ORM 2011

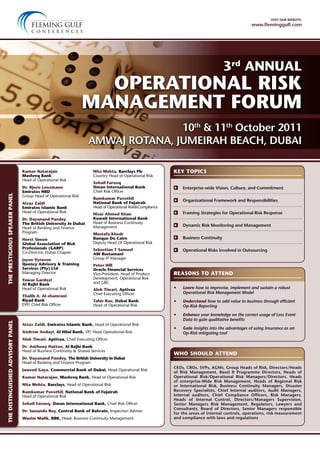

- 1. visit our website: www.fleminggulf.com THEDISTINGUISHEDADVISORYPANELTHEPRESTIGIOUSSPEAKERPANEL Aizaz Zaidi, Emirates Islamic Bank, Head of Operational Risk Andrew Andayi, Al Hilal Bank, VP/ Head Operational Risk Alok Tiwari, Aptivaa, Chief Executing Officer Dr. Anthony Hatton, Al Rajhi Bank Head of Business Continuity & Shared Services Dr. Dayanand Pandey, The British University in Dubai Head of Banking and Finance Program Jaweed Gaya, Commercial Bank of Dubai, Head Operational Risk Kumar Natarajan, Mashreq Bank, Head of Operational Risk Nita Mehta, Barclays, Head of Operational Risk Ramkumar Pavothil, National Bank of Fujairah Head of Operational Risk Sohail Farooq, Oman International Bank, Chief Risk Officer Dr. Sunando Roy, Central Bank of Bahrain, Inspection Adviser Wasim Malik, BBK, Head- Business Continuity Management Kumar Natarajan Mashreq Bank Head of Operational Risk Dr. Bjorn Lenzmann Emirates NBD Group Head of Operational Risk Aizaz Zaidi Emirates Islamic Bank Head of Operational Risk Dr. Dayanand Pandey The British University in Dubai Head of Banking and Finance Program Horst Simon Global Association of Risk Profesionals (GARP) Co-Director, Dubai Chapter Jayen Vyraven Quency Advisory & Training Services (Pty) Ltd Managing Director Yawar Gardezi Al Rajhi Bank Head of Operational Risk Thalib A. Al-shamrani Riyad Bank EVP/ Chief Risk Officer Nita Mehta, Barclays Plc Country Head of Operational Risk Sohail Farooq Oman International Bank Chief Risk Officer Ramkumar Pavothil National Bank of Fujairah Head of Operational Risk&Compliance Nisar Ahmed Khan Kuwait International Bank Head of Business Continuity Management Mostafa Khedr Banque Du Caire Deputy Head Of Operational Risk Sebastian T Samuel AW Rostamani Group IT Manager Peter Hill Oracle Financial Services Vice-President- Head of Product Development, Operational Risk and GRC Alok Tiwari, Aptivaa Chief Executing Officer Tahir Rao, Dubai Bank Head of Operational Risk Enterprise-wide Vision, Culture, and Commitment Organizational Framework and Responsibilities Framing Strategies for Operational Risk Response Dynamic Risk Monitoring and Management Business Continuity Operational Risks Involved in Outsourcing • Learn how to improvise, implement and sustain a robust Operational Risk Management Model • Understand how to add value to business through efficient Op-Risk Reporting • Enhance your knowledge on the correct usage of Loss Event Data to gain qualitative benefits • Gain insights into the advantages of using Insurance as an Op-Risk mitigating tool CEOs, CROs, SVPs, AGMs, Group Heads of Risk, Directors/Heads of Risk Management, Basel II Programme Directors, Heads of Operational Risk/Operational Risk Managers/Directors, Heads of enterprise-Wide Risk Management, Heads of Regional Risk or International Risk, Business Continuity Managers, Disaster Recovery Specialists, Chief Internal auditors, Audit Managers, Internal auditors, Chief Compliance Officers, Risk Managers, Heads of Internal Control, Directors/Managers Supervision, Senior Managers Risk Management, Regulators, Lawyers and Consultants, Board of Directors, Senior Managers responsible for the areas of internal controls, operations, risk measurement and compliance with laws and regulations 10th & 11th October 2011 Amwaj Rotana, Jumeirah Beach, Dubai 3rd Annual Operational Risk Management Forum KEY TOPICS Who Should Attend REASONS TO ATTEND

- 2. Premium Silver Partner: GOLD SPONSOr: KNOWLEDGE Partner: MEDIA PartnerS: Silver Sponsor: Lunch Sponsor: SPONSORS & PARTNERS Event Info: + 971 4 609 1570, fax: + 971 4 609 1589 Email: binoj.puthur@fleminggulf.com, www.fleminggulf.com

