Admission of a Partner

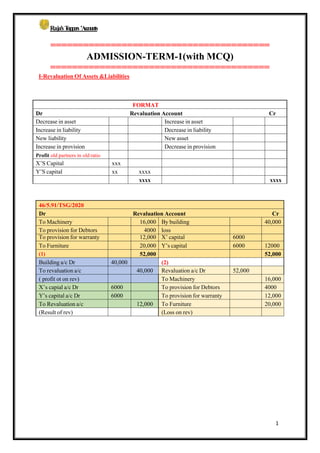

- 1. Raja’sT op p e r s’A ccou n ts ======================================== ADMISSION-TERM-1(with MCQ) ======================================== I-Revaluation Of Assets &Liabilities FORMAT Dr Revaluation Account Cr Decrease in asset Increase in asset Increase in liability Decrease in liability New liability New asset Increase in provision Decrease in provision Profit old partners in old ratio X’S Capital xxx Y’S capital xx xxxx xxxx xxxx 46/5.91/TSG/2020 Dr Revaluation Account Cr To Machinery 16,000 By building 40,000 To provision for Debtors 4000 loss To provision for warranty 12,000 X’ capital 6000 To Furniture 20,000 Y’s capital 6000 12000 (1) 52,000 52,000 Building a/c Dr 40,000 (2) To revaluation a/c 40,000 Revaluation a/c Dr 52,000 ( profit ot on rev) To Machinery 16,000 X’s capial a/c Dr 6000 To provision for Debtors 4000 Y’s capital a/c Dr 6000 To provision for warranty 12,000 To Revaluation a/c 12,000 To Furniture 20,000 (Result of rev) (Loss on rev) 1

- 2. Raja’sT op p e r s’A ccou n ts 49/5.92/TSG/2020 Dr Revaluation Account Cr To stock 40,000 loss To furniture 36000 X’ capital 76000x3/5 45,600 Y’s capital76000x2/5 30,400 76000 (1) 76,000 (2) 76,000 Revaluation a/c Dr 76,000 X’s capital a/c Dr 45600 To stock 40000 Y’s capital a/c Dr 30,400 To Furniture 36000 To Revaluation a/c 76000 (loss on revaluation) (Result of revaluation) 50// 5.92/TSG/2020 Dr Revaluation Account Cr X’s capital a/c Dr 6000 By investment 10,000 Y’s capital a/c Dr 4,000 10,000 10,000 10,000 Investment a/c Dr 10,000 Revaluation a/c Dr 10,000 To revaluation 10,000 X’s capital a/c Dr 6000 (increase in investment Y’s capital a/c Dr 4000 (result of revaluation 52// 5.92/TSG/2020 Dr Revaluation Account Cr To provision for debtors 5000 By creditors 5000 To provision for O/S bill 2000 By building 40,000 To creditors 3000 By investment 15,000 Ramesh capital 25,000 Naresh capital 25,000 60,000 60,000 (1)creditors 5000 (2)Revaluation a/c Dr 10,000 building 40,000 To provision for debtors 5000 investment 15,000 To provision for O/S bill 2000 To revaluation 60,000 To creditors 3000 (3)Revaluation a/c Dr 50,000 To Ramesh capital 25,000 To Naresh capital 25,000 2

