MHM Messenger: Department of Labor Releases Employee Benefit Plan Audit Quality Study

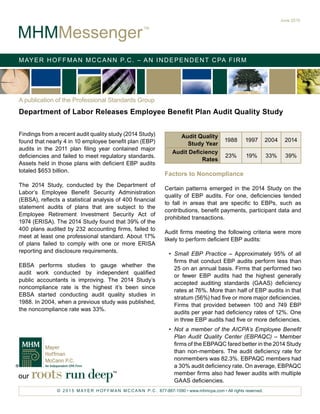

- 1. our roots rundeepTM Mayer Hoffman McCann P.C. – An Independent CPA Firm A publication of the Professional Standards Group MHMMessenger © 2 0 1 5 M ay e r H o f f m a n M c C a n n P. C . 877-887-1090 • www.mhmcpa.com • All rights reserved. TM Audit Quality Study Year 1988 1997 2004 2014 Audit Deficiency Rates 23% 19% 33% 39% Factors to Noncompliance Certain patterns emerged in the 2014 Study on the quality of EBP audits. For one, deficiencies tended to fall in areas that are specific to EBPs, such as contributions, benefit payments, participant data and prohibited transactions. Audit firms meeting the following criteria were more likely to perform deficient EBP audits: • Small EBP Practice – Approximately 95% of all firms that conduct EBP audits perform less than 25 on an annual basis. Firms that performed two or fewer EBP audits had the highest generally accepted auditing standards (GAAS) deficiency rates at 76%. More than half of EBP audits in that stratum (56%) had five or more major deficiencies. Firms that provided between 100 and 749 EBP audits per year had deficiency rates of 12%. One in three EBP audits had five or more deficiencies. • Not a member of the AICPA’s Employee Benefit Plan Audit Quality Center (EBPAQC) – Member firms of the EBPAQC fared better in the 2014 Study than non-members. The audit deficiency rate for nonmembers was 82.3%. EBPAQC members had a 30% audit deficiency rate. On average, EBPAQC member firms also had fewer audits with multiple GAAS deficiencies. Findings from a recent audit quality study (2014 Study) found that nearly 4 in 10 employee benefit plan (EBP) audits in the 2011 plan filing year contained major deficiencies and failed to meet regulatory standards. Assets held in those plans with deficient EBP audits totaled $653 billion. The 2014 Study, conducted by the Department of Labor’s Employee Benefit Security Administration (EBSA), reflects a statistical analysis of 400 financial statement audits of plans that are subject to the Employee Retirement Investment Security Act of 1974 (ERISA). The 2014 Study found that 39% of the 400 plans audited by 232 accounting firms, failed to meet at least one professional standard. About 17% of plans failed to comply with one or more ERISA reporting and disclosure requirements. EBSA performs studies to gauge whether the audit work conducted by independent qualified public accountants is improving. The 2014 Study’s noncompliance rate is the highest it’s been since EBSA started conducting audit quality studies in 1988. In 2004, when a previous study was published, the noncompliance rate was 33%. June 2015 Department of Labor Releases Employee Benefit Plan Audit Quality Study

- 2. © 2 0 1 5 M ay e r H o f f m a n M c C a n n P. C . 877-887-1090 • www.mhmcpa.com • All rights reserved. MHMMessenger 2 The 2014 Study found no correlation among the following: • Employee Benefit Plan Training – Firms failed to meet audit standards because they did not have the toolset to meet compliance requirements or they did not use the technical materials they had available. Firms with internal, EBP specific training had noncompliant audits, indicating that even if technical resources are available, they may not be used properly during an EBP audit. • Peer Review Rating – EBP audits conducted by CPAs are reviewed as part of the AICPA’s Practice Monitoring Peer Review Process. A CPA firm’s peer review, however, had little bearing on its EBP audit compliance. Approximately 52% of CPA firms that received clean peer reviews had deficient EBP audits. Implications for Plan Auditors Because audit compliance is not improving, employee benefit plans and their auditors will need to prepare for increased scrutiny by the EBSA. EBSA recommends enforcement efforts target CPA firms with small EBP audit practices that audit EBPs with large amounts of plan assets. It also will be looking at firms in the 25-99 EBP audit stratum. The stratum contains roughly $317.1 billion of plan assets and 9.3 million plan participants, and had a 41% audit deficiency rate in the 2014 Study. The 2014 Study also proposes that the DOL work with the National Association of State Boards of Accountancy and the AICPA to ramp up sanctions for auditors who consistently perform deficient audit work. This may mean state boards accept the results of investigations performed by the AICPA’s Professional Ethics Division or by EBSA, and then discipline noncompliant CPAs. EBSA is also proposing that state boards require additional licensing for auditors of EBPs. To improve the Practice Monitoring Peer Review Process, EBSA recommends working with AICPA’s Peer Review staff to: streamline the process and make it more responsive, ensure a sufficient peer review has been performed and identify the CPAs who have had deficient peer reviews and refer them to the applicable state accounting board. Proposed Changes to ERISA The 2014 Study proposes several changes to be made to ERISA. One would be to expand the definition of qualified public accountant to include additional requirements EBP auditors must meet. The DOL would have the power to determine what these requirements would be. Another would allow the DOL to delegate all or part of civil penalties for deficient audit work to the CPA who conducted the plan audit if the CPA’s deficient audit work resulted in the rejection of the plan’s Form 5500 filing. As noncompliance rates are increasing, so, too is the number of limited scope audits of EBPs. In 2001, 48% of EBP audits were limited scope, and in 2013, 83% of all EBP audits were limited scope. EBSA is recommending a repeal of the limited scope audit exemption. Currently, CPAs do not issue an opinion on financial statements for assets held by regulated entities (often financial institutions) in a limited scope audit. Close to 60% of the limited scope audits in the 2014 Study contained audit deficiencies.

- 3. © 2 0 1 5 M ay e r H o f f m a n M c C a n n P. C . 877-887-1090 • www.mhmcpa.com • All rights reserved. MHMMessenger 3 The information in this MHM Messenger is a brief summary and may not include all the details relevant to your situation. Please contact your MHM auditor to further discuss the impact on your audit or audit report. EBSA would like to have the power to establish accounting and auditing standards that are specific to EBPs or have a substantial affect on them. Currently, accounting standards for EBPs are established by the Financial Accounting Standards Board (FASB) and auditing standards for EBPs are established by the American Institute of Certified Public Accountants (AICPA). For More Information EBSA will be reaching out to the state boards of accountancy and audit firms in all plan strata about the findings from the survey and the importance of complying with ERISA. For specific questions or concerns about the results of the report, please contact Hal Hunt of the MHM Professional Standards Group. Hal can be reached at 816.945.5610 or hhunt@cbiz.com.