- 3. 8:15 Registration and Coffee 8:45 Welcome Note from Fleming Gulf 8:50 Opening Remarks from the Chairperson 9:00 Reinforcing Enterprise-wide Vision, Culture, and Commitment • Defining Operational Risk for the Organization. Importance of how to get the staff at large to be focused and committed towards an institution’s Operational Risk Objectives. • Demonstrating a Vision, Mandate, and Objectives– Formulating bank-wide vision, values and mandate at highest level communicated as clear evidence of buy-in at both the Board and most senior management level of the Bank. • Managing the Risk of a Firm’s Franchise and Reputation, ongoing discipline, strategy development and a plan for managing importance of crises that might impact the Bank’s reputation and franchise. Thalib A. Al-shamrani, Riyad Bank, EVP/ Chief Risk Officer 9:30 Interactive Panel Discussion: Fostering a Culture of Integrity and Risk Management Awareness Corporate culture and philosophy can have the greatest positive or negative impact on the Bank’s risk profile. A senior level commitment and a risk-aware culture, both are essential to build an effective business ethics Aizaz Zaidi, Emirates Islamic Bank, Head of Operational Risk Kumar Natarajan, Mashreq Bank, Head of Operational Risk Ramkumar Pavothil, National Bank of Fujairah Head of Operational Risk and Compliance 10:20 Morning Coffee & Networking 10:50 Operational Risk Frameworks and responsibilities • Empowering Business Units with Responsibility for Risk Management- How to stand out from your peers • Supporting and Leveraging Corporate Units’ Capabilities and Contributions- Defining roles and responsibilities of corporate units firm wide so as to reinforce key aspects of existing control and risk assessment programs • Designating Operational Risk Management Unit to Serve as a Facilitator Kumar Natarajan, Mashreq Bank, Head of Operational Risk 11:30 Dynamic Risk Monitoring and Management • Implementing Bottom-up Processes to Identify, Evaluate and Manage Operational Risks • Using a Portfolio-based Approach to evaluate Firmwide Loss Potential • Coordinating Event and Risk Indicator Data Firmwide • Applying Analytics to Improve ORM Decision Making • Implementing Dynamic Risk Profiling and Monitoring Nita Mehta, Barclays, Head of Operational Risk 12:10 Road map to Advanced Management Approach (AMA) of Operational Risk Management • Key Components of Operational Risk Management Framework • Minimum requirements of AMA • Challenges in implementation of AMA • Integrating RCSA, KRI and LDM • Loss Distribution Approach • Scenario based Approach • Detailed road map to AMA Alok Tiwari, Aptivaa, Chief Executing Officer 12:45 Prayer Break & Luncheon 14:00 Operational Risk Learning and Management • Building an innovative and comprehensive Global Risk Learning strategy • Driving a group-wide approach and standard for OpRisk Management • How to partner with the business functions through risk learning • Manage internal and external relationships and deliver practical risk solutions • Learning culture within a global organization Dr Dayanand Pandey, The British University in Dubai Head of Finance & Banking Program 14:40 Interactive Panel Discussion: Operational Risk Reporting & Response Framework • How Op-Risk Reporting can add value for business • Quantifying loss events • Using Loss Event Data to gain a qualitative benefit, while achieving its primary objective of recording loss events with a view to mitigate Operational Risks of the organization. • Disseminating Useful Management Information and Reports- Providing useful and actionable information about operational risks & losses • Using Incentives and Disincentives as a means to optimize operational risk • Reducing risks through upgrades in systems and manual processes • Employing Segregation and Diversification Strategies- developing programs for benchmarking and goal setting • Balancing risk and reward in diversification of physical asset concentrations Alok Tiwari, Aptivaa, Chief Executing Officer Nita Mehta, Barclays Plc, Country Head of Operational Risk Mostafa Khedr, Banque Du Caire, Deputy Head Of Op.Risk 15:30 Afternoon Tea & Networking 16:00 Op-Risk Appetite • What is Operational Risk Appetite (ORA) • Objectives and purpose of setting ORA • Process for setting Risk Appetite • Implementation and roll-out • Challenges Dr. Bjorn Lenzmann, Emirates NBD Group Head of Operational Risk 16:40 Operational Risks Involved in Outsourcing • Frameworks governing Ops Risk in outsourcing • How does it impact Operational risk • Measurement of Ops risk in Outsourcing • Minimizing Ops risk in Outsourcing • Tools and processes for management • Does Outsourcing decrease Ops risk? Tahir Rao, Dubai Bank, Head of Operational Risk 17:20 Closing Remarks from the Chairperson 17:45 Networking & Cocktail Reception Day 1 / 10th October 2011 Event Info: + 971 4 609 1570, fax: + 971 4 609 1589 Email: binoj.puthur@fleminggulf.com, www.fleminggulf.com