- 3. Raja’sT op p e r s’A ccou n ts ACCUMULATED RESERVES & UNDISTRIBUTED PROFIT/LOSS ACCUMULATED RESERVES & UNDISTRIBUTED PROFIT/LOSS - divide among old partner in old ratio X;Y 3;2 53/5.92/TSG/2021 54/5.92/TSG/2021 General reserve 2,50,000 General reserve 1,50,000 P&L a/c Dr 50,000 To X’s capital 150000x3/5 90,000 To Ram’s capital 2/3 2,00,000 To Y’s capital150000x2/5 60,000 To shyam’s capital 1/3 1,00,000 (300000 divided in 2:1) X’s capital20,000x3/5 12000 Y’s capital 20,000x2/5 8000 To P&L a/c Dr balance 20,000 55/5.92/TSG/2021 X’s capital 24000x5/10 12000 General reserve 36,000 Y’s capital 24000x3/10 7200 Contingency reserve 6000 Z’s capital 24000x2/10 4800 P&La/c 18,000 To Advertisement suspense 24,000 To X’s capital 60000x5/10 30,000 To Y’s capital 60000x3/10 18,000 To Z’s capital 60000x2/10 12,000 b 55/b/5.93/tsg/2021 c W.C. Rreserve 72,000 W.C. Rreserve 72,000 to WC claims 48000 To X's capital 36,000 To X's capital 12000 To Y's capital 36000 To Y's capital 12,000 ( WCF distributed) ( WCF distributed) d invest fluc reserve 24000 e General reserve Dr 4800 To investment 10,000 To inv flu fund 960 To X's capital 7000 To X's capital 1920 To Y's capital 7000 To Y's capital 1920 f A=6/10-3/10=3/10 B=3/10-3/10=0 C= 1/10-3/10=(2/10)GR General reserve 1,50,000 contigencyreserve 60,000 3

- 4. Raja’sT op p e r s’A ccou n ts P&Lcr 90,000 3,00,000 Advt susp 1,20,000 1,80,000 180,000x3/10=54000 c's capital dr 54,000 To a's capital 54,000 Memorandum Balance sheet of X,Y & Z 56/5.93/TSG/2021 Liability Assets X’S Capital 15,000 Motor 12,000 Y’s capital 17,500 Furniture 4,000 Z’s capital 20,000 52,500 stock 26,500 liabilities 30,000 Debtors 37,800 Cash 82500-80300 bal fig. 2200 82,500 82,500 56/5.93/TSG/2021 56/5.93/TSG/2021 Dr Revaluation Account Cr Motor 2500 loss furniture 200 X’s capital a/c 900 Y’s capital a/c 900 Z’s capital a/c 900 2700 2700 2700 CAPITALA/C X Y Z W X Y Z W 4Revaluation 900 900 900 1-By balance b/d 15,000 17,500 20,000 ToBal c/d 19100 21600 24100 18000 2-By Reserve 3-By P&L 5.By premium 5000 5,000 5,000 6- by cash 18,000 20,000 22,500 25,000 18,0.00 20,000 22,500 25,000 18,0.00 4

- 5. Raja’sT op p e r s’A ccou n ts Cash account Bal b/d 2200 By balance c/d 35,200 W’s capital 18,000 Premium Gw 15,000 35200 35,200 Balance sheet of X,Y Z& W 56/5.93/TSG/2021 Liability Assets X capital 19100 Cash 35,200 Y capital 21600 stock 26500 Z capital 24100 Debtors 37800 W capital 18000 82800 Motor 9500 liabilities 30,000 Furniture 3800 1,12,800 1,12,800 ills-46/5.49/TSG/2021 Dr Revaluation Account Cr Provision for bad dr.825-500 325 By investment 2,500 To stock 20,0000x 10% 2000 Loss To furniture 500 W’s capital 5625x 3/5 3375 To plant 40000x8% 3200 R’s capital 5625 x 2/5 2250 5625 To creditor 2,100 8125 8125 Capital a/c w R C w R C Revaluationa/c 3375 2250 Balance b/d 60,000 40,000 To cash 3,000 2,000 By General reserve 3000 2000 Balance c/d 62,625 41750 30,000 By premium for Gwill 6000 4000 By cash 30,000 69,000 46,000 30,000 69,000 46,000 30,000 5

