21:00 22:00 23:00 0:00 GWp 0 % 10 % 20 % 30 % 40 % 50 % 60 % 70 % 80 % 90 % PVshareoftotalproduction/demand Supply, other plants Supply, PV (66 GW) Total demand PV share (right scale) In 2020, without cap Germany: July weekday electricity demand and 160 GWp solar 0 10 20 30 40 50 60 70 80 90 0:00 1:00 2:00 3:00 4:00 5:00 6:00 7:00 8:00 9:00 10:00 11:00 12:00 13:00 14:00 15:00 16:00 17:00 18:00 19:00 20:00 21:00 22:00 23:00 0:00 GWp 0 % 10 % 20 % 30 % 40 % 50 % 60 % 70 % 80 % 90 % PVshareoftotalproduction/demand Supply, other plants Supply, PV (160 GW) Total demand PV share (right scale)

- 8. Sector report > Renewable Energy DnB NOR Markets – 8 02.09.2010 Source: DnB NOR Markets Equity Research Note: Calculations assume 10% derate factor, i.e. 1GW installed capacity on module level can deliver up to 900MW of electricity to the grid. True, it is possible to export electricity from Germany, but it would be a very uneconomic proposition given the EUR 0.17-0.23/kWh paid by the German utilities (and their ratepayers) versus the much lower price they are likely to obtain in return. 4. Wind – Growth slowing in 2010, CAGR of 10% expected next five years In 2009, growth in order intake slowed significantly due to reduced availability of capital, and this will slow installation growth in 2010. However, the attractive value proposition wind can offer today remains unchanged: a production cost in line with conventional sources like coal and natural gas (without subsidies), but with a highly predictable future cost. Driven by regional requirements for renewable energy share (e.g. in EU, 29 US states and Australia) and the need for new electricity generation capacity, wind is expected to grow 10% annually the next five years. 5. Investment strategy Should investors worry about 2012 when the party is extending into 2011? Of course, we say, but there will come warning signs from Germany before the Bundestag revises the FiT legislation. In the mean time there are several (for some companies - very) good quarters ahead of us. Investors can ride this wave a little longer, but do stay alert. One could also hope (or pray?) the 2012 situation will somehow be resolved by the time we get there.

- 9. Sector report > Renewable Energy DnB NOR Markets – 9 02.09.2010 2. Electricity market outlook Macro backdrop: Modest recovery The effects of the public stimulus efforts are fading and several countries will soon begin to tighten their fiscal policies. Meanwhile, unemployment is high and private demand still modest. After 3% growth since the trough a year ago, our macro team expects GDP growth in advanced countries to be significantly lower going forward. Overall OECD GDP is expected to grow by 1¾ per cent next year, with a growth rate of 2½ per cent thereafter. Global growth in 2011 is projected to be around 3½ per cent, and just above 4 per cent in years thereafter. Although potential output will grow more slowly than the historical norm, it will still take time to return to normal capacity utilization. Inflation will consequently remain low with a risk of deflation in some countries. They therefore expect the current zero interest rate policy to continue in the major economies until the first half of 2012. Unchanged short-term interest rates will lead to continued low long-term yields. Ever since the Lehman bankruptcy our macro team predicted a modest recovery lasting several years. Unfortunately, even their relatively downbeat expectations have turned out to be too optimistic. Forecasts from November 2008 indicated that OECD GDP would only rise by 2.5% from 2008 to 2011. Almost a year later – in August 2009 – the prediction was 2%, and now, in August 2010, the best guess is 0.8%. Exhibit 2-1: Key macro assumptions: GDP growth Source: DnB NOR Markets 2010:III This conservative prognosis is based on three fundamental assumptions. First, history shows that economic setbacks in the wake of banking crises are generally both deeper and longer lasting than other setbacks, although the variation between countries is large. One reason for this is that the period prior to a banking crisis is generally characterized by excessive borrowing and risk taking. When the crisis materialises, businesses, households and/or financial institutions all have to simultaneously reduce their debt/income ratios. Put simple, this can be done in two ways: a) by Our macro team still anticipates a weak, U- shaped recovery… …because of past experience with banking crises…

- 10. Sector report > Renewable Energy DnB NOR Markets – 10 02.09.2010 reducing debt (the numerator) or b) increasing income (the denominator). The latter is largely dependent on overall macro-economic conditions, while the former is controlled at the household level. When enough households choose to save more, savings will eventually rise on the macroeconomic level too, thus reducing growth in both activity and income. Lower income growth could in turn force households to save even more. This inevitable adjustment takes time. Until debt is brought down to a sustainable level output growth is expected to be low. Second, the current downturn in economic activity was extraordinarily severe. Capacity utilization was thus also exceptionally low, as capacity does not adjust as quickly as activity. OECD estimates that actual GDP in advanced countries was 5.5% below potential GDP in the spring of last year, the largest negative output gap since the Second World War. This is coupled with the highest unemployment rates – in both absolute and relative terms – in the post-war period. In some industries, capacity utilization was even lower and in Japan, where capital goods production accounts for a large share of total production, capacity utilization fell at one point below 40% of the past four decades' average. The consequences of significant excess capacity are obvious. Companies operating in markets with too low demand will start to compete on prices (cut margins), stop expanding capacity and cut costs as much as possible. This keeps total demand weak. Similarly, households that have either experienced or fear for job losses or wage cuts will hold back on spending. Price, margin and wage cuts all amplify deflationary forces. Finally, it was pointed out that the stimulus were largely temporary, albeit not without nuances. When interest rates are cut to zero, it is not possible to cut them any further. The substitution effect1 will still be there, but the income effect2 is exhausted now that interest rates have reached bottom. Electricity demand growth has historically been resilient vs macro Historically, electricity demand growth has been resilient, even in times of slow or even negative GDP growth. Until last year, there were only three instances with negative electricity demand growth rates in Germany3 , and they were caused by specific external shocks like the oil crisis and the collapse of the Eastern European industries. Exhibit 2-2: German electricity demand vs GDP 1952-2010e OECD electricity demand fell 4% in FY 2009, with 1Q 2010 up 1.9% again -8 -6 -4 -2 0 2 4 6 8 10 12 14 1952 1954 1956 1958 1960 1962 1964 1966 1968 1970 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010e YoYchange(%) Electricity demand / production GDP growth Industrial collapse in parts of Eastern Europe; Reunification Oil price shock Oil price shock Recent financial crisis Source: IEA, IMF, Eurostat, Destatis, Photon International, Kohlenstatistik.de 1 Substitution effect = low interest rates stimulate borrowing and consumption rather than savings 2 Income effect = lower borrowing costs increase disposable income 3 Germany used as example because this is where we found the longest data sets …and weak demand caused by ample capacity