- 4. 8:15 Registration and Coffee 8:45 Welcome Note from Fleming Gulf 8:50 Opening Remarks from the Chairperson 9:00 Effective usage of Loss Data •Why collect Loss Data? •The Data Quality Issue •How to use Loss Data to add value •The Value of a Data Consortium Horst Simon, Global Association of Risk Profesionals (GARP), Co-Director, Dubai Chapter 9:30 Interactive Panel discussion: Overlap between Internal Control, Internal Audit & Operational Risk Management Yawar Gardezi, Al Rajhi Bank, Head of Operational Risk Kumar Natarajan, Mashreq Bank, Head of Operational Risk Ramkumar Pavothil, National Bank of Fujairah Head of Operational Risk and Compliance Tahir Rao, Dubai Bank, Head of Operational Risk 10:30 Morning Coffee and Networking 11:00 A new definition of operational risk: The risk to the successful achievement of corporate objectives For many banks around the world, what we mean by operational risk has become more than the direct impact on earnings and capital arising from failures of people, processes and systems to include risks to reputation, business continuity, failure to comply with regulations and the impact of financial crime and fraud on business. Peter Hill, Oracle Financial Services Vice-President- Head of Product Development, Operational Risk and GRC 11:35 Op-Risk Finance Hedging • Significance of Op-Risk hedging • Aligning insurance, risk finance programs to Operational Risk • Measuring program performance over time Ramkumar Pavothil, National Bank of Fujairah Head of Operational Risk and Compliance 12:10 Effective Implementation of Op-Risk Framework through an Alternative Approach • How does traditional Op-Risk framework define, identify and manage operational risks • How is it implemented and what safeguards does it provide against operational losses • How robust it is in identifying operational risks and how can it be integrated with other risk types • What is the implementation framework of an alternative approach and how is it different from the traditional operational risk methodology • Key pros and cons- Which approach is more in-depth and more strategic Sohail Farooq, Oman International Bank, Chief Risk Officer 12:45 Prayer Break & Luncheon 14:00 Interactive Panel Discussion: Regional Challenges in Implementing Operational Risk Management Framework Sohail Farooq, Oman International Bank, Chief Risk Officer Peter Hill, Oracle Financial Services, Vice-President- Head of Product Development, Operational Risk and GRC Sebastian T Samuel, AW Rostamani, Group IT Manager Tahir Rao, Dubai Bank, Head of Operational Risk 14:40 Scenario Analysis- Developing a Stress Testing Framework • Embedding Scenario Analysis in Operational Risk Framework • Choice of Scenario • Use of the results of Scenarios in capital calculation Yawar Gardezi, Al Rajhi Bank, Head of Operational Risk 15:10 Afternoon Tea & Networking 15:30 Business Continuity Management – A Must for Business Success • How to develop and implement a sustainable business continuity program • Analyzing key risks to people, processes, technology, Infrastructure and suppliers • Adopting the most appropriate continuity strategy for key banking processes (eg. retail, commercial & online banking, treasury operations, call center, credit card and ATM operations) • How to effectively test and exercise the business continuity capability Nisar Ahmed Khan, Kuwait International Bank Head of Business Continuity Management 16:00 An Enterprise Architecture Driven Approach for GRC Implementation • Understanding the enterprise GRC context • Defining enterprise architecture concepts and relationship to GRC • The enterprise architecture approach for GRC • The AWR risk management framework • The ERM life-cycle solution • The Audit life-cycle solution • Implementation benefits and challenges • The MEGA GRC Platform Sebastian T Samuel, AW Rostamani, Group IT Manager 16:45 Closing Remarks from the Chairperson I would like to thank everyone who has helped me with the research and organization of this event, especially the speakers for their support and commitment. Binoj Puthur, Conference Producer Binoj.Puthur@fleminggulf.com Day 2 / 11th October 2011 Event Info: + 971 4 609 1570, fax: + 971 4 609 1589 Email: binoj.puthur@fleminggulf.com, www.fleminggulf.com

