Becton dickinson company

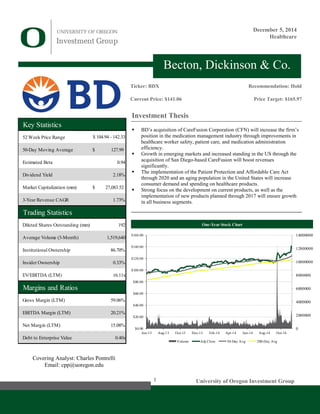

- 1. 1 University of Oregon Investment Group December 5, 2014 Healthcare Covering Analyst: Charles Pontrelli Email: cpp@uoregon.edu Investment Thesis BD’s acquisition of CareFusion Corporation (CFN) will increase the firm’s position in the medication management industry through improvements in healthcare worker safety, patient care, and medication administration efficiency. Growth in emerging markets and increased standing in the US through the acquisition of San Diego-based CareFusion will boost revenues significantly. The implementation of the Patient Protection and Affordable Care Act through 2020 and an aging population in the United States will increase consumer demand and spending on healthcare products. Strong focus on the development on current products, as well as the implementation of new products planned through 2017 will ensure growth in all business segments. Becton, Dickinson & Co. Key Statistics 52 Week Price Range 50-Day Moving Average 127.99$ Estimated Beta 0.94 Dividend Yield 2.18% Market Capitalization (mm) 27,083.52$ 3-Year Revenue CAGR 1.73% Trading Statistics Diluted Shares Outstanding (mm) 192 Average Volume (3-Month) 1,519,640 Institutional Ownership 86.70% Insider Ownership 0.33% EV/EBITDA (LTM) 16.11x Margins and Ratios Gross Margin (LTM) 59.06% EBITDA Margin (LTM) 20.21% Net Margin (LTM) 15.08% Debt to Enterprise Value 0.40x $ 104.94 - 142.33 Ticker: BDX Current Price: $141.06 Recommendation: Hold Price Target: $165.97 One-Year Stock Chart 0 2000000 4000000 6000000 8000000 10000000 12000000 14000000 $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 Jun-13 Aug-13 Oct-13 Dec-13 Feb-14 Apr-14 Jun-14 Aug-14 Oct-14 Volume Adj Close 50-Day Avg 200-Day Avg

- 2. December 5, 2014 UOIG 2 University of Oregon Investment Group 53% 33% 14% BD Medical BD Diagnostics BD Biosciences Becton, Dickinson & Co. Business Overview Maxwell W. Becton and Farleigh S. Dickinson founded Becton, Dickinson & Co. (BD) in 1897. In 1906, BD incorporated in New Jersey, where their headquarters are currently located in the city of Franklin Lakes. BD is a medical technology and supply company that manufactures medical devices, software, and instrument systems. The company went public in 1962, and 60% of their sales currently come from over-seas markets. BD markets their products through individual distribution channels and directly to customers by independent sales representatives, and orders are received and filled on a current basis. In October, 2014 BD announced its acquisition of CareFusion Corporation for $12.2 billion in stock and cash. Business overviews of both companies are given below in order to show how the acquisition will affect BD’s operations. Currently, BD’s operations are separated into three business segments: BD Medical, BD Diagnostics, and BD Biosciences, which are explained below. BD Medical The BD Medical segment manufactures a wide array of medical products. Some of the segment’s principal medical devices are prefilled IV flush syringes; needles, syringes and intravenous catheters for the delivery of medication; self- injection syringes and pen needles for the treatment of diabetes; regional anesthesia needles and trays; and generic prefilled injectables. Hospitals, clinics, pharmacies, public health agencies, and pharmaceutical companies are the primary customers served by BD Medical. Once the acquisition of CareFusion is closed, their operations will be consolidated into BD Medical, which will be a large driver of revenue. CareFusion’s Infusion Systems and Dispensing Technologies will complement BD’s product line in their Medical Surgical Systems. Additionally, disposables and reusable surgical products can be offered with the sale of BD’s disinfecting containers to establish long-term revenue streams. BD Medical includes three subunits: Medical Surgical Systems, Diabetes Care, and Pharmaceutical Systems. Medical Surgical Systems The Medical Surgical Systems unit is the largest driver of revenue for this segment. This unit’s core products are anesthesia, infusion therapy, injection, and sharps disposal products. Revenue growth in the past two years can be attributed to the sales of the BD PhaSeal™, which resulted from the Carmel Pharma, AB acquisition that occurred at the end of 2011. This business unit will benefit greatly from the addition of certain CareFusion products, such as CareFusion’s Alaris™ System, which can provide and manage multiple medications and fluids to a patient simultaneously. Diabetes Care The Diabetes Care unit produces self-injection syringes and pen needles for the treatment of diabetes, as well as pre-filled injectables. Revenue growth in this unit has recently benefitted from strong sales of BD Ultra-Fine™ and BD PentaPoint™ pen needles, which are self-injection systems to deliver insulin to diabetes patients. Pharmaceutical Systems Revenue growth for the Pharmaceutical Systems was supplemented by the acquisition of Safety Syringes in the first quarter of the fiscal year of 2013. This unit produces primarily glass and plastic prefilled syringes for biotech drugs and other pharmaceutical purposes. Figure 1: BD Revenue Breakdown for 2013 Source: BD 2013 10-K Figure 2: BD Medical Revenue Growth Source: UOIG Spreads Figure 3: BD Nano™ 4mm Pen Needle Source: bd.com 0 1000 2000 3000 4000 5000 6000 7000 8000 $Millions

- 3. December 5, 2014 UOIG 3 University of Oregon Investment Group BD Diagnostics BD Diagnostics manufactures products that detect infectious diseases, healthcare-associated infections, and cancers, as well as products that allow for the safe transport and collection of specimens. This segment works to improve safety conditions for patients, healthcare workers, hospitals, laboratories, and clinics. BD Diagnostics also aims to enhance laboratory efficiency and productivity. BD Diagnostics consists of two units: Preanalytical Systems and Diagnostic Systems. Preanalytical Systems For over 60 years, BD has enhanced the science of specimen collection and has increased lab efficiency and productivity. BD’s Preanalytical Systems is an industry leader in blood collection tubes and urine collection devices, such as their BD Vacutainer™ Push Button Blood Collection Set. This unit has also been helping customers in emerging markets, such as China and India, to improve lab safety by providing education on global standards of lab safety and proficiency testing. Diagnostic Systems This unit contains products that deal with disease and infection detection. The Diagnostic Systems unit experienced recent revenue growth due to strong sales of its automated diagnostic platforms, as well as its blood culture and TB systems. Not only this, but revenues were boosted by a strong flu season between 2013 and 2014. BD Biosciences BD Biosciences manufactures clinical and research products to assist in the study of cells and their components, as well as to improve the understanding of normal cell processes and diseased cell processes. This unit’s primary products are cell sorters and analyzers, antibodies and kits for cell analysis, and reagent systems for life science research. BD Biosciences’ largest customers are research and clinical laboratories, academic institutions, biotech companies, hospitals, and blood banks. CareFusion Corporation Business Overview CareFusion Corporation (CF) was incorporated in Delaware on January 14, 2009 as a spinoff of Cardinal Health, Inc. The spinoff was completed on August 31, 2009. CF was made of various clinical and medical product businesses that were a part of Cardinal Health. On September 1, 2009 CF began publicly trading on the New York Stock Exchange. They are currently headquartered in San Diego, CA. CF focuses on healthcare safety through the prevention of healthcare-associated infections and the reduction of medication errors. They are composed of two business segments: Medical Systems and Procedural Solutions. Both segments are further discussed below. Medical Systems The Medical Systems business segment focuses on the production of equipment for the use of medical management, which includes their respiratory ventilation and diagnostic technologies, infusion and medication dispensing technologies, as well as supply management. These products are designed to improve patient safety through the reduction of medication errors. CareFusion’s direct sales force primarily sells these products, but third-party distributors are used as well. The Medical Systems segment is divided into 3 separate units: Infusion Systems, Dispensing Technologies, and Respiratory Technologies. Figure 4: BD Diagnostics Revenue Growth Source: UOIG Spreads Figure 5: BD Biosciences Revenue Growth Source: UOIG Spreads Figure 6: CF Revenue Breakdown for 2013 Source: CF 2013 10-K 0 500 1000 1500 2000 2500 3000 3500 4000 0 200 400 600 800 1000 1200 1400 1600 $Millions$Millions 66% 34% Medical Systems Procedural Solutions

- 4. December 5, 2014 UOIG 4 University of Oregon Investment Group Infusion Systems CareFusion’s infusion systems deliver medications and various fluids to patients in precise amounts over a wide range of infusion rates. They are the leader when it comes to the design, development and marketing of IV infusion systems. One of their key products is their Alaris™ System, which is a pump system that simultaneously delivers medications and fluids from multiple delivery modules while also monitoring a patient’s vital signs. The Alaris™ System also only uses CareFusion disposables, allowing for a long-term revenue stream associated with the refilling of these disposables when needed. Dispensing Technologies This unit focuses on the production of automated dispensing systems for medications and supplies. These products are usually supplied to hospitals and other healthcare facilities inside the United States. CareFusion manufactures these dispensing systems in order to reduce medical error and increase efficiency in hospitals. Their Pyxis products automate the management of medications from the pharmacy to the nursing unit, as well as the medication management inside operating rooms. These products ultimately decrease order turnaround time and reduce transcription errors. Respiratory Technologies CareFusion’s Respiratory Technologies unit develops, manufactures, and markets mechanical ventilators and other consumables for patients with respiratory disorders. Respiratory disorders are among the highest cost, highest risk, and largest growing hospital populations. Their products provide both invasive and noninvasive respiratory support, and accommodate both pediatric and adult patients. Their AVEA and VELA ventilator systems are versatile units for the use in both acute care and alternate care settings. Procedural Solutions The Procedural Solutions business segment revolves around the production of disposable products and reusable surgical instruments. The majority of these products are used in the preparation of patients for the operating room, or in the operating room itself. A combination of CareFusion’s direct sales force and third-party distributors are used to sell these products. This segment is separated into three units: Infection Prevention, Medical Specialties, and Specialty Disposables. Infection Prevention This unit consists largely of single-use products for the preparation of surgical and vascular procedures. This includes their line of ChloraPrep single-use sterile applicators, IV infusion valves, and Chemo Safety System, which delivers chemotherapy drugs to patients without exposing healthcare personnel to the hazardous drugs. Medical Specialties CareFusion’s Medical Specialties business unit produces specialty medical devices, such as reusable surgical instruments and devices used in interventional care. They provide over 25,000 unique surgical instruments, as well as surgical instrument tracking and sterilization container systems. While most of these products are used in hospitals and clinics, the Medical Specialties unit also manufactures their PleurX drainage system, which is used in the home management of diseases and infections. Specialty Disposables 0 500 1000 1500 2000 2500 3000 3500 Figure 7: CF Medical Systems Revenue Growth Source: UOIG Spreads 0 500 1000 1500 2000 2500 Figure 8: CF Procedural Systems Revenue Growth Source: UOIG Spreads Figure 9: CF ChloraPrep Applicator Source: Google Images $Millions$Millions

