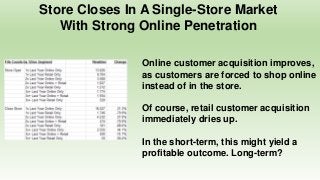

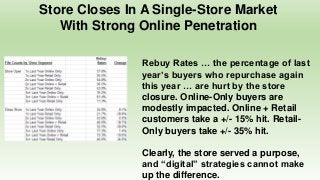

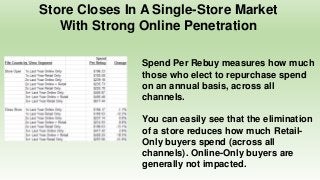

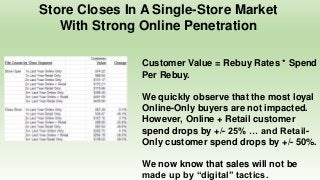

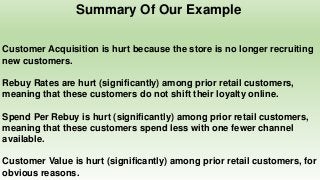

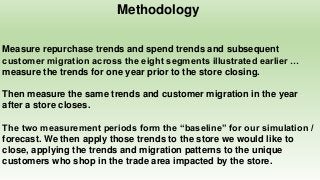

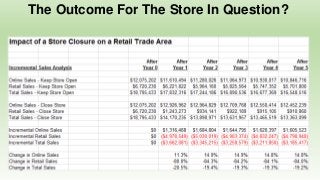

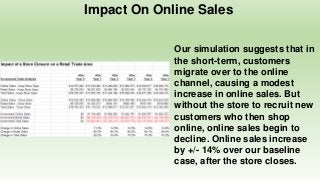

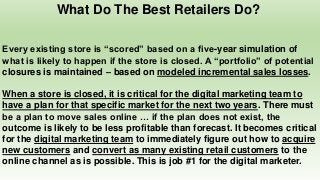

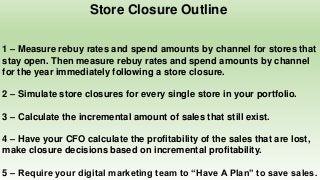

In this presentation, Kevin Hillstrom (President of MineThatData) discusses a methodology used to help retail brands determine which stores should be closed. The methodology features a five-year simulated forecast for a store trade area, quantifying what might happen if the store remains open, or if the store is closed. Online and in-store sales forecasts are generated, as are customer segment counts by channel.