1. zyxi (26 dec 2018)

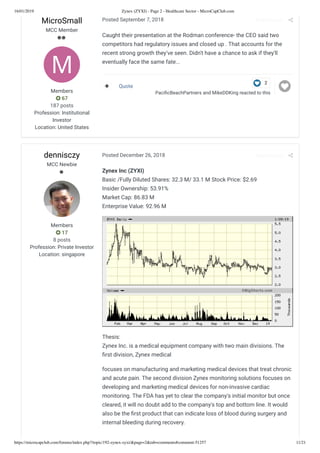

- 1. 16/01/2019 Zynex (ZYXI) - Page 2 - Healthcare Sector - MicroCapClub.com https://microcapclub.com/forums/index.php?/topic/192-zynex-zyxi/&page=2&tab=comments#comment-51257 11/21 MicroSmall MCC Member Members 67 187 posts Profession: Institutional Investor Location: United States Posted September 7, 2018 Report post Caught their presentation at the Rodman conference- the CEO said two competitors had regulatory issues and closed up . That accounts for the recent strong growth they've seen. Didn't have a chance to ask if they'll eventually face the same fate... Quote dennisczy MCC Newbie Members 17 8 posts Profession: Private Investor Location: singapore Posted December 26, 2018 Report post Zynex Inc (ZYXI) Basic /Fully Diluted Shares: 32.3 M/ 33.1 M Stock Price: $2.69 Insider Ownership: 53.91% Market Cap: 86.83 M Enterprise Value: 92.96 M Thesis: Zynex Inc. is a medical equipment company with two main divisions. The rst division, Zynex medical focuses on manufacturing and marketing medical devices that treat chronic and acute pain. The second division Zynex monitoring solutions focuses on developing and marketing medical devices for non-invasive cardiac monitoring. The FDA has yet to clear the company’s initial monitor but once cleared, it will no doubt add to the company's top and bottom line. It would also be the rst product that can indicate loss of blood during surgery and internal bleeding during recovery. 2 Paci cBeachPartners and MikeDDKing reacted to this I uploaded the copy taken from the forum instead of the original because there is a timestamp to prove that I wrote it before the recent appreciation in stock prices. Date of publish: Dec 26 2018

- 2. 16/01/2019 Zynex (ZYXI) - Page 2 - Healthcare Sector - MicroCapClub.com https://microcapclub.com/forums/index.php?/topic/192-zynex-zyxi/&page=2&tab=comments#comment-51257 12/21 Zynex has a lot of the characteristics that are indicative of a favorable risk to reward; expanding gross margins, cash ow positive, share buy-back program, explosive growth on both the top line and bottom line, no debt, and selling at cheap valuation multiples. Revenue grew by almost 76% from 2016 to 2017, and the year on year revenue for 2018 Q3 has increased by 20%. The reason for this explosive growth is due to the 2015 Q4 closure of Empi, Zynex's primary competitor, which left a $250 million market void that ZYXI is lling. The business itself is hugely pro table with gross margins of 81%. Currently, there are also industry tailwinds as the opioid crisis has led to an increase in demand for alternative means of pain relief that does not depend on opioids, and ZYXI is likely to bene t from it. TENS industry background: The majority of ZYXI’s revenues currently come from the sale of TENS devices and supplies. TENS devices are medical devices that use electrotherapy to reduce pain. To understand how it works you can watch this video: https://www.zynex.com/nwinstructions/ The TENS industry is currently bene tting from an industry tailwind due to the opioid crisis and consumers are seeing electrotherapy as an excellent alternative to using pain medication. The electrotherapy market is expected to grow at a CAGR of 4.2% and is expected to reach 1.2 billion USD by 2023. Currently, North America is the largest market in the world, and this trend is likely to continue as consumers turn away from conventional painkillers and drugs due to their side effects. Why does this opportunity exist: (I would move this section above the TENS industry background section) 1. OTCQB - The company is currently trading on the OTCQB, which doesn't allow most funds to invest in them. The management has plans to uplist the company to a national stock exchange. 2. Market’s distrust due to its history of operating losses and previous defaults. Though the company has been pro table for the past two years, it has a long history of operating losses, and I believe that the exit of Empi, the company's main competitor, played a large part in the company achieving pro tability. It was also in default of a credit line in 2016, which has already been fully paid off. Management team: I believe that the quality of management is high and they are opportunistic. For example, the management team immediately hired Empi’s past sales representatives after Empi’s closure back in 2015. According to management, Empi’s closure created a market void of $250 million. In addition, Glassdoor reviews are strong and approval for the CEO is around 78%, which is a very high review score. The CEO Thomas Sandgaard, started