- 11. Sector report > Renewable Energy DnB NOR Markets – 11 02.09.2010 As economies grow the electricity intensity in an economy tends to grow. This is reflected in our electricity demand estimates where we expect electricity to increase its share of total energy demand from 13.3% in 2006 to 20.2% in 2030. As a reference, IEA’s figures1 estimate that world electricity demand growing 2.7% p.a. from 2007 to 2015. Exhibit 2-3: Electricity demand by region Demand conclusion: Developing countries will be the primary drivers for electricity demand, particularly India and China, somewhat countered by higher energy efficiency. Electricity Demand by Region 18,302 21,554 24,494 28,023 32,240 37,298 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 2005 2010 2015 2020 2025 2030 TWh RoW: 4.1% China: 4.7% Japan: -0.1% Europe: 1.8% America: 1.2% 2005-2030 CAGR 2.8% Source: IEA, DnB NOR Markets Equity Research The table below shows some of the data we used for Exhibit 2-5. Today the developing countries (including China, India and Brazil) combined represent approximately 45% of total world electricity demand with an average MWh/capita of 2.5. With higher economic growth than developed countries this is expected to increase to 67% by 2030 (the population of these countries comprise more than 80% of the world's total). However, this still implies significantly lower electricity consumption per capita for developing countries. Exhibit 2-4: MWh/Capita and population growth Our electricity demand estimates are based on assumptions made for MWh/capita across regions. TWh Population (mn) MWh/Capita Country 2005 2010 2020 2030 2005 2010 2020 2030 2005 2010 2020 2030 Europe Germany: 2.4% 620 650 755 876 82 82 80 78 7.5 7.9 9.4 11.2 Spain: 0.5% 294 321 372 432 43 45 49 50 6.8 7.1 7.7 8.7 France: 2.0% 575 593 706 819 61 63 65 66 9.4 9.5 10.9 12.3 Italy: 1.2% 304 326 388 450 59 60 60 60 5.2 5.4 6.4 7.6 UK: 1.6% 398 401 477 553 60 62 65 68 6.6 6.5 7.3 8.1 Russia: 5.4% 953 1,054 1,206 1,358 143 140 135 129 6.7 7.5 8.9 10.5 Other Europe: 1.9% 1,767 1,989 2,485 3,120 281 280 278 273 6.3 7.1 8.9 11.4 Total Europe 4,911 5,335 6,388 7,608 729 733 733 723 6.7 7.3 8.7 10.5 America Canada: 1.9% 597 651 678 734 32 34 37 40 18.5 19.2 18.3 18.3 USA: 2.0% 4,257 4,370 4,664 5,152 303 318 346 370 14.1 13.8 13.5 13.9 Latin America: 2.2% 1,171 1,386 1,818 2,327 557 589 646 690 2.1 2.4 2.8 3.4 Total America 6,025 6,407 7,160 8,213 892 940 1,029 1,100 6.8 6.8 7.0 7.5 RoW Japan: 1.9% 1,134 1,087 1,098 1,109 127 127 124 117 8.9 8.6 8.9 9.4 China: 7.7% 2,500 3,733 5,659 8,789 1,312 1,354 1,431 1,462 1.9 2.8 4.0 6.0 South Korea: 4.4% 397 444 517 695 48 49 49 49 8.3 9.2 10.5 14.1 India: 6.4% 709 886 1,514 2,465 1,131 1,214 1,367 1,485 0.6 0.7 1.1 1.7 Other RoW: 3.0% 2,626 3,662 5,687 8,418 2,273 2,492 2,914 3,372 1.2 1.5 2.0 2.5 WORLD 18,302 21,554 28,023 37,298 6,512 6,909 7,648 8,309 2.8 3.1 3.7 4.5 Source: UN, IEA, DnB NOR Markets Equity Research Our electricity demand estimates are based on 1) energy intensity, 2) GDP 3) electricity intensity and 4) population growth. All these vary across 1 WEO 2010

- 12. Sector report > Renewable Energy DnB NOR Markets – 12 02.09.2010 regions and ultimately provide an MWh/capita result. The population estimates are according to UN's moderate population prospects scenario. Exhibit 2-5 below shows a selection of countries for which we have modelled energy consumption development and compared them to consensus GDP growth estimates and UN population projections. We expect developing countries like China and India to demand and need much more energy per person: currently they use only tiny fractions of what the developed world does. Russia’s leap on MWh/Capita is explained by the expected 10% drop in their population from 2005 to 2030, and with our estimate of 1.3% annual energy consumption growth, together implies a gradually less efficient energy market and higher use per person. Exhibit 2-5: Annual electricity use per capita We expect electricity consumption per capita among different countries to converge Percentage after country represents annual GDP per capita growth 2008 largest electricity users: Country TWh % USA 4,355 21 % China 3,451 17 % Japan 1,085 5 % Russia 1,023 5 % India 781 4 % Germany 633 3 % Canada 633 3 % France 575 3 % Other 7,939 39 % Total 20,475 100 % Electricity use and GDP per capita 2005, 2010e, 2020e and 2030e (big dot is 2030) Germany: 2.4% France: 2.0% Italy: 1.2% Canada: 1.9% USA: 2.0% China: 7.7% India: 6.4% OtherRoW:3.0% Russia: 5.4% Japan: 1.9% 1 10 100 - 2 4 6 8 10 12 14 16 18 20 MWh/Capita GDPpercapita(USD'000) 1 10 100 GDPpercapita(USD'000) Country/region with % showing estimated nominal yearly GDP/capita growth Source: IEA Source: DnB NOR Markets Equity Research, EIA, World Bank, Bloomberg, UN Demand growth is vulnerable, but aging plants must still be retired The world is facing a slowly, but steadily growing energy problem the coming years. This comes from the combination of • A steadily growing demand for electricity, particularly (in percentage terms) from developing regions of the world. In its projections published 10 August 2010, the EIA1 projects that total US electricity consumption will grow by 4% during 2010 and another 0.4% in 2011 – a slower rate assuming more normalised temperatures during the next summer. The same agency projects residential electricity prices to grow by 0.6% in 2010 and 2.9% in 2011. • Increasing pressure to reduce carbon emissions; of which the energy sector is the main culprit • An aging base of conventional energy generation assets (coal, oil and nuclear in particular) • In the case of nuclear, uniquely long lead-times (10-20 years) for the construction of new, efficient, low-carbon and safe(r) plants • The possibility of having seen peak oil; at least, there is a broad consensus that new discoveries are unlikely to be made in easily 1 www.eia.gov

