SC Economic Update

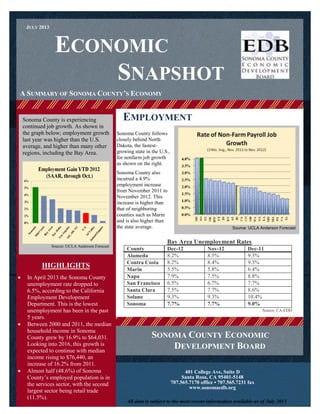

- 1. ECONOMIC SNAPSHOT EMPLOYMENT Bay Area Unemployment Rates County Dec-12 Nov-12 Dec-11 Alameda 8.2% 8.5% 9.3% Contra Costa 8.2% 8.4% 9.3% Marin 5.5% 5.8% 6.4% Napa 7.9% 7.5% 8.8% San Francisco 6.5% 6.7% 7.7% Santa Clara 7.5% 7.7% 8.6% Solano 9.3% 9.3% 10.4% Sonoma 7.7% 7.7% 9.0% Source: CA-EDD A SUMMARY OF SONOMA COUNTY’S ECONOMY HIGHLIGHTS In April 2013 the Sonoma County unemployment rate dropped to 6.5%, according to the California Employment Development Department. This is the lowest unemployment has been in the past 5 years. Between 2000 and 2011, the median household income in Sonoma County grew by 16.9% to $64,031. Looking into 2016, this growth is expected to continue with median income rising to $76,440, an increase of 16.2% from 2011. Almost half (48.6%) of Sonoma County’s employed population is in the services sector, with the second largest sector being retail trade (11.5%). 401 College Ave, Suite D Santa Rosa, CA 95401-5148 707.565.7170 office • 707.565.7231 fax www.sonomaedb.org SONOMA COUNTY ECONOMIC DEVELOPMENT BOARD JULY 2013 Sonoma County is experiencing continued job growth. As shown in the graph below; employment growth last year was higher than the U.S. average, and higher than many other regions, including the Bay Area. Source: UCLA Anderson Forecast Sonoma County follows closely behind North Dakota, the fastest- growing state in the U.S., for nonfarm job growth as shown on the right. Sonoma County also incurred a 4.9% employment increase from November 2011 to November 2012. This increase is higher than that of neighboring counties such as Marin and is also higher than the state average. Employment Development Department Source: UCLA Anderson Forecast All data is subject to the most recent information available as of July 2013

- 2. RESIDENTIAL REAL ESTATE Single-Family Home Sales: January 1 - March 31, 2013 Change from 2012 – 2013 Average Sale Price Median Sale Price Unit Sales Days on Market Average Sale Price Median Sale Price Unit Sales Sonoma County $459,315 $380,000 961 95 16% 20% 16% Santa Rosa $411,272 $356,500 392 83 21% 21% -20% Petaluma $480,227 $422,408 132 79 23% 24% -22% Sonoma $581,305 $425,000 75 101 -5% -3% -15% Cotati, Rohnert Park $370,322 $357,000 67 61 23% 20% -22% Windsor $367,573 $360,000 63 94 11% 12% -21% Sebastopol $614,196 $514,000 48 102 39% 30% 14% Cloverdale $360,864 $315,000 45 91 53% 37% 10% Healdsburg $767,220 $500,000 37 122 6% 29% -10% Guerneville $253,276 $249,000 18 117 26% 24% -31% Bodega Bay $514,125 $504,500 8 191 -26% -28% -47% Source: BAREIS MLS (Single-family homes sold January 1 - March 31, 2013 &2012) Commercial Real Estate information provided by Keegan & Coppin-ONCOR International The Sonoma County Economic Development Board (EDB) believes all data contained within this report to be accurate and the most current available, but does not guarantee its accuracy or completeness. Use of data from an outside source does not represent an endorsement of any product or service by the EDB, its members or affiliates. “In Sonoma County, almost all the recession is over with,” - Jerry Nickelsburg, Ph.D., senior economist of UCLA’s Anderson School of Management COMMERICAL REAL ESTATE Retail vacancy rates in Sonoma County have continued to decline since their peak in 2009 of 9.2%. In the second quarter of 2012, retail vacancy rates for Sonoma County were 5.6%. Office vacancy rates are currently fluctuating around 23%. Industrial vacancy rates have fallen to 12.3% since their peak of 15.6% in first quarter 2010 JULY 2013 Sonoma County Economic Snapshot All data is subject to the most recent information available as of July 2013