- 3. 16/01/2019 Zynex (ZYXI) - Page 2 - Healthcare Sector - MicroCapClub.com https://microcapclub.com/forums/index.php?/topic/192-zynex-zyxi/&page=2&tab=comments#comment-51257 13/21 the company from scratch and owns around 53% of the company. We know that his interests are aligned with the outside minority passive investors. Also, the CFO Daniel Moorhead has been buying shares recently. High quality of business: TENS devices have a razor and blade business model, where the supplies are incredibly pro table. The increase in margins, revenues, and income are likely due to the factors stated below. Purchase habits of doctors: The quality of revenue is high because they are selling the products directly to doctors who then prescribe the devices to patients, so in a sense, the real customers are the doctors. From my conversations with doctors/therapists and people who work in the industry, I understand that doctors generally do not change the brand of medical devices that they are familiar with and this includes the TENS devices that they are currently prescribing which results in customer lock-in. However, for big hospitals, both the doctors and a purchase committee make the purchase decisions. Insurance covered: The products are covered by insurance and my understanding of TENS users is that if the TENS unit is working, they are unlikely to switch the device. This is especially true since patients tend to trust the doctor's prescription and they are unlikely to change for no reason. Outsourced manufacturing: The company outsources the components manufacturing process for the products to external manufacturers, and then assemble the units in-house which translates to lower operating expense and higher gross margins. Strong nancial position and nancial metrics ZYXI is in a strong nancial position and has very attractive nancial characteristics. It has no debt and has been using it’s ample cash ow to repurchase shares. They recently announced a $0.07/share special dividend . TTM ROE and ROA ratios are around 112%, 78.2% respectively. I believe that these metrics will be sustained for a few years before they start to normalize as it captures more of the market. Valuation:

- 4. 16/01/2019 Zynex (ZYXI) - Page 2 - Healthcare Sector - MicroCapClub.com https://microcapclub.com/forums/index.php?/topic/192-zynex-zyxi/&page=2&tab=comments#comment-51257 14/21 A big chunk of the year is already gone, and I generally try not to annualize quarterly statements to predict revenue run rate as it may be misleading, but in this case, in order to show how cheap ZYXI is selling for, I valued the company using both the FY 2017 values and the 2018 TTM values (adjusted for Q3 nancials). Further upside Blood monitoring device: According to management, if approved by the FDA, the blood monitoring device will be the rst product that can indicate loss of blood during surgery and internal bleeding during recovery. They recently obtained a US patent in October for the product and is preparing for launch. Currently, the only way to detect blood loss is by visually monitoring a patient which is very inaccurate. Thus, the device, if approved, is likely to meet a currently unmet need. According to management, the worldwide market for the monitor is around 3 billion dollars. They also stated that for the full blown launch, they might consider outside capital, but the management is not yet in a position to give guidance on the capital needed. Comparable analysis Public comp: After the closure of EMPI, DYNT is the only public comp available. It is trading at an EV/EBITDA of 39x, EV/sales of 0.64x, with a market cap of around $ 20 million on the NASDAQ. They are still in the red, in terms of net income and slightly operating cash ow positive with $0.76 million OCF for FY 2018. Gross margin has averaged around 31% for the past 5 years. The company has been losing money every year since 2012 and debt to equity is around 0.85x. However, DYNT’s product line focuses more on physical therapy medical supplies such as braces and slings and to a smaller proportion, TENS units. Though the revenue for FY 2018 was $64.4 million, I believe that the sale of TENS units only contributed to a very small