- 13. Sector report > Renewable Energy DnB NOR Markets – 13 02.09.2010 accessible locations. This means the average cost per barrel of oil will be accreted with production from new fields. Adding to this, the geopolitical situation is such that the need for distributed electricity generation that reduces dependence on foreign imports of oil, gas, nuclear feedstock and to a lesser extent coal. Renewable energy is part of the solution to this. A mitigating factor of energy demand growth will be the strong drive towards energy efficiency solutions. A large portion of such projects, also referred to as the generation of “negative demand”, not only reduces energy demand and thereby reduces carbon emissions, but also offers positive investment IRRs. Exhibit 2-6 below supports our assumption that we have described above: • Electricity demand outpaces population growth. Shown by the “long-dashed” line (Elec./Population) • Electricity demand and GDP are correlated ~1:1. Shown by the “short-dotted” line (Elec./GDP) shows. Exhibit 2-6: OECD electricity usage indicators Electricity demand will grow faster than total energy growth because of economies advancing and a waning off coal and oil Source: IEA Notes: * Elec./TFC: Relative contribution of electricity to Total Final energy Consumption; * Elec./GDP: Electricity intensity of economic activity; Prod./Cons.: Electricity supply self-sufficiency = Net Production / (Net Production + Imports – Exports); * Elec./Population: Per capita electricity consumption Energy Supply: Current new-build pace is insufficient In addition to building new capacity to supply our projected growth in demand for energy in general and electricity in particular, a significant portion of existing production capacity must be replaced over the next years. This is predominantly the case in the western world, and much less a concern in the developing region. If we take Europe as an example, a 1.8% annual growth of demand translates into a supply shortage of 2,300 TWh in 2020 and nearly 4,200 TWh in 2030. Using an average load factor of 60%, this is 440 GW and 800 GW of capacity by those years respectively. In other words, by 2030 Europe needs to add and replace the equivalent of more than 80% of the existing asset base by 2030 in order to meet this demand. The world needs to build and replace the equivalent to 80 per cent of all current capacity by 2030

- 14. Sector report > Renewable Energy DnB NOR Markets – 14 02.09.2010 Exhibit 2-7: Europe has an age problem Projected European demand vs supply from existing capacity 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 2007 2009 2011 2013 2015 2017 2019 2021 2023 2025 2027 2029 TWh Supply shortage: Demand @ 1.8% annual growth Generation capacity, existing plants Demand Source: DnB NOR Markets Equity Research, RWE, VGB PowerTech, Electricity Generation 2007 To put these figures into perspective, there are 196 existing nuclear power plants in Europe that together provide a capacity of 170 GW. Considering a nuclear power plant like the state-of-the-art 1.6 GW Olkiluoto-3 which is being built in Finland (last update regarding commissioning is 2013, nearly four years after the original schedule), Europe would need almost 500 similar plants over the next two decades if nuclear alone should satisfy the expected growth in demand. According to The International Energy Atomic Agency however, only 19 plants (see Exhibit 2-10 on page 16) with a combined capacity of 17 GW are under construction. Exhibit 2-8 below supports our opinion of a growing sense of urgency concerning Europe’s electricity supply situation. The figure shows five main types of electricity generation assets, and their respective age profiles as of 2007. For example, it shows that during the next 15 years, approximately 69 GW, or half, of the 134 GW hard coal capacities online today will have reached the end of their planned lives. Decisions will have to be made on whether to make expensive life extension investments, or close them permanently. Exhibit 2-8: European thermal power capacity trends 1960-2010 Hard coal: 74GW built in the 1960s and '70s Annual commissioning of power generation capacities in the EU-27 in GW * Source: RWE (2010), Platts Database, Worldwatch Institute Note * Adjusted net generation capacity. Lignite = Brunt kull (Norwegian) If nuclear was to satisfy all replacements and new demand, Europe would need to build and complete 500 new state-of-the-art nuclear plants the next twenty years

- 15. Sector report > Renewable Energy DnB NOR Markets – 15 02.09.2010 Nuclear: Phasing out or new dawn? In 2002, the then-ruling coalition of Social Democrats and Greens passed a law that said all of Germany's nuclear power plants were due to go off line by 2022 at the latest. However, it now looks like this will be delayed by 10 to 15 years, "on technical grounds", based on recent comments by Chancellor Angela Merkel. An independent consultants' report published in mid-August 2010 this week, indicated that such a time frame would ensure Germany's energy needs, in terms of energy prices and greenhouse gas emissions, are met as the country transitions to renewable energy sources. By 2050, however, Germany still aims to have half of all energy needs supplied by renewable energy, with nuclear and coal power continuing until supplies can be met entirely by clean energy. A poll published on Friday 27 August found that 56% of Germans are against keeping nuclear power plants beyond 2021. There are three main arguments backing a phase-out of nuclear energy: • "Chernobyl-like" incidents • Increasingly problematic to dispose of radioactive waste; particularly long-term, but also short-term repositories are in thin supply • Non-proliferation of nuclear weapons, and the difficulty of separating civilian nuclear electricity plants with military (or indeed civilian, in the case of Iran, where this border is particularly fuzzy) nuclear arms With fossil fuel costs at historical highs, many countries are discussing a new look at nuclear energy as a proven technology to deliver large quantities of base-load electricity. Nuclear's benefits are obvious: near-zero CO2 emissions; the ability of to a certain extent to balance intermittent wind energy production; no sensitivity to oil and coal prices; security of supply (if your country has uranium and plutonium resources), and all this with a proven technology. Exhibit 2-9: The 439 operating nuclear power plants worldwide Existing in Europe Total 195 plants Total 169 GW Source: International Atomic Energy Agency (IAEA) Hearing these arguments, many find it hard to understand why the world’s major utilities, with strong credit ratings and cash flows, are not scrambling to submit plans for new reactors. There are currently 61 nuclear plants under construction where the lion's share is in China (23), Russia (11), Korea (6) and India (4). Compared to the just mentioned 69GW of hard coal capacity which is to close down in Europe within the next 15 years, only 19 new plants are under construction in Europe with a total capacity of World operational nuclear reactors by country (total 439# @ 372 GW) 0 20 40 60 80 100 120 Argentina Armenia Belgium Brazil Bulgaria Canada China CzechRep. Finland France Germany Hungary India Iran Japan Korea Lithuania Mexico Netherlands Pakistan Romania Russia Slovakia Slovenia SouthAfrica Spain Sweden Switzerland Taiwan Ukraine UK USA Numberofunits 0 20,000 40,000 60,000 80,000 100,000 120,000 TotalMWcapacity Total MW (right scale) No. of Units (left scale) Benefits of nuclear: • CO2 free electricity • Low exposure to fuel cost Issues for nuclear: • Long lead time • Usually ends up costing much more than originally planned • Lack of long-term waste repositories • NIMBY factor

