EMEA Insurers Snapshot - Regional Snapshot

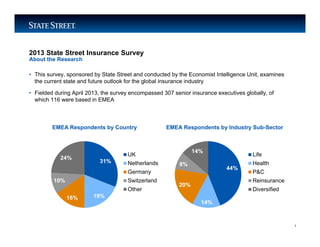

- 1. LIMITED ACCESS 2013 State Street Insurance Survey • This survey, sponsored by State Street and conducted by the Economist Intelligence Unit, examines the current state and future outlook for the global insurance industry • Fielded during April 2013, the survey encompassed 307 senior insurance executives globally, of which 116 were based in EMEA About the Research 1 44% 14% 20% 8% 14% Life Health P&C Reinsurance Diversified 31% 19%16% 10% 24% UK Netherlands Germany Switzerland Other EMEA Respondents by Country EMEA Respondents by Industry Sub-Sector

- 2. LIMITED ACCESS Key Challenges Facing Insurers in EMEA Managing Risk Improving the assessment and pricing of risks Balancing liquidity and reserve adequacy Regulation and Compliance Adapting to evolving insurance regulations Ensuring transparency of business policies and processes Driving Innovation Bringing new, innovative products to market quickly Adapting distribution to changing demographics Finding New Sources of Value Effectively allocating capital to the most business-critical priorities Investing in more complex investment types Optimizing Business Strategy Converting fixed costs to variable costs Using data more effectively across our company 55% 53% 47% 49% 47% 57% 55% 41% 58% 53% 33% 16% 41% 26% 43% 26% 19% 27% 24% 24% Minor challenge Major challengeSource: 2013 State Street Insurance Survey, conducted by The Economist Intelligence Unit 2 Adapting to regulation and quickly launching innovative products are the leading challenges for EMEA-based insurers

- 3. LIMITED ACCESS 60% 69% 58% 53% 61% 31% 19% 28% 27% 19% 9% 12% 14% 20% 20% 40% 20% 0% 20% 40% 60% 80% 100% European Regulatory Environment Top Five Regulatory Concerns for Insurers Operating in Europe Source: 2013 State Street Insurance Survey, conducted by The Economist Intelligence Unit CORP-0759 3 • Regulatory reform in the wake of the global financial crisis continues to transform the insurance industry • Solvency II is a huge concern for insurers operating in Europe: 91 percent describe it as a challenge, with nearly one- third (31 percent) seeing it as a “major” challenge • Nearly half of respondents (49 percent) judge their firms to be taking a very proactive approach to Solvency II requirements, while the rest are delaying efforts until uncertainty around key aspects of the regulation is resolved European insurers are confronting a host of regulatory issues, dominated by Solvency II Preparing for Solvency II Complying with FATCA Keeping pace with evolving EU and national tax legislation Adapting to regulations on unbundling banking and insurance products Preparing for PRIPs Not a challenge Minor challenge Major challenge