- 5. MEET OUR RENOWNED SPEAKERS Chairperson Ramkumar Pavothil | National Bank of Fujairah | Head of Operational Risk and Compliance Ramkumar joined the National Bank of Fujairah as Head of Operational Risk and Compliance in May 2008, where he has been instrumental in the establishment and ongoing management of the Operational Risk Management and Compliance framework in the National Bank of Fujairah. Ram brings with him 15 years of experience in the banking industry with a strong background of 9 years in Operational Risk Management. Prior to NBF, he served with HSBC for 10 years in Operational Risk, Internal Control, Internal Audit and Banking Operations, and with Al Rajhi Bank for 2 years where he was responsible for the initial set-up of the Bank’s Operational Risk Management framework. He has received various certifications in Risk Management including CCSA (Certificate in Control Self Assessment from the Institute of Internal Auditors, USA), ACOR (Advanced Certificate in Operational Risk from the Chartered Institute of Securities and Investments, UK) and CISM (Certificate in Information Security Management from ISACA) Kumar Natarajan | Mashreq Bank | Head Operational Risk Kumar is a career banker with over 20 years of experience across the areas of Credit, Operations, and Audit with the last 10 years devoted to Operational risk function. He has been focusing on designing and implementing a practical operational risk framework which demonstrates a clear value add to the organisation. A professional with an eye for detail with good knowledge on technical and technological aspects of the business, he is currently heading the operational risk function for Mashreq bank, prior to which he was with First Gulf Bank for over 6 years where he set up the operational risk function. In his Audit role he has traveled extensively over the Middle-east and South Asia region and has a very good understanding of this region, specifically with regards to operational risks prevalent.Kumar obtained a Bachelor of commerce degree from the University of Mumbai and picked up a diploma in general management and a Masters in Financial Management from Jamnalal Bajaj Institute of Management Studies / University of Mumbai in India. He is a member of PRMIA and a professional member of Institute of Operational Risk. Dr. Dayanand Pandey | The British University in Dubai | Head of Banking & Finance Program Dr. Dayanand Pandey is currently Head of Finance & Banking program at the British University in Dubai, Honorary fellow of the University of Birmingham, UK and Consultant-Risk & Training at Bank Melli Iran, UAE. Prior to the BUiD, he was Head of Risk Management &Training at Bank Melli Iran (BMI), Regional Office in Dubai. Bank Melli Iran is the largest and the oldest bank of Iran with more than 30 years of presence in UAE. The bank deals in retail, corporate and trade related financial products. Dr Pandey was entrusted the task of implementing ERM across the bank and to comply with Basel II guidelines of UAE Central Bank. Previously, he has worked as the Coordinator of Master of Applied Finance and Banking Program with the University of Wollongong in Dubai, Senior Lecturer at the Emirates Institute for Banking and Financial Studies in Sharjah, Professor of Economics and Chairman Global MBA program at IMT, Ghaziabad. He is a Graduate in Economics; Post Graduate in Business Economics and Ph D in Risk Management. Dr. Pandey has published a number of books and scholarly articles in journals of repute. He has authored a book on Managerial Economics published from Pearson Education, Economic Environment of Business and Risk management from Excel Publications. He is a regular speaker at various international conferences and seminars. Sohail Farooq | Oman International Bank | Chief Risk Officer Sohail is an an innovative Canadian professional with over 15+ years of proven expertise in risk management, ALM and corporate strategy. He has been serving as a trusted adviser to business leaders in the GCC for the past 7 years, and is known for developing and executing compelling strategies for increasing the headline earnings, streamlining work flow and creating a team environment to increase productivity. At present he