- 16. Sector report > Renewable Energy DnB NOR Markets – 16 02.09.2010 17GW. For the time being, not enough nuclear plants are being planned for nuclear to be a substitute to the high carbon alternatives and be the solution to the energy crises. Exhibit 2-10: 31 Capacity of nuclear plants under construction Under construction in Europe Total 19 plants Total 17.0 GW Source: International Atomic Energy Agency (IAEA) The Finnish nuclear project Olkiluoto-3, with its 1.6GW net capacity, was designed to be a shiny showcase for the nuclear industry. It was originally meant for start up in summer 2009, but various problems have delayed the construction and the current completion date is set to be in 2013. It is estimated to be at least 50 per cent over budget. In June 2010 the AREVA- Siemens Consortium announced that the majority of the work is expected to be completed in 2012 and electricity production at Olkiluoto 3 is scheduled to start in 2013. In July 2010 the Finnish parliament granted a license to build a fourth reactor on the Olkiluoto site (Olkiluoto-4). As previously mentioned, Europe would need to build around 500 plants similar to Olkiluoto-3 over the next two decades if nuclear alone was to substitute both replacement needs and the expected growth in demand. Exhibit 2-11 below shows unplanned power losses from all nuclear plants in the world. Although a range of factors can trigger these unplanned shutdowns, it is obvious that several countries have serious challenges linked to the predictability of supply from their nuclear sector. World nuclear reactors under construction (total 61# @ 59GW) 0 5 10 15 20 25 Argentina Brazil Bulgaria China Finland France India Iran Japan Korea Pakistan Russia Slovakia Taiwan Ukraine USA Numberofunits 0 5,000 10,000 15,000 20,000 25,000 TotalMWcapacity Total MW (right scale) No. of Units (left scale)

- 17. Sector report > Renewable Energy DnB NOR Markets – 17 02.09.2010 Exhibit 2-11: How safe and reliable is really nuclear? Several countries have serious problems with unplanned losses of production from their nuclear plants. These losses can come from: • Grid instability or failure • Environmental factors (low cooling pond level, deluges, earthquakes) • Labour strikes • Fuel coast downs • Lack of demand Unplanned Capacity Loss factors 0 % 5 % 10 % 15 % 20 % 25 % 30 % 35 % Argentina Armenia Belgium Brazil Bulgaria Canada China Czech Finland France Germany Hungary India Japan Korea Lithuania Mexico Netherland Pakistan Romania Russia Slovakia Slovenia S.Africa Spain Sweden Switzerland Taiwan Ukraine UK USA World UCL 2006 2007 2008 2009 Average 2006-09 Source: International Atomic Energy Agency (IAEA) Note 1: Number after country indicates number of reactors Note: Unplanned capacity loss (UCL) factor is defined as the ratio of the unplanned energy losses during a given period of time, to the reference energy generation. UCL is energy that was not produced during the period because of unplanned shutdowns, outage extensions, or unplanned load reductions due to causes under plant management control. Causes of energy losses are considered to be unplanned if they are not scheduled at least four weeks in advance. Reference energy generation is the energy that could be produced if the unit were operated continuously at full power under representative annual mean conditions for the unit. Our conclusion on nuclear is that while it on paper provides an attractive solution by i) cost/kWh and ii) energy stability measures, the length and degrees of uncertainty regarding a) plant lead-times and costs, b) operational predictability in geologically unstable regions and c) permanent waste repositories, we factor nuclear in only to be a help, not a solution to the world’s growing need for energy. Nuclear can be used as a bridging technology until renewable energy can reliably replace it. Energy security remains a significant driver of renewable energy Energy security will remain one of the most important drivers behind renewable energy in the coming years. The underlying concern is the same everywhere: Countries need secure and inexpensive access to energy to see continued economic growth. The main reason for the growing concern is the high fossil fuel prices and uneven distribution of oil production and consumption in the world, see Exhibit 2-12.

- 18. Sector report > Renewable Energy DnB NOR Markets – 18 02.09.2010 Exhibit 2-12: Energy security and oil supply “deficits” Supply (million barrels per day) 2006 2007 2008 2009 2010 OECD 21.6 21.5 20.9 20.8 20.4 USA 8.3 8.5 8.5 8.9 9.0 Canada 3.3 3.4 3.4 3.4 3.4 Mexico 3.7 3.5 3.2 2.9 2.7 North Sea 4.8 4.5 4.3 4.0 3.7 Other OECD 1.5 1.5 1.6 1.6 1.6 Non-OECD 63.0 63.0 64.5 63.1 64.3 OPEC 34.7 34.4 35.7 33.9 34.5 Former Soviet Union 12.2 12.6 12.5 12.8 13.0 China 3.9 3.9 4.0 4.0 4.0 Other Non-OECD 12.2 12.1 12.3 12.5 12.8 Total World 84.5 84.4 85.4 83.9 84.7 Non-OPEC Production 49.8 50.0 49.7 50.0 50.2 Consumption (million barrels per day) 2006 2007 2008 2009 2010 OECD 49.5 49.2 47.6 45.5 45.4 USA 21.0 21.0 19.8 19.0 19.2 Canada 2.3 2.3 2.3 2.2 2.3 Europe 15.7 15.3 15.3 14.7 14.6 Japan 5.2 5.0 4.8 4.3 4.1 Other OECD 5.3 5.5 5.4 5.3 5.3 Non-OECD 35.4 36.8 37.9 38.2 39.2 Former Soviet Union 4.2 4.2 4.3 4.2 4.1 Europe 0.8 0.8 0.8 0.8 0.8 China 7.2 7.6 7.9 8.1 8.4 Other Asia 8.8 9.1 9.2 9.2 9.3 Other Non-OECD 14.4 15.1 15.7 16.0 16.6 Total World 84.9 85.9 85.5 83.7 84.6 Source: EIA Also refer to Exhibit 4-3 on page 34 for details on how USD 11 trillion was spent on oil by oil importers to OPEC from 1975-2009, with Saudi Arabia, Iran and the United Arab Emirates the biggest benefactors. In addition, IEA estimates that OPEC will pocket another USD 28 trillion for oil and gas exports in the period 2008-2030. As discussed through the preceding pages, the need for new production capacity is expected to increase significantly the next years, and even without growth in demand, the problem of aging energy plants will require capacity to be replaced. The governments around the world are then faced Oil "deflicts" (negative) or "surpluses" (positive) -20 -10 0 10 20 30 40 USA Canada Other OECD Former Soviet Union China Other Non- OECD mbpd 2006 2007 2008 2009 2010e* Estimated OPEC revenues from oil and gas exports 2008- 2030: $28 trillion.

