Child Support Guidelines Explained

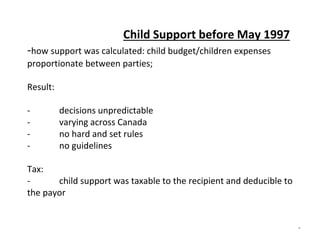

- 1. Child Support before May 1997 -how support was calculated: child budget/children expenses proportionate between parties; Result: - decisions unpredictable - varying across Canada - no hard and set rules - no guidelines Tax: - child support was taxable to the recipient and deducible to the payor *

- 2. Child support after May 1, 1997 • Federal Government introduced Child Support Guidelines and amended the Divorce Act. As a result: 1. child support is not taxable or deductible; 2. any child support order made on or after May 1, 1997, must be in accordance with the FCSG. • However, for those recipients who are receiving child support pursuant to an Order or Agreement dated on or before May 1, 1997, must continue to pay tax on support and payor can deduct support paid until the Order/ Agreement is varied. *

- 3. Purpose of FCSG • S.1(a) of the FCSG - The objectives of the Guidelines are: (a) “to establish a fair standard for children that ensures that they continue to benefit from the financial means of both spouses after separation; (b) to reduce the conflict and tension between the spouses by making the calculation of child support Orders more objective; (c) to improve the efficiency of the legal process by giving courts and spouses guidance in setting the levels of child support orders and encouraging settlement; and, (d) to ensure consistent treatment of spouses and children who are in similar circumstances. *

- 4. Who Can Claim Support? • under the Divorce Act only a spouse or former spouse can claim support • a child has no standing to bring a claim pursuant to the Divorce Act/ can do so under provincial legislation *

- 5. Who is entitled to Support? • under Divorce Act – s. 15 (1) – child must be a “child of the marriage” • Definition – “child of the marriage” – (s.2(1)) child of two spouses (former spouses), even if one parent is not the biological parent (but stands in loco parentis) who at the time is: • (a) under the age of majority (18) and has not withdrawn from parental control; • (b) is age of majority and over, and under parental control , but unable bc of illness, disability, or any other cause to withdraw from parental charge or to obtain the necessities of life *

- 6. • under the Family Law Act – s.31 (2) - for child to be eligible, the child must be: • unmarried; • a minor (under 18 yrs of age) or enrolled in a full time program of education; and, • if 16 yrs or older still has not withdrawn from parental control *

- 7. Obligation to Pay Support • either the child’s parents or individuals who are loco parentis to the child • loco parentis – spouse or former spouse who “stands in the place of a parent” (s.2(2) of the Divorce Act (step- parent) / assumes the role of a parent • under the FLA – s.1(1) – a person who has demonstrated a “settled intention to treat a child as a child of his/her family (not foster parent). *

- 8. • Chartier v. Chartier (1998) SCJ No. 79 (S.C.C.) – test for settled intention – objective test – case by case: • all factors are relevant and must be considered in determining a child’s relationship with parent; • court looks at financial provision / social interaction/ role in discipline and education; • person cannot terminate the parent relationship – right belongs to the child; *

- 9. How the Guidelines Work • the tables and rules for the determination of child support are set out in the Family Law Act and the Divorce Act - child support guidelines; • in Ontario there is the federal child support guidelines (divorce act) and the Ontario child support guidelines (family law act) – claim support under both acts • depends if advance case under the divorce act or family law act/ minor differences under the wording of the two sets of guidelines/ amounts of child support under provincial is the same as federal *

- 10. Amount of Child Support • tables are formulated based on mathematical formula/ based on average spending on children in families at difference levels of income • when looking at the tables, only consider the payors income (tables only show the basic s. 3 support) you must determine the total taxable income for the year for the payor • the total income is by reviewing line 101 of your income tax act and making the necessary deductions and additions as per Schedule III of the Guidelines • usually look at line 150 income as set out in Income tax return, but income for support purposes may be greater than disclosed income on line 150 *

- 11. • Presumptive Rule – s.3(1) of the FCSG – “Unless otherwise provided under the Guidelines, the amount of support order for children under the age of majority is- (a) the amount as set out in the applicable table, according to the number of children under the age of majority to whom the order relates and the income of the spouse against whom the order is sought; and, (b) the amount, if any, determined under s. 7; *

- 12. Income over $150,000 • s. 4 of the FCSG - for incomes over $150,000, the amount of support is determined as follows: • a. Amount as determined under s. 3 of the FCSG (based on Table); OR, • b. If the court believes this amount is inappropriate, the amount of support as determined by the Table for the first $150,000 and wrt the balance of the payor’s income, a discretionary amount having regard to the condition, means, needs and other circumstances of the children who are entitled to support and the financial ability of each spouse to contribute to the support of the children; • c. the amount, if any, as determined under s. 7 of the FCSG. *

