Report

Share

Recommended

Recommended

More Related Content

Similar to ACC 201 Ch 13 Problem (LinkedIn)

Similar to ACC 201 Ch 13 Problem (LinkedIn) (17)

Question 3 (24 markS) Westcock Shipbuilding Ltd. has a December 31 y.pdf

Question 3 (24 markS) Westcock Shipbuilding Ltd. has a December 31 y.pdf

All answers must be on the answer sheet provided. $ and . needed.docx

All answers must be on the answer sheet provided. $ and . needed.docx

Prepare journal entries to record each of the following independent .docx

Prepare journal entries to record each of the following independent .docx

Included in the December 31, 2015, Jacobi Company balance sheet wa.docx

Included in the December 31, 2015, Jacobi Company balance sheet wa.docx

Included in the December 31, 2015, Jacobi Company balance sheet .docx

Included in the December 31, 2015, Jacobi Company balance sheet .docx

For this exam, omit all general journal entry explanations.Ensure .pdf

For this exam, omit all general journal entry explanations.Ensure .pdf

ACCT 221Midterm Problems1. Albert Corporation is author.docx

ACCT 221Midterm Problems1. Albert Corporation is author.docx

Identifying and Analyzing Financial Statement Effects of Stock Trans.pdf

Identifying and Analyzing Financial Statement Effects of Stock Trans.pdf

Winnie Corporation was organized on January 1- 2022- It is authorized.pdf

Winnie Corporation was organized on January 1- 2022- It is authorized.pdf

Questions 11-15 are based on the followingRose Corporation acquir.pdf

Questions 11-15 are based on the followingRose Corporation acquir.pdf

Acct 221Final Exam Student NameQuestion 1 30 pointsa. .docx

Acct 221Final Exam Student NameQuestion 1 30 pointsa. .docx

Stockholders’ Equity 1 Corporate Capital Illustration Experience Tradition/tu...

Stockholders’ Equity 1 Corporate Capital Illustration Experience Tradition/tu...

ACC 201 Ch 13 Problem (LinkedIn)

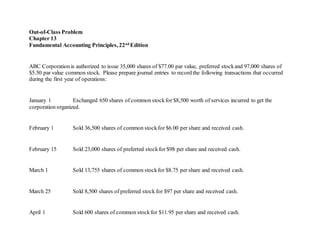

- 1. Out-of-Class Problem Chapter 13 Fundamental Accounting Principles, 22nd Edition ABC Corporation is authorized to issue 35,000 shares of $77.00 par value, preferred stockand 97,000 shares of $5.50 par value common stock. Please prepare journal entries to record the following transactions that occurred during the first year of operations: January 1 Exchanged 650 shares of common stockfor $8,500 worth of services incurred to get the corporation organized. February 1 Sold 36,500 shares of common stockfor $6.00 per share and received cash. February 15 Sold 23,000 shares of preferred stockfor $98 per share and received cash. March 1 Sold 13,755 shares of common stockfor $8.75 per share and received cash. March 25 Sold 8,500 shares of preferred stock for $97 per share and received cash. April 1 Sold 600 shares of common stockfor $11.95 per share and received cash.

- 2. Page 1 DEBIT CREDIT Jan 1 Organizational Expense 8,500.00 Common Stock 3,575.00 Paid-In Capital In Excess of Par Value 4,925.00 (Gave 650 shares of common stock to promoters at $5.50 par value) Feb 1 Cash 219,000.00 Common Stock 200,750.00 Paid-In Capital In Excess of Par Value 18,250.00 (Sold 36,500 shares of common stock to investors at $5.50 par value) 15 Cash 2,254,000.00 Preferred Stock 1,771,000.00 Paid-In Capital In Excess of Par Value 483,000.00 (Sold 23,000 shares of preferred stock to investors at $77 par value) Mar 1 Cash 120,356.25 Common Stock 75,652.50 Paid-In Capital In Excess of Par Value 44,703.75 (Sold 13,755 shares of common stock to investors at $5.50 par value) 25 Cash 824,500.00 Preferred Stock 654,500.00 Paid-In Capital In Excess of Par Value 170,000.00 (Sold 8,500 shares of preferred stock to investors at $77 par value) Apr 1 Cash 7,170.00 Common Stock 3,300.00 Paid-In Capital In Excess of Par Value 3,870.00 (Sold 600 shares of common stock to investors at $5.50 par value) GENERAL JOURNAL DATE DESCRIPTION 2015 Shares Outstanding 650 Common Shares Outstanding 37,150 Common Shares Outstanding 23,000 Preferred Shares Outstanding 50,905 Common Shares Outstanding 31,500 Preferred Shares Outstanding 51,505 Common