Transfer Pricing

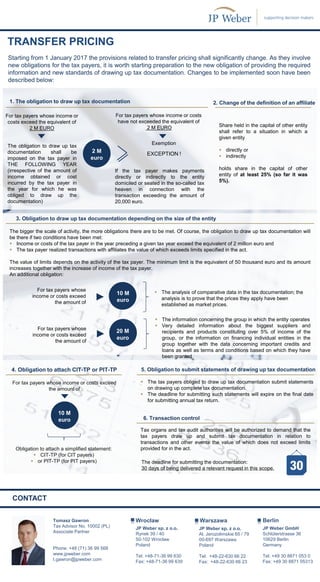

- 1. Starting from 1 January 2017 the provisions related to transfer pricing shall significantly change. As they involve new obligations for the tax payers, it is worth starting preparation to the new obligation of providing the required information and new standards of drawing up tax documentation. Changes to be implemented soon have been described below: The obligation to draw up tax documentation shall be imposed on the tax payer in THE FOLLOWING YEAR (irrespective of the amount of income obtained or cost incurred by the tax payer in the year for which he was obliged to draw up the documentation) Share held in the capital of other entity shall refer to a situation in which a given entity directly or indirectly holds share in the capital of other entity of at least 25% (so far it was 5%). 2. Change of the definition of an affiliate1. The obligation to draw up tax documentation 2 M euro For tax payers whose income or costs exceed the equivalent of 2 M EURO Exemption EXCEPTION ! If the tax payer makes payments directly or indirectly to the entity domiciled or seated in the so-called tax heaven in connection with the transaction exceeding the amount of 20,000 euro. The bigger the scale of activity, the more obligations there are to be met. Of course, the obligation to draw up tax documentation will be there if two conditions have been met: Income or costs of the tax payer in the year preceding a given tax year exceed the equivalent of 2 million euro and The tax payer realized transactions with affiliates the value of which exceeds limits specified in the act. The value of limits depends on the activity of the tax payer. The minimum limit is the equivalent of 50 thousand euro and its amount increases together with the increase of income of the tax payer. An additional obligation: 3. Obligation to draw up tax documentation depending on the size of the entity 10 M euro For tax payers whose income or costs exceed the amount of The analysis of comparative data in the tax documentation; the analysis is to prove that the prices they apply have been established as market prices. 20 M euro For tax payers whose income or costs exceed the amount of The information concerning the group in which the entity operates Very detailed information about the biggest suppliers and recipients and products constituting over 5% of income of the group, or the information on financing individual entities in the group together with the data concerning important credits and loans as well as terms and conditions based on which they have been granted Tomasz Gawron Tax Advisor No. 10002 (PL) Associate Partner Phone: +48 (71) 36 99 568 www.jpweber.com t.gawron@jpweber.com TRANSFER PRICING Wrocław JP Weber sp. z o.o. Rynek 39 / 40 50-102 Wroclaw Poland Tel: +48-71-36 99 630 Fax: +48-71-36 99 639 Warszawa JP Weber sp. z o.o. Al. Jerozolimskie 65 / 79 00-697 Warszawa Poland Tel: +48-22-630 66 22 Fax: +48-22-630 66 23 Berlin JP Weber GmbH Schlüterstrasse 36 10629 Berlin Germany Tel: +49 30 8871 053 0 Fax: +49 30 8871 05313 CONTACT For tax payers whose income or costs have not exceeded the equivalent of 2 M EURO 4. Obligation to attach CIT-TP or PIT-TP 10 M euro For tax payers whose income or costs exceed the amount of Obligation to attach a simplified statement: CIT-TP (for CIT payers) or PIT-TP (for PIT payers) The tax payers obliged to draw up tax documentation submit statements on drawing up complete tax documentation. The deadline for submitting such statements will expire on the final date for submitting annual tax return. 5. Obligation to submit statements of drawing up tax documentation Tax organs and tax audit authorities will be authorized to demand that the tax payers draw up and submit tax documentation in relation to transactions and other events the value of which does not exceed limits provided for in the act. 6. Transaction control The deadline for submitting the documentation: 30 days of being delivered a relevant request in this scope.