Gst Some Important Topic.

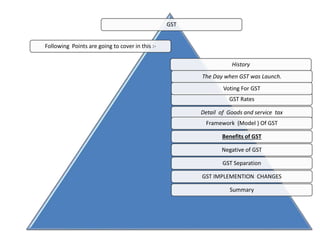

- 1. GST Following Points are going to cover in this :- History The Day when GST was Launch. Detail of Goods and service tax Benefits of GST Negative of GST GST Rates Voting For GST Framework (Model ) Of GST GST Separation GST IMPLEMENTION CHANGES Summary

- 3. GST is not a new phenomenon. It was first implemented in france in 1954, and since then many countries have implemented this unified taxation system to become part of a global whole. Now that India is adopting this new tax regime, let us look back at the how and when of the goods and services tax and its history in the nation. France was the world’s first country to implement GST law in the year 1954. Since then, 159 other countries have adopted the GST law in some form or other. In many countries, VAT is the substitute for GST, but unlike the Indian VAT system, these countries have a single VAT tax which fulfills the same purpose as GST. In India, the discussion on GST law was flagged off in the year 2000, when the then prime minister atal bihari Vajpayee brought the issue to the table. The GST bill, known as the Goods and Services Tax, was introduced in Lok Sabha in December of 2014 and will be implemented from July 1st, 2017.

- 4. The Day When The GST Was Launched

- 5. The Goods and Services Tax (GST), was launched on the midnight of 30 June 2017 by the Prime Minister of India Narendra Modi. The launch was marked by a historic midnight (June 30-July 1, 2017) session of both the houses of parliament convened at the Central Hall of the Parliament. Though the session was attended by high-profile guests from the business and the entertainment industry including Ratan Tata.

- 7. 1/3rd voting power 2/3rd voting power MIN QUORUM-50% MEMBERS GST Council Chairman Union Min. of State for Finance/Revenue Min. of Finance or any other Min. nominated by each State Govt. Each decision must have approval of 3/4th members of the council.

- 8. GST Rates

- 9. When Goods and Services Tax is implemented, there will be 3 kinds of applicable Goods and ServiceTaxes:CGST,SGST&IGST. CGST:wheretherevenuewillbecollectedbythecentralgovernment SGST:wheretherevenuewillbecollectedbythestategovernmentsforintra-statesales IGST:wheretherevenuewillbecollectedbythecentralgovernmentforinter-statesales ,thetaxstructureunderthenewregimewillbeasfollows: Salewithinthestate CGST+SGST VAT+CentralExcise/Servicetax RevenuewillnowbesharedbetweentheCentreandtheState SaletoanotherState IGST CentralSalesTax+Excise/ServiceTax Therewillonlybeonetypeoftax(central)nowincaseofinter-statesales.

- 10. Detail Of Goods And Service Tax

- 11. The Goods and Services Tax or GST is scheduled that has been launched on the 1st of July, and it is set to revolutionize the way we do our taxes. are clubbed into one, whether they are levied on services(service tax) or goods(excise and vat). Touted by the government to be India's biggest tax reform in 70 years of independence, the Goods and Services Tax (GST) was finally launched on the midnight of 30 June 2017. The launch was marked by a historic midnight (30 June - 1 July 2017) session of both the houses of parliament convened at the Central Hall of the Parliament, The rate of GST in India is between double to four times that levied in other countries like Singapore.

- 12. Framework(Model) of GST India will have Concurrent Dual GST comprising of Central GST and State GST levied on the same base. GST rate= CGST rate + SGST rate Total tax collected in GST will be distributed to centre and state as per CGST , SGST rate Central GST(or CGST) would be administered by Central Govt. State GST(or SGST) would be administered by State Govt. Integrated GST(or IGST) administered by central Govt. on inter state transfer of goods and services. In this model, all the goods and services would be subject to concurrent taxation by the state and the centre. For example, if a product have levy at base price of Rs. 10000 and rate of GST are 8% , CGST is 3% and SGST is 5% ,then tax collected during transaction is 800 , 300 goes to central govt as CGST tax, 500 goes to the state govt. as SGST tax. Central GST (CGST) • No Service Tax • No Excise • No Cess, Surcharges , etc. State GST (SGST) • No VAT • No Cess, Surcharges , entry taxes, etc.

- 13. Benefits & Negative of GST •Improved Logistics/Seamless movement of goods across the country as entry check points(for entry tax)won’t be there. It will end the warehousing obsession of large companies. •It will convert India into a uniform market. •Better compliance and tax buoyancy. •A lower GST rate and removal of Cascading effect will bring down the prices. •GST will be levied only at destination point and not at various points(from manufacturing to retail outputs). •Expected to build a transparent and corruption-free tax administration. •Both CGST and SGST will be charged at same floor(manufacturing cost). This will benefit the consumers as the cost will go down. •No distinction b/w imported goods and Indigenous goods. Same rate(CGST/SGST) on both. •Exports would however will be zero rated i.e. exporters of goods/services need not pay the GST. GST paid by them on the procurement of goods/services will be refunded to them.

- 14. GST Sepration GST Central GST State GST 1. Central excise duty 2. Additional excise duty 3. Service tax 4. Countervailing duty(CVD) 5. Additional duty of customs(ADC) 6. Surcharge, Education and Secondary/Higher secondary 1. VAT 2. Purchase tax 3. Entertainment tax 4. Luxury tax 5. Lottery tax 6. State surcharge and cesses leviable

- 15. GST IMPLEMENTATION CHALLENGES Robust IT (Information technology) Network: • Success of GST depends on robust IT network connecting central govt., every state govt. , all Banks, public/private companies, manufacturers, dealers etc. • Centre has already Incorporated an SPV- GSTN. But real challenge is in some of the states which lack IT infrastructure. • A very large database needed for registrations, tax return filing, IGST, CGST, SGST settlements all over the country. Extensive Training to tax administration staff for better GST implementation. Dispute Settlement Authority: Decision making problems in GST council due to the democratic structure of the council. So, an independent authority must be set up to settle disputes between Centre and States.

- 16. Summary The idea behind having one consolidated indirect tax to subsume multiple currently existing indirect taxes is to benefit the Indian economy in a number of ways: •It will help the country’s businesses gain a level playing field •It will put us on par with foreign nations who have a more structured tax system •It will also translate into gains for the end consumer who not have to pay cascading taxes any more •There will now be a single tax on goods and services In addition to the above, •The Goods and Services Tax Law aims at streamlining the indirect taxation regime. As mentioned above, GST will subsume all indirect taxes levied on goods and service, including State and Central level taxes. The GST mechanism is an advancement on the VAT system, the idea being that a unified GST Law will create a seamless nationwide market. •It is also expected that Goods and Services Tax will improve the collection of taxes as well as boost the development of Indian economy by removing the indirect tax barriers between states and integrating the country through a uniform tax rate.