- 5. December 5, 2014 UOIG 5 University of Oregon Investment Group The Specialty Disposables unit is organized around the marketing and manufacturing of respiratory consumable products that work with CareFusion’s range of ventilators, such as ventilator circuits and oxygen masks. In December 2013 CareFusion acquired Vital Signs, which manufactures single-use respiratory care and anesthesiology consumables. Industry Overview BD operates in the Medical Instrument & Supply Manufacturing industry. This industry researches, develops, and manufactures surgical, medical, dental, and veterinary products. With over 15,429 businesses in this industry, it is considered quite large. The company with the largest market share in this is Johnson & Johnson, with an 8.4% market share. BD has the third largest market share at 3.2%. Companies in this industry have moderate fixed capital expenses. A large variety of products are made in this industry for highly specialized applications, so not all products can be made on an automated manufacturing line. Skilled employees are needed to make many of these products, and these companies usually receive salaries that are above the average for the manufacturing sector. For every $1 spent on capital, approximately $0.17 is spent on wages for employees. Larger companies in this industry have a few advantages, one being economies of scale. They are able to significantly reduce the costs of the production of goods. Not only this, but their greater revenues allow them to spend more on research and development, which is critical in this industry. Larger companies are also able to use their large financial resources to acquire the smaller companies. The smaller companies are usually more innovative, so these acquisitions greatly benefit companies such as Johnson & Johnson and Becton, Dickinson & Co. If current trends continue, the industry will consolidate and the market shares of larger companies will grow. Growth potential for this industry is moderate. While the industry is mature and has many large, established companies, the possibilities of growth for companies such as BD are great due to the availability of small, innovative companies that can be acquired. Also, with the rate at which medical technology is advancing there is great potential for growth. Not only this, but there are many favorable macroeconomic factors that will assist in the growth of this industry. Macroeconomic Factors Aging Adult Population In the past few years, the percentage of the adult population aged 65 and older has increased significantly. This is mostly due to baby boomers (adults born between the years 1945 and 1964). The growth rate of this population over the last 5 years has been about 3.1%, compared to a growth rate of 0.8% between the years of 1995 and 2000. This growth rate is expected to increase to 3.3% between 2014 and 2019. This is due to the majority of baby boomers that still remain that have not crossed the 65 year threshold. In the US in 2019, senior adults (age 65 or over) are expected to make up approximately 16.4% of the population, compared to 14.5% currently. In most cases, as people age they require more medical care. This increase in medical Figure 10: % Change of People with Health Insurance Source: IBIS World %Change Figure 11: Healthcare Sector vs. Medical Instrument and Supply Manufacturing Industry Costs Source: IBIS World 0 1 2 3 4 5 1991 1996 2001 2006 2011 2016 Source: IBIS World Figure 12: % Change of Adults over the Age of 65 %ChangePercentage -4 -3 -2 -1 0 1 2 3 4 17.4 19.2 3 31.2 1.62.5 3 59 45.5 10.3 17.2 6.6 10.5 0 10 20 30 40 50 60 70 80 90 100 Average Costs of all Industries in Sector Industry Costs Other Rent & Utilities Marketing Depreciation Purchases Wages Profit

- 6. December 5, 2014 UOIG 6 University of Oregon Investment Group care will lead to an increase in demand for medical supplies. An increase in healthcare expenditure is one indicator of healthcare industry performance. Patient Protection and Affordable Care Act The passing of Patient Protection and Affordable Care act by President Obama and his administration has changed the US healthcare market, and will therefore affect BD. The goal of the PPACA is to increase the quality and affordability of health insurance by expanding private and public health insurance coverage. It requires all insurance companies to cover all people who apply for insurance within new standards. Not only this, but it requires insurance companies to offer the same rates regardless of pre-existing conditions or sex. One adverse effect that comes from the PPACA is the enactment of a 2.3% medical excise tax on sales of certain medical products within the US. In 2013 this tax was $40 million for BD. This tax could arguably stifle innovation and cut into research and development. Another adverse effect of the PPACA is that it reduces Medicaid and Medicare payments to hospitals, clinical laboratories, and pharmaceutical companies. This could reduce the amount of medical procedures performed, which, in turn, would reduce the demand for medical supplies. Finally, the PPACA could lower the reimbursement rates for BD’s products, therefore reducing sales. However, the PPACA will at the same time affect BD favorably through the expansion of healthcare. Healthcare expenditures will undoubtedly increase substantially, with an estimated 32 million people gaining healthcare by 2019. Even though there are possible adverse effects, as listed above, it can be expected that there will be a net benefit from the PPACA. Product Regulation The Medical Instrument and Supply Manufacturing industry is extremely regulated by the Food and Drug Administration (FDA) and other agencies. The approval of the sale of a product by the FDA takes at least 90 days, with the majority taking much longer than that. Any change to a device that has already been cleared must be refiled with the FDA. Even after a device is cleared, there is extensive product testing that occurs. There are many regulatory requirements, such as medical device reporting (MDR), Quality System Regulation (QSR), and labelling regulations. All of these are time-intensive and, if not passes, can result in a long delay of the product or a serious fine. While these regulations are substantial, they also lead to the securing of patents, because of how long it takes to get approved. Small firms with these patents are seen as lucrative acquisitions by larger companies because of the new and innovative products they can acquire. Globalization Expansion into international markets, especially emerging markets like China and South America, pose promising opportunities for companies in the healthcare industry. China, for example, is having an enormous boost in population and healthcare expansion. Companies such as BD will be competing to obtain market shares in these emerging markets because of their opportunities for growth. However, with expansion into global markets comes foreign currency exchange risk. BD conducts a large portion of its business outside the United States, and is therefore subject to this foreign currency exchange risk. While BD participates in hedging activities to reduce this risk, it will never completely remove these risks. Figure 13: The Patient Protection and Affordable Care Act Logo Source: Google Images Figure 14: % Change of Number of Physician Visits Source: IBIS World %Change Figure 15: FDA Logo Source: Google Images Figure 16: Industry Barriers to Entry Source: IBIS World Barriers to Entry Checklist Level Competition Medium Concentration Low Life Cycle Stage Mature Capital Intensity Medium Technology Change High Regulation & Policy Heavy Industry Assistance Medium -10 -5 0 5 10 15

- 7. December 5, 2014 UOIG 7 University of Oregon Investment Group Competition The Medical Instrument and Supply Manufacturing industry is considered moderately competitive. Because of the amount of government regulation on products and companies within the industry, competition can be limited. As stated before, the regulation by organizations like the FDA can be a significant barrier to entry. However, the industry is fueled by innovation, so every company is looking for how to improve and add to their line of products. Specialization is very important in the medical industry, so this allows smaller companies to compete. As stated before, these small companies are attractive targets of larger companies for buyouts. While this rapid technological innovation has its benefits, it also has some drawbacks. The constant change in technology means that any one company is at risk at becoming obsolete. Pricing power will become more important in the coming years, due to the price concessions that healthcare providers and governments are pushing for. Companies will need to cut costs and achieve economies of scale to be competitive. These companies will therefore most likely turn to outsourcing, increasing spending on acquisitions, and increasing research and development costs to develop proprietary technology. While there is a large amount of internal competition within the Medical Instrument and Supply Manufacturing industry, there is traditionally little external competition. However, this is changing with due to the advancements of the biotechnology industry. Treatments from the biotech industry, such as synthetic bone, organ, and tissue replacements can make some medical instruments and supplies obsolete. Technology advancements in this industry are therefore critical to the survival of a firm. Strategic Positioning Sales and Marketing BD’s current sales and marketing strategy is to focus on capitalizing on emerging markets such as China and India. Over the past few years China has made many steps to increase the accessibility of healthcare for its citizens. This creates a large opportunity for revenue growth for BD. To obtain positioning in this market and other emerging markets, BD has been increasing brand equity through customer-focused initiatives. When possible, BD partners with various organizations across the globe to volunteer in impoverished communities to raise awareness about diseases and strengthen healthcare. For example, in 2005 BD launched their Service Trip Program by collaborating with the Catholic Medical Mission Board in order to address and combat HIV/AIDS in Zambia. BD also sends products as well as employees to various countries to give their time and expertise in laboratories to treat diseases and improve health standards. The presence of BD in these emerging markets allows BD to leverage the trust it has gained in order increase revenues and capitalize on these markets. Customer Relationships BD prides itself in its customer relations. Therefore, BD markets its products in the US through independent distribution channels and directly to consumers through their independent sales representatives. Because of these independent distribution channels and sales representatives, BD is able to reduce order Figure 17: Industry Products and Services Segmentation Source: IBIS World Figure 18: Net Income vs. SG&A Expense Source: UOIG Spreads $Millions Figure 19: CMMB Logo Source: Google Images 0 500 1000 1500 2000 2500 3000 3500 4000 4500 5000 Net Income SG&A 23% 19% 15% 13% 11% 8% 6% 5% Orthopedic Instruments Surgical Instruments Diagnostic Apparatus Stents and Catheters Other Syringes and Hypodermic Needles Blood Transfusion and IV Equipment Dental Instruments

