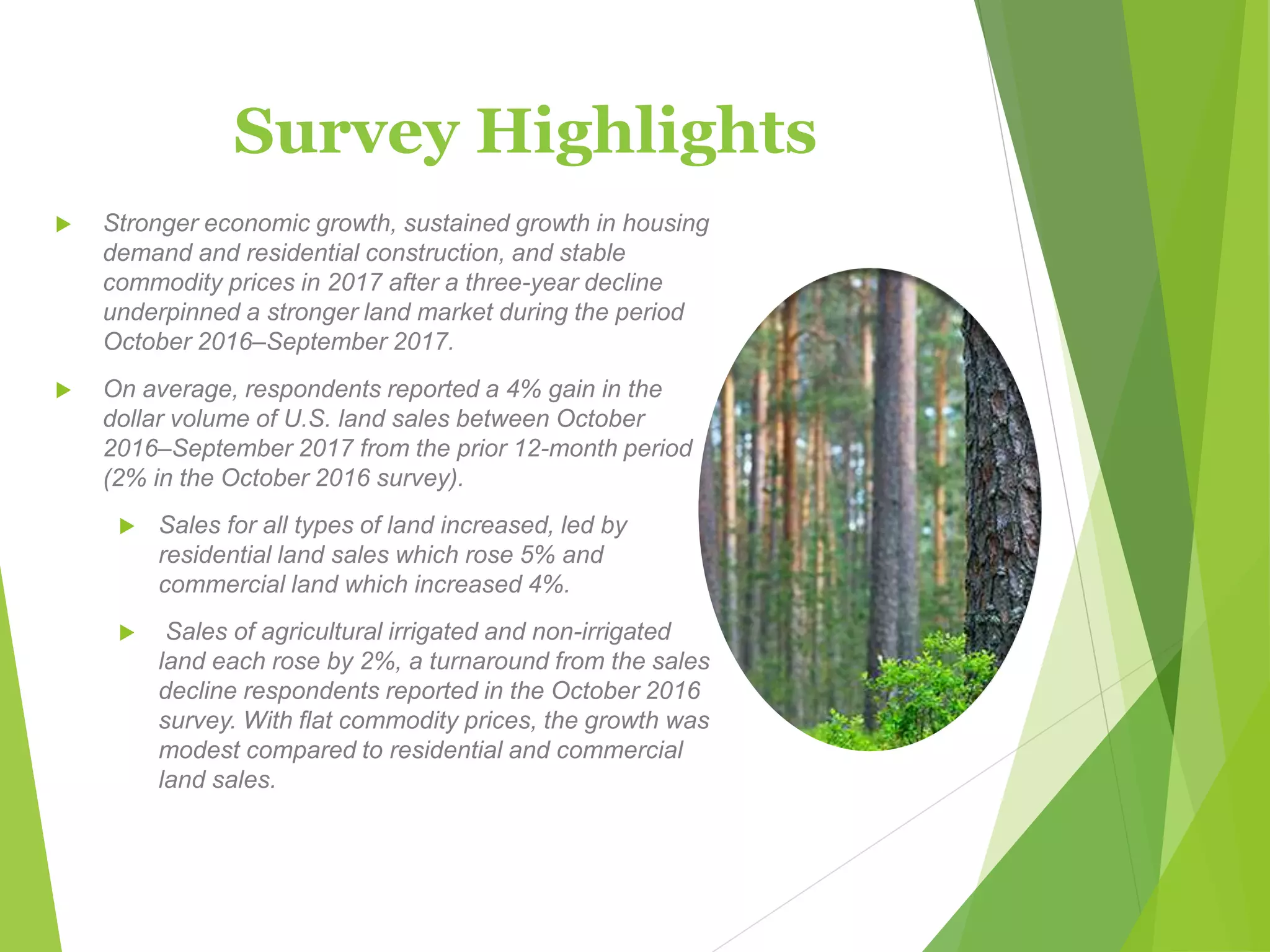

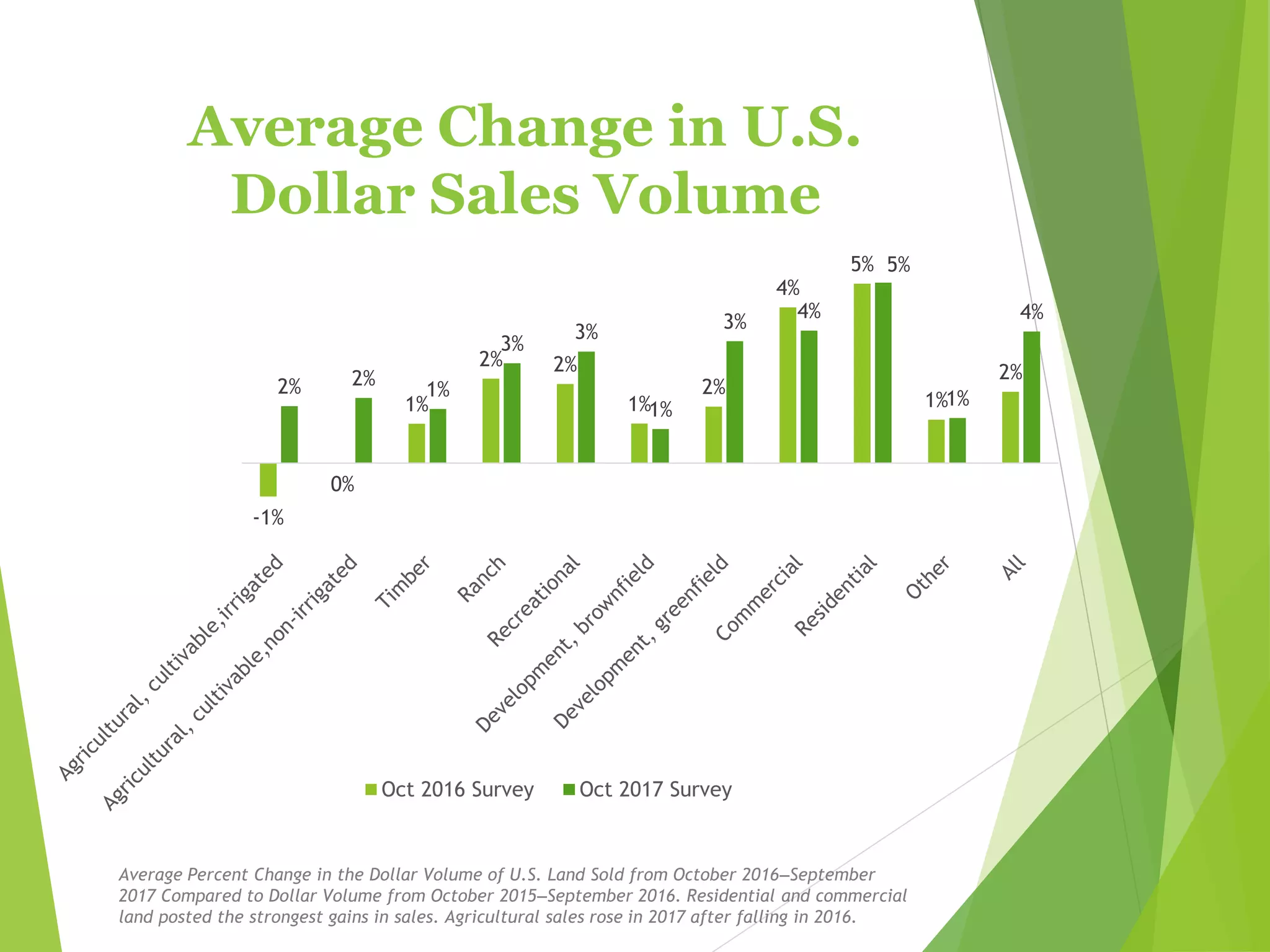

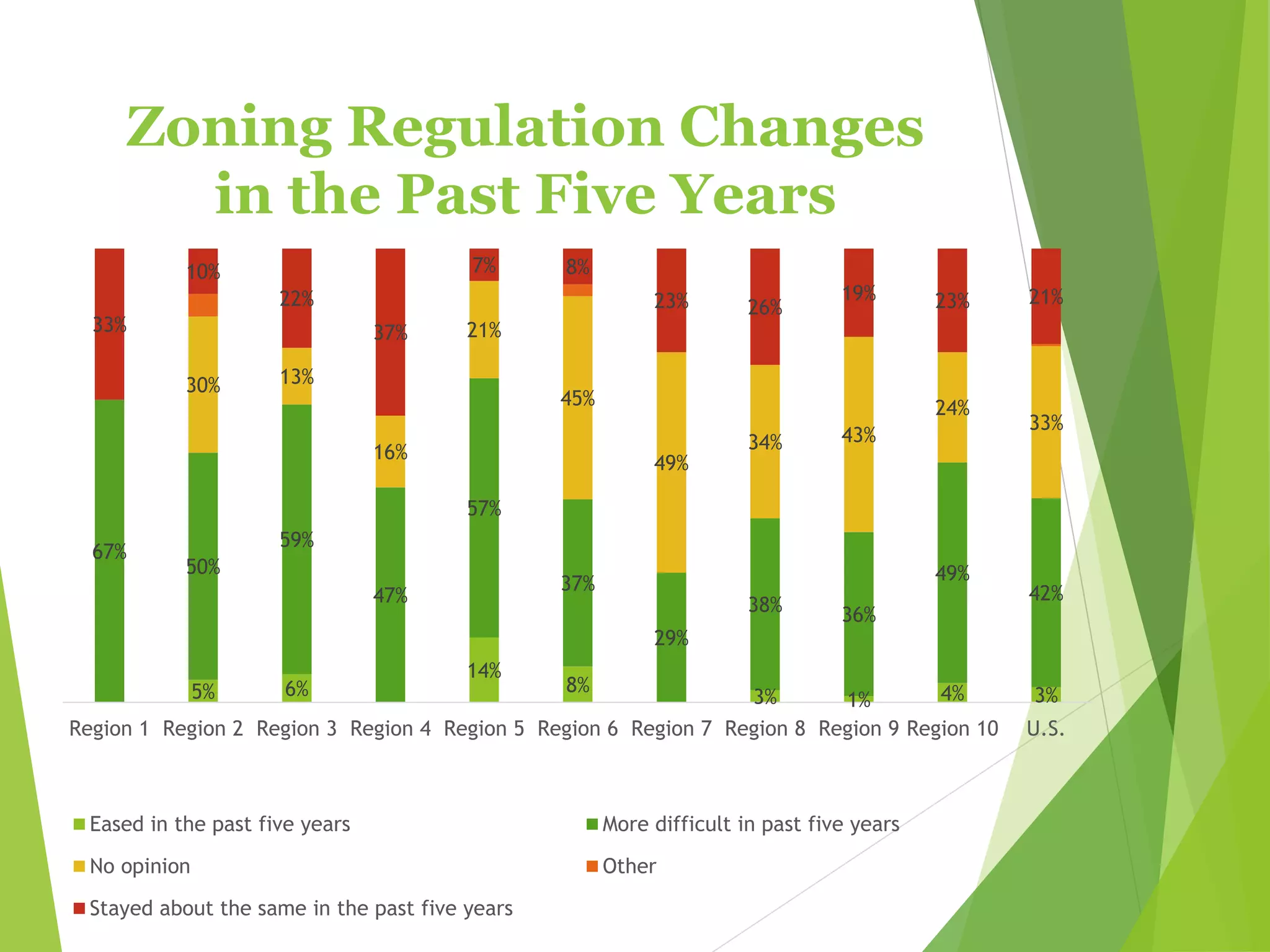

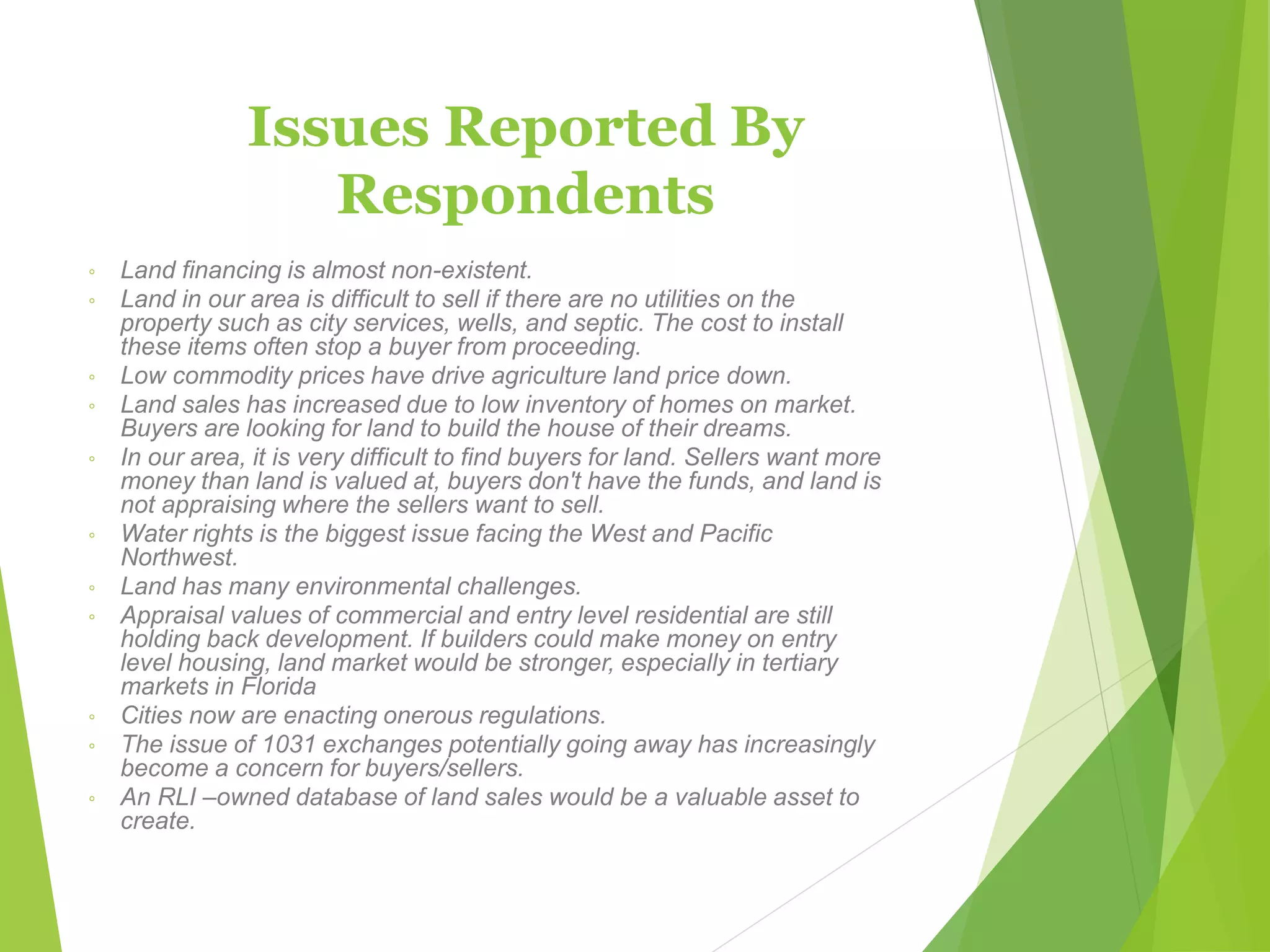

The 2017 U.S. Land Market Survey, conducted by the National Association of Realtors (NAR) and the Realtors Land Institute (RLI), indicated stronger land market conditions with a 4% increase in dollar volume of land sales and a 3% increase in land prices. Residential land sales led the growth, with expectations for continued increases in sales volume and prices for all land types through 2018. The survey also highlighted challenges such as tightening zoning regulations and financing issues affecting land transactions.