Packs Versus Bonds

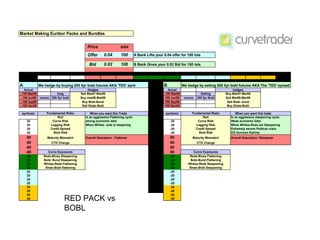

- 1. Market Making Euribor Packs and Bundles Price size Offer 0.04 100 A Bank Lifts your 0.04 offer for 100 lots Bid 0.02 100 B Bank Gives your 0.02 Bid for 100 lots A We hedge by buying 200 5yr bobl futures AKA 'TED' sprd B We hedge by selling 200 5yr bobl futures AKA The 'TED' spread Actual Hedges Actual hedges ,-100 Mar08 long Sell Mar07-Mar08 100 Mar08 Selling Buy Mar07-Mar08 ,-100 jun08 versus 200 5yr bobl Buy mar08-Mar09 100 Jun08 versus 200 5yr Bobl Sell Mar08-Mar09 ,-100 sep08 Buy Bobl-Bund 100 Sep08 Sell Bobl- bund ,-100 dec08 Sell Shatz-Bobl 100 Dec08 Buy Shatz-Bobl synthetic Fundamental Risks When you want this Trade synthetic Fundamental Risks When you want this trade Roll In an aggressive Flattening cycle Roll In an aggressive steepening cycle. 20 Curve Risk strong economic data -20 Curve Risk Weak economic Date 20 Legging Risk When Whites -reds is steepning -20 Legging Risk When Whites-Reds are Steepening 20 Credit Spread -20 Credit Spread Extremely severe Political crisis 20 Stub Risk -20 Stub Risk EG Hurrican Katrina -80 Maturity Mismatch Overall Desciption - Flattener 80 Maturity Mismatch Overall Desciption- Steepener -80 CTD Change 80 CTD Change -80 80 -80 Curve Exposures 80 Curve Exposures 20 Reds-Blues Steepening -20 Reds-Blues Flattening 20 Bobl- Bund Steepening -20 Bobl-Bund Flattening 20 Whites-Reds Flattening -20 Whites-Reds Steepening 20 Shatz-Bobl flattening -20 Shatz-Bobl Steepening 20 -20 20 -20 20 -20 ` 20 -20 20 -20 20 -20 20 -20 20 RED PACK vs -20 BOBL

- 2. Price size Offer 0.04 100 A Bank Lifts your 0.04 offer for 100 lots Bid 0.02 100 B Bank Gives your 0.02 Bid for 100 lots A We hedge by buying 200 5yr bobl futures AKA 'TED' sprd B We hedge by selling 200 5yr bobl futures AKA The 'TED' spread Actual methods of locking in profit Actual methods of locking in profit ,-100 Mar09 long Sell sep08-sep09 100 Mar09 Selling Buy sep08-sep09 ,-100 jun09 versus 200 5yr bobl Sell Bobl- bund 100 Jun09 versus 200 5yr Bobl buy bobl-bund ,-100 sep09 100 Sep09 ,-100 dec09 Or hedge up 100 Dec09 Or hedge up synthetic Fundamental Risks When you want this Trade synthetic Fundamental Risks When you want this trade Roll When the curve is Steepening Roll 20 Curve Risk Times of Crisis IE Hurrican Katrina -20 Curve Risk 20 Legging Risk International Tensions -20 Legging Risk 20 Credit Spread -20 Credit Spread 20 Stub Risk -20 Stub Risk 20 Maturity Mismatch Overall Desciption- Steepener -20 Maturity Mismatch Overall Description- Flattener 20 CTD Change -20 CTD Change 20 -20 20 Curve Exposures -20 Curve Exposures -80 Reds-Blues Flattening 80 Reds-Blues Steepens -80 Bobl-Bund Flattening 80 Bobl-Bund Steepens -80 80 -80 80 20 -20 20 -20 20 -20 ` 20 -20 20 -20 20 -20 20 20 GREEN PACK vs -20 -20 BOBL