- 19. Sector report > Renewable Energy DnB NOR Markets – 19 02.09.2010 the following problem: If new generation capacity is based on fossil fuel, dependence of potentially unstable regimes will increase in the future. Examples of energy security concerns are China’s future availability of coal and Europe’s dependence of natural gas from Russia (again, there is speculation that supplies of Russian gas to Ukraine will be shut down, as issues of payment for deliveries persist). China’s massive investments in renewable energy and EU's aggressive targets for renewable energy in 2020, are, at least partly, openly motivated by energy security. Electricity prices likely to rise The electricity price is the single most important long-term driver for renewable energy, and for renewable sources like solar and wind to capture significant market shares in the future, they must be competitive without subsidies. Short-term, the electricity price (before transmission costs and taxes) is determined by the marginal – the last kWh of – electricity, see Exhibit 2-13. In most markets, this is gas and/or coal, due to the relative short start-up time and their high fuel costs. Hence, the current base load prices in deregulated markets like Germany equal their respective costs of producing electricity. Exhibit 2-13: The marginal plant principle in Germany "Must run" is hydro, wind and CHP. CO2 costs have a significant impact on generation costs for fossil fuels and thus electricity prices Source: RWE 2010 Notes: 1) OCGT: Open-Cycle Gas Turbine. 2) CCGT: Combined-Cycle Gas Turbine. 3) Must run: run-of-river, wind, CHP. Long-term, the electricity prices are determined by the cost of new capacity. And to build new capacity, decent returns on invested capital are needed. This, rather than the marginal costs that we observe today, is the benchmark for renewable sources. The main reason is that renewable electricity generation is not expected to replace existing capacity, but rather to reduce the share of fossil fuels in new capacity needed the upcoming decades. Hence, the theory behind electricity prices is relatively straightforward in a deregulated market with no limitations in transmission capacity: Short-term, it is the marginal cost of electricity production ("the marginal plant") that sets the electricity prices. Long-term, utilities need a certain return on invested capital in order to ensure a dynamic efficient market with new production capacity coming online. Coal and gas provides the marginal kWh and therefore defines the electricity price Long-term, renewables must be bench-marked against other new-build costs, not today’s electricity prices

- 20. Sector report > Renewable Energy DnB NOR Markets – 20 02.09.2010 In Exhibit 2-14 we show our high-low estimated costs of electricity production, including capital expenses. Our calculations show that wind already today is competitive with conventional sources used for electricity production. This is especially the case when including possible costs related to CO2 emissions. For solar, the financial crisis has driven the sector to close the gap on the other power generating resources. Exhibit 2-14: Cost of new electricity production by source From last year's report, the solar mid- point is down $1¢ and the low point down $3¢, while the cost of conventional energy sources is revised upwards $1-3¢. MPR – Market price referent California's estimated cost of electricity generation from a new, combined-cycle natural gas power plant Levelised Cost of Energy (LCOE) Discounted lifetime costs over lifetime production 5 4 4 5 9 13 3 4 3 5 7 14 7 9 8 11 12 24 6 6 7 8 11 25 10 14 13 21 16 47 11 10 13 14 18 45 0 10 20 30 40 50 60 Nuclear Coal Nat.Gas (CC) Nat.Gas (CT/ST) Coal(CCS) Oil Hydro Geothermal Biomass Wind Onshore Wind Offshore Solar Conventional Renewable UScent/kWh CO2 cost Low-high range Cal. MPR 2011 (20-yr) Base case Source: DnB NOR Markets Equity Research In most markets today, fossil fuels are the marginal cost of electricity production. Exhibit 2-15 below illustrates the world’s ten largest energy consumers’ respective shares of electricity sources. The mix varies greatly from market to market! Exhibit 2-15: Electricity supply 2008 by market and source Examples: • USA: 70% from coal and gas • France: 77% from nuclear • China: 67% from coal • Italy: 54% from gas • India: 81% from coal Electricity generation by source (shares of total) 0 % 10 % 20 % 30 % 40 % 50 % 60 % 70 % 80 % 90 % 100 % OECD: 10,702 TWh USA: 4,355 TWh China: 3,451 TWh Japan: 1,085 TWh Russia: 1,023 TWh India: 781 TWh Germany: 633 TWh Canada: 633 TWh France: 575 TWh Italy: 318 TWh Spain: 309 TWh Coal Oil Gas Nuclear Hydro Other renew. Other Source: DnB NOR Markets Equity Research, IEA One important fact to keep in mind when comparing cost of electricity is predictability of future cost. The last two years have shown us that future

- 21. Sector report > Renewable Energy DnB NOR Markets – 21 02.09.2010 price of fossil fuels are very difficult to predict and the future generating cost is not determined by spot prices. Adding the probability of a future CO2-tax, return on investment in a new coal or natural gas plant is very unpredictable. This is a significant advantage for renewable energy, since production cost (mostly capital cost) is known for the next 20-25 years. Electricity markets are very heterogenous The world electricity market is impossible to analyze as one single entity due to widely different government price regulations and limitations in the transmission capacities, generation portfolios, marginal production costs and source etc. Often, prices are regulated with the government setting the electricity price and subsidizing the power producer if they produce power with losses. Either the customers or the tax payers pay the true cost of electricity – the only difference is that in the latter case it is not visible on the monthly bill from the utility. Furthermore, in deregulated markets there may be different prices in different regions due to constraints in the transmission capacity. An example is Norway; 2008 gave very low prices in the southern parts due to high water reservoir levels, while the Northern parts saw significantly higher prices, for the opposite reason. It is important to differentiate between wholesale price and retail price to analyze the competitiveness of the different energy sources used for electricity production. In Exhibit 2-16 we show a breakdown of the retail price for a kWh in Germany (January 2009). Exhibit 2-16: Cost break down for a German kWh (23.69 EURc/kWh) The German consumer’s electricity bill as of April 2010 • Price: EUR 23.7ct/kWh • REA surcharge: 2.05ct January 2009 • Price: EUR 22.7ct/kWh • REA surcharge: 1.13ct Assumptions: 3,500 kWh per year consumption, 19% VAT, wholesale prices for prorated purchases Source: RWE, Bundesverband der Energie- und Wasserwirtschaft e.V. (German Energy and Water Association), April 2010. The wholesale price for electricity is only a small portion (34%) of the consumer’s electricity bill. The difference between wholesale electricity price and consumer prices is important in discussions on grid parity. When solar companies discus grid parity of PV installation, it is usually seen from the consumer's perspective. On that basis, grid parity will be reached when a PV-system can be installed on a roof and produce power at a lower cost than the price of buying it in the market (EUR 22.7ct /kWh in the example above). Hence, since electricity is produced locally (no grid needs) the PV system’s owner can include grid fees and taxes in addition to the wholesale price of electricity for the purpose of comparison. For utilities or IPPs, on the other hand, the picture is completely different. Their investment conclusion is based on the wholesale price. Since the truly big volumes of demand for renewable energy will have to come from utilities, it is in our view correct to mark the cost of renewables against this benchmark. Hence, the solar industry is still some way from reaching grid parity.