- 6. Raja’sT op p e r s’A ccou n ts Cash account Bal b/d 12000 By o/s salary 3000 C’s capital 30,000 W’s capital 3000 Premium Gw 10,000 R’s capital 2000 By balance c/d 44,000 52,000 52,000 Balance sheet of X,Y Z& W Liability Assets W’s capital 62,625 cash 44,000 R’s capital 41,750 Debtor 18,000 C’s capital 30,000 1,34,375 Bad debt (1500) Creditors 20,000+2100 22,100 16,500 Less provision 5% of 16,500 825 15,675 Stock20000-2000 18000 Furniture40,000-500 39500 P& Machinery 40,000-3200 36800 investment 2500 1,56,475 1,56,475 47/5.51/TSG/2021 Dr Revaluation Account Cr building 25,000 stock 1,00,000 Machinery 10,000 Delivery van 1,20,000 Outstanding salary 30,000 A’s capital 1,55,000X3/5 93,000 B’s capital 1,55,000X2/5 62,000 1,55,000 2,20,000 2,20,000 Capital a/c A B C A B C To Goodwill w/off 30,000 20,000 Balance b/d 8,00,000 4,00,000 Balance c/d 11,73,000 5,82,000 5,00,000 By General reserve 90,000 60,000 Revaluationa/c 93,000 62,000 C’s current account-80000 48,000 32,000 By premium for Gwill 72,000 48,000 By cash 5,00,000 11,03,000 6,02,000 5,00,000 Bank account Bal b/d 5,75,000 By balance c/d 11,95,000 C’s capital 5,00,000 6

- 7. Raja’sT op p e r s’A ccou n ts Premium Gw 1,20,000 1195,000 11,95,000 Balance sheet of X,Y Z& W Liability Assets A’s capital 11,73,000 cash 25,000 B’s capital 5,82,000 Bank 11,95,000 C’s capital 5,00,000 21,55,000 stock 4,00,000 creditors 2,50,000 Debtors 50,000 Bills payable 1,00,000 Delivery van 1,20,000 Outstandingsalary 30,000 building 4,75,000 Machinery 1,90,000 C’s current account 80,000 25,35,000 25,35,000 Asha & Aditi were partners sharing y 15,000. profit in 3:2. They admitted Raghav for 1/4th share with the capital of 6,00,000 and his share of goodwill in cash. Goodwill is to be valued at two years purchase of average profit of last four years.. The profits were 2014-₹3,50,000, 2015- ₹4,75,000, 2016- ₹6,70,000, 2017- ₹7,45,000. The following additional information’s were also given. 1. To cover the cost oof management cost 56,250 should be made. 2. Closing stock of 2017 was over valued Give the necessary journals on Rahul’s admission. (ills 38/5.34/TSG/2021) year profit adjustment adjusted profit 2014 3,50,000 -56,250 2,93,750 2015 4,75,000 -56,250 4,18,750 2016 6,70,000 -56,250 6,13,750 2017 7,,45,000 -56,250 -15,000 6,73,750 Goodwill= 293750+418750+613750+673750=20.00.000/4=500,000x2=10,00,000 Raghav goodwill=10,00,000x1/4=2,50,000 cash a/c Dr 8,50,000 ToRaghav capital 6,00,000 To premium for Goodwill 2,50,000 premium for Goodwill 2,50,000 To asha's capital 250,000x3/5 1,50,000 To Aditi capital2,50,000x2/5 1,00,000 7

- 8. Raja’sT op p e r s’A ccou n ts 39/5.35/TSG/2021 Revaluation account Provision for Dr 500 stock 3000 Machinery 2000 Land & Building 14700 furniture 1250 investment 2000 outstanding Ebill 5,000 prepaid insurance 5000 swdesh capital 7975 swaraj capital 7975 24,700 24,700 Bank account To balance b/d 15,000 swdesh capital 2500 sambav capital 20,000 swaraj capital 2500 premium for Gwill 5000 balance c/d 35,000 40,000 40,000 Capital account swdesh swaraj sambav swdesh swaraj sambav to cash 2,500 2,500 balance b/d 60,000 40,000 67975 47,975 20,000 revaluation na/c 7975 7,975 By premium for G.will 2500 2,500 By cash 20,000 70475 50,475 20,000 70475 50,475 20,000 Balance sheet cash 12,000 swdesh 67975 bank 35,000 swaraj 47,975 Debtors20000-1000 19,000 sambav 20,000 stock 23,000 creditors 50,000 furniture 8750 bills payable 15000 machinery 16000 outstanding exps 8,000 Land & building 88,200 investment 2,000 prepaid insurance 5,000 2,08,950 2,08,950 =============================================================== 8

