Presentation review 2015

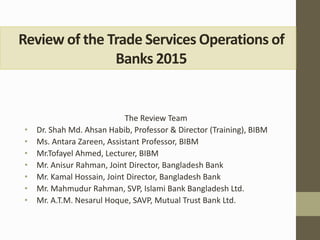

- 1. Review of the Trade Services Operations of Banks 2015 The Review Team • Dr. Shah Md. Ahsan Habib, Professor & Director (Training), BIBM • Ms. Antara Zareen, Assistant Professor, BIBM • Mr.Tofayel Ahmed, Lecturer, BIBM • Mr. Anisur Rahman, Joint Director, Bangladesh Bank • Mr. Kamal Hossain, Joint Director, Bangladesh Bank • Mr. Mahmudur Rahman, SVP, Islami Bank Bangladesh Ltd. • Mr. A.T.M. Nesarul Hoque, SAVP, Mutual Trust Bank Ltd.

- 2. Background

- 3. Objectives • one, to discuss overall activities of trade services operations of banks for the year 2015; • two, to discuss regulatory and operational aspects of trade services of banks in Bangladesh; and • three, to examine the trends and challenges of trade services operations of banks for the period CY2011-CY 2015.

- 4. Methodology

- 5. Table 1: Sampling Distribution (Branches/Head Offices of Banks) Offshore Banking Units Bank Group Bank Bank Branches Dhaka Outside Dhaka SCBs 3 6 8 PCB 25 28 17 8 FCB 4 4 1 4 Total 32 37 33 12

- 6. Organization of the Review Report

- 7. 2. Market Trends, Products and Regulatory Setup for Trade Services by Banks: Global Context 2.1 Trends in Trade and Trade Services in the Global Market 2.2 Regulatory Framework of Global Trade Service Market and Documents 2.3 Trade Services/Finance Products in Global Context 2.4 Challenges in Global Trade Service Market

- 8. 3. Regulatory Environment,Products,and Operational Procedures of Trade Services in Bangladesh 3.1 Regulatory Environment of Trade Services in Bangladesh 3.2 International Trade Payment and Financing Process in Use in Bangladesh 3.3 Trade Finance Services by Banks 3.4 Other Trade Related Services by Banks 3.5 Operational Efficiency Issues of Trade Services 3.6 Malpractices in Trade Services 3.7 Monitoring and Reporting of Trade Services

- 9. SCB 7% PCB 81% FCB 12% Export 2015 SCB 15% PCB 73% FCB 12% Import 2015 4. Trends and Relevant Issues in Trade Services during CY2011-CY2015 in Bangladesh

- 10. 4. Trends and Relevant Issues in Trade Services during CY2011-CY2015 in Bangladesh 4.1 Methods of Payments used in Import Payment Figure-23:Use of Methods in Import Payment[No. of Cases] in Percentage During CY2011-2015 1 5 3 4 8 0 1 2 3 4 5 6 7 8 9 2011 2012 2013 2014 2015 Cash in Advance 1 1 1 1 0.5 0 0.2 0.4 0.6 0.8 1 1.2 2011 2012 2013 2014 2015 Open Account 1 10 13 11 4 0 2 4 6 8 10 12 14 2011 2012 2013 2014 2015 Documentary Collection 97 84 83 84 87.5 75 80 85 90 95 100 2011 2012 2013 2014 2015 Documentary Credit

- 11. 4. Trends and Relevant Issues in Trade Services during CY2011-CY2015 in Bangladesh 4.1 Methods of Payments used in Export Receipt Figure-27: Use of Methods in Export Receipts (No. of Cases) in percentage during CY2011-2015 2 3 3 3 6.8 0 1 2 3 4 5 6 7 8 2011 2012 2013 2014 2015 Cash in Advance 2 2 0.5 1 1.2 0 0.5 1 1.5 2 2.5 2011 2012 2013 2014 2015 Open Account 30 35 44.5 40 39.6 0 5 10 15 20 25 30 35 40 45 50 2011 2012 2013 2014 2015 Documentary Collection 66 60 52 56 52.4 0 10 20 30 40 50 60 70 2011 2012 2013 2014 2015 Documentary Credit

