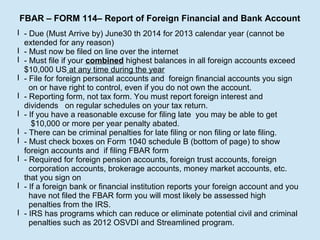

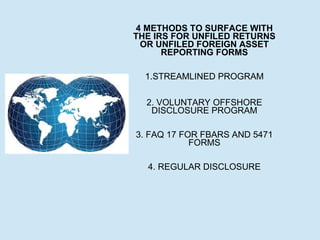

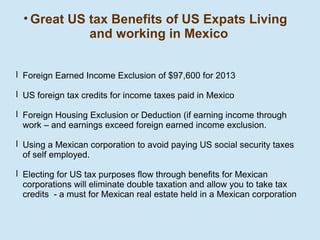

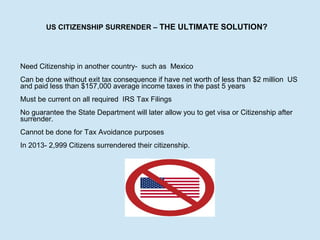

This document outlines the tax obligations for U.S. citizens and green card holders living in Mexico, including the requirement to file U.S. tax returns reporting worldwide income and the potential for tax credits to avoid double taxation. It also details the Foreign Bank Account Report (FBAR) requirements and the penalties for non-compliance, as well as highlights various IRS reporting forms for foreign financial assets and entities. Additionally, it discusses tax benefits for expatriates and increases in IRS audits targeting U.S. expats, while offering services from an experienced attorney in this field.