New Tax Regime vs Old Tax Regime

•

0 likes•27 views

What is the new tax regime? Which tax regime is more beneficial? How to choose between old and new tax systems? What benefits need to be foregone for opting new regime?

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

More Related Content

Similar to New Tax Regime vs Old Tax Regime

Similar to New Tax Regime vs Old Tax Regime (20)

ITR Pay Tax Later A Comprehensive Guide to the Government Scheme

ITR Pay Tax Later A Comprehensive Guide to the Government Scheme

The OHL Wire ISSUE 11 - What Will Change On 1 July 2015

The OHL Wire ISSUE 11 - What Will Change On 1 July 2015

PPI Response to HMT consultation- strengethening the incentive to save Sept 2015

PPI Response to HMT consultation- strengethening the incentive to save Sept 2015

rsm_india_newsflash_-_employees_guidance_on_new_vs_old_tax_regime_individuals...

rsm_india_newsflash_-_employees_guidance_on_new_vs_old_tax_regime_individuals...

01. introduction to taxation ICAB, KL, Study Manual

01. introduction to taxation ICAB, KL, Study Manual

UK Income Tax Liabilities for Different Pension.pptx

UK Income Tax Liabilities for Different Pension.pptx

20151003 PPI Comparison of pension outcomes under EET and TEE tax treatment

20151003 PPI Comparison of pension outcomes under EET and TEE tax treatment

More from Manish Anil Gupta & Co. - A CA firm in Delhi, India

What Documents Are Required For TAN Application? A duly filled and signed application form, A passport-sized photograph of the authorised partner, ID proof of all partners. Copies must be made on an A4 paper,Address proof , latest partnership deed, Account statement,Registration certificate for the business and KYC details etc.Check List for TAN Apply (Individual/Proprietorship)

Check List for TAN Apply (Individual/Proprietorship)Manish Anil Gupta & Co. - A CA firm in Delhi, India

A complete guide on list of books of accounts to be maintained and audit requirements specified in Income Tax Act under section 44AA and Rule 6F.Checklist for Required Documents for Audit Books Finalisation

Checklist for Required Documents for Audit Books FinalisationManish Anil Gupta & Co. - A CA firm in Delhi, India

This article briefly describes the many checklist points for Company Audits Finalization & Auditor& Responsibility for Auditing the Statements.

Check List for Required Documents for Audit Books Finalisation

Check List for Required Documents for Audit Books FinalisationManish Anil Gupta & Co. - A CA firm in Delhi, India

A trademark checklist starts with developing a trademark. Then, you need to search its availability, create and submit a trademark application, and enforce it.Check List for Trademark (TM-A) - Manish Anil Gupta

Check List for Trademark (TM-A) - Manish Anil GuptaManish Anil Gupta & Co. - A CA firm in Delhi, India

GST refund process involves many steps. RFD-01 must be filed on GST portal for most types of the refund whereas GSTR-1 and GSTR-3B filing is done for few.Check List for GST Refund Process Involves Many Steps

Check List for GST Refund Process Involves Many StepsManish Anil Gupta & Co. - A CA firm in Delhi, India

More from Manish Anil Gupta & Co. - A CA firm in Delhi, India (20)

Check List for TAN Apply (Individual/Proprietorship)

Check List for TAN Apply (Individual/Proprietorship)

Documents for PAN Card Apply(Hub) - Manish Anil Gupta

Documents for PAN Card Apply(Hub) - Manish Anil Gupta

Checklist for Required Documents for Audit Books Finalisation

Checklist for Required Documents for Audit Books Finalisation

Check List for Required Documents for Audit Books Finalisation

Check List for Required Documents for Audit Books Finalisation

Check List for Trademark (TM-A) - Manish Anil Gupta

Check List for Trademark (TM-A) - Manish Anil Gupta

Check List for Letter of Under Taking(GST-LUT).pdf

Check List for Letter of Under Taking(GST-LUT).pdf

Check List for GST Refund Process Involves Many Steps

Check List for GST Refund Process Involves Many Steps

Check List for GST Audit or 9C - Manish Anil Gupta

Check List for GST Audit or 9C - Manish Anil Gupta

Recently uploaded

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai Escorts

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Today call girl service available 24X7*▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 CALL 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓 SERVICE ✅

⭐➡️HOT & SEXY MODELS // COLLEGE GIRLS

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

★ SAFE AND SECURE HIGH CLASS SERVICE AFFORDABLE RATE

★ 100% SATISFACTION,UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL 24x7 :: #S07 3 * 5 *7 *Star Hotel Service .In Call & Out call SeRvIcEs :