- 12. 4. Trends and Relevant Issues in Trade Services during CY2011-CY2014 in Bangladesh 4.2 Use of Documentary Credit: Different Types 34.5 4 42 18 0.05 1.45 0 5 10 15 20 25 30 35 40 45 Irrevocable LC (Cash LC) Confirmed LC Back to Back LC [Local] Back to Back LC [Foreign including EPZs] Transferable LC Others Different Types of Import LC Issued[ No. of Cases] in Percentage During CY2015 33 2 37 28 0 5 10 15 20 25 30 35 40 Irrevocable LC Confirmed LC Back to Back LC from Local Banks Transferable LC from Foreign Banks Different Types of Export LC Received[ No. of Cases] in Percentage During CY2015

- 13. 4. Trends and Relevant Issues in Trade Services during CY2011-CY2014 in Bangladesh 4.2 Use of Documentary Credit: Different Types 4.3 Documents Required in Documentary Credit 4.4 Margin, Issuance of LC, Amendments, Credit Availability and Examination 4.5 Trade Finance in Banks in Bangladesh

- 14. 4. Trends and Relevant Issues in Trade Services during CY2011-CY2014 in Bangladesh 4.5 Trade Finance in Banks in Bangladesh 10 1 9 -6.72 -8 -6 -4 -2 0 2 4 6 8 10 12 2012 2013 2014 2015 Overall Growth in Trade Finance 2012-2015 13 -4 6 -16 -20 -15 -10 -5 0 5 10 15 2012 2013 2014 2015 Growth in Trade Finance 2012-2015:SCBs 7 4 12 3 0 2 4 6 8 10 12 14 2012 2013 2014 2015 Growth in Trade Finance 2012-2015:PCBs 15 34 4 -51 -60 -50 -40 -30 -20 -10 0 10 20 30 40 2012 2013 2014 2015 Growth in Trade Finance 2012-2015:FCBs

- 15. 4.5 Trade Finance in Banks in Bangladesh SCB 33% FCB 3% PCB 64% Trade Finance for 2015

- 16. 4. Trends and Relevant Issues in Trade Services during CY2011-CY2015 in Bangladesh 4.7 Remittance Services by Banks 4.6 International Bank Guarantee in Bangladesh 4.8 Maintenance of Foreign Currency Accounts 4.9 Activities of Correspondent Banks/Offices in the Country and Outside Bangladesh 4.10 Cost, Risk and Exchange Rate Issues of Trade Services in Bangladesh

- 17. 4. Trends and Relevant Issues in Trade Services during CY2011-CY2015 in Bangladesh 4.12 Regulatory Compliance- A Critical Challenge 4.11 Non-Performing Loans in Trade Financing 4.13 Malpractices in Trade Financing in Bangladesh 4.14 Sanctions and trade services in Bangladesh 4.15 Correspondent Banking- A New Challenge

- 18. 4. Trends and Relevant Issues in Trade Services during CY2011-CY2015 in Bangladesh 4.17 Information about Customers 4.16 Product Information Gap and Improved Capacity 4.18 Trade Finance Gap in Bangladesh 4.19 Trade based Money laundering 4.20 Monitoring and Reporting Trade Services

- 19. 5. Summary Observationsand Recommendations In connection with trade financing, one notable observation in CY2015 is that the volume of total trade financing by banks decreased as compared to the previous year. This is in line with the overall credit demand condition of the country. All broad bank groups experienced negative growth in trade financing especially, FCBs came across remarkable decline. PCBs were also the most dominant share holder as a bank group in trade financing, remittance services, and maintenance of foreign currency accounts. However, only in export financing, it was the SCBs that contributed most in CY2015. As a whole the market share of PCBs increased in CY 2015. Offshore banking market that mainly offer trade services in the country however remained dominated by the FCBs.

- 20. 5. Summary Observationsand Recommendations Documentary credit remained the most prominent payment technique in import and export transactions in Bangladesh in CY2015, not different from the previous years. Though the extensive use of documentary credit started in response mainly to the regulatory compulsion, LC remained the most dominant even after removing restrictions on some areas of transactions. This is sharp contrast to the global practice in general where most payment transactions take place through open account. Increase in Cash in Advance in import transactions is a notable development in CY 2015 which may be attributed to the change in the regulatory requirement of the BB in CY 2014 because of which in many cases importers are paying cash in advance for relatively small imports. Documentary collection remained the second most important trade facilitation tool in the country. In EPZs however, the situation is different where documentary collection is the most commonly used method followed by open account that are facilitated by the offshore units of banks.