- 5. 16/01/2019 Zynex (ZYXI) - Page 2 - Healthcare Sector - MicroCapClub.com https://microcapclub.com/forums/index.php?/topic/192-zynex-zyxi/&page=2&tab=comments#comment-51257 15/21 percentage of revenue. Thus, comparing it to ZYXI may be seen as comparing apples to oranges. Other Competition: International Rehabilitative Sciences (doing business as RS medical) is ZYXI’s primary competitor in the TENS space. RS medical is a private company, so information is hard to get a hold of. According to Owler, it has an annual revenue of $ 20.4 million (USD) with an estimated employee count of 47. ZYXI has a TTM revenue of 30.7 million and 109 employees. It is worth mentioning that ZYXI’s hiring strategy would make it hard for RS medical to gain a signi cant foothold in the industry. In the 2018 Q3 conference call, ZYXI’s CEO said that there are targeting cities where they do not have a signi cant sales presence. Their goal is to blanket the entire country with high quality sales reps to make it di cult for competition to break in, and given ZYXI’s larger scale, this should provide barriers to entry of competitors. Beyond RS Medical, there are some smaller competitors, but they do not have as much scale. Conservative expectation for 2019 (base case) Though I think that it is likely for the monitoring device to be approved by the FDA in 2019, I am not adding it in my valuation as it is somewhat speculative. It is likely that the TENS device sales will be funneled down to product supply sales as it has for the last few years. Since revenue for product devices in the fourth quarter tends to be much stronger than the rest of the year, I assumed that for FY 2018 and 2019, device revenue would at least stay constant at 8.8 million, even though 2018 annual revenue run rate is likely to surpass that. This means that revenue from product supplies is expected to increase by at least 7 to 10 million per year. Also, I assumed SG&A to be constant 9.7 million as it has stayed relatively stable for the past few years even amidst the company’s expansion. Given the quick increase in revenue and margin expansion and lack of large competitors, I believe that there is room for multiple expansion as the market starts to take notice of this company. The table below shows the different scenarios if this happens. Assuming that net cash stays at 8 million (according to the most recent quarter) and assuming diluted shares outstanding stays at 33.1 million, my conservative base case price target at an EV/EBIT of 8X is around $4.6/share, which offers around 71% upside at time of writing. Even in the bear case, which assumes the stock stays at the current EV/EBIT multiple of 6.15X, there is a 30% upside from the current

- 6. 16/01/2019 Zynex (ZYXI) - Page 2 - Healthcare Sector - MicroCapClub.com https://microcapclub.com/forums/index.php?/topic/192-zynex-zyxi/&page=2&tab=comments#comment-51257 16/21 stock price of $2.69. But I believe that this is a great business, so time is its ally and the compounding effect is likely to take place as time progresses which could result in multiple expansion well beyond my conservative projections. Risks Patents and competition: The company does not have any patent for the products that are currently generating revenue. However, this is more of a long-term risk: if they managed to get the FDA approval for the blood monitoring device this risk would be much less signi cant. Mitigant: From my conversation with doctors and people working with doctors I don't see why a competitor would want to manufacture a TENS unit that has precisely the same functionality as ZYXI, even if they nd the market to be attractive. Insurance redemption risk: The company was in poor nancial shape after Medicare stopped covering TENS for chronic low back pain, as Medicare deemed that it was not necessary for the treatment of low back pain. Even though the company is in much better shape right now as compared to before, I believe that this poses as a rather signi cant risk to the thesis. Management risk: The management team was involved in a lawsuit a while back where they allegedly in ated stock prices between March 2008 and March 2009. The lawsuit was settled by paying around $2.5 million in cash. This case re ects poorly on the management. Catalysts 1. FDA approval of blood monitor. 2. Organic growth of TENS device continues. 3. Uplisting to a major stock exchange nal pitch.pdf Quote Edit Ian Cassel Administrator Posted January 3 Report post Congrats @dennisczy , welcome to MicroCapClub.