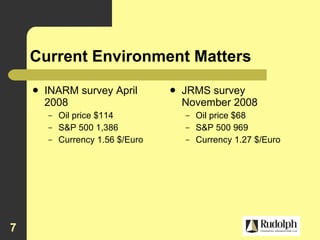

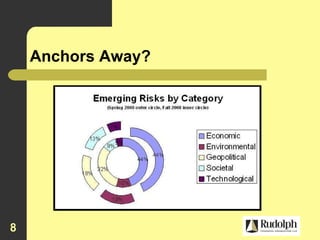

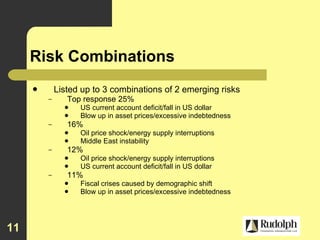

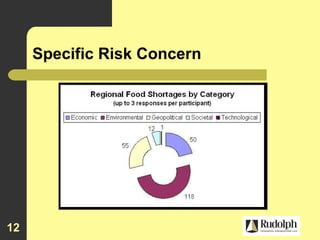

The document discusses emerging risks as identified by the World Economic Forum, highlighting the top five risks such as regional food shortages and economic instability. It notes trends in risk combination perceptions and surveys conducted in late 2008 regarding economic indicators like oil prices and the S&P 500. Additionally, it outlines specific concerns regarding climate change, freshwater loss, and the impacts of geopolitical instability.