- 9. Raja’sT op p e r s’A ccou n ts ills-40/5.35/TSG/2021 Revaluation account Furniture 11,000 debtors 5000 provision for Dr 4000 Land & building 62,000 provision for B/R 2,250 claims damages 8000 chander capital 20875 Damini capital 20875 670001-26650=41750 67,000 Bank account To balance b/d 30,000 chander capital 12500 Elins capital 3,00,000 damini capital 12500 premium for Gwill 50,000 balance c/d 3,55,000 3,80,000 40,000 Capital account chander Damini Elina chander Damini Elina to cash 12,500 12,500 balance b/d 2,50,000 2,16,000 balance c/d 2,83,375 2,49,375 3,00,000 revaluation na/c 20,875 20,875 By premium for G.will 25,000 25,000 By cash 3,00,000 295875 2,61,875 3,00,000 295875 2,61,875 3,00,000 Balance sheet LIABILITY ASSETS chander 283375 bank 3,55,000 Damini capital 249375 Bills receivable 42,750 Elina's capital 3,00,000 Debtors 76,000 creditors 1,04,000 Furniture 99,000 claims outstanding 8000 Land & building 3,72,000 9,44,750 9,44,750 ============================================================= Treatment of workmen compensation fund 9

- 10. Raja’sT op p e r s’A ccou n ts 1lls43/5.43/TSG/2021 1 workmen com fund 90,000 2 workmen com fund 90,000 To Ram's capital 40,000 To wc claims 45,000 ToMohan's capital 30,000 To Ram's capital 20,000 To sohan's capital 20,000 ToMohan's capital 15,000 To sohan's capital 10,000 3 workmen com fund 90,000 Revaluation 9000 To wc claims 99,000 Ram's capital 4000 Mohan'scapital 3000 sohan's capital 2000 To revaluation 9,000 Treatment of investment fluctuation fund 1lls44/5.46/TSG/2021 1 inv fluc fund 18,000 2 same as case-1 To somus capital 8,000 Tosumit's s capital 6,000 4 inv fluc fund 18,000 To sahil's s capital 4,000 revaluation 9000 To wc claims 27,000 3 inv fluc fund 18,000 To investment 9,000 somus capital 4000 To somus capital 4,000 sumit's s capital 3000 Tosumit's s capital 3,000 sahil's s capital 2000 To sahil's s capital 2,000 To Revaluation 9000 5 inv fluc fund 18,000 investment 18000 To somus capital 8,000 To Revaluation 18,000 Tosumit's s capital 6,000 To sahil's s capital 4,000 RevaluationDr 18000 To somus capital 8,000 Tosumit's s capital 6,000 To sahil's s capital 4,000 10

- 11. Raja’sT op p e r s’A ccou n ts 57/5.94/TSG/2020 Dr Revaluation Account Cr Decrease in asset Increase in asset Increase in liability Decrease in liability New liability New Liability Increase in provision Decrease in provision Profit old partners in old ratio X’S Capital xxx Y’S capital xx xxxx xxxx xxxx ================================================= Admission of partners-full problem =================================================== 57/5.94/TSG/2020 Dr Revaluation Account Cr To stock 500 By Building 2,500 To Plant & Machinery 875 To Provision for Debtors 375 To Profit A capital 750x2/3 500 B's capital 750x1/3 250 750 2,500 2,500 57/5.94/TSG/2021 BALANCE SHEET of ABC liability Asset A capital 17,500 Cash 11,100 B's capital 11,250 Building 27,500 C's capital 7,500 36,250 Plant & Machinery 16,625 creditors 32,950 stock 9,500 Debtors4850-375 4,475 11