- 3. TOURISM The long-term outlook for Sonoma County’s tourism industry remains positive. The region is growing in recognition as a premier tourist destination, and its proximity to Bay Area attractions and airports will continue to support growth. Compared to the national average, Sonoma County residents spend considerably more per capita on travel, housing, and entertainment. They spend 13% less on apparel and services. The largest consumer expenditures were on housing, transportation, and food.000 Leisure and hospitality will be among Sonoma County’s largest drivers, but some risks to labor market improvements exist, which will weigh on local demand for hospitality services. An uptick in visitors and stronger pricing power has allowed hotels and other hospitality industries to increase payrolls. However, another year of reduced spending by local governments, on K-12 education in particular, has resulted in layoffs and other cuts. Tech manufacturers have also slowed hiring. As a result, workers in these industries will be less likely to increase their spending on restaurants. Source: California Board of Equalization (www.boe.ca.gov) HIGHLIGHTS & DEVELOPMENT $53.8million expansion project of Charles M. Schulz-Sonoma County Airport expected to begin in August 2013. This expansion will allow more flights to come into Sonoma County’s airport, expectedly increasing tourism. Travel and Leisure Magazine named Healdsburg Plaza one of the “Most Beautiful Town Squares in the US.” Hotel Occupancy was up 11.4% in 201 In 2012 visitor-generated taxes made up $168 per household, while tourism- related employment accounted for almost 17,000 jobs in Sonoma County (almost 1 in 10 jobs According to a 2011 study by the American Booksellers Association, Sonoma County is ranked 14th in the United States based on the health of its independent retail sector, this study was conducted out of 363 metropolitan areas. Sonoma County Tourism Visit California “Sonoma County has long been an attractive destination for visitors… We certainly are anticipating that the county will continue the upward trend in TOT revenues that we have enjoyed over the past few years.” - Tim McGregor, board chairman of Sonoma County Tourism. FOR MORE INFORMATION ABOUT SONOMA COUNTY TOURISM & UPCOMING EVENTS PLEASE VISIT WWW.SONOMACOUNTY.COM JULY 2013 Sonoma County Economic Snapshot All data is subject to the most recent information available as of July 2013 The Economic Development Board’s Purchasing Trends Index shows this to be the second year that Sonoma County has scored higher than the United States Index, since 2007. This quarter’s index score of 70 indicates that businesses feel less economically challenged operating in Sonoma County than in the US as a whole.

- 4. Sonoma County Economic Snapshot JULY 2013 “We really are a county of small businesses, almost micro businesses…” - Ben Stone, executive director Sonoma County Economic Development Board This graph depicts a Business Confidence index, by the Economic Development Board, with information from Sonoma County’s local business leaders. 401 College Ave, Suite D Santa Rosa, CA 95401-5148 707.565.7170 office • 707.565.7231 fax www.sonomaedb.org All data is subject to the most recent information available as of July 2013 Sonoma County has almost 18,000 businesses, most of which are small in scale. Nine out of 10 companies in Sonoma County employ fewer than 20 workers, according to a 2011 survey by the state Employment Development Department. According to the EDB’s study of the Sonoma County Economy, prepared by Moody’s Analytics; Technology and Tourism are expected to lead the county in growth in 2013. Technology, led by the many medical device manufacturers in Sonoma County, and wine and tourism are strengthening at a rate faster than the national average. A trend that remains consistent into 2016 is the shrinking percentage of households earning less than $35,000. The proportion of the county in this range will decrease by 4.5 percentage points by 2016. This trend, coupled with the increasing proportion of the county earning over $100,000, will result in further concentration of households in higher-income tiers. QUICK FACTS