- 8. December 5, 2014 UOIG 8 University of Oregon Investment Group backlog significantly. It allows BD to receive and fill orders on a current basis. These independent channels are spread throughout their various geographic regions to reach their customers. This allows BD to cater to a customer’s needs more effectively by deciding what products need to be supplied where, or create new products to meet those needs. Also, none of BD’s customers account for more than 10% of BD’s revenues. This allows BD to change its products to fit a variety of groups, and benefits BD and its customer-focused strategy greatly. Operational Efficiency In recent years BD has implemented an operation strategy by the name of Project ReLoCo in order to cut costs. This project is a global, cross-functional business initiative that is designed to reduce manufacturing costs through the reduction of raw material costs and start-up costs. Management attributes the 80 bps growth of gross margin from 2012 to 2013 to the efforts of Project ReLoCo. BD management is also incorporating a Lean Six Sigma operation into their business. This operation aims to reduce manufacturing and operating costs by analyzing how products are made and how efficiencies might be increased. While the two above operations aim to cut costs and improve efficiency, the acquisition of CareFusion may prevent costs from being reduced because of the restructuring that will occur once deal is finalized. Also, CareFusion has a higher percentage of cost of goods sold as a portion of revenue than BD has, so this could affect BD’s costs in the near future. Research and Development As stated above, research and development is a key factor in the success of a company in the medical instrument and supply manufacturing industry. Rapid technological advancements in medical technology require firms to be on the forefront of product innovation. BD is focused on organic R&D spending in order to continually improve its current products and develop new ones to supplement those already existing. Management currently focuses a large portion of R&D spending on products that are successful in high growth markets in order to increase revenue growth. BD’s research and development is also spending resources on how to improve efficiency and cut costs of current operations. Acquisitions are also a very important of BD’s R&D strategy. By acquiring companies BD is able to expand its product offerings. Acquisitions are discussed in greater detail below. Business Growth Strategies Geographic Growth BD’s current strategy is to expand both internationally and domestically in all of its business segments. While in most recent years their focus has been on international expansion, the acquisition of CareFusion will increase their domestic revenues significantly. Emerging Markets Emerging markets have been a large focus of BD’s in the past due to the high growth rates of healthcare offerings in these markets. New legislation in countries such as China and Brazil that work to ensure healthcare worker safety helped growth rates in 2013, and will continue to improve growth rates. Many Figure 20: Gross Margin Growth Source: UOIG Spreads Figure 21: R&D Expense vs. Net Income Source: UOIG Spreads Figure 22: R&D Expense vs. EBITDA Source: UOIG Spreads $Millions$Millions 50% 51% 52% 53% 54% 55% 56% 57% 0 500 1000 1500 2000 2500 R&D Net Income 0 500 1000 1500 2000 2500 3000 3500 4000 4500 R&D EBITDA

- 9. December 5, 2014 UOIG 9 University of Oregon Investment Group emerging markets are focusing on improvements to healthcare safety and the reduction of healthcare related infections. The products that CareFusion’s Medical Segment offers will supplement BD’s current products and capitalize on the need for medical safety supplies in these emerging markets. As mentioned before, BD is increasing brand equity in these emerging markets through their philanthropic work. By supporting private and public sector partners and enhancing clinical expertise and training in laboratories and hospitals, BD is able to establish a strong customer base. BD has been operating in India and China since 1995, so they have a large amount of knowledge on public policy and the healthcare changes occurring in Asia currently. As of October 27, 2014 BD was ranked 10th on the EPA’s Fortune 500® Partners List. In countries such as China that are working to improve their environmental impact, having BD as a player in the market is beneficial to their image. United States The United States currently is responsible for the majority of BD’s sales. In the macroeconomics factors section above, the PPACA was discussed. This could ultimately be beneficial for revenue growth in the US due to the substantial increase in healthcare offerings. With over 32 million Americans expected to obtain healthcare by 2019, healthcare expenditures will almost certainly increase. However, with the medical device excise tax, reductions in Medicare and Medicaid payments to hospitals, and possible cuts to reimbursements of BD’s products, the PPACA could also cause significant adverse effects to revenue growth. BD’s acquisition of CareFusion, a US based company, should improve domestic growth rates. With almost 77% of its revenue generated from domestic sales, CareFusion could increase domestic revenues for BD’s Medical segment significantly. This acquisition will be discussed in greater detail in the acquisitions section. New Product Growth While BD has concentrated their focus away from a product-focused strategy to a customer-focused strategy in the past few years, R&D expenses have increased to further the development of innovative products. With their customer-focused strategy, BD needs to be able to cater to all customers’ needs, so they need a wide variety of products, especially those in emerging markets. Between 2015 and 2017 BD plans to release over 14 new products in the US and internationally in order to increase sales and provide a greater selection to its customer base. Through Q3 of 2014, new products have accounted for approximately 11% of revenues, while for the 2013 fiscal year new products only accounted for about 8% of revenue. This shows the effectiveness of BD’s R&D department and its innovating capabilities. BD’s acquisition of CareFusion will also introduce a large amount of new products into its offerings. More on this will be discussed in the acquisitions section. Organic Growth Funding for organic growth is planned to increase in the coming years. This is due to the Project ReLoCo and Lean Six Sigma strategies to cut costs across all business segments and increase operational efficiencies. BD continues to allocate more funding towards R&D to develop current product lines, such as the BD Max™ product line, which is one of BD Diagnostics’ revenue drivers. This past year alone 3 new products were released for the BD Max system. Figure 23: EPA Logo Source: Google Images Figure 24: CareFusion Corporation Logo Source: Google Images Figure 25: BD Max™ System Source: Google Images

- 10. December 5, 2014 UOIG 10 University of Oregon Investment Group Also, the expansion of distribution channels domestically and internationally is expected to increase organically in order expand BD’s customer base, as well as fulfill the needs of pre-existing customers. Acquisitions Being in the medical instrument and supply manufacturing industry, acquisitions are essential to being competitive because of the rapid technology advancements and the introduction of many new products every year. BD acquires companies that it believes can fill “gaps” in its operations by supplementing already existing products. For example, on March 11, 2013 BD acquired Cato Software Solutions (“Cato”). Cato provides a suite of medication safety solutions for IV medication preparation, as well as physician therapy planning and bedside documentation. This acquisition helped BD’s strategy by helping healthcare workers eliminate medication errors and streamline workflows. Additionally, it increases BD’s presence in the hospital pharmacy space. BD management says that no company is acquired unless it can deliver tangible and significant benefits to BD’s products that BD cannot do on its own otherwise. CareFusion Corporation On October 5, 2014 Becton, Dickinson & Co. announced that would acquire CareFusion Corporation. This acquisition was agreed on unanimously by the Boards of both companies. The deal states that CareFusion shareholders will receive approximately $49 in cash and .0777 of a share of BD for every share of CareFusion. The agreement is expected to close in the middle of 2015, with BD shareholders owning approximately 92% of the combined company and CareFusion shareholders owning approximately 8%. To finance the acquisition, BD acquired a loan of $9.1 billion from Goldman Sachs. CareFusion will add a variety of products that will complement BD’s through expansion in the medication management industry. This acquisition also aligns with BD’s new customer-focused strategy by increasing patient safety through CareFusion’s automated medication dispensing systems, IV infusion systems, and their patient preparation products. BD will also be able to provide CareFusion products to a wider customer base through expansion in emerging markets, such as China and Brazil. This will enhance emerging market growth opportunities. The combinations of the two companies’ product portfolios will help to increase efficiencies and reduce safety issues in hospitals and hospital pharmacies. BD will attempt to mitigate restructuring costs through a detailed execution plan that they have in place to ensure a seamless integration. Upon the closing of the acquisition, CareFusion will be integrated in to BD’s Medical segment. The cost of producing goods sold may increase marginally due to CareFusion having a larger percentage cost of goods sold that make up their revenue than BD. However, BD management maintains that gross margins will stay approximately the same. Also, CareFusion management maintains its financial guidance of 5 to 7 percent for the 2015 fiscal year, while BD maintains its guidance of 4 to 5 percent. While BD wants to expand CareFusion’s products to emerging markets, management has stated they are committed to maintaining a presence in San Diego, CA, the headquarters location of CareFusion. This will allow for increased revenue growth in the US, which in most recent years has been secondary to revenue growth in emerging markets. However, BD will be Figure 26: Cato Software Solutions Source: Google Images Figure 27: CareFusion Alaris® with Guardrails® System Source: Google Images Source: carefusion.com Figure 28: CareFusion Genesis® Sterilization Containers

- 11. December 5, 2014 UOIG 11 University of Oregon Investment Group focusing on the expansion of CareFusion’s product offerings in emerging markets. Management and Employee Relations Vincent A. Forlenza—Chairman, Chief Executive Officer, and President Vincent Forlenza has been a part of BD since 1980. On January 1, 2009 he was appointed President, and on October 1, 2011 was appointed Chief Executive Officer. Mr. Forlenza was named Chairman on July 1, 2012, and has held the position since. Prior to these positions, Mr. Forlenza was the Chief Operating Officer of BD and has extensive experience with the BD Biosciences and BD Diagnostics segments. He was also formerly the Chairman of AdvaMed Dx at AdvaMed. Mr. Forlenza holds a Bachelor’s Degree in Chemical Engineering from Lehigh University, as well as an MBA from the Wharton School of the University of Pennsylvania. Christopher R. Reidy—Chief Financial Officer and Executive Vice President of Administration Christopher R. Reidy has been the Executive Vice President of Administration and Chief Financial Officer since July 15, 2013. Prior to being at BD, Mr. Reidy served as the Chief Financial Officer and Corporate Vice President of Automatic Data Processing Inc. (ADP) from October 2, 2006 to November 5, 2012. Mr. Reidy also served as the Chief Financial Officer at the National Basketball Association. He holds a BS in Accounting from St. Francis College, as well as a MBA from Harvard University. William A. Kozy—Chief Operating Officer and Executive Vice President William Kozy has been an Executive Vice President since June 2006, and was appointed Chief Operating Officer in November of 2012. Mr. Kozy previously served as the President of BD Diagnostics from November 2003 to June 2006. He has been with BD since 1974 when he took on a sales job. He has a BA in English from Kenyon College in Ohio. Gary M. Cohen—Executive Vice President Gary Cohen has been an Executive Vice President of BD since 2006. Prior to his position as Executive Vice President, Mr. Cohen has held various capacities at BD. He served as the President of BD Medical from May 1999 to June 2006. Mr. Cohen also served as the Chairman of the Center for Disease Control and Prevention Foundation from 2010 to 2014. He holds a BA and MBA from Rutgers University. Management Guidance Management provides guidance on EPS, revenues, and net income for the fiscal year of 2014 for their three business segments. The revenue model below is in line with their management guidance for coming year. Q3 of 2014 was in line with management guidance from Q2. Management expects that for the fiscal year of 2014 there will be an estimated revenue growth between 4 and 5 percent, and attain this growth by the end of the fiscal year. Guidance also expects an EPS between $6.12 and $6.22 for 2014, which represents a growth of between 6 and 7 percent from 2013. At the beginning of the fiscal year, management announced guidance for revenue growth for BD Medical, BD Diagnostics, and Figure 29: BD Headquarters Source: bd.com Figure 30: BD Management Compensation vs. Revenue $10,700.00 $10,800.00 $10,900.00 $11,000.00 $11,100.00 $11,200.00 $11,300.00 $11,400.00 $11,500.00 $11,600.00 $11,700.00 $0.00 $1,000,000.00 $2,000,000.00 $3,000,000.00 $4,000,000.00 $5,000,000.00 $6,000,000.00 $7,000,000.00 $8,000,000.00 $9,000,000.00 $10,000,000.00 2011 2012 2013 V. Forlenza C. Reidy W. Kozy G. Cohen Revenues ($ Millions) Source: bd.com $2,500.00 $2,600.00 $2,700.00 $2,800.00 $2,900.00 $3,000.00 $3,100.00 $3,200.00 $3,300.00 $3,400.00 $0.00 $1,000,000.00 $2,000,000.00 $3,000,000.00 $4,000,000.00 $5,000,000.00 $6,000,000.00 $7,000,000.00 $8,000,000.00 $9,000,000.00 $10,000,000.00 2011 2012 2013 V. Forlenza C. Reidy W. Kozy G. Cohen EBITDA ($ Millions) Source: bd.com Figure 31: BD Management Compensation vs. EBITDA Source: Google Images

