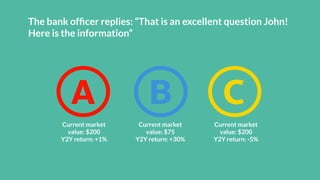

John is opening a new bank account and is offered a choice of three stocks (A, B, or C) as a welcome gift. Stock A and C have the highest current market values of $200, but John wants to consider future returns. The bank provides the yearly return rates, showing Stock B has increased 30% per year on average. While Stocks A and C have higher current values, Stock B's high growth rate makes it the best choice for maximizing future returns over time. This choice parallels the technique of movement pruning in neural networks, which selects weights based on how much they change rather than just their current values.