- 22. Sector report > Renewable Energy DnB NOR Markets – 22 02.09.2010 3. Estimating cost of new electricity production (LCOE) What is LCOE and why do we need it? Levelized cost of energy (LCOE) is the net present value of all the costs connected to the energy technology investment divided by the net present value of the energy generated during the expected lifetime of the technology. LCOE gives an estimate of the cost per kWh which makes different energy technologies comparable. When compared to local electricity prices (or subsidies) it determines if a specific energy technology project is economical profitable. It also takes the different investment patterns and returns on investment into account. Key findings: Wind can compete without subsidies Our calculations show that in favourable locations, onshore wind can cost as little as USD 0.05-0.06 per kWh, but a more typical cost is USD 0.07-0.10 per kWh. This is competitive, excluding subsidies, with conventional energy sources like coal, gas and hydro. At a typical cost of USD 0.20-0.30 per kWh, solar PV still has quite a distance to go before reaching grid parity on a broad level. However, as we discuss in the following paragraph, the variations from country to country and in between regions are so significant that a global conclusion is impossible to reach. An LCOE evaluation will only yield "proper" results when made for a specific project, taking into account local and regional grid capacities, load curves and demand curves, availability and predictability of feedstock (coal, gas etc) and many more factors. LCOE: Sensitive to the different cost parameters The levelized cost of energy (LCOE) for the different electricity sources is very sensitive to the different cost parameter assumptions. Fuel and carbon prices, construction costs, load factors, lifetimes, lead times and discount rates will deeply affect the cost results. Uncertainty drives up the costs through higher discount rates for all technologies. This is specially the case for low carbon technologies due to their higher investment costs. The competitiveness of solar, wind and hydro is also very dependent on the local characteristics of each particular market. Pros and cons of the different technologies It is impossible to say that any one technology has an overall advantage over the others on a global scale – not even regionally. That comes from the wide dispersion of actual and estimated cost data gathered by the IEA1 . Global LCOE comparisons can therefore only be done for illustrative purposes – however each technology nevertheless has an inherent set of traits that sets it apart: 1 International Energy Agency (IEA): “Projected Costs of Generating Electricity” (2010)

- 23. Sector report > Renewable Energy DnB NOR Markets – 23 02.09.2010 Technology Pros Cons Nuclear • Low-carbon • Low fuel cost, opex • Predictable costs • Significant size • Long lead time • High capital at risk • Long-term waste disposal • Security • Nuclear proliferation • NIMBY • High decommissioning cost Coal • Cheap (excl CO2 and other emissions), if close to mine • Significant size • Can be sited near demand center • Large fuel reserves • Dirty, both on CO2 and other pollutants • High CCS cost Gas • Lower carbon than coal and oil • Can be cited near demand center • Suitable for marginal production capacity • Still emits carbon compounds • Leakage of methane gas is 21 times worse than CO2 Hydro • Low-carbon • No fuel costs • Minimal stop/start costs • Low maintenance • Ease of energy storage • Limited potential for new sites • Transmission costs significant Wind • Low-carbon • No fuel costs • Land area can still be used to i.e. agriculture • NIMBY • Unpredictable output • Significant transmission costs. (especially offshore) Solar (PV) • Low-carbon • No fuel costs • Cost are less scale dependent • Low maintenance • Expensive CapEx. • Unpredictable output • Expensive energy storage (battery technology) The main changes since our 2009 report are; 1) Higher carbon price. We increased our future base carbon price to $30/ton which we still believe is a conservative assumption due to more political pressure to increase low carbon energy technologies. 2) Lower Solar PV capital expenditure due to the impressive cost reductions throughout the value chain. 3) Different discount rates to illustrate the impact discount rates have on total costs.

- 24. Sector report > Renewable Energy DnB NOR Markets – 24 02.09.2010 Wind – onshore Exhibit 3-1: Cost of new electricity production from onshore wind ONSHORE WIND Assumptions unit Low Base High Investment Costs Discount Rate 7.5% 7.5% 7.5% Economic lifetime years 25 20 20 CapEx USD/kW 1,500 1,750 2,200 Capacity Factor 35% 30% 22% Fuel Costs - - - - - - - - O&M Costs Fixed USDc/kWh 1.0 1.5 3.1 Variable USDc/kWh - - - Externality costs CO2 quota price USD/ton 30 50 Investment USDc/kWh 4.4 6.5 11.2 Fuel USDc/kWh - - - O&M USDc/kWh 1.0 1.5 3.1 Externalities USDc/kWh - 0.0 0.0 Total cost USDc/kWh 5.4 8.1 14.3 Source: DnB NOR Markets Evaluation of the cost factors Capital cost Fuel cost O&M cost Externalities Onshore wind is capital intensive and the investment depends on factors like location, existing infrastructure, and grid connection. Construction time on the other hand is very low, around one year. Typical investment costs in main markets like Europe and USA is 1.5-2.5 USD/Wp for a wind park, all included. In China, wind parks are constructed at close to half of this. A wind turbine normally will stay in operation for 20 years, and depending on the wind resources the capacity factor is 25-40%. None The reported specific O&M costs for wind power plants vary widely from country to country, even in the same region there can be significant differences. The US Department of Energy (2007) reported O&M costs below USDc 1 /kWh. According to IEA (2010 numbers) the costs vary from 0,5 to 4,2 USDc/kWh depending on the location, size and age of the wind park. If we assume that most parks in the future will be more operating and maintenance efficient, an average of USDc 1.5 /kWh is reasonable. Only related to production of wind turbine LCOE Cost Onshore wind 81 % 0 % 19 % 0 % Investment Fuel O&M Externalities