- 12. Raja’sT op p e r s’A ccou n ts 69,200 69,200 57/5.94/TSG/2021 CASH ACCOUNT To Balance b/d 600 By Balance c/d 11,100 To C's capital 7,500 To premium for Goodwill 3,000 11,100 11,100 Capital Account C A B C To Balance c/d 57/5.94/TSG/2021 A B 17,500 11,250 7,500 By Balance b/d 15,000 10,000 By Revaluation 500 250 By Premium for G.will 2,000 1,000 By Cash 7,500 17,500 11,250 7,500 17,500 11,250 7,500 59/5.94/TSG/2021 Revaluation Account To Stock 4,000 Plant 20,000 To Provi for Debtors 3,000 building 15,000 To creditors 1,000 To Profit A capital 18,000 B's capital 9,000 27,000 35,000 35,000 59/5.94/TSG/2021 BALANCE SHEET of ABC liability Asset A capital 2,38,000 Bank 2,00,000 B's capital 1,79,000 Debtors60000-3000 57,000 C's capital 1,00,000 5,17,000 Stock40000-4000 36,000 creditors 59,000 Plant 1,20,000 Bills payable 10,000 Building 1,65,000 outstandingExpenses 2,000 Cash 10,000 5,88,000 5,88,000 12

- 13. Raja’sT op p e r s’A ccou n ts 61/5.95/TSG/2020 Revaluation Account To provi for debtor 5,000 By Land & Building 26,000 To work men compen 6,000 To Profit M capital 15000x2/5 6,000 V's capital 15000x3/5 9,000 15,000 26,000 26,000 61/5.95/TSG/2020 BALANCE SHEET-MVG M capital 5,98,000 Cash/bank 6,00,000 V's capital 4,17,000 Land & Building 3,26,000 G's capital 4,00,000 14,15,000 Machinery 2,80,000 Bills payable 1,50,000 Stock 80,000 Workmen claims 6,000 Debtors 3,00,000 Provi for Debtors 15,000 2,85,000 15,71,000 15,71,000 BANK ACCOUNT To Balance b/d 40,000 By Balance c/d 2,00,000 To C's capital 1,00,000 To premium for Goodwill 60,000 2,00,000 2,00,000 59/5.94/TSG/2021 Capital Account A B C A B C To Balance c/d 2,38,000 1,79,000 1,00,000 By Balance b/d 1,80,000 1,50,000 By Revaluation 18,000 9,000 By Premium for G/will 40,000 20,000 By Cash 1,00,000 2,38,000 1,79,000 1,00,000 2,38,000 1,79,000 1,00,000 13

- 14. Raja’sT op p e r s’A ccou n ts Capital Account 61/5.95/TSG/2020 M V G M V G To Balance c/d 5,98,000 4,17,000 4,00,000 By Balance b/d 5,20,000 3,00,000 By General reserve 12,000 18,000 By Revaluation 6,000 9,000 By Premium for Goodwill 60,000 90,000 By Cash 4,00,000 5,98,000 4,17,000 4,00,000 5,98,000 4,17,000 4,00,000 old ratio M=2/5-2/10=2/10, V=3/5-3/10= 3/10 SR=2:3 Total goodwill=3,00,000, Gayathri goodwill 3,00,000x5/10=1,50,000 divided in 2:3= 60,000:90,000 62/5.96/TSG/2021 Revaluation Account To stock 1,800 building 15,000 To furniture 440 O/Commission 2,400 To o/s rent 4,800 Bank 2,400 To Provision for Debtors 275 Shym capital 12485 x 2/5 4,994 Sanjay capital 12485 x3/5 7,491 12,485 19,800- 7315=12485 19,800 19,800 62/5.96/TSG/2021 BALANCESHEET cash 710 Shyam’s capital 47044 Bank 64325 sanjay’s capital 53541 Debtors 5,500 shanker’s capital 30,000 1,30585 Less provision 275 5,225 creditor 12435 stock 16,200 Outstanding rent 4,800 Furniture 3,960 Building 55,000 Accrued commission 2,400 1,47,820 1,47,820 61/5.95/TSG/2020 Bank account To bal b/d 50,000 bal c/d 6,00,000 Gayathri’s capital 4,00,000 premium for Gwill 1,50,000 6,00,000 6,00,000 14