- 21. 5. Summary Observationsand Recommendations Like in CY 2014, of the pre-shipment finance, PC was not the main component rather SOD or Export Cash Credit accounted for about half of the total pre-shipment credit in CY 2015. It has been observed that banks were more interested to offer SOD or Export Cash Credit in place of PC to charge relatively higher interest returns. It is against the spirit of the BB’s policy of supporting exporters with lower interest rate and government’s stand to support exporter with soft loan facilities. It has also been observed that a considerable proportion of eligible exporters do not avail the low-cost EDF facilities. It could be because of the lack of awareness of the customers, inadequate information to the bankers, and lack of co-ordination between the bankers and customers. There should be more transparency between banks and the policy makers regarding these issues to identify the right kind of solutions.

- 22. 5. Summary Observationsand Recommendations Global data clearly indicate trade financing gap in the context of developing countries including Bangladesh, especially, a considerable number of small traders do not get access to trade financing in the country. Though corporate guarantees are replacing collateral requirements for big players, collateral requirement remained the key obstacle for the relatively small traders. Even a reputed trader exporting a new product does face difficulty in obtaining trade financing or related support services. In some instances, even clients were required to offer full margin and collateral. Of course, there are arguments of minimizing risk on the part of banks, however, overcautious and conservative approach could prove to be a big challenge for the traders. To ensure the access to trade finance, customized mechanism needs to develop for small traders.

- 23. 5. Summary Observationsand Recommendations It has been observed that global banks have started to revisit its correspondent banking relationships. The ultimate impact came in the form of cutting down correspondent relationships with banks with low capital base. There are also instances when a global bank has withdrawn its correspondent relationship from entire country. There are now more regional banks in Bangladesh market that are actively engaged in trade finance business of the country. In addition to that, recently, a few third parties are also playing very important roles of intermediaries between banks and earning fees and commissions. Some local banks are already facing the difficulties. Banks and the regulators together need to work on the issue to minimize this problem

- 24. 5. Summary Observationsand Recommendations In several instances banks had to create forced LIM and LTR due to the non-compliance of the importers. Non-compliance on the part of exporters resulted in NPL in some cases. There are also instances of fund diversion, cancellation of the contacts, and non-professional behavior on the part of banks that results NPL. Generally, the available data on trade financing indicates very insignificant volume of NPL. Sometimes these data could mislead, as the classified data are commonly shown as part of term loans. The NPL data on trade financing should be disclosed separately for better transparency.

- 25. 5. Summary Observationsand Recommendations Incidences of trade based money-laundering is a growing concern for policy makers and central banks throughout the globe. Though the available sets of AML rules are in line with globally accepted standards, still there is lot of scopes to improve their enforcements. ADs need to be more serious regarding legal compliance and identifying right prices for the exportable and importable products, as observed from the discussion with Bangladesh Bank. Compliance is already is the greatest concerns for the banks, and banks should be ready for the cost implications of such developments. Compliance of AML rules should be a collective concern. Collective efforts from FEPD and BFIU of BB and custom authority are the prerequisite for greater enforcement of AML rules.

- 26. 5. Summary Observationsand Recommendations Enforcement of online reporting and monitoring system by the Bangladesh Bank have brought positive changes in terms of decline in irregularities by banks and improvement in data accuracy. Especially, reporting practices by banks improved remarkable in terms of accuracy. BB is working to improve reporting efficiency by offering training; however, this should be considered as a continuous process to ensure greater efficiency and minimizing information gap. Improvements were observed in regard to the monitoring and coordination among stakeholders. AD Forum is a good initiative by the Bangladesh Bank for ensuring greater coordination among Bangladesh Bank and authorized dealers. Introduction of Dashboard, integrated online arrangement and greater coordination among customs and BB helped identifying several cases of irregularities and frauds in recent time. Since the obligation of ensuring the prices of importable items are 'competitive' and the price of exportable item are 'fair' lays with banks so, they have to find out an effective mechanism to implement the obligation. A consolidated trade database needs to be established to facilitate the issue.

- 27. • Dr. Shah Md. Ahsan Habib, ahsan@bibm.org.bd • Ms. Antara Zareen, antara@bibm.org.bd • Mr.Tofayel Ahmed, tofayel@bibm.org.bd • Mr. Anisur Rahman, feod.import@bb.org.bd • Mr. Kamal Hossain, kamal.hossain@bb.org.bd • Mr. Mahmudur Rahman, mahmudur@islamibankbd.com. • Mr. A.T.M. Nesarul Hoque, nesarulh@gmail.com