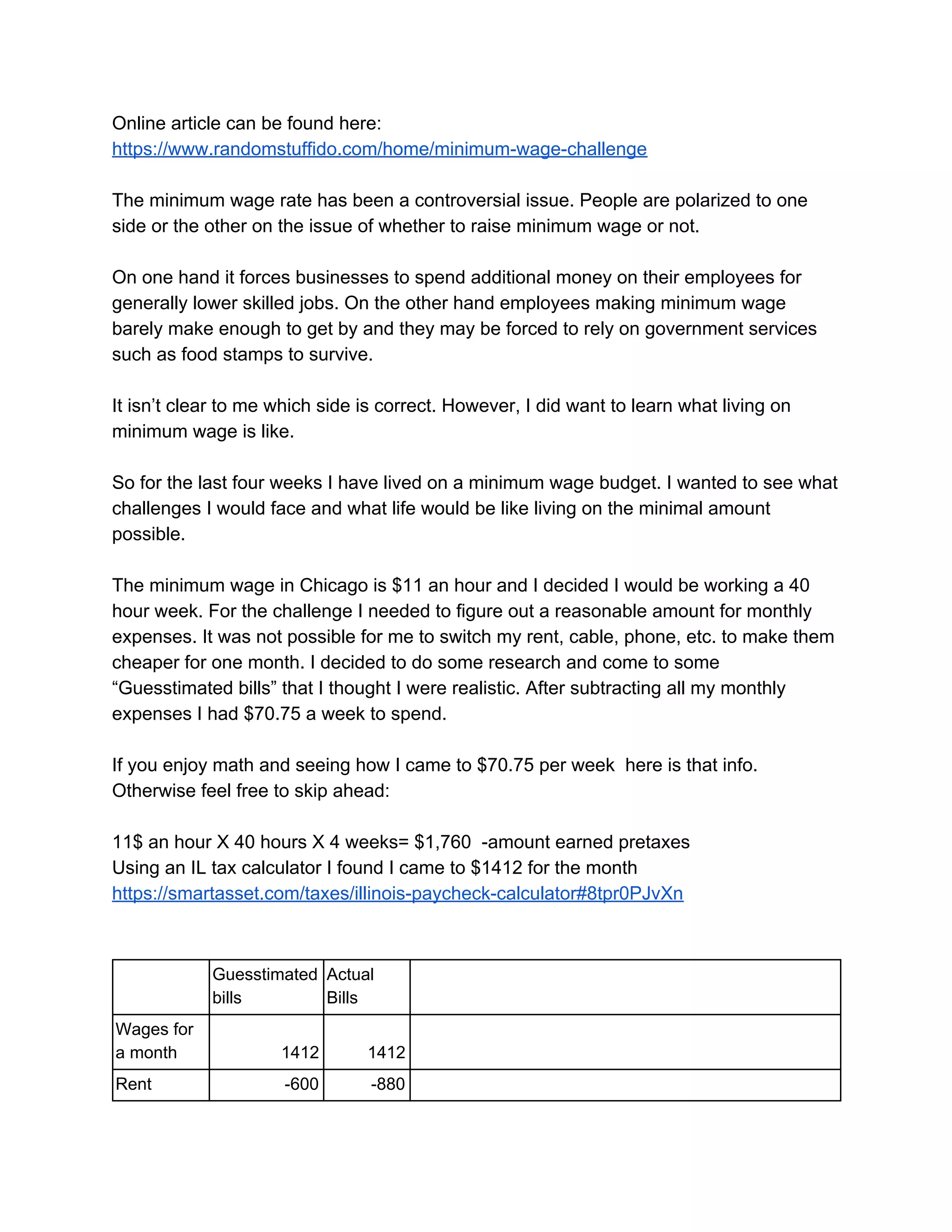

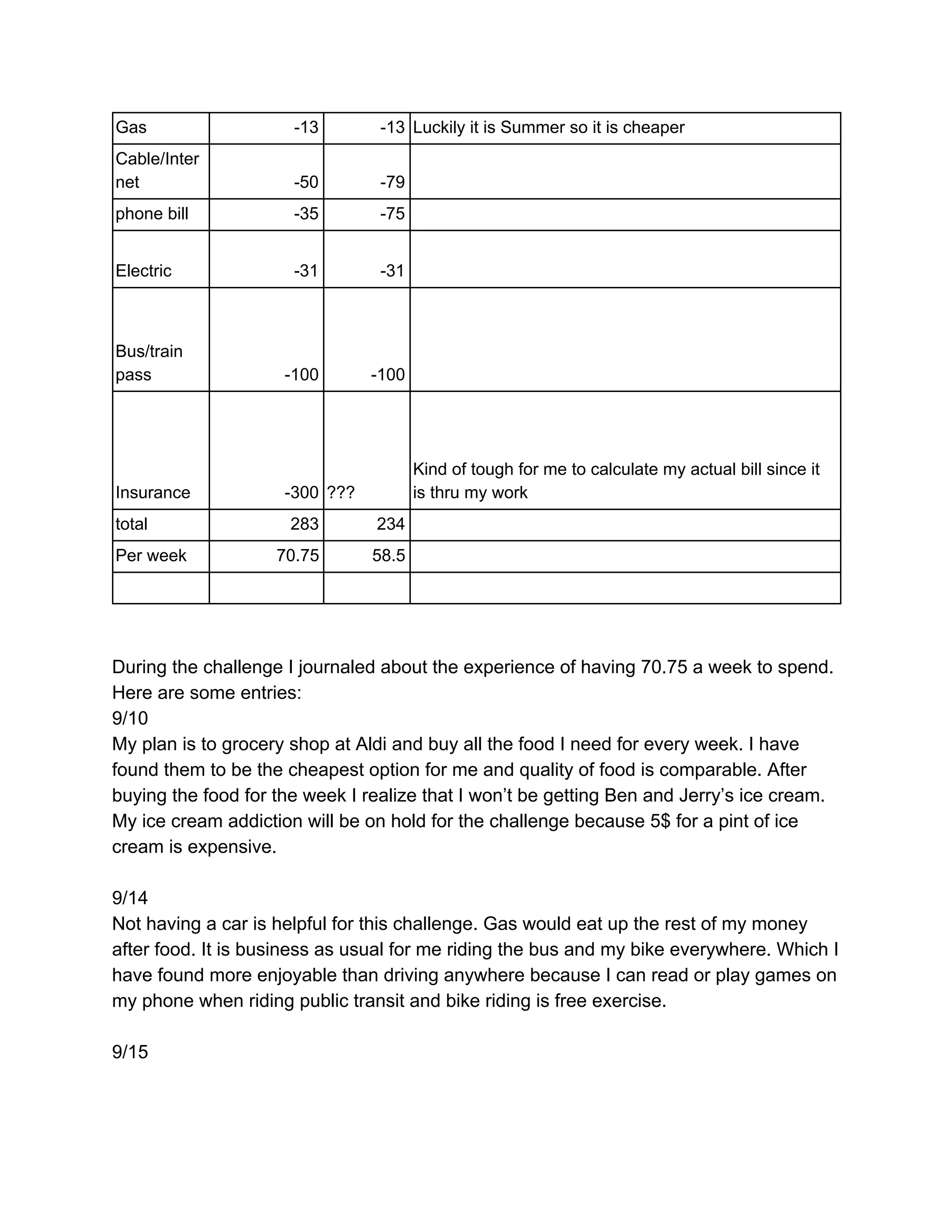

The article describes a personal challenge of living on minimum wage for four weeks in Chicago, where the author earned $1,412 while managing expenses like rent, groceries, and medical bills. Throughout the experience, the author faced difficulties in budgeting for food and medical needs, highlighting the struggles individuals may encounter while living on such a low income. The overall conclusion emphasizes the challenges of survival on minimum wage and encourages readers to understand this situation through their own experiences.