- 12. December 5, 2014 UOIG 12 University of Oregon Investment Group BD Biosciences to be 5.5 to 6 percent, 3 to 3.5 percent, and 4 to 5 percent, respectively. For the year-to-date, all segments are in line with their guidance. It should be noted that, historically, management has not given beatable guidance. Actual growth percentages usually fall in line with the guidance that management gives at the beginning of the fiscal year. Portfolio Strategy Becton, Dickinson & Co. is currently held by the Investment Group in both the Svigals’ and Tall Firs Portfolios. As of November 26, 2014 BD represented 3.20% of the Svigals’ Portfolio and 3.29% of the Tall Firs Portfolio. With its consistent revenues and dividends, BD is a strong value play, and is therefore a great company to hold in both the Tall Firs (value tilt) and Svigals’ (value/growth blend) Portfolios. Additionally, Tall Firs is underweight in large- cap stocks. Since purchase, BD has earned a 251.8% return on investment in the Tall Firs Portfolio and 93.03% return on investment in the Svigals’ Portfolio. Recent News “Becton Dickinson & Co Files SEC form 10-K, Annual Report” Edgar Online—November 26, 2014 BD filed their 10-K with the SEC on November 26, 2014. EPS, net income, and revenue growth all met management expectations. CEO Vince Forlenza gave guidance for the 2015 fiscal year, with EPS having a growth rate between 8 and 9 percent and revenues having an estimated growth between 4.5 and 5 percent. The announcement of the results in the 10-K caused a spike in the stock price on the NYSE, going from a closing price of $134.73 the day prior to a closing price of $136.79. “BD Board Declares Dividend” PR Newswire—November 25, 2014 The Board of Directors of Becton, Dickinson & Co. announced that for the fourth quarter of 2014 is $0.60 per share, which is an increase of about 10% from the previous quarter. Shareholders will receive the dividend on December 31, 2014. Management has set a guidance of $2.40 per share for fiscal year 2015. This announcement caused an increase in stock price, from $131.11 on November 24 to $134.73 on November 25. “Becton Dickinson to acquire CareFusion for $12.2 billion in cash, stock” Reuters—October 5, 2014 BD and CareFusion agreed upon the acquisition of CareFusion by BD for $12.2 billion in cash and stock. Goldman Sachs approved BD for a $9.1 billion loan to finance the acquisition. BD also announces that, within the first full year of the acquisition, they will experience double-digit earnings growth. The deal is expected to close around Q2 of fiscal year 2015. More details on the acquisition are included in the acquisitions section. The announcement of the deal caused a stock price jump from $115.84 to $124.98. Figure 32: BD Three Month Stock Price $100.00 $105.00 $110.00 $115.00 $120.00 $125.00 $130.00 $135.00 $140.00 $145.00 Source: Yahoo Finance Figure 33: BD Dividends per Quarter Figure 34: Goldman Sachs Group Inc. Logo Source: BD 10-K Source: Google Images $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 First Quarter Second Quarter Third Quarter Fourth Quarter 2012 2013 2014 Source: Yahoo Finance

- 13. December 5, 2014 UOIG 13 University of Oregon Investment Group Catalysts Upside The large acquisition of CareFusion Corporation will increase revenues and positioning in the medication management industry significantly, as well as supplement BD’s current products. The PPACA will benefit BD through the expansion of healthcare offerings in the US, which will increase the amount of people with health insurance, hospital and clinic visits, as well as total health expenditure, which will boost BD sales. The rapid growth in the adult population age 65 and over will increase demand for BD product, since this population, on average, requires more medical care. Strategies to cut costs in the manufacturing of products and increased focus on research and development will increase organic growth. Downside There is strong competition in the Medical Instrument and Supply Manufacturing industry, such as Johnson & Johnson and Baxter International. Reduced reimbursements of BD’s products, the medical device excise tax, as well as reductions in payments from Medicare and Medicaid to hospitals from the PPACA could adversely affect BD’s sales. The rapid advancements in medical technology could make some of BD’s products obsolete if planned acquisitions and R&D developments do not benefit the company as expected. Because of its international operations, BD is subject to foreign currency exchange fluctuations and local economic factors, which could adversely affect sales. Comparable Analysis Comparable companies were screened for estimated growth rates for EPS, beta, D/E, as well as gross profit margins. Other metrics considered were industry, sector, company size, market capitalization, and headquarter location. All comparable companies, except for Covidien Plc are based in the United States. Projected revenue growth for the comparable companies is very similar to that of BDX, and is a good indicator of performance. Finally, companies were also screened for their product offerings and exposure to international markets. Initially, 10 large market capitalization companies in the Healthcare sector were considered. This was reduced to 5 after using the metrics mentioned above. The comparable analyses are below. Boston Scientific Corporation (BSX)—35% Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. The company operates in three segments: Cardiovascular, Rhythm Management, and MedSurg. It offers interventional cardiology products, stents, balloon catheters, as well as cardiac rhythm management devices.—Yahoo Finance Boston Scientific Corporation was chosen because it has the closest revenue growth than any of the other companies, its net margin was very close to BD’s, Johnson & Johnson 8.40% Stryker 4.90% Becton, Dickinson & Co. 3.20% Baxter International 2.10% Boston Scientific Corp. 1.90% Covidien PLC 1.30% Other 78.20% Figure 36: Estimated Industry Market Share Source: IBIS World Figure 37: Boston Scientific Corporation Logo Source: Google Images Figure 35: BD Vacutainer™ Tubes Source: bd.com

- 14. December 5, 2014 UOIG 14 University of Oregon Investment Group and it had a very similar debt to equity ratio. Not only this, but it has a very close EV/EBITDA ratio, which is a good indicator of cash flow. It was weighted higher than Covidien Plc because, while Covidien has similar metrics to both Boston Scientific Corporation and BD, Boston Scientific Corporation is has a greater market share in the Medical Instrument and Supply Manufacturing Industry. Covidien Plc (COV)—25% Covidien plc develops, manufactures, and sells healthcare products for use in clinical and home settings worldwide, and markets its products through a direct sales force and third-party distributors. The company operates through Medical Devices and U.S. Medical Supplies segments. It sells advanced surgical solutions, general surgical solutions, and access and delivery products to support procedures.—Yahoo Finance Covidien Plc showed very similar revenue growth rates to that of BD. Their gross margins are also similar, as well as their betas. However, it was announced in mid-2014 that Covidien would be acquired by medical device manufacturer Medtronic Inc. Therefore, this acquisition, combined with the fact that it has a lower market share in the industry than Boston Scientific Corporation, is the reason it was weighted lower. Thermo Fisher Scientific, Inc. (TMO)—15% Thermo Fisher Scientific Inc. provides analytical instruments, equipment, reagents and consumables, software, and services for research, manufacturing, analysis, discovery, and diagnostics in the United States and internationally. It operates in three segments: Analytical Technologies; Specialty Diagnostics; and Laboratory Products and Services. It serves pharmaceutical, biotechnology, academic, government, environmental, and other research and industrial markets.—Yahoo Finance Thermo Fisher Scientific Inc. was chosen as a comparable company because of its similar gross margin, expected revenue growth, and EBITDA margin. It also operates in the same industry as BD. However, its market capitalization and enterprise value are much larger than BD’s, and its beta is a good deal higher than BD’s. CR Bard Inc. (BCR)—15% C. R. Bard, Inc. designs, manufactures, packages, distributes, and sells medical, surgical, diagnostic, and patient care devices worldwide. It offers vascular products, urology products, surgical specialty products, as well as catheter stabilization devices. It sells its products directly to hospitals, individual healthcare professionals, extended care facilities, and alternate site facilities.— Yahoo Finance. CR Bard Inc. has similar estimated sales growth rates to BD for 2014-2016. Net margin, as well as gross margin, were similar, indicating similar cost structures. However, it has significantly a smaller market capitalization and enterprise value than BD, hence the lower weighting. Baxter International, Inc. (BAX)—10% Baxter International Inc. manufactures, develops, and markets products for people with hemophilia, immune disorders, infectious diseases, kidney diseases, trauma, and other chronic and acute medical conditions. Baxter International is organized into two business segments: Medical Products and Bioscience. It sells its products through its direct sales force, independent distributors, drug Figure 38: Covidien Plc Logo Source: Google Images Figure 39: Thermo Fisher Scientific, Inc. Logo Source: Google Images Figure 40: CR Bard Inc. Logo Source: Google Images

