Small Business Lending Index September 2017

•

1 like•121 views

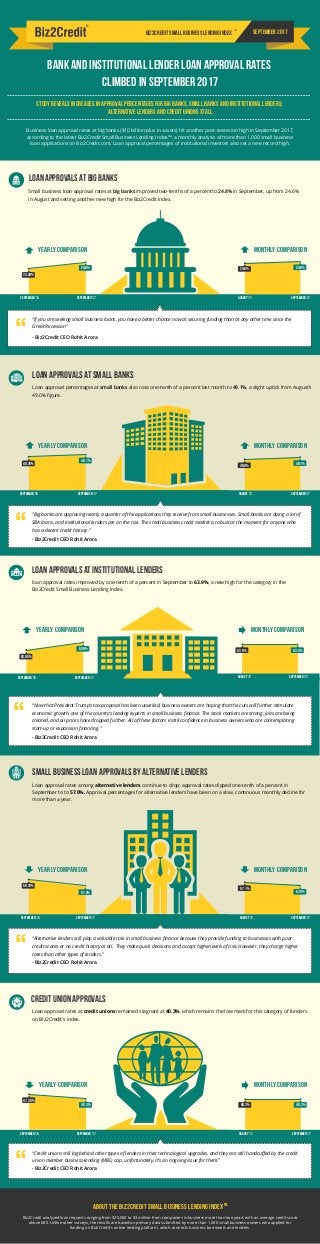

Biz2Credit: https://www.biz2credit.com/ Related Resource: https://www.biz2credit.com/small-business-lending-index/september-2017 According to the month of September 2017, Big banks approved 24.8% of small business loan, slightly up from 24.6% compared to August 2017. For further queries, contact us at: 800-200-5678 Follow us at: Twitter: https://twitter.com/biz2credit Facebook: https://www.facebook.com/biz2credit Linkedin: https://www.linkedin.com/company/biz2credit-llc Pinterest: http://www.pinterest.com/biz2credit/ Google+: https://plus.google.com/u/0/+Biz2credit/

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

More from Biz2Credit

More from Biz2Credit (20)

Unlocking the Secrets to 50 Percent More Profit - Biz2Credit

Unlocking the Secrets to 50 Percent More Profit - Biz2Credit

The Changing Face of Small Business Owners - Biz2Credit

The Changing Face of Small Business Owners - Biz2Credit

Latino Small Business Owners Lagging Behind - Biz2Credit

Latino Small Business Owners Lagging Behind - Biz2Credit

Biz2Credit Small Business Lending Index - July 2015

Biz2Credit Small Business Lending Index - July 2015

Small Business Lending Index June 2015 – Biz2Credit

Small Business Lending Index June 2015 – Biz2Credit

Small Business Lending Index January 2015 - Biz2Credit

Small Business Lending Index January 2015 - Biz2Credit

Small Business Lending Index May 2015 – Biz2Credit

Small Business Lending Index May 2015 – Biz2Credit

Small Business Lending Index February 2015 - Biz2Credit

Small Business Lending Index February 2015 - Biz2Credit

Biz2Credit Small Business Lending Index - March 2015

Biz2Credit Small Business Lending Index - March 2015

Biz2Credit Small Business Lending Index - April 2015

Biz2Credit Small Business Lending Index - April 2015

Recently uploaded

Recently uploaded (15)

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377087607

FULL ENJOY Call Girls In Mahipalpur Delhi Contact Us 8377087607

Shareholders Agreement Template for Compulsorily Convertible Debt Funding- St...

Shareholders Agreement Template for Compulsorily Convertible Debt Funding- St...

Enabling Business Users to Interpret Data Through Self-Service Analytics (2).pdf

Enabling Business Users to Interpret Data Through Self-Service Analytics (2).pdf

EXPERIENCE THE FUTURE OF WORK FOR FUTURE OF BUSINESSES

EXPERIENCE THE FUTURE OF WORK FOR FUTURE OF BUSINESSES

EV Electric Vehicle Startup Pitch Deck- StartupSprouts.in

EV Electric Vehicle Startup Pitch Deck- StartupSprouts.in

JAIPUR CALL GIRLS SERVICE REAL HOT SEXY 👯 CALL GIRLS IN JAIPUR BOOK YOUR DREA...

JAIPUR CALL GIRLS SERVICE REAL HOT SEXY 👯 CALL GIRLS IN JAIPUR BOOK YOUR DREA...

Jual Obat Aborsi Bojonegoro ( Asli No.1 ) 085657271886 Obat Penggugur Kandung...

Jual Obat Aborsi Bojonegoro ( Asli No.1 ) 085657271886 Obat Penggugur Kandung...