- 3. Market Making Euribor Packs and Bundles Price size Offer 0.04 100 A Bank Lifts your 0.04 offer for 100 lots Bid 0.02 100 B Bank Gives your 0.02 Bid for 100 lots A We hedge by buying 200 5yr bobl futures AKA 'TED' sprd B We hedge by selling 200 5yr bobl futures AKA The 'TED' spread Actual methods of locking in profit Actual methods of locking in profit ,-100 Mar09 long Sell Mar08-Mar10 100 Mar09 Selling buy Mar08-Mar10 ,-100 jun09 versus 200 5yr bobl Sell Bobl- bund 100 Jun09 versus 200 5yr Bobl buy bobl-bund ,-100 sep09 sell Shatz-Bund 100 Sep09 buy Shatz-bund ,-100 dec09 Or hedge up 100 Dec09 Or hedge up synthetic Fundamental Risks When you want this Trade synthetic Fundamental Risks When you want this trade Roll When the curve is Steepening Roll When the curve is Steepening 20 Curve Risk Times of Crisis IE Hurrican Katrina -20 Curve Risk 20 Legging Risk International Tensions -20 Legging Risk 20 Credit Spread -20 Credit Spread 20 Stub Risk -20 Stub Risk 20 Maturity Mismatch Overall Desciption- Steepener -20 Maturity Mismatch Overall Description- Flattener 20 CTD Change -20 CTD Change 20 -20 20 Curve Exposures -20 Curve Exposures 20 Reds-Blues Flattening -20 Reds-Blues Steepens 20 Bobl-Bund Flattening -20 Bobl-Bund Steepens 20 Shatz-Bund flattening -20 Shatz-Bund steepens 20 -20 -80 80 -80 80 -80 80 ` -80 80 20 -20 20 BLUE PACK vs -20 20 -20 20 BOBL -20

- 4. Market maker Euribor Packs Vs 2-year Shatz Price Size Offer 0.04 100 A Bank Lifts your 0.04 offer for 100 lots Bid 0.02 100 B Bank Gives your 0.02 Bid for 100 lots Actual Hedges Actual Hedges -100 long Sell m7-m8 100 short Buy m7-m8 -100 versus 500 shatz Sell Shatz-Bobl 100 versus 500 shatz Buy Shatz- Bobl -100 Buy some outright z7 100 sell some outright z7 -100 100 synthetic we hedge by buying 500 2 yr Shatz futures AKA 'TED' sprd synthetic we hedge by selling 500 2 yr shatz futures AKA 'TED' sprd 50 Risks when you want this trade -50 Risks When you want this trade 50 Roll In a bear Market -50 Roll In a bull Market 50 Curve Risk -50 Curve Risk 50 Legging Risk -50 Legging Risk -50 Credit Spread 50 Credit Spread -50 Stub Risk 50 Stub Risk -50 Maturity Mismatch Market Bearish 50 Maturity Mismatch Market Bullish -50 CTD Change 50 CTD Change Curve Exposure Curve Exposure Whites-Reds Flattening Whites Red-Steepening Shatz-Bobl Flattening Upward moving market RED PACK vs Shatz-Bobl Steepening Downward moving Market Reds Blues Steepens SHATZ Reds Blues flattening

- 5. WHITE PACK vs SHATZ Market maker Euribor Packs Vs 2-year Shatz Price Size Offer 0.04 100 A Bank Lifts your 0.04 offer for 100 lots Bid 0.02 100 B Bank Gives your 0.02 Bid for 100 lots Actual Hedges Actual Hedges -100 long Buy m7-m8 100 short Sell m7-m8 -100 versus 500 shatz Buy Shatz- Bobl 100 versus 500 shatz Sell Shatz-Bobl -100 sell some outright z7 100 Buy some outright z7 -100 100 synthetic we hedge by buying 500 2 yr Shatz futures AKA 'TED' sprd synthetic we hedge by selling 500 2 yr shatz futures AKA 'TED' sprd -50 Risks when you want this trade 50 Risks When you want this trade -50 Roll In a Bull Market 50 Roll In a Bear Market -50 Curve Risk 50 Curve Risk -50 Legging Risk 50 Legging Risk 50 Credit Spread -50 Credit Spread 50 Stub Risk -50 Stub Risk 50 Maturity Mismatch Market Bullish -50 Maturity Mismatch Market Bearish 50 CTD Change -50 CTD Change Curve Exposure Curve Exposure Whites Red-Steepening Whites-Reds Flattening Shatz-Bobl Steepening Shatz-Bobl Steepening Downward moving Market Upward Moving Market Reds Blues flattening Reds-Blues Steepening