★ A-Level (5 star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob)Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

100% SAFE AND SECURE 24 HOURS SERVICE AVAILABLE HOME AND HOTEL SERVICES

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...roshnidevijkn ( Why You Choose Us? ) Escorts

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Everyday With Jareena * Mumbai Escorts *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALLVIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...dipikadinghjn ( Why You Choose Us? ) Escorts

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangements Near You

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9352852248

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 🌐 beautieservice.com 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9352852248

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S020524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9352852248

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...From Luxury Escort : 9352852248 Make on-demand Arrangements Near yOU

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Girls Waiting For You To Fuck

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...Call Girls in Nagpur High Profile

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S040524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-992072VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...dipikadinghjn ( Why You Choose Us? ) Escorts

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Call Girls

Booking Now open +91- 9352852248

Why you Choose Us- +91- 9352852248

HOT⇄ 8005736733

Mr ashu ji

Call Mr ashu Ji +91- 9352852248

𝐇𝐨𝐭𝐞𝐥 𝐑𝐨𝐨𝐦𝐬 𝐈𝐧𝐜𝐥𝐮𝐝𝐢𝐧𝐠 𝐑𝐚𝐭𝐞 𝐒𝐡𝐨𝐭𝐬/𝐇𝐨𝐮𝐫𝐲🆓 .█▬█⓿▀█▀ 𝐈𝐍𝐃𝐄𝐏𝐄𝐍𝐃𝐄𝐍𝐓 𝐆𝐈𝐑𝐋 𝐕𝐈𝐏 𝐄𝐒𝐂𝐎𝐑𝐓

Hello Guys ! High Profiles young Beauties and Good Looking standard Profiles Available , Enquire Now if you are interested in Hifi Service and want to get connect with someone who can understand your needs.

Service offers you the most beautiful High Profile sexy independent female Escorts in genuine ✔✔✔ To enjoy with hot and sexy girls ✔✔✔$s07

★providing:-

• Models

• vip Models

• Russian Models

• Foreigner Models

• TV Actress and Celebrities

• Receptionist

• Air Hostess

• Call Center Working Girls/Women

• Hi-Tech Co. Girls/Women

• HousewifeCall Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...roshnidevijkn ( Why You Choose Us? ) Escorts

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot Indian Girls Waiting For You To Fuck

Booking Contact Details

WhatsApp Chat: +91-6297143586

pune Escort Service includes providing maximum physical satisfaction to their clients as well as engaging conversation that keeps your time enjoyable and entertaining. Plus they look fabulously elegant; making an impressionable.

Independent Escorts pune understands the value of confidentiality and discretion - they will go the extra mile to meet your needs. Simply contact them via text messaging or through their online profiles; they'd be more than delighted to accommodate any request or arrange a romantic date or fun-filled night together.

We provide -

01-may-2024(v.n)

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot ...

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot ...Call Girls in Nagpur High Profile

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts * Ruhi Singh *

FOR BOOKING ★ A-Level (5-star Escort) (Akanksha): ☎️ +91-9920725232

AVAILABLE FOR COMPLETE ENJOYMENT WITH HIGH PROFILE INDIAN MODEL AVAILABLE HOTEL & HOME

Visit Our Site For More Pleasure in your City 👉 ☎️ +91-9920725232 👈

★ SAFE AND SECURE HIGH-CLASS SERVICE AFFORDABLE RATE

★

SATISFACTION, UNLIMITED ENJOYMENT.

★ All Meetings are confidential and no information is provided to any one at any cost.

★ EXCLUSIVE PROFILes Are Safe and Consensual with Most Limits Respected

★ Service Available In: - HOME & HOTEL Star Hotel Service. In Call & Out call

SeRvIcEs :

★ A-Level (star escort)

★ Strip-tease

★ BBBJ (Bareback Blowjob) Receive advanced sexual techniques in different mode make their life more pleasurable.

★ Spending time in hotel rooms

★ BJ (Blowjob Without a Condom)

★ Completion (Oral to completion)

★ Covered (Covered blowjob Without condom

★ANAL SERVICES.