- 15. Raja’sT op p e r s’A ccou n ts Capital Account 62/5.96/TSG/2021 Shyam Sanjay Shankar Shyam Sanjay Shankar To Balance c/d 47,044 53,541 30,000 By Balance b/d 34,050 34,050 By Revaluation 4,994 7,491 By Premium for Goodwill 8,000 12,000 By Cash 30,000 47,044 53,541 30,000 47,044 53,541 30,000 62/5.96/TSG/2021 bank account bal b/d710+11925) 11925 balance c/d 64325 premium 20,000 Revaluation 2400 shanker capital 30,000 64325 64325 =========================================================================== 63*/5.95/TSG/2021important model Revaluation Account Provision for debtors 34000x5% 1,700 Prepaid expenses 1,200 (Debtor30000+B/R4000) B, capital( drawings) 2,000 A’s capital-(expenses) 2100 A’s capital 300 B's capital 200 C's capital 100 600 3,800 3,800 63*/5.95/TSG/2021 BALANCESHEET A capital 61,800 Land and Building 50,000 B's capital 57,800 Plant & Machinery 40,000 C's capital 39,900 Furniture 30,000 D's capital 50,000 2,09,500 pre paid expenses 1,200 creditors 30,000 stock 20,000 Less: D’s capital -10,000 20,000 Debtors 30,000 Bills payable 10,000 BR dishonoured +4,000 34,000 Less provision 1,700 32,300 Bills receivable 20,000 15

- 16. Raja’sT op p e r s’A ccou n ts Bank 46,000 2,39,500 2,39,500 CAPITALACCOUNT 63*/5.95/TSG/2021 A B C D A B C D Revaluationexps 2,000 By Balance b/d 60,000 60,000 40,000 Revaluation 300 200 100 creditor 10,000 To Balance c/d 61,800 57,800 39,900 40,000 cash 40,000 Revaluation 2,100 62,100 60,000 40,000 50,000 62,100 60,000 40,000 50,000 1 prepaid expenses 1,200 3 A's capital Dr 300 B, capital( drawings) 2,000 B's capital Dr 200 To Revaluation A/c 3,200 C'c capital Dr 100 (profit on Revaluation) To Revaluation a/c 600 (resultof Revaluation) 2 Revaluation A/c DR 3,800 Provision for debtors 1,700 4 Creditor a/c Dr 10,000 A’scapital 2100 Bank a/c Dr 40,000 (Loss on Revaluation) To D's capital 50,000 ( D's capital recorded) 5 Revaluation a/c dr 2,100 To A's capital 2,100 6 B's capital Dr 2,000 (A's drawings) To Revaluation 2,000 (Revaluation exps ) Debtors a/c Dr 4,000 To Bank 4,000 DiscountedBill dishonoured =========================================================================== Bank account Balance b/d 10,000 B/R(bank) 4000 D’s capital 40,000 balance c/d 46,000 50,000 50,000 16