- 15. December 5, 2014 UOIG 15 University of Oregon Investment Group wholesalers, and specialty pharmacies or other alternate site providers to hospitals. It operates domestically and internationally.—Yahoo Finance Baxter International, Inc. has a very similar business model as BD. Two of BD’s business segments are even the same as Baxter’s. However, estimated revenue and EPS growth between 2014 and 2016 differ between the companies. BD also has a higher gross margin than Baxter International. Even though it is a direct competitor to BD, Baxter International is weighted the lowest due to the reasons stated above. Discounted Cash Flow Analysis The discounted cash flow analysis of BD was took into account both BD’s historical financial data and CareFusion’s. This is because the acquisition of CareFusion is so large that will have a significant impact on future performance. Therefore, all historical data was combined in their respective categories, and then forecasted together. A percentage of revenue method was used to predict future financial data. Management guidance, industry expectations, historical trends, and analyst expectations for both companies was taken into account when forecasting data. In the final price target, the discounted cash flow analysis was weighted higher than the comparable analysis because the discounted cash flow analysis will be a better representative of future performance than the comparable analysis. Revenue Model The revenue model was created by breaking out both companies into their respective business segments and, if applicable, then the segments’ smaller organizational units. Financial data from 2009 until 2013 (2014 for CareFusion because their fiscal year ended June 30) was used, and then projected out until 2023, which was the terminal year for analysis. Factors that influenced BD revenue growth rates were the aging adult population, increases in healthcare expenditures, planned new product releases, and synergies created through the acquisition of CareFusion. CareFusion revenue growth rates were affected by management guidance and historical trends. Once both companies were forecasted out individually, their historical and projected revenues were combined into one revenue model, to show how CareFusion will increase BD’s revenues substantially, and how the combined company’s sales will trend in the future. Beta Beta was calculated using a variety of methods. First, the 1, 3, and 5 year daily betas were calculated for both BD and CareFusion by regressing their historical stock prices against those of the S&P 500. The 3 and 5 year weekly betas were then calculated for both companies. Weighted betas for the 1, 3, and 5 year daily and 3 and 5 year weekly were then calculated by weighting a companies’ beta according to its market capitalization size. Vasicek and Hamada betas were calculated using both a blend of comparable companies and an ETF specific to the Medical Instrument and Supply Manufacturing Industry. The Vasicek and Hamada betas were weighted higher than the 1 year and 3 year daily weighted mix betas because of the large change that is occurring through the acquisition of CareFusion by BD. These betas were also used because of consolidation within the industry, and BD will move Figure 41: CR Bard Inc. Logo Source: Google Images Figure 42: Projected Revenues Through 2023 Source: UOIG Spreads $Millions Figure 43: Beta Source: UOIG Spreads Beta SE Weighting 1 Year Daily-BDX 0.79 0.08 0.00% 3 Year Daily-BDX 0.75 0.03 0.00% 5 Year Daily-BDX 0.71 0.02 0.00% 3 Year Weekly-BDX 0.72 0.08 0.00% 5 Year Weekly-BDX 0.66 0.05 0.00% 1 Year Daily-CFN 0.82 0.16 0.00% 3 Year Daily-CFN 0.84 0.06 0.00% 5 Year Daily-CFN 0.88 0.04 0.00% 3 Year Weekly-CFN 0.58 0.16 0.00% 5 Year Weekly-CFN 0.70 0.09 0.00% 1 Year Daily-Weighted Mix 0.80 10.00% 3 Year Daily-Weighted Mix 0.78 10.00% 5 Year Daily-Weighted Mix 0.76 0.00% 3 Year Weekly-Weighted Mix 0.68 0.00% 5 Year Weekly-Weighted Mix 0.67 0.00% 3 Year Daily Vasicek - Comps 0.81 20.00% 3 Year Daily Vasicek - ETF 1.04 20.00% 3 year Daily Hamada - Comps 0.87 20.00% 3 Year Daily Hamada - ETF 1.18 20.00% Becton, Dickinson & Co. Beta 0.94 $- $2,000.00 $4,000.00 $6,000.00 $8,000.00 $10,000.00 $12,000.00 $14,000.00 $16,000.00 $18,000.00

- 16. December 5, 2014 UOIG 16 University of Oregon Investment Group toward the industry average over time. Also, the weighted mix betas were used instead of the individual betas of the companies because they will be better indicators of future performance. After assigning weightings to each of the betas, a final beta of .94 was reached. Cost of Goods Sold The cost of goods sold was projected for the combined company. Cost of goods sold as a percentage of revenue was projected to decrease because of BD’s Project ReLoCo and Lean Six Sigma projects. These two projects will drive down the cost of manufacturing goods and increase efficiencies. Selling, General and Administrative Growth in Selling, General and Administrative is due to increases in rent payments, salary expenditure, and other payments for operations. In 2013 SG&A was higher due to an unfavorable litigation against BD that resulted in a $341 million charge. SG&A projections were based off historical percentages of revenue, and are predicted to gradually increase. Research and Development Research and Development is projected to increase as a percentage of revenue going through 2023. R&D is critical to the success of firms like BD, so as BD continues their cost cutting strategies into the future, some of the savings will be directed towards research and development. Depreciation and Amortization Depreciation and Amortization was projected to increase as a percentage of Net PP&E Beginning through the terminal year. This is because of plans to continue expanding operations into emerging markets, as well as a continued strategy of small acquisitions to fill “gaps” in BD’s product line. Historical data for both BD and CareFusion were combined and projected into the terminal year together. Net Working Capital Projections for Net Working Capital were primarily based off of historical trends. Both companies’ historical data were added together and then projected together. They were projected forward as a percentage of revenue. Capital Expenditures Capital Expenditures, like Net Working Capital, were also projected using a percentage of revenue method. Both BD’s and CareFusion’s historical data was combined, and then the combined company’s Capital Expenditures were projected. Projection growth rates increase year to year because of the expectations to expand operations, therefore increasing capital expenditures. Cost of Debt Cost of Debt was calculated by combining both BD’s debt and CareFusion’s debt together. This is because, after the merger, BD will take on all of CareFusion’s short term and long term debt. Also, BD’s loan of $9.1 billion from Goldman Sachs was factored into Cost of Debt because of its significant value. The resulting Cost of Debt is 3.8% Tax Rate The tax rate calculated was for the combined company through the terminal year. It was based off both BD’s and CareFusion’s historical tax rates. Also, Figure 45: Beta Sensitivity Table Source: UOIG Spreads Figure 46: Beta Sensitivity Table ImpliedPrice Undervalued/(Overvalued) Terminal Growth Rate Terminal Growth Rate 158 2.0% 2.5% 3.0% 3.5% 4.0% 0.74 156.30 183.96 221.79 276.65 363.39 0.84 134.77 156.70 185.72 225.93 285.37 0.94 116.83 134.54 157.38 187.92 230.85 1.04 101.64 116.18 134.52 158.36 190.60 1.14 88.62 100.72 115.70 134.72 159.67 AdjustedBeta Undervalued/(Overvalued) Terminal Growth Rate 0 2.00% 2.50% 3.00% 3.50% 4.00% 0.74 10.80% 30.41% 57.23% 96.12% 157.61% 0.84 (4.46%) 11.09% 31.66% 60.17% 102.30% 0.94 (17.18%) (4.62%) 11.57% 33.22% 63.65% 1.04 (27.95%) (17.64%) (4.64%) 12.26% 35.12% 1.14 (37.18%) (28.60%) (17.98%) (4.50%) 13.19% AdjustedBeta Figure 44: Cost of Goods Sold Source: UOIG Spreads Source: UOIG Spreads 42.80% 43.00% 43.20% 43.40% 43.60% 43.80% 44.00% 44.20% 44.40% 44.60%

- 17. December 5, 2014 UOIG 17 University of Oregon Investment Group tax rates of comparable companies were taken into account. As mentioned previously, a 2.3% medical device excise tax was enacted on January 1, 2013. However, this tax was factored into operating expenses and was not factored into the effective tax rate. An effective tax rate of 21.63% was calculated for the terminal year. Recommendation I recommend a hold for both the Tall Firs Portfolio and the Svigals’ Portfolio. The acquisition of CareFusion will increase BD’s sales significantly through CareFusion’s complementary product line. Not only this, but BD will be able to offer CareFusion’s products to a larger customer base through their independent distribution channels in emerging markets. Additionally, BD’s development of their already superior products, their effort to strengthen their brand equity, and their ability to cut costs through economies of scale will bolster organic growth. With an undervaluation of 17.66%, Becton, Dickinson & Co. is a strong hold for both portfolios.Source: UOIG Spreads Method: Price Objective Weighting DCF Analysis $158.17 60% Comparable Analysis $177.68 40% Price Target $165.97 Current Price $141.06 Undervalued 17.66% Final Price Target Figure 47: Final Implied Price