- 25. Sector report > Renewable Energy DnB NOR Markets – 25 02.09.2010 Wind - Offshore Exhibit 3-2: Cost of new electricity production from offshore wind OFFSHORE WIND Assumptions unit Low Base High Investment Costs Discount Rate 7.5% 7.5% 7.5% Economic lifetime years 25 20 20 CapEx USD/kW 3,000 3,500 4,500 Capacity Factor 55% 45% 35% Fuel Costs - - - - - - - - O&M Costs Fixed USDc/kWh 1.9 2.5 3.6 Variable USDc/kWh - - - Externality costs CO2 quota price USD/ton 30 50 Investment USDc/kWh 5.6 8.7 14.4 Fuel USDc/kWh - - - O&M USDc/kWh 1.9 2.5 3.6 Externalities USDc/kWh - 0.0 0.0 Total cost USDc/kWh 7.5 11.3 18.0 Source: DnB NOR Markets Equity Research Evaluation of the cost factors Capital cost Fuel cost O&M cost Externalities Offshore wind is more capital intensive than onshore and the investment depends on factors like location, existing infrastructure, and grid connection. The variety in CapEx depends significantly on the different technologies used, i.e. floating vs. bottom mounted technologies. Offshore wind as an alternative to onshore has just recently started to be attractive. Therefore investment costs are likely to decrease steadily from today's values. Typical investment costs in Europe today is 3-5 USD/Wp, all included. A wind turbine will normally stay in operation for at least 20 years (some expect up to 25 years due to less turbulence), but no turbine has been tested off-shore for that time period. There is typically better wind resources off-shore, giving a capacity factor of 35- 55%. None There are few offshore wind farms in operation and O&M costs are thus more uncertain than for onshore. IEA (2010) collected data from eight different offshore wind farms where O&M costs varied from USDc 1.0 to USDc 5.0 per kWh. IEA expect O&M costs to drop to USDc 1.5 – 2.0 on average over the next decade, but stated that the assumptions were subject to high uncertainty. Only related to the production of the wind turbines and base structures. LCOE Cost Offshore wind 0 % 23 % 0 % 77 % Investment Fuel O&M Externalities

- 26. Sector report > Renewable Energy DnB NOR Markets – 26 02.09.2010 Solar - PV Exhibit 3-3: Cost of new electricity production from PV SOLAR Assumptions unit Low Base High Investment Costs Discount Rate 7.5% 7.5% 7.5% Economic lifetime years 25 25 20 CapEx USD/kW 2,000 3,000 4,000 Capacity Factor 17% 14% 11% Fuel Costs - - - - - - - - O&M Costs Fixed USDc/kWh 1.61 2.45 4.36 Variable USDc/kWh - - - Externality costs CO2 quota price USD/ton 30 50 Investment USDc/kWh 12.05 21.94 40.72 Fuel USDc/kWh - - - O&M USDc/kWh 1.61 2.45 4.36 Externalities USDc/kWh - 0.14 0.25 Total cost USDc/kWh 13.66 24.53 45.33 Source: DnB NOR Markets Evaluation of the cost factors Capital cost Fuel cost O&M cost Externalities PV is highly capital intensive. However, the cost is less scale dependent than other renewable energies, meaning it can be installed in small, decentralized units, without making each kWh hopelessly expensive. Investment costs generally reflect the level of support mechanisms in each market, and therefore vary significantly. The fallout of the Spanish market in 2008 was countered by the record breaking growth in Germany resulting in a positive growth in 2009. This resulted in a 16% mid-year FIT cut in July 2010 in Germany. Other markets have also experienced significantly growth which is a necessity for the growth in solar to continue. Technological progress will probably decrease capital costs per kW in 2011 by 10 to 20 per cent from 2010 levels, possibly even more. None Very low. Since solar plants are a fairly recent phenomena, real-life and long-term data on specific O&M costs is limited. The only moving parts are the tracking systems, and most are designed to last more than 20 years, many without lubrication. In addition, the inverter will have to be changed every 6-7 years or so. And in regions without rain, the panels need to be cleaned routinely. In total, O&M costs average around USDc 1.5-3.5 per kWh, maybe less, and for residential systems it will be next to nothing. Only related to production of the solar module and its components. LCOE Cost Solar 89 % 0 % 10 % 1 % Investment Fuel O&M Externalities

- 27. Sector report > Renewable Energy DnB NOR Markets – 27 02.09.2010 Nuclear Nuclear power generated electricity has a vast potential. The existing plants produce electricity at a very low price, and emit no CO2. However, there is a very high NIMBY factor and waste disposal is still an environmental concern. In addition the lead times are long, often more than 7-8 years. Exhibit 3-4: Cost of new electricity production from nuclear Assumptions unit Low Base High Investment Costs Discount Rate 7.5% 7.5% 7.5% Economic lifetime years 60 45 45 CapEx USD/kW 3,000 4,000 5,000 Capacity Factor 90% 83% 75% Fuel Costs Uranium Price USD/lbm 20 30 50 Waste disposal USDc/kWh 0.10 0.20 0.25 Efficiency 34% 34% 34% O&M Costs Fixed USDc/kWh 0.76 1.03 1.37 Variable USDc/kWh 0.16 0.20 0.24 Externality costs CO2 quota price USD/ton 30 50 Investment USDc/kWh 2.89 4.29 5.94 Fuel USDc/kWh 0.83 1.24 2.07 O&M USDc/kWh 0.92 1.23 1.61 Externalities USDc/kWh - - - Total cost USDc/kWh 4.64 6.76 9.61 Source: DnB NOR Markets Equity Research Evaluation of the cost factors Capital cost Fuel cost O&M cost Externalities The capital costs constitute a significant part of the total LCOE, thus the construction and red tape involved in the investment process are the most important factors determining the final LCOE. According to IEA the capital costs of 20 nuclear plants from OECD countries lay between 2 USD/W and 5 USD/W. Platt’s estimated that the construction cost for an EPR power plant is around 3 USD/Wp. However, the Finnish Olkiluoto3 1.6 GWp nuclear power plant under construction will realise significantly higher costs. The plant, scheduled for completion by 2011 at the earliest, has run into problems and the final cost will most likely exceed 5 USD/Wp. Plants have low incremental fuel cost, and achieve a typically capacity factor of 75-90%. The fuel cost is approximately 15-20% of the current generation cost. This, however, is based on long-term contracts with significantly lower prices than spot. There are worries regarding future supply constraints and fuel costs may increase. Waste disposal is also included in this LCOE estimate and is accounted to be USDc 0.2 per kWh. Nuclear plants have been in operations for decades and there exists exact information regarding O&M cost. Nuclear Energy Institute (NEI) has reported O&M costs of USDc 1.29 - 1.4 per kWh in the US every year since 2003. More concerning is that nuclear generation requires nuclear physicists and engineers and hence requires highly skilled and attractive labor. The supply of personnel may be a bottleneck for nuclear expansion going forward. Only related to construction, the CO2 emissions from nuclear generated electricity are minimal. Decommissioning costs usually is accounted to be 15% of construction costs on average and runs at the end of the plants lifetime. Due to a nuclear power plants long lifetime, the levelised decommissioning costs are negligible with any reasonable discount rate and therefore excluded from this report. LCOECost Nuclear 18 % 18 % 0 % 64 % Investment Fuel O&M Externalities