Contact me

TELEPHONE

WHATSAPP

Looking for Enjoy all Day(Akanksha) : ☎️ +91-9920725232

Mumbai, Andheri, Navi Mumbai, Thane, Mumbai Airport, Mumbai Central, South Mumbai, Juhu, Bandra, Colaba, Nariman point, Malad, Powai, Mira Road, Dahisar, Mira Bhayandar, Worli, Santacruz, Vile Parle, Lower Parel, Chembur, Dadar, Ghatkopar, Kurla, Mulund, Goregaon, Kandivali, Borivali, Jogeshwari, Kalyan, Vashi , Nerul, Panvel, Dombivli, Lokhandwala, Four Bungalows, Versova, NRI Complex, Kharghar, Belapur, Taloja, Marine Drive, Hiranandani Gardens, Churchgate, Marine lines, Oshiwara, DN Nagar, Jb Nagar, Marol Naka, Saki Naka, Andheri East, Andheri West, Bandra West, Bandra East , Thane West, Ghodbundar Road,

There is a lot of talk about it in the media and news, so you might be wondering if this particular service is really worth the effort. A call girl service is exactly what it sounds like – a service where a woman offers sexual services over the phone. This type of service has been around for a long time and has become increasingly popular over the years. In most cases, call girl services are legal and regulated in many countries. There are a few things to keep in mind when considering the choice of whether to use a call girl service. First and foremost, make sure that you are comfortable with the particular person you are using the service from. Second, research accordingly before choosing a call girl. Don't just go with the first provider that comes up in your search; get opinions from others as well. Finally, be sure to have fun while using a call girl service; it's not just about sex. S030524N

★OUR BEST SERVICES: - FOR BOOKING ★ A-Level (5-star escort) ★ Strip-tease ★ BBBJ (Bareback Blowjob) ★ Spending time in my rooms ★ BJ (Blowjob Without a Condom) ★ COF (Come on Face) ★ Completion ★ (Oral to completion) noncovered ★ Special Massage ★ O-Level (Oral) ★ Blow Job; ★ Oral fun uncovered) ★ COB (Come on Body) ★. Extra ball (Have ride many times) ☛ ☛ ☛ ✔✔ secure✔✔ 100% safe WHATSAPP CALL ME +91-9920725232

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...dipikadinghjn ( Why You Choose Us? ) Escorts

Recently uploaded (20)

falcon-invoice-discounting-unlocking-prime-investment-opportunities

falcon-invoice-discounting-unlocking-prime-investment-opportunities

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Kharghar Blowjob Housewife Call Girls NUmber-9833754194-CBD Belapur Internati...

Business Principles, Tools, and Techniques in Participating in Various Types...

Business Principles, Tools, and Techniques in Participating in Various Types...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

VIP Kalyan Call Girls 🌐 9920725232 🌐 Make Your Dreams Come True With Mumbai E...

Vasai-Virar High Profile Model Call Girls📞9833754194-Nalasopara Satisfy Call ...

Vasai-Virar High Profile Model Call Girls📞9833754194-Nalasopara Satisfy Call ...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

VIP Call Girl in Mumbai Central 💧 9920725232 ( Call Me ) Get A New Crush Ever...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

From Luxury Escort Service Kamathipura : 9352852248 Make on-demand Arrangemen...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Booking open Available Pune Call Girls Shivane 6297143586 Call Hot Indian Gi...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

Mira Road Awesome 100% Independent Call Girls NUmber-9833754194-Dahisar Inter...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

VIP Independent Call Girls in Mira Bhayandar 🌹 9920725232 ( Call Me ) Mumbai ...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Call Girls Service Pune ₹7.5k Pick Up & Drop With Cash Payment 9352852248 Cal...

Best VIP Call Girls Morni Hills Just Click Me 6367492432

Best VIP Call Girls Morni Hills Just Click Me 6367492432

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot ...

Booking open Available Pune Call Girls Talegaon Dabhade 6297143586 Call Hot ...

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

Vasai-Virar Fantastic Call Girls-9833754194-Call Girls MUmbai

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

Call Girls Koregaon Park Call Me 7737669865 Budget Friendly No Advance Booking

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

VIP Independent Call Girls in Mumbai 🌹 9920725232 ( Call Me ) Mumbai Escorts ...

Kopar Khairane Russian Call Girls Number-9833754194-Navi Mumbai Fantastic Unl...

Kopar Khairane Russian Call Girls Number-9833754194-Navi Mumbai Fantastic Unl...