is the CRO at Oman International Bank. His prior work also includes credit portfolio management at major Canadian banks, Scotiabank and CIBC World Markets, where as a member of credit & structuring committees he was mandated to risk-proof credit portfolios, transaction and securitization structures. As a consultant with Oliver Wyman Financial Services, he developed the state of the art operational risk frameworks which featured risk hot spot drill-downs and were calibrated to risk appetite. He holds a Masters degree in Quantitative Finance from Hochschule für Bankwirtschaft Frankfurt am Main (Frankfurt School of Finance & Management) in Germany and an M.B.A. from the School of Business Administration, Dalhousie University, Halifax, Canada. Yawar Gardezi | Al Rajhi Bank | Head of Operational Risk Yawar is currently working as a Head of Operational Risk for Al Rajhi Bank. He has been with Al Rajhi Bank for the last three years where he is responsible for the development and implementation of Operational Risk Framework with the goal to achieve the AMA accreditation. Key focus area has been Operational Risk Policy and procedures and supporting tools development. Prior to that he has worked for National Australia Bank, Australia. He has more than 16 years of experience in the field of Operational Risk, Finance, Business Banking & Credit Analysis. He has done MBA and a CPA from Australia. Nisar Ahmed Khan | Kuwait International Bank | Head of Business Continuity Management Nisar Khan has more than 8 years of experience in managing Business Continuity Management programs with the regulator, conventional and Islamic banking. Nisar is currently the Head of Business Continuity Management for Kuwait International Bank, prior to joining KIB, Nisar worked as Service Continuity Specialist for Central Bank of Kuwait. He also served for United Bank (Pakistan) as Business Resilience Manager. Previously he served as a BC/DR Manager for a consultancy firm, delivering end- to-end BCM programs and training to leading companies in Pakistan. Nisar also has vast experience in implementing enterprise level IT Continuity and Disaster Recovery solutions such as Storage Area Networks (SAN), Backup, Recovery, Replication and high availability clustering, secondary data centers and redundant data networks. Nisar holds a Masters degree in IT and Business. He is a professional member (MBCI) and is certified (CBCI) with merit from British Continuity Institute UK, BS25999 Lead Auditor as well as a member of ISACA. He is a frequent contributor for various online groups and forums pertaining to Business Continuity Management. Horst Simon | Global Association of Risk Profesionals (GARP) | Co-Director, Dubai Chapter Horst has been in the banking and consultancy industries for over 30 years. As Head of Risk Technology in Mashreq Bank in the United Arab Emirates, he pioneered the concept of Risk Technology Management; implementation of a strategic risk mitigation framework to achieve active risk management capability, support good risk governance and ensure sustainable competitive advantage. Horst started his work in the Middle East in 2005 at EmiratesNBD Group, where he was tasked with building an Operational Risk Management function for the Group. He held previous operational risk and banking operations positions with Barclays Bank plc and with the Standard Bank Group of South-Africa Ltd, living and working in 4 countries. His special interest is in the field of People Risk and he has delivered many presentations at international conferences on the Mitigation of People Risk and other risk management topics. He is a member of the Professional Speakers Association of Southern Africa. Horst currently works with leading global players in the field of Risk Management Consultancy and Training as well as Business Process Outsourcing in the following positions: Director- Operational Risk Management- Horwath MAK, Senior Associate- RiskBusiness, Principal- Risk Management, Consultant- Quintica Middle East, Advisor to WNS Global Services, Co- Regional Director, Dubai Chapter- Global Association of Risk Professionals (GARP) Thalib Ali Al-Shamrani | Riyad Bank, Saudi Arabia | Executive Vice President, Chief Risk Officer Mr Thalib Ali Al-Shamrani has around 26 years of Banking