- 18. UOIG 18 December 5, 2014University of Oregon Investment Group Appendix 1 – Relative Valuation Comparables Analysis BDX BSX COV TMO BCR BAX ($ in millions) Becton, Dickinson & Co. Boston Scientific Corporation Covidien Plc Thermo Fisher Scientific, Inc. CR Bard Inc. Baxter International Stock Characteristics Max Min Median Weight Avg. 35.00% 25.00% 15.00% 15.00% 10.00% Current Price $171.27 $12.94 $115.31 $33.03 $141.06 $12.94 $101.62 $129.00 $171.27 $73.44 Beta 1.19 0.76 0.96 1.03 0.94 1.17 0.99 1.19 0.79 0.76 Size Short-TermDebt 3,088.00 - 300.00 755.20 208.00 3.00 1,007.00 3,088.00 - 392.00 Long-TermDebt 14,856.00 1,403.00 6,562.50 5,303.90 14,856.00 4,249.00 4,042.00 11,388.00 1,403.00 8,876.00 Cash and Cash Equivalent 4,380.00 246.00 1,100.00 828.30 4,380.00 246.00 1,228.00 544.00 972.00 2,078.00 Non-Controlling Interest - - - - - - - - - - Preferred Stock - - - - - - - - - - Diluted Basic Shares 1,326.00 75.00 426.00 702.55 192.00 1,326.00 452.00 400.00 75.00 542.00 Market Capitalization 51,600.00 12,845.25 33,444.00 31,135.75 27,083.52 17,158.44 45,932.24 51,600.00 12,845.25 39,804.48 Enterprise Value 65,532.00 13,276.25 42,381.00 36,366.55 37,767.52 21,164.44 49,753.24 65,532.00 13,276.25 46,994.48 Growth Expectations % Revenue Growth 2015E 3.83% .39% 0.04 3.37% 3.41% 3.77% 3.52% 3.71% 3.83% .39% % Revenue Growth 2016E 4.59% 3.75% 0.04 4.10% 4.12% 3.97% 4.26% 3.91% 4.59% 3.75% % EBITDA Growth 2015E 8.91% (9.09%) 0.05 5.60% (9.09%) 7.67% 3.72% 8.91% 5.51% (1.78%) % EBITDA Growth 2016E 7.46% 4.92% 0.06 6.35% 4.92% 6.34% 5.73% 7.46% 6.19% 6.54% % EPS Growth 2015E 11.58% (3.89%) 0.09 7.46% 9.01% 9.64% 4.58% 11.58% 10.63% (3.89%) % EPS Growth 2016E 10.99% 5.12% 0.09 9.98% 5.12% 10.99% 9.22% 10.77% 9.40% 8.10% Profitability Margins Gross Margin 70.41% 48.89% 0.59 61.17% 59.06% 70.41% 59.58% 48.89% 61.71% 50.43% EBIT Margin 24.52% 14.23% 0.22 19.78% 20.21% 14.23% 22.81% 22.00% 24.52% 21.17% EBITDA Margin 29.59% 23.75% 0.27 26.10% 26.65% 23.75% 28.24% 24.33% 29.59% 26.39% Net Margin 17.76% 15.03% 0.16 16.39% 15.84% 15.03% 17.76% 16.58% 17.33% 16.07% Credit Metrics Interest Expense $433.00 $45.00 211.50 $215.05 $232.00 $219.00 $204.00 $433.00 $45.00 $157.00 Debt/EV 0.40 0.10 0.20 0.16 0.40 0.20 0.10 0.22 0.11 0.20 Leverage Ratio 4.57 1.43 2.27 2.22 4.57 2.42 1.68 3.54 1.43 2.12 Interest Coverage Ratio 27.87 8.03 14.49 13.97 14.22 8.03 14.75 9.43 21.78 27.87 Operating Results Revenue $16,787.00 $3,312.00 11,519.00 $9,929.25 $12,379.00 $7,405.00 $10,659.00 $16,787.00 $3,312.00 $16,579.00 Gross Profit $8,360.00 $2,044.00 6,831.00 $5,786.45 $7,311.00 $5,214.00 $6,351.00 $8,208.00 $2,044.00 $8,360.00 EBIT $3,693.00 $812.00 2,466.50 $2,003.40 $2,502.00 $1,054.00 $2,431.00 $3,693.00 $812.00 $3,510.00 EBITDA $4,376.00 $980.00 3,154.50 $2,565.35 $3,299.00 $1,759.00 $3,010.00 $4,084.00 $980.00 $4,376.00 Net Income $2,783.00 $574.00 1,926.86 $1,632.85 $1,960.72 $1,113.00 $1,893.00 $2,783.00 $574.00 $2,665.00 Capital Expenditures $1,810.00 $96.00 405.00 $450.05 $674.00 $267.00 $397.00 $413.00 $96.00 $1,810.00 Multiples EV/Revenue 4.67x 2.83x 3.48x 3.64x 3.05x 2.86x 4.67x 3.90x 4.01x 2.83x EV/Gross Profit 7.98 4.06 6.06 6.11 5.17 4.06 7.83 7.98 6.50 5.62 EV/EBIT 20.47 13.39 17.05 18.60 15.09 20.08 20.47 17.74 16.35 13.39 EV/EBITDA 16.53 10.74 12.79 13.86 11.45 12.03 16.53 16.05 13.55 10.74 EV/(EBITDA-Capex) 19.04 14.19 16.43 16.49 14.39 14.19 19.04 17.85 15.02 18.31 Market Cap/Net Income = P/E 24.26 13.81 16.98 19.09 13.81 15.42 24.26 18.54 22.38 14.94 Multiple Implied Price Weight EV/Revenue 178.88 15.00% EV/Gross Profit 177.13 20.00% EV/EBIT 186.71 15.00% EV/EBITDA 182.44 20.00% EV/(EBITDA-Capex) 169.76 30.00% Market Cap/Net Income = P/E 194.98 0.00% Price Target $177.68 Current Price 141.06 Undervalued 25.96%

- 19. UOIG 19 December 5, 2014University of Oregon Investment Group Appendix 2 – Discounted Cash Flows Valuation DiscountedCash FlowAnalysis Q1 Q2 Q3 Q4 ($ in millions) 2009A 2010A 2011A 2012A 2013A 12/31/2013A 03/31/2014A 06/30/2014A 09/30/2014E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E Total Revenue $10,066.00 $10,502.00 $11,023.00 $11,306.00 $11,604.00 $2,937.00 $3,039.00 $3,279.00 $3,124.00 $12,379.00 $12,800.59 $13,327.48 $13,865.51 $14,412.36 $14,958.39 $15,494.61 $16,022.46 $16,538.32 $17,038.35 % YoY Growth .97% 4.33% 4.96% 2.57% 2.64% 6.05% 3.55% 5.07% 4.81% 6.68% 3.41% 4.12% 4.04% 3.94% 3.79% 3.58% 3.41% 3.22% 3.02% Cost of Goods Sold 4517.00 4456.00 4123.00 4840.00 4307.00 1201.00 1202.00 1285.00 1380.00 $5,068.00 $5,677.06 $5,872.09 $6,080.03 $6,302.53 $6,529.34 $6,743.25 $6,961.76 $7,175.98 $7,384.42 % Revenue 44.87% 42.43% 37.40% 42.81% 37.12% 40.89% 39.55% 39.19% 44.17% 40.94% 44.35% 44.06% 43.85% 43.73% 43.65% 43.52% 43.45% 43.39% 43.34% Gross Profit $5,549.00 $6,046.00 $6,900.00 $6,466.00 $7,297.00 $1,736.00 $1,837.00 $1,994.00 $1,744.00 $7,311.00 $7,123.53 $7,455.39 $7,785.49 $8,109.84 $8,429.06 $8,751.36 $9,060.70 $9,362.34 $9,653.93 Gross Margin 55.13% 57.57% 62.60% 57.19% 62.88% 59.11% 60.45% 60.81% 55.83% 59.06% 55.65% 55.94% 56.15% 56.27% 56.35% 56.48% 56.55% 56.61% 56.66% Selling General and Administrative Expense 2736.00 2781.00 2891.00 2956.00 3402.00 788.00 789.00 826.00 826.00 3,229.00 3,360.16 3,507.79 3,653.56 3,801.98 3,952.01 4,098.32 4,241.15 4,381.00 4,516.87 % Revenue 27.18% 26.48% 26.23% 26.15% 29.32% 26.83% 25.96% 25.19% 26.44% 26.08% 26.25% 26.32% 26.35% 26.38% 26.42% 26.45% 26.47% 26.49% 26.51% Depreciation and Amortization 659.00 658.00 680.00 709.00 730.00 235.00 183.00 195.00 184.00 797.00 $805.88 $863.32 $920.11 $977.73 $1,036.24 $1,095.81 $1,155.53 $1,216.12 $1,276.20 % PP&E Beginning 19.60% 18.58% 18.58% 18.98% 18.79% 5.96% 4.63% 4.88% 4.49% 19.45% 19.67% 19.72% 19.77% 19.83% 19.88% 19.94% 19.98% 20.03% 20.07% Research and Development 565.00 571.00 616.00 636.00 686.00 173.00 194.00 184.00 189.00 740.00 725.79 761.00 802.81 843.12 879.55 915.73 951.73 988.99 1,024.00 % Revenue 5.61% 5.44% 5.59% 5.63% 5.91% 5.89% 6.38% 5.61% 6.05% 5.98% 5.67% 5.71% 5.79% 5.85% 5.88% 5.91% 5.94% 5.98% 6.01% Other Expense 72.00 3.00 51.00 33.00 59.00 10.00 8.00 8.00 17.00 43.00 38.40 39.98 41.60 43.24 44.88 46.48 48.07 49.61 51.12 % Revenue .72% .03% .46% .29% .51% .34% .26% .24% .54% .35% .30% .30% .30% .30% .30% .30% .30% .30% .30% Earnings Before Interest & Taxes $1,517.00 $2,033.00 $2,662.00 $2,132.00 $2,420.00 $530.00 $663.00 $781.00 $528.00 $2,502.00 $2,193.30 $2,283.30 $2,367.40 $2,443.77 $2,516.38 $2,595.00 $2,664.23 $2,726.61 $2,785.75 % Revenue 15.07% 19.36% 24.15% 18.86% 20.85% 18.05% 21.82% 23.82% 16.90% 20.21% 17.13% 17.13% 17.07% 16.96% 16.82% 16.75% 16.63% 16.49% 16.35% Interest Expense 141.00 156.00 163.00 222.00 214.00 55.00 60.00 53.00 64.00 232.00 256.01 259.89 249.58 252.22 254.29 255.66 256.36 256.34 255.58 % Revenue 1.40% 1.49% 1.48% 1.96% 1.84% 1.87% 1.97% 1.62% 2.05% 1.87% 2.00% 1.95% 1.80% 1.75% 1.70% 1.65% 1.60% 1.55% 1.50% Interest (Income) (33.00) (35.00) (43.00) (50.00) (40.00) (14.00) (10.00) (12.00) (10.00) (46.00) (44.80) (46.65) (48.53) (50.44) (52.35) (54.23) (56.08) (57.88) (59.63) % Revenue (.33%) (.33%) (.39%) (.44%) (.34%) (.48%) (.33%) (.37%) (.32%) (.37%) (.35%) (.35%) (.35%) (.35%) (.35%) (.35%) (.35%) (.35%) (.35%) Earnings Before Taxes 1,409.00 1,912.00 2,542.00 1,960.00 2,246.00 489.00 613.00 740.00 474.00 2,316.00 1,982.09 2,070.06 2,166.35 2,241.99 2,314.44 2,393.57 2,463.95 2,528.15 2,589.81 % Revenue 14.00% 18.21% 23.06% 17.34% 19.36% 16.65% 20.17% 22.57% 15.17% 18.71% 15.48% 15.53% 15.62% 15.56% 15.47% 15.45% 15.38% 15.29% 15.20% Less Taxes (Benefits) 464.00 577.00 543.00 489.00 390.00 122.00 106.00 123.00 98.00 449.00 436.06 454.58 474.86 490.32 505.24 521.56 535.66 548.36 560.18 TaxRate 32.93% 30.18% 21.36% 24.95% 17.36% 24.95% 17.29% 16.62% 20.68% 19.39% 22.00% 21.96% 21.92% 21.87% 21.83% 21.79% 21.74% 21.69% 21.63% Loss fromdiscontinued operations (342.00) (226.00) (23.00) (70.00) (359.00) - - - (93.72) (93.72) (128.01) (133.27) (138.66) (144.12) (149.58) (154.95) (160.22) (165.38) (170.38) % Revenue (3.40%) (2.15%) (.21%) (.62%) (3.09%) 0.00% 0.00% 0.00% (3.00%) (.76%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) (1.00%) Net Income $1,287.00 $1,561.00 $2,022.00 $1,541.00 $2,215.00 $367.00 $507.00 $617.00 $469.72 $1,960.72 $1,674.04 $1,748.75 $1,830.14 $1,895.79 $1,958.78 $2,026.96 $2,088.51 $2,145.18 $2,200.01 Net Margin 12.79% 14.86% 18.34% 13.63% 19.09% 12.50% 16.68% 18.82% 15.04% 15.84% 13.08% 13.12% 13.20% 13.15% 13.09% 13.08% 13.03% 12.97% 12.91% Add Back: Depreciation and Amortization 659.00 658.00 680.00 709.00 730.00 235.00 183.00 195.00 184.00 797.00 805.88 863.32 920.11 977.73 1,036.24 1,095.81 1,155.53 1,216.12 1,276.20 Add Back: Interest Expense*(1-TaxRate) 94.57 108.92 128.18 166.61 176.84 41.28 49.62 44.19 50.77 187.02 199.69 202.81 194.87 197.06 198.78 199.95 200.63 200.74 200.29 Operating Cash Flow $2,040.57 $2,327.92 $2,830.18 $2,416.61 $3,121.84 $643.28 $739.62 $856.19 $704.49 $2,944.74 $2,679.60 $2,814.88 $2,945.13 $3,070.58 $3,193.80 $3,322.73 $3,444.66 $3,562.05 $3,676.50 % Revenue 20.27% 22.17% 25.68% 21.37% 26.90% 21.90% 24.34% 26.11% 22.55% 23.79% 20.93% 21.12% 21.24% 21.31% 21.35% 21.44% 21.50% 21.54% 21.58% Current Assets 5,017.00 4,812.00 4,989.00 5,121.00 5,318.00 5,584.00 5,685.00 5,802.00 5,803.77 5,803.77 5,770.51 6,037.35 6,306.04 6,580.68 6,825.52 7,125.97 7,389.56 7,640.70 7,893.87 % Revenue 49.84% 45.82% 45.26% 45.29% 45.83% 190.13% 187.07% 176.94% 185.78% 46.88% 45.08% 45.30% 45.48% 45.66% 45.63% 45.99% 46.12% 46.20% 46.33% Current Liabilities 2,486.00 2,425.00 2,442.00 2,911.00 2,722.00 3,069.00 3,090.00 3,288.00 2,719.13 2,719.13 2,598.52 2,721.47 2,846.59 2,968.95 3,099.38 3,225.98 3,351.90 3,479.66 3,607.02 % Revenue 24.70% 23.09% 22.15% 25.75% 23.46% 104.49% 101.68% 100.27% 87.04% 21.97% 20.30% 20.42% 20.53% 20.60% 20.72% 20.82% 20.92% 21.04% 21.17% Net Working Capital $2,531.00 $2,387.00 $2,547.00 $2,210.00 $2,596.00 $2,515.00 $2,595.00 $2,514.00 $3,084.64 $3,084.64 $3,171.99 $3,315.88 $3,459.45 $3,611.74 $3,726.14 $3,899.99 $4,037.66 $4,161.04 $4,286.85 % Revenue 25.14% 22.73% 23.11% 19.55% 22.37% 85.63% 85.39% 76.67% 98.74% 24.92% 24.78% 24.88% 24.95% 25.06% 24.91% 25.17% 25.20% 25.16% 25.16% Change in Working Capital $248.00 ($144.00) $160.00 ($337.00) $386.00 ($81.00) $80.00 ($81.00) $570.64 $488.64 $87.35 $143.89 $143.57 $152.29 $114.40 $173.86 $137.67 $123.38 $125.81 Capital Expenditures 704.00 665.00 653.00 596.00 677.00 117.00 134.00 149.00 274.00 674.00 692.51 725.02 758.44 795.56 833.18 869.25 906.87 942.68 979.71 % Revenue 6.99% 6.33% 5.92% 5.27% 5.83% 3.98% 4.41% 4.54% 8.77% 5.44% 5.41% 5.44% 5.47% 5.52% 5.57% 5.61% 5.66% 5.70% 5.75% Acquisitions 41.00 505.00 492.00 253.00 136.00 473.00 57.00 42.00 8.00 580.00 394.26 414.48 438.15 464.08 486.15 514.42 536.75 560.65 584.42 % Revenue .41% 4.81% 4.46% 2.24% 1.17% 16.10% 1.88% 1.28% .26% 4.69% 3.08% 3.11% 3.16% 3.22% 3.25% 3.32% 3.35% 3.39% 3.43% UnleveredFree Cash Flow $1,047.57 $1,301.92 $1,525.18 $1,904.61 $1,922.84 $134.28 $468.62 $746.19 ($148.15) $1,202.10 $1,505.48 $1,531.49 $1,604.96 $1,658.65 $1,760.07 $1,765.20 $1,863.37 $1,935.33 $1,986.58 DiscountedFree Cash Flow $1,421.05 $1,364.52 $1,349.78 $1,316.70 $1,318.85 $1,248.51 $1,244.03 $1,219.60 $1,181.68