(Sexy Sheela) Call Girl Mumbai Call Now 👉9920725232👈 Mumbai Escorts 24x7

(Sexy Sheela) Call Girl Mumbai Call Now 👉9920725232👈 Mumbai Escorts 24x7

New Tax Regime vs Old Tax Regime

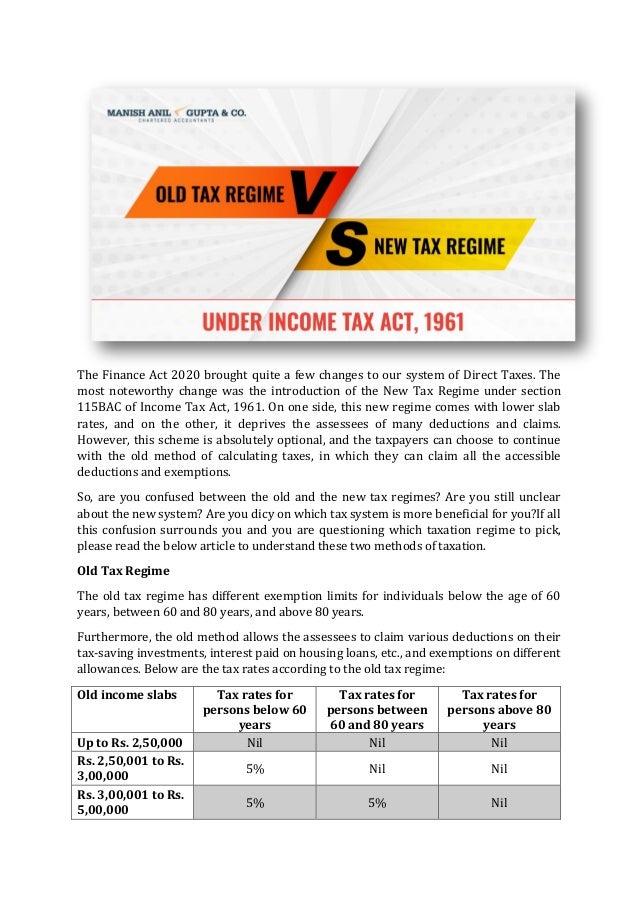

- 1. The Finance Act 2020 brought quite a few changes to our system of Direct Taxes. The most noteworthy change was the introduction of the New Tax Regime under section 115BAC of Income Tax Act, 1961. On one side, this new regime comes with lower slab rates, and on the other, it deprives the assessees of many deductions and claims. However, this scheme is absolutely optional, and the taxpayers can choose to continue with the old method of calculating taxes, in which they can claim all the accessible deductions and exemptions. So, are you confused between the old and the new tax regimes? Are you still unclear about the new system? Are you dicy on which tax system is more beneficial for you?If all this confusion surrounds you and you are questioning which taxation regime to pick, please read the below article to understand these two methods of taxation. Old Tax Regime The old tax regime has different exemption limits for individuals below the age of 60 years, between 60 and 80 years, and above 80 years. Furthermore, the old method allows the assessees to claim various deductions on their tax-saving investments, interest paid on housing loans, etc., and exemptions on different allowances. Below are the tax rates according to the old tax regime: Old income slabs Tax rates for persons below 60 years Tax rates for persons between 60 and 80 years Tax rates for persons above 80 years Up to Rs. 2,50,000 Nil Nil Nil Rs. 2,50,001 to Rs. 3,00,000 5% Nil Nil Rs. 3,00,001 to Rs. 5,00,000 5% 5% Nil

- 2. Rs. 5,00,001 to Rs. 10,00,000 20% 20% 20% Above Rs. 10,00,000 30% 30% 30% New Tax Regime The Income Tax rates are the same across all age groups as per the new tax regime. The income slabs are smaller, and there are seven slabs in the new tax system. The Income Tax rates as per the new tax regime are specified in the table below: New income slabs Tax rates applicable Up to Rs. 2,50,000 Nil Rs. 2,50,001 to Rs. 5,00,000 5% Rs. 5,00,001 to Rs. 7,50,000 10% Rs. 7,50,001 to Rs. 10,00,000 15% Rs. 10,00,001 to Rs. 12,50,000 20% Rs. 12,50,001 to Rs. 15,00,000 25% Above Rs. 15,00,000 30% So, it can be seen in the above table that the new tax regime steadily increases the tax rates from one income slab to another. Deductions & exemptions to be forgone while opting for the new tax regime The government has considered that the Act provides various exemptions and deductions, which make compliance by the assessee and administration of the tax laws by the tax authorities a cumbersome process. Hence, the new tax regime requires a number of deductions and exemptions to be forgone. Thus, it is imperative to evaluate the impact of deductions/exemptions that need to be given up to benefit from lower tax rates. Some of the common tax exemptions/deductions which are not allowed to be claimed under the new regime include: • Leave travel allowance (LTA) • House rent allowance (HRA) • Children education allowance • Standard deduction on salary • Deduction for professional tax • Interest paid on housing loan in case of self-occupied property • Deduction for investments or expenses under Chapter VI-A like: o deduction u/s 80C towards contribution to Public Provident Fund, payment of children’s tuition fees, life insurance premium, principal on housing loan, etc. o other deductions towards medical insurance premium, medical expenditure, interest on education loan, donations, etc.