- 28. Sector report > Renewable Energy DnB NOR Markets – 28 02.09.2010 Hydro Hydro is the most competitive energy source according to our calculations, but the supply constraint is obvious. A hydro plant is dependent on environmental factors as waterfalls and streams, and most of the ones viable for energy production already have a power plant installed. Therefore the price of hydro varies and may be a lot higher than our estimates. According to IEA, some power plants, i.e. Japan and Czech Republic, are 10 times more expensive than some power plants in China. Exhibit 3-5: Cost of new electricity production from hydro HYDRO Assumptions unit Low Base High Investment Costs Discount Rate 7.5% 7.5% 7.5% Economic lifetime years 60 50 30 CapEx USD/kW 1,800 2,800 4,000 Capacity Factor 60% 50% 40% Fuel Costs - - - - - - - - O&M Costs Fixed USDc/kWh 0.29 0.57 1.00 Variable USDc/kWh 0.08 0.10 0.12 Externality costs CO2 quota price USD/ton 30 50 Investment USDc/kWh 2.60 4.95 9.67 Fuel USDc/kWh - - - O&M USDc/kWh 0.37 0.67 1.12 Externalities USDc/kWh - 0.01 0.02 Total cost USDc/kWh 2.97 5.63 10.80 Source: DnB NOR Markets Equity Research Evaluation of the cost factors Capital cost Fuel cost O&M cost Externalities Hydro is a capital intensive energy source, but measured by capital cost per Wp it is much less expensive than e.g. nuclear. The capital costs vary considerably dependant on suitable locations. None O&M of a hydro plant is very low compared to other power producers. It varies between plants and regions, but it is typically well below 1 USDc/kWh. Only in construction of the plant. Hydro plants may at some extent threaten local biodiversity. LCOE Cost Hydro 12 % 0 % 0 % 88 % Investment Fuel O&M Externalities

- 29. Sector report > Renewable Energy DnB NOR Markets – 29 02.09.2010 Natural Gas Natural gas is the most versatile and economically attractive interesting fossil fuel electricity source in the current environment. Capital investments are comparatively low, and the externalities are significantly lower than coal and oil. Since most new gas power plants in North America and Europe are combined cycle power plant1 , we use these to calculate power price from new natural gas electricity generation. Exhibit 3-6: Cost of new electricity production from natural gas NATURAL GAS Assumptions unit Low Base High Investment Costs Discount Rate 7.5% 7.5% 7.5% Economic lifetime years 40 40 35 CapEx USD/kW 1,000 1,200 1,500 Capacity Factor 60% 50% 40% Fuel Costs Gas Price USD/Mbtu 4 6 10 Efficiency 60% 60% 60% O&M Costs Fixed USDc/kWh 0.23 0.34 0.51 Variable USDc/kWh 0.20 0.25 0.30 Externality costs CO2 quota price USD/ton 30 50 Investment USDc/kWh 1.51 2.18 3.49 Fuel USDc/kWh 2.28 3.26 5.70 O&M USDc/kWh 0.43 0.59 0.81 Externalities USDc/kWh - 1.69 2.95 Total cost USDc/kWh 4.22 7.71 12.96 Source: DnB NOR Markets Equity Research Evaluation of the cost factors Capital cost Fuel cost O&M cost Externalities Data from IEA estimated that the construction cost for a Combined Cycle power plant is 1-1.5 USD/Wp, approximately 28% of the LCOE cost of electricity. Given the short lead-time and technological maturity, the investment cost is fairly transparent. Natural gas often represents the marginal cost of electricity and the capacity factor is therefore usually low, often down to 10-30%. Hence, even though capital cost is low per Wp, the cost per kWh is high. Gas plants are highly fuel- intensive and the business case is thus mainly dependent on the projections one makes about the gas prices vs the electricity prices. The gas prices vary from country to country and the spot prices NBP (UK) and Henry Hub (US) where at levels half of oil- linked spot prices (Japanese LNG) in summer 2009. Since then, spot prices have increased, and we estimate a gas price of around USD 6 per MBtu. O&M Costs equals less than 10% of the levelised cost of electricity generated from gas plants. While the CO2 emissions are in a different league than nuclear, hydro and other carbon neutral energy sources it is also in a different league than its fellow fossil fuel sources. Coal emits 50% more CO2 than gas generated electricity. But even so, given today's CO2 quota price the externality cost/kWh is approximately 25% of cost cost/kWh. 1 In a combined cycle power plant (CCPP), or combined cycle gas turbine (CCGT) plant, a gas turbine generator generates electricity and the waste heat is used to make steam. This steam is then used to generate additional electricity via a steam turbine. The last step increases the efficiency of electricity generation to around 60% for state-of-the-art power plants. LCOE Cost Natura Gas 28 % 42 % 8 % 22 % Investment Fuel O&M Externalities

- 30. Sector report > Renewable Energy DnB NOR Markets – 30 02.09.2010 Coal Coal is by far the most important electricity source in the world contributing more than 40% of all electricity produced. While generation costs historically have been extremely low, explaining its vast impact, the current coal prices and environmental concerns are turning coal into a high cost electricity source. Exhibit 3-7: Cost of new electricity production from coal COAL Assumptions unit Low Base High Investment Costs Discount Rate 7.5% 7.5% 7.5% Economic lifetime years 50 45 40 CapEx USD/kW 1,000 2,500 3,500 Capacity Factor 80% 75% 70% Fuel Costs Coal Price USD/s.ton 60 75 100 Efficiency 41% 41% 41% O&M Costs Fixed USDc/kWh 0.34 0.46 0.59 Variable USDc/kWh 0.32 0.40 0.48 Externality costs CO2 quota price USD/ton 30 50 Investment USDc/kWh 1.10 2.97 4.53 Fuel USDc/kWh 1.99 2.37 3.32 O&M USDc/kWh 0.66 0.86 1.07 Externalities USDc/kWh - 2.73 4.77 Total cost USDc/kWh 3.75 8.92 13.69 Source: DnB NOR Markets Equity Research Evaluation of the cost factors Capital cost Fuel cost O&M cost Externalities Capital cost per MW is high for coal, but high capacity factor reduce the capital cost per kWh. Platts estimates and IEA market data indicate a construction cost for a supercritical, pulverized coal plant is around 2 -3 USD/Wp. This implies that capital costs comprise ~32% of the LCOE. Up till 2006 the fuel costs were negligible, but when coal drove though USD 100/short ton the fuel costs became a major cost driver. Some countries (i.e. Australia and the US) are not subject to the fluctuations of the international market. They operate with domestic coal prices below the current spot price. A coal plant is labor intensive and the O&M costs will vary depending on the local salary level. Coal plants emit 0.95kg/kWh thereby being the worst polluter in the electricity sector. With a CO2 quota price of ~30 USD/ton this equals 2.73 USDc/kWh. If CO2 quota prices were to increase to USD 75/ton the cost of CO2 would exceed the entire low-cost scenario. LCOE Cost Coal 32 % 10 % 31 % 27 % Investment Fuel O&M Externalities