2019.01.22 Roth New Pacific Report

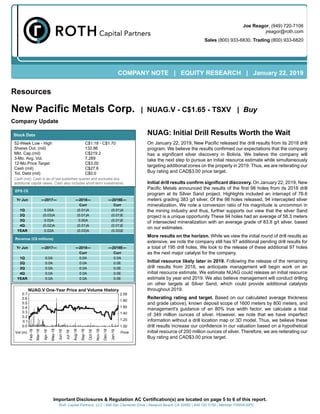

- 1. Joe Reagor, (949) 720-7106 jreagor@roth.com Sales (800) 933-6830, Trading (800) 933-6820 COMPANY NOTE | EQUITY RESEARCH | January 22, 2019 Resources New Pacific Metals Corp. | NUAG.V - C$1.65 - TSXV | Buy Company Update Stock Data 52-Week Low - High C$1.18 - C$1.70 Shares Out. (mil) 132.86 Mkt. Cap.(mil) C$219.2 3-Mo. Avg. Vol. 7,269 12-Mo.Price Target C$3.00 Cash (mil) C$27.6 Tot. Debt (mil) C$0.0 Cash (mil): Cash is as of last published quarter and excludes any additional capital raises. Cash also includes short-term investments. EPS C$ Yr Jun —2017— —2018— —2019E— Curr Curr 1Q 0.05A (0.01)A (0.01)A 2Q (0.03)A (0.01)A (0.01)E 3Q 0.02A 0.00A (0.01)E 4Q (0.02)A (0.01)A (0.01)E YEAR 0.02A (0.03)A (0.03)E Revenue (C$ millions) Yr Jun —2017— —2018— —2019E— Curr Curr 1Q 0.0A 0.0A 0.0A 2Q 0.0A 0.0A 0.0E 3Q 0.0A 0.0A 0.0E 4Q 0.0A 0.0A 0.0E YEAR 0.0A 0.0A 0.0E 2.00 1.80 1.60 1.40 1.20 1.00 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 PriceVol (m) NUAG.V One-Year Price and Volume History NUAG: Initial Drill Results Worth the Wait On January 22, 2019, New Pacific released the drill results from its 2018 drill program. We believe the results confirmed our expectations that the company has a significant silver discovery in Bolivia. We believe the company will take the next step to pursue an initial resource estimate while simultaneously targeting additional zones on the property in 2019. Thus, we are reiterating our Buy rating and CAD$3.00 price target. Initial drill results confirm significant discovery. On January 22, 2019, New Pacific Metals announced the results of the first 98 holes from its 2018 drill program at its Silver Sand project. Highlights included an intercept of 76.6 meters grading 383 g/t silver. Of the 98 holes released, 94 intercepted silver mineralization. We note a conversion ratio of his magnitude is uncommon in the mining industry and thus, further supports our view that the silver Sand project is a unique opportunity These 94 holes had an average of 58.3 meters of intersected mineralization with an average grade of 83.8 g/t silver, based on our estimates. More results on the horizon. While we view the initial round of drill results as extensive, we note the company still has 97 additional pending drill results for a total of 195 drill holes. We look to the release of these additional 97 holes as the next major catalyst for the company. Initial resource likely later in 2019. Following the release of the remaining drill results from 2018, we anticipate management will begin work on an initial resource estimate. We estimate NUAG could release an initial resource estimate by year end 2019. We also believe management will conduct drilling on other targets at Silver Sand, which could provide additional catalysts throughout 2019. Reiterating rating and target. Based on our calculated average thickness and grade (above), known deposit scope of 1600 meters by 800 meters, and management's guidance of an 80% true width factor, we calculate a total of 349 million ounces of silver. However, we note that we have imperfect information without a drill location map or 3D model. Thus, we believe these drill results increase our confidence in our valuation based on a hypothetical initial resource of 200 million ounces of silver. Therefore, we are reiterating our Buy rating and CAD$3.00 price target. Important Disclosures & Regulation AC Certification(s) are located on page 5 to 6 of this report. Roth Capital Partners, LLC | 888 San Clemente Drive | Newport Beach CA 92660 | 949 720 5700 | Member FINRA/SIPC

