FAQ Overtime Pay.docx

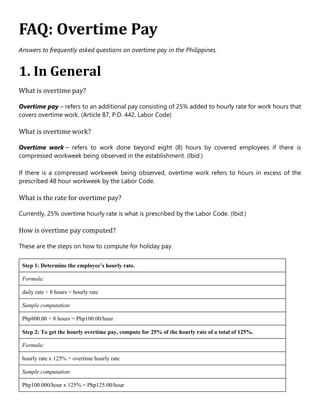

- 1. FAQ: Overtime Pay Answers to frequently asked questions on overtime pay in the Philippines. 1. In General What is overtime pay? Overtime pay – refers to an additional pay consisting of 25% added to hourly rate for work hours that covers overtime work. (Article 87, P.D. 442, Labor Code) What is overtime work? Overtime work – refers to work done beyond eight (8) hours by covered employees if there is compressed workweek being observed in the establishment. (Ibid.) If there is a compressed workweek being observed, overtime work refers to hours in excess of the prescribed 48 hour workweek by the Labor Code. What is the rate for overtime pay? Currently, 25% overtime hourly rate is what is prescribed by the Labor Code. (Ibid.) How is overtime pay computed? These are the steps on how to compute for holiday pay. Step 1: Determine the employee’s hourly rate. Formula: daily rate ÷ 8 hours = hourly rate Sample computation: Php800.00 ÷ 8 hours = Php100.00/hour Step 2: To get the hourly overtime pay, compute for 25% of the hourly rate of a total of 125%. Formula: hourly rate x 125% = overtime hourly rate Sample computation: Php100.000/hour x 125% = Php125.00/hour

- 2. Step 3: Multiply the overtime hourly rate against the hours worked (e.g. 2 hours). Formula: overtime hourly rate x 2 hours of work = pay with overtime pay Sample computation: Php125.00/hour x 2 hours = Php250.00 Step 4: Add pay with overtime pay for ordinary hours rendered (e.g. 6 hours). Formula: pay with overtime pay + pay for ordinary hours = day’s wage Sample computation: Php250.00 + Php600.00 = Php850.00 Is cost of living allowance or COLE included in computing for overtime pay? No, cost of living allowance (COLA) is not included in computing for overtime pay. 2. Coverage Who are entitled to overtime pay? Covered employees are entitled to overtime pay. Covered employees are those who are not listed as exempt employees. The following are “exempt employees” who are not entitled to overtime pay: 1. Government employees, whether employed by the National Government or any of its political subdivisions, including those employed in government-owned and/or controlled corporations with original charters or created under special laws; 2. Managerial employees, if they meet all of the following conditions: 2.1. Their primary duty is to manage the establishment in which they are employed or of a department or subdivision thereof; 2.1. They customarily and regularly direct the work of two or more employees therein; and, 2.2. They have the authority to hire or fire other employees of lower rank; or their suggestions and recommendations as to hiring, firing, and promotion, or any other change of status of other employees are given particular weight.

- 3. 3. Officers or members of a managerial staff, if they perform the following duties and responsibilities: 3.1. Primarily perform work directly related to management policies of their employer; 3.2. Customarily and regularly exercise discretion and independent judgment 3.3. (a) Regularly and directly assist a proprietor or managerial employee in the management of the establishment or subdivision thereof in which he or she is employed; or (b) execute, under general supervision, work along specialized or technical lines requiring special training, experience, or knowledge; or (c) execute, under general supervision, special assignments and tasks; and, 3.4. Do not devote more than twenty percent (20%) of their hours worked in a workweek to activities which are not directly and closely related to the performance of the work described in paragraphs 5.1, 5.2, and 5.3 above; 4. Kasambahay and persons in the personal service of another; 5. Workers who are paid by results, including those who are paid on piece rate, takay, pakyaw, or task basis, and other non-time work, if their output rates are in accordance with the standards prescribed in the regulations, or where such rates have been fixed by the Secretary of Labor and Employment; and, 6. Field personnel, if they regularly perform their duties away from the principal or branch office or place of business of the employer and whose actual hours of work in the field cannot be determined with reasonable certainty. Employees who are not excluded are referred to as “covered employees.” (DOLE-BWC Handbook on Workers’ Statutory Monetary Benefits) Do rank-and-file employees get overtime pay? If they are covered employees (as defined above), then rank-and-file employees are entitled to overtime pay. Do supervisors get overtime pay? If they are covered employees (as defined above), then supervisors are entitled to overtime pay. Do officers or members of the managerial staff get overtime pay? No, officers or members of the managerial staff do not get overtime pay because they are not covered employees (as defined above). Do managers get overtime pay?