Indian Call girl in Dubai 0508644382 Dubai Call girls

Indian Call girl in Dubai 0508644382 Dubai Call girls

+971565801893>>Safe and original mtp kit for sale in Dubai>>+971565801893

+971565801893>>Safe and original mtp kit for sale in Dubai>>+971565801893

How Multicultural Toys Helps in Child Development.pptx

How Multicultural Toys Helps in Child Development.pptx

CARA BINA PENDAPATAN PASIF HARIAN RM9000 BERMODALKAN RM30 DI TDC

CARA BINA PENDAPATAN PASIF HARIAN RM9000 BERMODALKAN RM30 DI TDC

Small Business Lending Index September 2017

- 1. 24.8% 23.40% yearly comparison MONTHLY comparison 24.8%24.6% AUGUST’17 SEPTEMBER’17 Bank and Institutional Lender Loan Approval Rates Climbed in September 2017 Study reveals increases in approval percentages for big banks, small banks and institutional lenders; alternative lenders and credit unions stall september 2017BIZ2CREDIT Small Business Lending Index Business loan approval rates at big banks ($10 billion-plus in assets) hit another post-recession high in September 2017, according to the latest Biz2Credit Small Business Lending Index™, a monthly analysis of more than 1,000 small business loan applications on Biz2Credit.com. Loan approval percentages of institutional investors also set a new record high. TM Loan Approvals at Institutional Lenders loan approval rates improved by one-tenth of a percent in September to 63.9%, a new high for the category in the Biz2Credit Small Business Lending Index. Loan Approvals at Big banks Small business loan approval rates at big banks improved two-tenths of a percent to 24.8% in September, up from 24.6% in August and setting another new high for the Biz2Credit Index. Credit union approvals Loan approval rates at credit unions remained stagnant at 40.3%, which remains the low mark for this category of funders on Biz2Credit’s index. Small business loan approvals by Alternative lenders Loan approval rates among alternative lenders continue to drop; approval rates dipped one-tenth of a percent in September to to 57.0%. Approval percentages for alternative lenders have been on a slow, continuous monthly decline for more than a year. “If you are seeking small business loans, you have a better chance now at securing funding than at any other time since the Great Recession” - Biz2Credit CEO Rohit Arora “ SEPTEMBER’16 SEPTEMBER’17 yearly comparison 40.3% 41.30% MONTHLY comparison 40.3%40.3% “Credit unions still lag behind other types of lenders in their technological upgrades, and they are still handcuffed by the credit union member business-lending (MBL) cap, unfortunately, It’s an ongoing issue for them.” - Biz2Credit CEO Rohit Arora “ SEPTEMBER’17AUGUST’17SEPTEMBER’16 SEPTEMBER ’17 yearly comparison 57.0% 59.70% MONTHLY comparison 57.0% 57.1% AUGUST’17SEPTEMBER’16 SEPTEMBER’17 “Alternative lenders still play a valuable role in small business finance because they provide funding to businesses with poor credit scores or no credit history at all, They make quick decisions and accept higherlevels of risk. However, they charge higher rates than other types of lenders.” - Biz2Credit CEO Rohit Arora “ SEPTEMBER’17 yearly comparison 49.1% 48.70% Loan Approvals at Small banks Loan approval percentages at small banks also rose one-tenth of a percent last month to 49.1%, a slight uptick from August’s 49.0% figure. MONTHLY comparison 49.1% 49.0% “Big banks are approving nearly a quarter of the applications they receive from small businesses. Small banks are doing a lot of SBA loans, and institutional lenders are on the rise. The small business credit market is robust at the moment for anyone who has a decent credit history.” - Biz2Credit CEO Rohit Arora “ SEPTEMBER’16 SEPTEMBER’17 AUGUST’17 SEPTEMBER’17 63.9% 63.9%63.9% 63.00% “Now that President Trump’s tax proposal has been unveiled, business owners are hoping that the cuts will further stimulate economic growth, one of the country’s leading experts in small business finance. The stock markets are strong, jobs are being created, and oil prices have dropped further. All of these factors instill confidence in business owners who are contemplating start-up or expansion financing.” - Biz2Credit CEO Rohit Arora “ yearly comparison MONTHLY comparison SEPTEMBER’16 SEPTEMBER’17 AUGUST’17 SEPTEMBER’17 About the Biz2Credit Small Business Lending IndexTM Biz2Credit analyzed loan requests ranging from $25,000 to $3 million from companies in business more than two years with an average credit score above 680. Unlike other surveys, the results are based on primary data submitted by more than 1,000 small business owners who applied for funding on Biz2Credit's online lending platform, which connects business borrowers and lenders.