experience with the latest 20 years in senior and executive management level. He has been serving as Chief Risk Officer and Head of Credit for the last 6 years. In this role he manages the Bank wide Risk including; Credit, Market Risk, Operation Risk, Insurance and Compliance. Prior to that, he was The CFO of the Bank for nearly 10 years. In addition, He was involved within his career with the Bank in Managing and overseeing other Divisions in The Bank such as, Financial and strategic planning, corporate Banking, Retail Banking, Treasury, Investment, IT, HR and support. Thalib is a member of the following Executive level Committees: Management Committee, Main Credit Committee, ALCO, Investment Committee, Risk Management Review Group, Technology Committee, Risk and Compliance Committee and HR committee. He is also a permanent invitee to The Board Audit Committee, Chairman of Fiduciary Committee, Member of Strategic Planning Group of the Bank, Vice Chairman of a subsidiary Financial Services Company and Chairman of the Executive Committee as a member of the Board, Member of Saudi Banks CFO Committee when was The CFO of The Bank, Member of Chief Credit Officers / Chief Risk Officers of the Saudi Banks and Chairman of Real Estate Company. Thalib holds a B.A. in Business Administration and has participated in many trainings in Banking and Finance- Internationally and locally- some of which are: Banking Operation in retail Branches Riyad Bank 1985, On job training with National Westminster Bank London, Integrated Financial Management Program Euro-money London, DC Gardner training courses in Money market & derivatives product and FX & Treasury program, Young Managers Program INSEAD Paris, On job training with Chemical Bank New York, Executive managers Program, American Management Association, Accounting study in London School of Accountancy, Internal Control Systems, TQM, The Seven Habits of Highly Effective Managers Covey Leadership Centre, Balanced Score card with ORACL, A number of Executive management, Risk Management and Finance courses. Dr. Bjorn Lenzmann | Emirates NBD | Group Head of Operational Risk Dr. Björn Lenzmann is Group Head of Operational Risk at Emirates NBD in Dubai. He is responsible for the development and implementation of the Group-wide Operational Risk framework and methodologies. Björn joined Emirates NDB from KPMG as Associate Director within KPMG Germany’s Financial Risk Management Practice. He has worked with several banking and insurance clients to implement Operational Risk solutions that allowed them to qualify for the different Basel II approaches including scenario analysis, KRI, and capital and insurance modelling. He was a member of the KPMG’s German OpRisk competence team and is a regular speaker on Operational Risk Management at national and international conferences. Prior to joining KPMG Björn has worked for Commerzbank, a leading German bank heading the OpRisk quantification team developing and implementing the AMA model. He was the bank’s representative in several working groups of the data consortium ORX and a member of the Forum for European discussion on Operational Risk (FEDOR). Nita Mehta | Barclays Plc | Country Head of Operational Risk Nita Mehta has vast experience of over17 years in Financial Services Sector wide ranging from Investment Banking, Treasury, Commercial Banking and Retail Banking. In investment banking, she has worked in different areas of investment banking spanning over mutual funds, merchant banking, stock broking and mergers/acquisitions heading Risk, Compliance, Audit and Governance functions. She is in Dubai for last 6 yeas. In her previous position, she was Regional Head of Operational Risk in Standard Chartered Bank, biggest treasury in GCC predominantly focusing on operational risk in Global Markets and Corporate Finance for 3 years. Nita currently holds the position with Barclays Bank as Country Head of Operational Risk focusing on Operational Risk, Audit and Governance of Commercial Banking, Retail Banking and Treasury. Alok Tiwari | Aptivaa | Chief Executing Officer Alok, CEO and founder member of Aptivaa, has over 16 years of experience in the area of risk management and has specialized in Governance and Risk Management, Regulatory Compliance, Strategy and