- 20. UOIG 20 December 5, 2014University of Oregon Investment Group Appendix 3—Revenue Model Combined Revenue Model Revenue Model Q1/Q2 Q2/Q3 Q3/Q4 Q4/Q1 ($ in millions) 2009A 2010A 2011A 2012A 2013A 12/31/2013A 03/31/2014A 06/30/2014A 09/30/2014E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E Becton, Dickinson and Co. 6986.00 7125.00 7583.00 7708.00 8054.00 2015.00 2071.00 2157.00 2202.00 8445.00 8798.38 9167.91 9551.26 9946.63 10344.43 10735.66 11121.80 11499.45 11865.37 % Growth 1.28% 1.99% 6.43% 1.65% 4.49% 6.05% 3.55% 5.07% 4.81% 4.85% 4.18% 4.20% 4.18% 4.14% 4.00% 3.78% 3.60% 3.40% 3.18% % of Total Revenue 69.40% 67.84% 68.79% 68.18% 69.41% 68.61% 68.15% 65.78% 70.49% 68.22% 68.73% 68.79% 68.88% 69.01% 69.15% 69.29% 69.41% 69.53% 69.64% CareFusion Corporation 3080.00 3377.00 3440.00 3598.00 3550.00 922.00 968.00 1122.00 922.00 3934.00 4002.22 4159.58 4314.26 4465.73 4613.97 4758.95 4900.66 5038.87 5172.98 % Growth .23% 9.64% 1.87% 4.59% (1.33%) 1.43% 7.44% 24.25% 11.08% 8.23% 4.17% 3.93% 3.72% 3.51% 3.32% 3.14% 2.98% 2.82% 2.66% % of Total Revenue 30.60% 32.16% 31.21% 31.82% 30.59% 31.39% 31.85% 34.22% 29.51% 31.78% 31.27% 31.21% 31.12% 30.99% 30.85% 30.71% 30.59% 30.47% 30.36% Total Revenue $10,066.00 $10,502.00 $11,023.00 $11,306.00 $11,604.00 $2,937.00 $3,039.00 $3,279.00 $3,124.00 $12,379.00 $12,800.59 $13,327.48 $13,865.51 $14,412.36 $14,958.39 $15,494.61 $16,022.46 $16,538.32 $17,038.35 % Growth .97% 4.33% 4.96% 2.57% 2.64% 4.56% 4.76% 10.93% 6.58% 6.68% 3.41% 4.12% 4.04% 3.94% 3.79% 3.58% 3.41% 3.22% 3.02% Becton, Dickinson and Co. Revenue Model Q1 Q2 Q3 Q4 ($ in millions) 2009A 2010A 2011A 2012A 2013A 12/31/2013A 03/31/2014A 06/30/2014A 09/30/2014E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E BD Medical 3556.00 3797.00 4007.00 4090.00 4306.00 1064.00 1116.00 1201.00 1193.00 4574.00 4767.90 4978.64 5206.44 5449.87 5699.50 5946.41 6193.50 6435.29 6671.46 % Growth 0.40% 6.75% 5.53% 2.07% 5.28% 8.24% 5.08% 5.35% 6.52% 6.22% 4.24% 4.42% 4.58% 4.68% 4.58% 4.33% 4.16% 3.90% 3.67% % of Total Revenue 50.90% 53.29% 52.84% 53.06% 53.46% 52.80% 53.89% 55.68% 54.18% 54.16% 54.19% 54.31% 54.51% 54.79% 55.10% 55.39% 55.69% 55.96% 56.23% BD Diagnostics 2226.00 2319.00 2480.00 2538.00 2646.00 672.00 653.00 679.00 708.00 2712.00 2827.79 2942.67 3055.34 3165.64 3273.61 3379.11 3480.94 3581.33 3677.72 % Growth 3.06% 4.18% 6.94% 2.34% 4.26% 3.07% (.91%) 3.66% 4.27% 2.49% 4.27% 4.06% 3.83% 3.61% 3.41% 3.22% 3.01% 2.88% 2.69% % of Total Revenue 31.86% 32.55% 32.70% 32.93% 32.85% 33.35% 31.53% 31.48% 32.15% 32.11% 32.14% 32.10% 31.99% 31.83% 31.65% 31.48% 31.30% 31.14% 31.00% BD Biosciences 1204.00 1009.00 1096.00 1080.00 1102.00 279.00 302.00 277.00 301.00 1159.00 1202.69 1246.59 1289.48 1331.13 1371.33 1410.13 1447.36 1482.82 1516.19 % Growth 0.75% (16.20%) 8.62% (1.46%) 2.04% 5.28% 8.24% 7.78% 8.66% 5.17% 3.77% 3.65% 3.44% 3.23% 3.02% 2.83% 2.64% 2.45% 2.25% % of Total Revenue 17.23% 14.16% 14.45% 14.01% 13.68% 13.85% 14.58% 12.84% 13.67% 13.72% 13.67% 13.60% 13.50% 13.38% 13.26% 13.14% 13.01% 12.89% 12.78% Total Revenue $6,986.00 $7,125.00 $7,583.00 $7,708.00 $8,054.00 $2,015.00 $2,071.00 $2,157.00 $2,202.00 $8,445.00 $8,798.38 $9,167.91 $9,551.26 $9,946.63 $10,344.43 $10,735.66 $11,121.80 $11,499.45 $11,865.37 % Growth 1.28% 1.99% 6.43% 1.65% 4.49% 6.05% 3.55% 5.07% 4.81% 4.85% 4.18% 4.20% 4.18% 4.14% 4.00% 3.78% 3.60% 3.40% 3.18% Revenue Model Q1 Q2 Q3 Q4 ($ in millions) 2009A 2010A 2011A 2012A 2013A 12/31/2013A 03/31/2014A 06/30/2014A 09/30/2014E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E BD Medical Medical Surgical Systems 1889.00 2010.00 2082.00 2105.00 2196.00 579.00 551.00 590.00 588.00 2308.00 2397.32 2493.69 2597.68 2707.30 2820.74 2932.16 3043.87 3151.93 3255.94 % Growth (5.79%) 6.41% 3.58% 1.10% 4.32% 8.02% 2.23% 5.17% 5.00% 5.10% 3.87% 4.02% 4.17% 4.22% 4.19% 3.95% 3.81% 3.55% 3.30% % of Segment Revenue 53.12% 52.94% 51.96% 51.47% 50.99% 54.42% 49.37% 49.13% 49.29% 50.46% 50.28% 50.09% 49.89% 49.68% 49.49% 49.31% 49.15% 48.98% 48.80% Diabetes Care 715.00 786.00 866.00 911.00 969.00 264.00 251.00 258.00 264.00 1037.00 1090.82 1149.40 1212.04 1278.94 1348.39 1418.24 1488.01 1556.61 1624.01 % Growth 3.03% 9.93% 10.18% 5.20% 6.37% 8.64% 8.19% 3.20% 8.20% 7.02% 5.19% 5.37% 5.45% 5.52% 5.43% 5.18% 4.92% 4.61% 4.33% % of Segment Revenue 20.11% 20.70% 21.61% 22.27% 22.50% 24.81% 22.49% 21.48% 22.13% 22.67% 22.88% 23.09% 23.28% 23.47% 23.66% 23.85% 24.03% 24.19% 24.34% Pharmaceutical Care 952.00 1001.00 1059.00 1074.00 1142.00 221.00 314.00 353.00 341.00 1229.00 1279.76 1335.56 1396.72 1463.63 1530.37 1596.02 1661.62 1726.75 1791.51 % Growth 1.06% 5.15% 5.79% 1.42% 6.33% 7.80% 7.90% 6.97% 7.91% 7.62% 4.13% 4.36% 4.58% 4.79% 4.56% 4.29% 4.11% 3.92% 3.75% % of Segment Revenue 26.77% 26.36% 26.43% 26.26% 26.51% 20.77% 28.14% 29.39% 28.58% 26.87% 26.84% 26.83% 26.83% 26.86% 26.85% 26.84% 26.83% 26.83% 26.85% Total Segment Revenue $3,556.00 $3,797.00 $4,007.00 $4,090.00 $4,307.00 $1,064.00 $1,116.00 $1,201.00 $1,193.00 $4,574.00 $4,767.90 $4,978.64 $5,206.44 $5,449.87 $5,699.50 $5,946.41 $6,193.50 $6,435.29 $6,671.46 % Growth 0.40% 6.78% 5.53% 2.07% 5.31% 8.24% 5.08% 5.35% 6.52% 6.20% 4.24% 4.42% 4.58% 4.68% 4.58% 4.33% 4.16% 3.90% 3.67% Revenue Model Q1 Q2 Q3 Q4 ($ in millions) 2009A 2010A 2011A 2012A 2013A 12/31/2013A 03/31/2014A 06/30/2014A 09/30/2014E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E BD Diagnostics Preanalytical Systems 1143.00 1198.00 1278.00 1301.00 1352.00 347.00 342.00 364.00 358.00 1411.00 1466.03 1520.86 1574.24 1626.03 1676.11 1725.23 1771.98 1817.52 1862.05 % Growth 1.69% 4.81% 6.68% 1.80% 3.92% 3.58% 3.64% 5.51% 4.68% 4.36% 3.90% 3.74% 3.51% 3.29% 3.08% 2.93% 2.71% 2.57% 2.45% % of Segment Revenue 51.35% 51.66% 51.51% 51.26% 51.10% 51.64% 52.37% 53.61% 50.56% 52.03% 51.84% 51.68% 51.52% 51.37% 51.20% 51.06% 50.91% 50.75% 50.63% Diagnostic Systems 1083.00 1121.00 1203.00 1237.00 1294.00 325.00 311.00 315.00 350.00 1301.00 1361.76 1421.81 1481.10 1539.60 1597.49 1653.88 1708.96 1763.82 1815.67 % Growth 4.54% 3.51% 7.31% 2.83% 4.61% 2.52% (5.47%) 1.61% 3.55% .54% 4.67% 4.41% 4.17% 3.95% 3.76% 3.53% 3.33% 3.21% 2.94% % of Segment Revenue 48.65% 48.34% 48.49% 48.74% 48.90% 48.36% 47.63% 46.39% 49.44% 47.97% 48.16% 48.32% 48.48% 48.63% 48.80% 48.94% 49.09% 49.25% 49.37% Total Segment Revenue $2,226.00 $2,319.00 $2,481.00 $2,538.00 $2,646.00 $672.00 $653.00 $679.00 $708.00 $2,712.00 $2,827.79 $2,942.67 $3,055.34 $3,165.64 $3,273.61 $3,379.11 $3,480.94 $3,581.33 $3,677.72 % Growth 3.06% 4.18% 6.99% 2.30% 4.26% 3.07% (.91%) 3.66% 4.27% 2.49% 4.27% 4.06% 3.83% 3.61% 3.41% 3.22% 3.01% 2.88% 2.69%