- 13. • Presumption in favour of guideline amount • Need “clear and compelling evidence” to depart from guideline amount • Payor must rebut presumption • Large quantum of support by itself not a reason to depart from guideline amount • Consider child care budget • Francis v. Baker (1998) SCJ no. 52 (S.C.C.) – need to balance principles of predictability, consistency and efficiency with fairness, flexibility and recognition of the actual condition, needs, means and other circumstances of the children. *

- 14. Income that Fluctuates • S.16 of FCSG – Subject to s. 17-20 (ie. Pattern of income, pre- tax corporate income, imputing income, non-resident), annual income for support purposes is based on “total income” in T1 General ITR and adjusted in accordance with Schedule III (adjustments to income); • S.17 of the FCSG - if income fluctuates, court can average over the last three years and determine an amount that is fair and reasonable; • Discretionary by court ; • Onus on payor to deviate from s.16 of the FCSG (i.e.. Line 150 etc.); *

- 15. Corporate Income • s.18 of the FCSG– a court may include all or part of the company’s pre-tax corporate earnings (or retained earnings in corp) if the court is of the opinion that income is available to the payor for the purposes of paying support; • court can also add back into income, wages paid to former or current spouse from corp – amount that reflects the work performed by the spouse for the corporation *

- 16. Impute Income • s.19 of FCSG – court may income if the parent is intentionally underemployed or unemployed; • impute income because both parents have an obligation to support the children; • parent must earn what he is capable of earning; • don’t need to prove that the payor is intending to avoid his support obligations; *

- 17. Special or Extraordinary Expenses • In addition to s. 3 support, payors must also pay their share of any special or extraordinary expenses (s.7 expenses); • s. 7 expenses are to be shared by the parties in proportion to their incomes, after deducting from the expense, the contribution from the child, if any, and any “ subsidies, benefits, or income tax deductions or credits in relation to the expense”; • payor pays the net proportionate share of the expense *

- 18. • s. 7 FCSG - Special or Extraordinary expenses: - child care expenses (must be incurred as a result of the parent’s employment, illness, disability or education or training for employment); - portion of medical and dental insurance premiums attributed to the child; - health related expenses that exceed insurance reimbursement (ie. Orthodontic treatment, counseling etc.) - extraordinary expenses for primary or secondary school; - expenses for post-secondary education; - extraordinary expenses for extracurricular activities *

- 19. • Two part test to determine if a claimed expense is to be included in the quantum of child support; • The court must determine if the expense is “reasonable and necessary” ; • “necessary” in relation to the best interests of the child; • “reasonable” having regard to the means of the spouses and those of the children and the family pattern of spending before the separation ( only for those expenses outside of the specified expenses); *

- 20. • Two categories of special expenses, the expense (not the activity) must be “extraordinary”: - primary and secondary school (or educational program) - expenses in relation to extracurricular activities • s. 7 (1.1) definition of “extraordinary expense”: (a) The expense is extraordinary if it exceeds what the recipient spouse can reasonably cover; (b) Even if the recipient spouse can cover the expense, still may be extraordinary, if it exceeds what the recipient spouse can reasonably cover, the nature and number of educational programs or extracurricular activities, special needs and talents of child, overall cost of the program or activity; *

- 21. • if child support is a large amount, court may not order s.7 expense because not extraordinary • extraordinary extracurricular expenses often a source of contention – but the test is if the expenses is necessary and reasonable; • expense can be anticipated bf the court orders contribution; • expense can also be retroactive if payor does not pay; • court can order a fixed amount paid based on the activity or the court can order a % based on future activities; *

- 22. • Lewi v. Lewi (2006) OJ No. 1847 (CA)- court examined what contribution adult child should make to post- secondary education expenses; • court has a broad discretion to consider the amount to be contributed by the child; • have to consider the means of the child and those of the parent; • no formula to consider the amount to be paid by the child; *

- 23. • extracurricular activities – s. 3 base support includes some allowance for usual or ordinary extracurricular activities; • Although s. 7 does not specify that consent is required bf enrolling a child in an extracurricular activity, the courts have held that custodial parents cannot just enroll the children in all kinds of expensive extracurricular activities and then demand contribution from the payor; • s. 7 (1) (f) is unusual extraordinary or special expenses for extracurricular activities; *

- 24. EXCEPTION TO PRESUMPTION Exceptions to presumption that the quantum of child support is based solely on the table amount (court has discretion to determine the amount of support): - Adult child - payor income over $150,000 - loco parentis - shared/ split custody - Undue hardship *