- 3. Opting for the new tax regime An individual or HUF taxpayer (resident and non-resident) may opt for the new tax regime based on the respective applicable deductions/exemptions and sources of income. Switching between the old and new tax regimes can be done either yearly or only once. The frequency of opting for the new tax regime depends on the source of income during the financial year. The same has been discussed below: ➢ Where income includes income from business or profession: If an individual or HUF has income from a business or profession, once the option to avail new tax regime for a financial year has been exercised, then the new rates shall apply for subsequent years as well. However, the Act provides such assessees one single option of switching back to the old tax regime. Once this switchback option has been exercised, then again new tax regime cannot be opted for in a lifetime unless the assessee ceases to have income from a business or profession. ➢ Where income does not include income from business or profession: If an individual or HUF does not have income from a business or profession, then the selection can be made on a yearly basis. For salaried individuals, the employer is required to withhold tax before the payment of the salaries. Hence, the employee is needed to inform the employer regarding his preferred tax regime. An employee may select between old and new tax rates and intimate his employer at the beginning of the financial year or at the time of joining new employment during the year. However, when filing the Income Tax return, the employee can change the tax regime initially selected. For instance, at the beginning of the financial year, an employee chooses the new tax regime, and his employer deducts tax from his salary based on slab rates under the new regime. However, during the year, he makes certain tax-saving investments such as contribution to PPF, Sukanya Samriddhi Scheme, etc., and at the time of filing his Income Tax return, he realises that the old tax system is more beneficial to him. In such a scenario, he can opt for the old tax regime while filing his return of income though the employer had deducted taxes based on the new regime. Continuing with the Old Tax Regime The old tax regime has been in place for quite some time now, and the assessees are perhaps more accustomed to it. However, the answer to whether or not they should select this old method depends mainly on the slab in which their income falls and the tax-saving investments they have in their portfolio. Since this regime allows them deductions involving tax-saving investments, it’s suitable to opt for this option if their portfolio includes a considerable amount of the same. By doing so, they can claim the benefit of deduction up to Rs. 1.5 lakhs permitted under section 80C and drastically reduce their Income Tax liability.Taxpayers can avail of a further deduction of Rs.50,000 for investments made in NPS u/s 80CCD(1B). The old system offers the assessees other advantages also, such as HRA exemption, LTA

- 4. exemption and deductions like the deduction for home loan interest up to Rs. 2 lakhs and deduction for donations, to name a few. Hence, the assessees can opt for this tax regime if they are eligible of claiming such deductions and exemptions offered in the old Income Tax regime. Opting for the New Income Tax Regime The assessees could be charged a lower tax rate as per the new tax regime, subject to their income level. For example, if a taxpayer’s total taxable income is Rs. 6,75,000, he would fall in the 20% tax slab as per the old method. Whereas, as per the new tax rates, the maximum rate chargeable on his income would be only 10%.The new tax regime gradually increases the tax rate from one income slab to another. This shows that the new regime is better suited for lower-income groups, freshers who wish to avoid paperwork and pensioners. Moreover, since the new tax system does not allow any deductions from taxable income, a person having less tax-saving investments may get more benefits from the new tax rates. Those having a small home loan amount can also consider the lower tax system. Individuals and HUF can adopt new tax rates if their tax liability is low in the new tax regime compared to the old tax regime. Crucial points to keep in mind before opting for any one regime Before selecting between the old and new regimes, it would be fruitful to follow the following steps: • Recognise the deductions and exemptions available and applicable to you. • Calculate your total taxable income before and after taking deductions into consideration and determine the tax liabilities as per the old and the new regimes and decide accordingly. • Furthermore, consider your long-term goals and strategise your investments suitably. It’s not wise to avoid investing in tax-saving options just for opting for the new tax scheme. Summing Up Both the regimes have their own sets of pros and cons. The old system offers many exemptions and deductions under numerous sections – availing a few of these require people to invest in tax-saving investment options, helping inculcate a good habit of investing. On the other hand, the new regime gives people more flexibility and tries to simplify the process. Whether the new scheme works for an assessee or the old one will depend on the income composition and deductions available, and one will have to decide based on his circumstances. The alternatives must be evaluated prudently, and online tax calculators can be used to determine the tax liability under each method before selecting between the two taxation methods. Source: https://www.manishanilgupta.com/blog-details/new-tax-regime-vs-old- tax-regime