- 21. UOIG 21 December 5, 2014University of Oregon Investment Group Revenue Model Q1 Q2 Q3 Q4 ($ in millions) 2009A 2010A 2011A 2012A 2013A 12/31/2013A 03/31/2014A 06/30/2014A 09/30/2014E 2014E 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E BD Biosciences Bioscences 1204.00 1009.00 1096.00 1080.00 1102.00 279.00 302.00 277.00 301.00 1159.00 1202.69 1246.59 1289.48 1331.13 1371.33 1410.13 1447.36 1482.82 1516.19 % Growth 0.75% (16.20%) 8.62% (1.46%) 2.04% 5.28% 8.24% 7.78% .33% 5.17% 3.77% 3.65% 3.44% 3.23% 3.02% 2.83% 2.64% 2.45% 2.25% % of Segment Revenue 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 100% 100% 100% 100% 100% 100% 100% 100% 100% Total Segment Revenue $1,204.00 $1,009.00 $1,096.00 $1,080.00 $1,102.00 $279.00 $302.00 $277.00 $301.00 $1,159.00 $1,202.69 $1,246.59 $1,289.48 $1,331.13 $1,371.33 $1,410.13 $1,447.36 $1,482.82 $1,516.19 % Growth 0.75% (16.20%) 8.62% (1.46%) 2.04% 5.28% 8.24% 7.78% 8.66% 5.17% 3.77% 3.65% 3.44% 3.23% 3.02% 2.83% 2.64% 2.45% 2.25% CareFusion Corporation Revenue Model Q1 Q2 Q3 Q4 ($ in millions) 2009A 2010A 2011A 2012A 2013A 09/30/2013A 12/31/2013A 03/31/2014A 06/30/2014A 2014A 2015E 2016E 2017E 2018E 2019E 2020E 2021E 2022E 2023E Medical Systems 2034.00 2071.00 2214.00 2439.00 2329.00 524.00 587.00 571.00 712.00 2394.00 2463.43 2529.69 2592.93 2652.83 2709.34 2762.71 2812.99 2859.97 2903.44 % Growth 0% 1.82% 6.90% 10.16% (4.51%) (4.90%) (2.49%) (2.23%) 20.27% 2.79% 2.90% 2.69% 2.50% 2.31% 2.13% 1.97% 1.82% 1.67% 1.52% % of Total Revenue 66.04% 61.33% 64.36% 67.79% 65.61% 63.13% 63.67% 58.99% 63.46% 62.31% 61.55% 60.82% 60.10% 59.40% 58.72% 58.05% 57.40% 56.76% 56.13% Procedural Solutions 1046.00 1306.00 1226.00 1159.00 1221.00 306.00 335.00 397.00 410.00 1448.00 1538.79 1629.89 1721.32 1812.90 1904.63 1996.24 2087.67 2178.90 2269.54 % Growth 0.00% 24.86% (6.13%) (5.46%) 5.35% 6.99% 9.12% 25.24% 31.83% 18.59% 6.27% 5.92% 5.61% 5.32% 5.06% 4.81% 4.58% 4.37% 4.16% % of Total Revenue 33.96% 38.67% 35.64% 32.21% 34.39% 36.87% 36.33% 41.01% 36.54% 37.69% 38.45% 39.18% 39.90% 40.60% 41.28% 41.95% 42.60% 43.24% 43.87% Total Revenue $3,080.00 $3,377.00 $3,440.00 $3,598.00 $3,550.00 $830.00 $922.00 $968.00 $1,122.00 $3,842.00 $4,002.22 $4,159.58 $4,314.26 $4,465.73 $4,613.97 $4,758.95 $4,900.66 $5,038.87 $5,172.98 % Growth .23% 9.64% 1.87% 4.59% (1.33%) (.84%) 1.43% 7.44% 24.25% 8.23% 4.17% 3.93% 3.72% 3.51% 3.32% 3.14% 2.98% 2.82% 2.66% Appendix 3—Continued