Ibom International sought a trading environment providing speed, efficiency, and transparency. They have access to the Chicago Mercantile Exchange platform to view real-time prices and make bids. As a member of the exchange, Ibom can buy and sell crude oil, natural gas, diesel, and gasoline for clients on the exchange in spot or rolling spot transactions on an FOB basis.

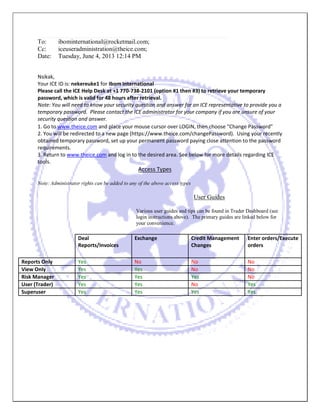

![Thank you,

Winston Garth - Trade Support Analyst

IntercontinentalExchange | ICE

2100 RiverEdge Pkwy | 5th Floor | Atlanta, GA 30328

Tel: 770.738.2101| Fax: 770.951.5481 | winston.garth@theice.com

24-hour ice helpdesk 770.738.2101

http://www.theice.com/

E Group Inc. (Chicago Mercantile Exchange) is the world's largest futures exchange company. It owns and operates largederivatives and futures exchanges in Chicago and New York City, as well as online trading platforms. It also owns the Dow Jones stock and financial indexes, and CME Clearing Services, which provides settlement and clearing of exchange trades. The exchange-traded derivative contracts include futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, rare and precious metals, weather, and real estate.[1]

The corporate world headquarters are in Chicago in the Loop. The corporation was formed by the 2007 merger of the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT). On March 17, 2008, CME Group announced it had acquired NYMEX Holdings, Inc., the parent company of the New York Mercantile Exchange and Commodity Exchange, Inc (COMEX). The acquisition was formally completed on August 22, 2008.[2] The four exchanges now operate as designated contract markets (DCM) of the CME Group.[3]

On February 10, 2010, CME announced its purchase of 90% of Dow Jones Indexes, including the Dow Jones Industrial Average.[4] CME Group, as the world's largest future exchanges, announced that the company will allow international investors to use the Chinesecurrency Renminbi as collateral for trading in all its futures products as of January 2012.[5] CME Group also owns 5% of BM&F Bovespa, the São Paulo, Brazil stock exchange operator. On October 17, 2012, CME announced it was acquiring the Kansas City Board of Trade for $126 Million in cash. KCBOT is the dominant venue for the sell of hard red winter wheat. The Chicago Board of Trade is the leading producer of soft red winter wheat.[6]

Clearing Members (EXCHANGE SEAT)(This is not all the members)

Clearing Firm

CME

CBOT

NYMEX

COMEX

IRS

CDS

ABN AMRO Clearing Chicago LLC

ADM Investor Services, Inc.

Advantage Futures, LLC

Bank of Montreal

Barclays Capital Inc.

BMO Capital Markets Corp.

BNP Paribas Prime Brokerage, Inc.

BNP Paribas Securities Corp.

BNY Mellon Clearing, LLC

BOCI Commodities and Futures Limited +

BP Energy Company](https://image.slidesharecdn.com/8507e20c-73c4-4f90-af33-2316b9909fca-141212151048-conversion-gate01/85/IBOMTRADRPROFILE-EXCHANGEACCESS-7-320.jpg)