Embed presentation

Download to read offline

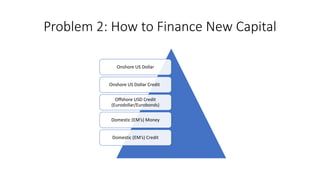

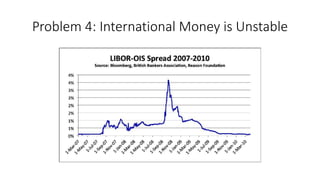

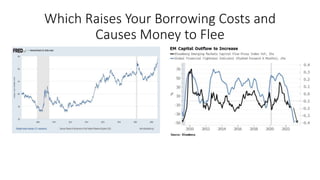

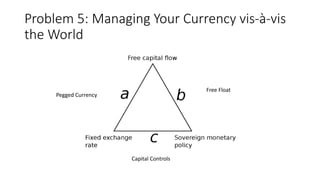

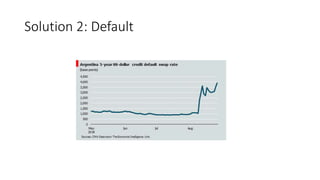

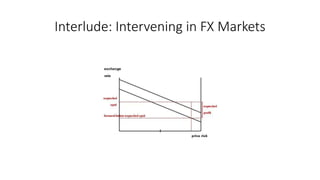

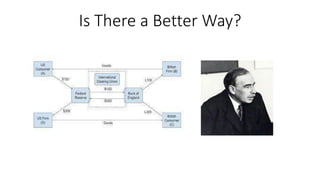

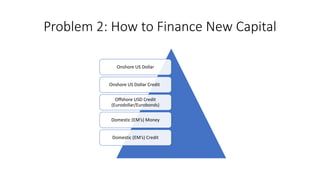

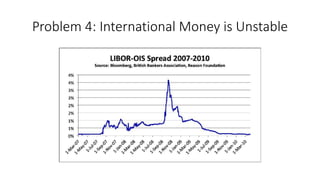

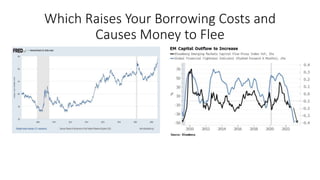

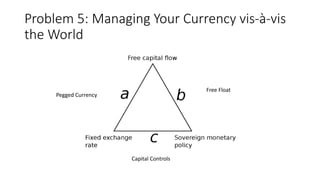

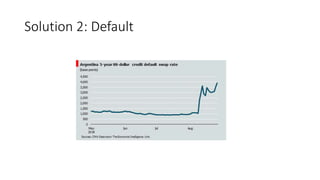

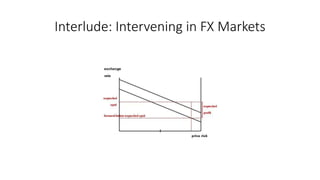

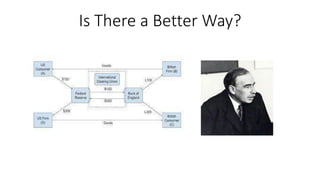

This document discusses problems faced by emerging markets (EMs) versus developed markets (DMs) in the international political economy and potential policy solutions. It outlines five main problems EMs face: 1) development challenges, 2) financing new capital, 3) foreign direct investment versus foreign portfolio investment, 4) instability of international money, and 5) managing currency valuation. It then evaluates four potential solutions: 1) austerity, 2) default, 3) capital controls, and 4) running a permanent trade surplus. It questions whether there is a better system than the current hierarchical global financial order and concludes by reiterating the initial question around the differences between EMs and DMs in terms of credit risk versus interest rate risk.