- 2. VALUATION We note NUAG is at an earlier stage than the majority of the other mining companies we cover, but believe the company’s Silver Sand asset is too unique to ignore until further information becomes available. Our use of a CAD$3.00 price target is based on the expectation that the company spends over CAD$12 million advancing the asset through drilling over the next year, which we believe could outline an initial resource north of 200 million ounces of silver. If the company is able to define a resource of this magnitude, we believe this valuation would prove conservative. Additionally, based on the current value of the company, we see significant upside potential. Thus, we are reiterating our Buy rating. Factors that could impede NUAG's ability to reach our price target include, but are not limited to: unexpected dilutive transactions, failure to delineate a significant resource, negative regulatory decisions, disappointing drill results, unexpected delays, unexpected technical issues, and other unforeseeable events. RISKS Political risk. Natural resource companies are subject to significant political risk. Although most mining jurisdictions have known laws, potential exists for these laws to change. As a Bolivia focused company, NUAG has slightly higher political risk than other similar stage mining companies. Commodity price risk. All natural resource companies have some form of commodity price risk. This risk is not only related to final products, but can also be in regards to input costs and substitute goods. NUAG’s biggest commodity price risk is to that of silver, but the company also has exposure to input costs such as energy. Operational and technical risk. Natural resources companies have significant operational and technical risks. Despite completing NI 43-101 compliant (or similar) resource estimates, deposits can still vary significantly compared to expectations. Additionally, numerous unforeseeable issues can occur with operations and exploration activities. Given the early-stage nature of the Silver sand project, SVM has significantly greater technical risk to other later-stage exploration companies. Pre-revenue risk. New Pacific is a pre-revenue company and is likely to need significant additional capital in order to reach positive cash flow. There is also no guarantee the company will ever become cash flow positive. Market risk. Although most natural resource companies are more closely tied to individual commodity price performance, large business cycle forces or economic crises can impact a company’s valuation significantly. NUAG has similar market risk to other precious metals companies. Cautionary Note to US Investors: Estimates of Measured, Indicated and Inferred Resources “Measured Mineral Resources” and “Indicated Mineral Resources.” US investors are advised that although these terms are required by Canadian regulations, the US Securities and Exchange Commission (SEC) does not recognize them, and describes the equivalent as “Mineralized Material.” US investors are cautioned not to assume that these terms are any form of guarantee. “Inferred Mineral Resources.” US Investors are advised that while this term is required by Canadian regulations, the SEC does not recognize it. “Inferred Mineral Resources” are not delineated with a great deal of certainty and should not be considered likely to be brought into production in whole or in part. Page 2 of 6 NEW PACIFIC METALS CORP. Company Note - January 22, 2019

- 3. COMPANY DESCRIPTION New Pacific Metals Corp, formerly New Pacific Holdings Corp., is an investment issuer engaged in investing in privately held and publicly traded corporations. The Company operates through two segments: investment and mining. The investment segment focuses on investing in other privately-held and publicly-traded corporations. The mining segment focuses on safeguarding the value of its exploration and development mineral properties. The investment objective for the Company as an investment issuer is to seek a high return on investment opportunities, primarily in the natural resource, industrial or technology sectors, and to preserve capital and limit downside risk while achieving a reasonable rate of return by focusing on opportunities with attractive risk to reward profiles. The Company was engaged in the acquisition and exploration of mineral property interests in Canada and China. The Company focuses on the development of the Tagish Lake Gold Property and the RZY Project. Source: Eikon as of 2/13/18. Page 3 of 6 NEW PACIFIC METALS CORP. Company Note - January 22, 2019

- 4. Amounts in CAD$ million 2017A 1Q18A 2Q18A 3Q18A 4Q18A 2018A 1Q19A 2Q19E 3Q19E 4Q19E 2019E Revenue - - - - - - - - - - - Operating Expenses (0.9) 1.1 1.2 0.8 1.6 4.6 0.4 0.9 0.9 0.9 3.1 Operating Income 0.9 (1.1) (1.2) (0.8) (1.6) (4.6) (0.4) (0.9) (0.9) (0.9) (3.1) Other Expenses (0.4) 0.5 (0.1) (0.5) (0.4) (0.5) 0.3 - - - 0.3 Pretax Income 1.4 (1.6) (1.1) (0.3) (1.2) (4.1) (0.8) (0.9) (0.9) (0.9) (3.5) Taxes - - - - - - - - - - - Net Income 1.4 (1.6) (1.1) (0.3) (1.2) (4.1) (0.8) (0.9) (0.9) (0.9) (3.5) Basic Shares 66.9 104.0 120.5 132.0 131.9 122.1 132.5 132.9 132.9 132.9 132.8 FD Shares 67.4 104.0 120.5 132.0 131.9 122.1 132.5 146.2 146.2 146.2 142.8 Basic EPS $0.02 ($0.01) ($0.01) ($0.00) ($0.01) ($0.03) ($0.01) ($0.01) ($0.01) ($0.01) ($0.03) FD EPS $0.02 ($0.01) ($0.01) ($0.00) ($0.01) ($0.03) ($0.01) ($0.01) ($0.01) ($0.01) ($0.03) Joseph Reagor jreagor@roth.com (949)-720-7106 New Pacific Key Estimates Source: SEC Filings, ROTH Capital Partners estimates Page 4 of 6 NEW PACIFIC METALS CORP. Company Note - January 22, 2019

