Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Viewers also liked (7)

Growth Of Representations and Warranties Insurance

Growth Of Representations and Warranties Insurance

At a Human Services Tipping Point: How Leaders Move from Ideas to Outcomes

At a Human Services Tipping Point: How Leaders Move from Ideas to Outcomes

Similar to BRIDGE LOAN PROGRAM+001

Similar to BRIDGE LOAN PROGRAM+001 (20)

Capstone Global Finance Project Funding Program - facts, information & process

Capstone Global Finance Project Funding Program - facts, information & process

eBOOK - HOW SUCCESSFUL PROPERTY DEVELOPMENT IS ALL ABOUT SUCCESSFUL DEBT STR...

eBOOK - HOW SUCCESSFUL PROPERTY DEVELOPMENT IS ALL ABOUT SUCCESSFUL DEBT STR...

Bridging Finance Guide-20 Steps to Bridging Finance Success by Blueray Capital

Bridging Finance Guide-20 Steps to Bridging Finance Success by Blueray Capital

Capstone global finance project funding program facts, information & process

Capstone global finance project funding program facts, information & process

BRIDGE LOAN PROGRAM+001

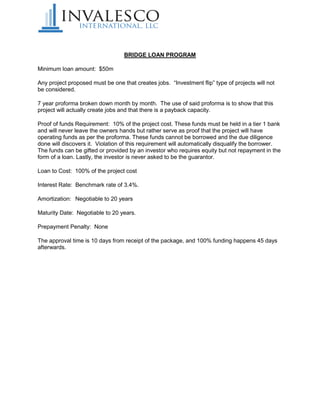

- 1. BRIDGE LOAN PROGRAM Minimum loan amount: $50m Any project proposed must be one that creates jobs. “Investment flip” type of projects will not be considered. 7 year proforma broken down month by month. The use of said proforma is to show that this project will actually create jobs and that there is a payback capacity. Proof of funds Requirement: 10% of the project cost. These funds must be held in a tier 1 bank and will never leave the owners hands but rather serve as proof that the project will have operating funds as per the proforma. These funds cannot be borrowed and the due diligence done will discovers it. Violation of this requirement will automatically disqualify the borrower. The funds can be gifted or provided by an investor who requires equity but not repayment in the form of a loan. Lastly, the investor is never asked to be the guarantor. Loan to Cost: 100% of the project cost Interest Rate: Benchmark rate of 3.4%. Amortization: Negotiable to 20 years Maturity Date: Negotiable to 20 years. Prepayment Penalty: None The approval time is 10 days from receipt of the package, and 100% funding happens 45 days afterwards.