- 4. No, managerial employees do not get overtime pay because they are not covered employees (as defined above). Do drivers get overtime pay? If they are covered employees (as defined above), then drivers are entitled to overtime pay. Conversely, if they are not covered employees and thus are exempt employees, then they are not entitled to overtime pay. For more information, see: Drivers. 3. Whether compulsory or not May an employer compel overtime work? Generally, an employer cannot simply compel overtime work if there is no emergency as enumerated under the Omnibus Rules Implementing the Labor Code. (Last paragraph, Section 10, Rule I, Book III, Omnibus Rules Implementing the Labor Code) Conversely, if there is an emergency as enumerated under the Omnibus Rules, then an employer may compel overtime work. What is an emergency overtime work enumerated under the Omnibus Rules Implementing the Labor Code? An emergency overtime work refers to the grounds listed in the Omnibus Rules granting the employer the right to compel overtime work to address an emergency. Hence, the Omnibus Rules empowers the employer to require employees to work beyond eight (8) hours a day in these situations: 1) When the country is at war or when any other national or local emergency has been declared by Congress or the Chief Executive; 2) When overtime work is necessary to prevent loss of life or property, or in case of imminent danger to public safety due to actual or impending emergency in the locality caused by serious accident, fire, floods, typhoons, earthquake, epidemic or other disaster or calamities; 3) When there is urgent work to be performed on machines, installations, or equipment, in order to avoid serious loss or damage to the employer or some other causes of similar nature; 4) When the work is necessary to prevent loss or damage to perishable goods;

- 5. 5) When the completion or continuation of work started before the 8th hour is necessary to prevent serious obstruction or prejudice to the business or operations of the employer; or 6) When overtime work is necessary to avail of favorable weather or environmental conditions where performance or quality of work is dependent thereon. (Section 10, Rule I, Book III, Ibid.) May employees refuse to do overtime work? It depends if there is an applicable ground for emergency overtime work. If there is a ground for emergency overtime work, then the employees may not refuse overtime work as the employer is allowed to compel such work under the Omnibus Rules; otherwise, they may be subjected to disciplinary action which could result in penalties, including dismissal. If there is no ground for emergency overtime work, then the employees may refuse overtime work as the Omnibus Rules do not allow the employer to require overtime work without any of the enumerated grounds being applicable. May the employer increase the grounds for emergency overtime work? No, the employer may not increase the grounds for emergency overtime work. The reason being is that the Omnibus Rules explicitly prohibit the rendering of overtime work unless there are grounds justifying emergency overtime work. 4. With other benefits Do covered employees get overtime pay during regular holidays? Yes, covered employees get overtime pay during regular holidays. The rendering of overtime work on a regular holiday will result in the giving of both the overtime pay and holiday pay. For purposes of computation, the employees will receive their daily rate with overtime pay, plusany applicable holiday pay. For more information, see: Overtime Pay, Holiday Pay Do covered employees get overtime pay during special non-working days? Yes, covered employees get overtime pay during special non-working days. The rendering of overtime work on a special non-working day will result in the giving of both the overtime pay and premium pay. For purposes of computation, the employees will receive their daily rate with overtime pay, plus premium pay applied thereto. For more information, see: Overtime Pay, Premium Pay

- 6. 5. Additional things to note May undertime be offset by overtime? No, undertime work cannot be offset by overtime. Undertime work – refers to rendering work less than the daily work hours, such as doing work for only 7 hours due to being late for an hour. May overtime pay be substituted with a leave credit, meal, ticket, goods, etc.? No, overtime pay cannot be substituted with a leave credit, meal, ticket, goods, etc. The benefit has to be paid by the employer to the covered employees. Any agreement between the employer and the covered employees on payment substitution will be void for being contrary to law and public policy. What if my employer is not paying overtime pay? If the employer is not paying overtime pay, the employee should first check if they are one of the covered employees. If they are covered employees, then they should raise it the soonest as a grievance to their employer. If the matter remains unresolved, employees may seek assistance from the nearest Department of Labor and Employment Office. If the employees are not covered employees, they are not entitled thereto and thus cannot demand payment thereof. Burden of proof Who has the burden of proof to prove overtime work was done? The burden of proof to show that overtime work was actually done rests on the employee. This is because the benefit of overtime pay is not one of those regularly received by the employee as part his compensation and benefits (e.g. salary, allowance, etc.). Favorable employee stipulations May employment contracts, company policies, collective bargaining agreements, and other employment agreements increase overtime benefits than what is provided by law? Yes, employment contracts, company policies, collective bargaining agreements, and other employment agreements may increase overtime benefits than what is provided by law. For example, the statutory overtime hourly rate at 25% may be increased to 30%.

- 7. On the other hand, such stipulations and policies cannot decrease benefits that have been provided by law. Statutory benefits are the bare minimum. References ⦁ Book III, Presidential Decree No. 442, a.k.a. Labor Code of the Philippines ⦁ Book IIII, Omnibus Rules Implementing the Labor Code ▪ 2022 DOLE-BWC Handbook on Workers’ Statutory Monetary Benefits • Overtime Pay – Labor Law PH • Holiday Pay – Labor Law PH • Premium Pay – Labor Law PH