Risk System Consulting, primarily in Financial Risk Management to the financial services sector. Alok is also a member of Advisory Board of Chartis Research- a leading research and advisory services firm which specializes exclusively in the risk technology market, analyzing systems, products, vendors, applications and related trends in the risk technology domain. Prior to founding Aptivaa he was heading the Enterprise Risk Management (ERM) practice of a Big 4 consulting firm. He has successfully conducted program management for implementing the Basel II framework at large Banks in Asia and Europe. He has been involved in more than 10 Basel II implementation, 4 large EWRM Implementation Projects, 30 Risk Analysis & Assessments and 6 Risk Model Testing and validation projects (covering models such as Value at Risk (VaR), KMV, Credit VaR and Portfolio Performance Analysis). He has lead assignments for top tier clients such as ICICI Bank, Barclays, Lloyds TSB, State Bank of India, Axis Bank, National Bank of Abu Dhabi, Bank Audi, SAMBA Financial Group, Life Insurance Corporation of India and other leading names. He has also conducted trainings workshops for senior personnel of the Banking and Financial Services Sector on Basel II and Risk Management in India, South East Asia and Middle East Asia. Alok has also spoken at the IBA Conferences- India, ACCA-Kenya, International Risk Management Congress-Dubai, IFC Conferences-Colombo and Dhaka, Annual International Seminar-Dubai, Value from Risk forum – South Asia and has been a discussion panel member at various seminars on Risk Management and Basel II. Sebastian T Samuel | AW Rostamani | Group IT Manager Sebastian T Samuel is the Group IT Manager at AW Rostamani Group, one of the leading business groups in the UAE, with diverse portfolio of businesses. With over 2500 employees and net assets in excess of AED 6 billion, AW Rostamani group is among the finest business success stories to come out of the UAE. Sebastian holds masters in computer applications and is certified in the enterprise governance of IT. He has a wide range of experience in managing IT for multiple industries like automotive, real estate, manufacturing, logistics and contracting. He has over 20 years of engagement expertise in various IT domains such as Requirement Management, System Analysis, Business Process Management, ERP Implementation, IT Service and Delivery Management, Enterprise Risk Management, Corporate Performance Management, Enterprise Architecture, IT Strategy and Planning and IT Governance. Tahir Rao | Dubai Bank | Head of Operational Risk Tahir Rao is presently working with Dubai Bank, as Head- Operational Risk and is responsible for implementation of Operational Risk Frameworks. Last assignment was with Union National Bank, as AVP & Manager Operational Risk and established Ops Risk Framework and implemented the Operational Risk Solutions for RCSA, KRIs, Loss Database, stress testing, scenario analysis and capital modelling. Overall more than 15 years of Operational Risk, Internal Audit and Credit Risk Review experience working with best regional and international banks, like Dubai Bank, Union National Bank, Standard Chartered Bank and United Bank Limited. His qualifications include MBA (Philippines), Diploma in Banking from The Institute of Bankers (Pakistan) and Certified Internal Auditor (CIA) from The Institute of Internal Auditors (USA). Peter Hill | Oracle Financial Services | Vice-President- Head of Product Development, Operational Risk and GRC Peter Hill is an acknowledged expert in operational risk management and leads the operational risk and compliance product development at Oracle Financial Services. He is a former treasurer of a financial markets dealing room in the City of London. Hill can draw on more than 25 years of banking experience and has witnessed many operational risks at first hand. Hill’s experience of banks going bust goes back to Bankhaus Herstatt, a German bank caught by over trading that subsequently collapsed in 1974. Hill has also worked for a string of operational risk software and consulting firms, including Chase Cooper, Algorithmics and Amelia Financial Systems. Event Info: + 971 4 609 1570, fax: + 971 4 609 1589 Email: binoj.puthur@fleminggulf.com, www.fleminggulf.com