- 5. Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report. Disclosures: An Associated Person owns debt or equity securities of New Pacific Metals Corp.. Shares of New Pacific Metals Corp. and Silvercorp Metals Inc. may be subject to the Securities and Exchange Commission's Penny Stock Rules, which may set forth sales practice requirements for certain low-priced securities. ROTH makes a market in shares of Silvercorp Metals Inc. and as such, buys and sells from customers on a principal basis. Rating and Price Target History for: New Pacific Metals Corp. (NUAG.V) as of 01-21-2019 1.80 1.60 1.40 1.20 1.00 0.80 0.60 0.40 0.20 2016 Q1 Q2 Q3 2017 Q1 Q2 Q3 2018 Q1 Q2 Q3 2019 Q1 02/15/18 I:B:$3 Created by: BlueMatrix Rating and Price Target History for: Silvercorp Metals Inc. (SVM) as of 01-21-2019 5 4 3 2 1 0 2016 Q1 Q2 Q3 2017 Q1 Q2 Q3 2018 Q1 Q2 Q3 2019 Q1 08/28/17 I:B:$3.5 11/09/17 B:$3.8 05/29/18 B:$4.25 Created by: BlueMatrix Each box on the Rating and Price Target History chart above represents a date on which an analyst made a change to a rating or price target, except for the first box, which may only represent the first note written during the past three years. Distribution Ratings/IB Services shows the number of companies in each rating category from which Roth or an affiliate received compensation for investment banking services in the past 12 month. Distribution of IB Services Firmwide IB Serv./Past 12 Mos. Page 5 of 6 NEW PACIFIC METALS CORP. Company Note - January 22, 2019

- 6. as of 01/22/19 Rating Count Percent Count Percent Buy [B] 271 78.55 149 54.98 Neutral [N] 47 13.62 27 57.45 Sell [S] 3 0.87 2 66.67 Under Review [UR] 24 6.96 11 45.83 Our rating system attempts to incorporate industry, company and/or overall market risk and volatility. Consequently, at any given point in time, our investment rating on a stock and its implied price movement may not correspond to the stated 12- month price target. Ratings System Definitions - ROTH employs a rating system based on the following: Buy: A rating, which at the time it is instituted and or reiterated, that indicates an expectation of a total return of at least 10% over the next 12 months. Neutral: A rating, which at the time it is instituted and or reiterated, that indicates an expectation of a total return between negative 10% and 10% over the next 12 months. Sell: A rating, which at the time it is instituted and or reiterated, that indicates an expectation that the price will depreciate by more than 10% over the next 12 months. Under Review [UR]: A rating, which at the time it is instituted and or reiterated, indicates the temporary removal of the prior rating, price target and estimates for the security. Prior rating, price target and estimates should no longer be relied upon for UR-rated securities. Not Covered [NC]: ROTH does not publish research or have an opinion about this security. ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months. The material, information and facts discussed in this report other than the information regarding ROTH Capital Partners, LLC and its affiliates, are from sources believed to be reliable, but are in no way guaranteed to be complete or accurate. This report should not be used as a complete analysis of the company, industry or security discussed in the report. Additional information is available upon request. This is not, however, an offer or solicitation of the securities discussed. Any opinions or estimates in this report are subject to change without notice. An investment in the stock may involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Additionally, an investment in the stock may involve a high degree of risk and may not be suitable for all investors. No part of this report may be reproduced in any form without the express written permission of ROTH. Copyright 2019. Member: FINRA/SIPC. Page 6 of 6 NEW PACIFIC METALS CORP. Company Note - January 22, 2019