- 25. ADULT CHILD • s. 3(2) of the FCSG - if the child is over the age of 18, the amount of support is determined as follows: • as per the FCSG as if the child was a minor; • if the amount if inappropriate, an amount that the court says is appropriate having regard to the means, needs and other circumstances of the child and the ability of each spouse to support the child; *

- 26. • expectation that adult children going to school are going to contribute something to their support; • court can consider if s. 3 (2) guideline support is appropriate for a adult child when considering s. 7 expenses for adult child (i.e.. Child goes away to school). No standard set formula. Maybe four months out of the year when the child resides at home or partial during the yr because the recipient must maintain the house. Court can still order full guideline support; • no absolute cut off age for child support *

- 27. • if adult child has sufficient income or assets, even if in school may not be entitled to support depending on his needs and the means of the parents; • guideline support may be inappropriate if adult child has resources; • if adult child rejects parent, some courts have refused to grant adult child support. Not the case for minor kids, must continue to pay support even if they have rejected their parents; *

- 28. s.5 - support by step parent • obligation of biological parent and loco parentis to support child; • court may vary the quantum of support; • primary obligation is biological parent with step parent also contributing; • No set rules as to how to calculate the support obligation from a step parent (may get full guidelines from both/ set off/ difference etc. ); *

- 29. • income of recipient – irrelevant in most cases except for the following: - s. 7 expenses - shared custody - split custody - income over $150K - undue hardship *

- 30. Split Custody • s. 8 of the FCSG – Split Custody • Both spouses have full custody of one or more of the children; • amount of support is the difference paid by each spouse to the other (eg. one spouse’s support obligation is $1000 per month, the other spouse’s obligation is $400 per month, the spouse with the greater income will pay $600 to the other spouse); *

- 31. shared custody – 40% • S. 9 of the FCSG - if one spouse has the right to access or custody of child for 40% or more of time over the year, quantum of support based on amount set out in table, increased cost of shared custody arrangement and condition, means, needs and other circumstances of each spouse and of the children; • no single method of determining 40%– hours/ days - look at hours, discount time at school friends etc. – start from the assumption that the custodial parent has 100%) *

- 32. • Contino v. Leonelli- Contino (2005) S.C.J. No. 65 (S.C.C.) – child support in shared custody situation requires the exercise of discretion and not just a set – off; • may be a starting point and then gross up because of the increased cost with both homes – don’t want to have a large difference in the standard of living between both houses- court has discretion; • just because a payor reaches a 40% threshold does not necessarily mean that support is reduced *

- 33. The amount of support is determined as follows: • Determine if the 40% threshold has been met; • Determine the parties incomes for support purposes - amount set out in Applicable Table for each spouse; • Increased cost arrangements – examine budgets and actual expenditures wrt children; • Condition, means, needs of each spouse and the child of the marriage – broad discretion; • examine actual spending patterns wrt children/ ratio of incomes/ net worth of parties/ standard of living for the children in each household; *

- 34. Hardship • s. 10 of the FCSG – court can order a different amount of guideline support if the amount results in hardship; • Circumstances that may cause a payor to suffer undue hardship in paying support: high family debts, high cost of access, legal obligation to pay support to another person – high threshold to meet the test; • s. 3, 4 (income over $150k), 5 (loco parentis), 8 (split custody), 9 (shared custody) – may apply to vary the amount of support if undue hardship; *

- 35. • firstly, the applying spouse must have a standard of living that is lower than the recipient ; • hardship must be exceptional or excessive / very high threshold; • List in s. 10(2) is not exhaustive (includes the following); • Circumstances relate to payor not recipient at this stage; • If hardship – court then considers the standard of living of each household. Payor must have lower standard of living than recipient. Must consider all income earners in household; • If yes, then determine the amount of support to be paid. Need to look at means and needs of the parties (income and expenses of both households) *

- 36. PRIORITY OF CHILD SUPPORT • child support has priority over spousal support; • The quantum of child support may impact the quantum of spousal support; • As a result, any future change in child support, may result in a change in the quantum of spousal support. *

- 37. ONGOING INCOME INFORMATION • s. 25 - under the FCSG, as long as support is owing, the recipient spouse may obtain, on request (not more than once per year), information wrt income from the payor spouse; • recipient spouse income – (important wrt s. 7 , split or shared custody) also must provide information wrt her income upon request *

- 38. • Any existing Order and new Orders made after March 2010 (not apply to existing Agreements)- the payor must automatically provide his/her income information (unless the parties agree otherwise) within 30 days of the anniversary of the Order (s.24.1 and s.25.1 of the FCSG); • Recipient must also automatically provide her information (s. 7, split, shared custody) if her income was necessary to determine support; • Must provide Income Tax Return and Notice of Assessment and any other document to substantiate your income as set out in s. 21 of the FCSG; *