- 17. Raja’sT op p e r s’A ccou n ts 64/5.97/TSG/2020 Revaluation Account stock 20,000 Bank (bad debt recovered) 4,000 o/s salary 12,000 Loss A’s capital 19,500 D’s capital 65,00 26,000 32,000 32,000 64/5.97/TSG/2021 BALANCESHEET Liability Asset A capital 7,59,000 Bank 5,27,000 D's capital 4,53,000 Debtors 6,00,000 V s capital 3,03,000 15,15,000 stock 2,80,000 creditors 2,20,000 Investment 4,40,000 EPF 1,00,000 o/s exps 12,000 18,47,000 18,47,000 64/5.97/TSG/2021 BANK To Balance b/d 1,40,000 balance c/d 5,27,000 Premium for goodwill 80,000 v capital 3,03,000 Revaluation 4000 5,27,000 5,27,000 64/5.97/TSG/2021 Capital Account A D V A D V Revaluation 21,000 7,000 By Balance b/d 6,00,000 4,00,000 To balance c/d 7,59,000 4,53,000 3,03,000 By G. Reserve 90,000 30,000 Inv Fluct fund 30,000 10,000 By premium 60,000 20,000 By cash 3,03,000 7,80,000 4,60,000 3,03,000 7,80,000 4,60,000 3,03,000 X capital 7,59,000 Y's capital 4,53,000 For 4/5 total capital 12,12,000 V’s capital =12,12000X5/4X1/5=3,03,000 17

- 18. Raja’sT op p e r s’A ccou n ts 65/5.97/TSG/2021 Old ratio5:3 SR=5:3 Revaluation Account stock 3,000 provision for Debtors 600 Employee provident fund 5,000 Loss transferred creditors 1,000 X capital 11,500 Fixed Assets 10,000 Y's capital 6,900 18,400 19,000 19,000 65/5.97/TSG/2021 Capital Account X Y Z X Y Z profit& Loss 1,500 900 Balance b/d 70,000 31,000 Revaluation 11,500 6,900 cash 20,000 balance c/d 72,625 25,375 20,000 Premium for Gwill 12,000 W.C.Fund in 5:3 3625 2175 85,625 33,175 20,000 85,625 33,175 20,000 65/5.97/TSG/2021 Balance sheet Liability Assets Xcapital 72,625 cash ,37,000 Y's capital 25,375 Frixed Assets 70,000 Z's capital 20,000 1,18,000 Sundry Debtors 20,000 creditors 16,000 stock 22,000 Employee provident fund 15,000 1,49,000 1,49,000 65/5.97/TSG/2021 Bank & Cash Account Balance b/d 5,000 balance c/d 37,000 premium 12,000 Z's capital 20,000 37,000 37,000 18

- 19. Raja’sT op p e r s’A ccou n ts CAPITALADJUSTMENT ILLS 59/5.71/TSG/2021 X&Y is 3;2, New ratio of Z=1/5, balance =1-1/5=4/5 For 4/5 capitals of X&Y is 80,000+60,000=1,40,000 For 1/5 capital= 1,40,000x5/4x1/5=35000 ================================================================== 86/5.105/TSG/2020 Revaluation Account Plant & Machinery 28,000 Stock 500 Bad Debts 500 Loss Abha's capital 14,000 Binya's capital 14,000 28,000 28,500 28,500 Balance sheet Liablities Assets Abhy's capital 39,500 Bank 38,000 Binay's capital 14,500 Debtors 22,000 Chitra's capital 18,000 72,000 LESS Bad debts 1,500 20,500 Employee's provident fund 8,000 stock 2,500 creditors 13,000 Plant & Machinery 32,000 93,000 93,000 86/5.102/TSG/2020 Capital Account Abhay Binay Chitra Abhay Binay Chitra Revaluation 14,000 14,000 Balance b/d 55,000 30,000 86/5.102/TSG/2020cash/Bank account Balance b/d 15,000 Balance c/d 38,000 C's capital 18,000 premium 5000 38,000 38,000 19

- 20. Raja’sT op p e r s’A ccou n ts Goodwill w/off 5,000 5,000 Bank 18,000 P& La/c 2,500 2,500 premium for Gwill 20000x1/4 2,500 2,500 stock 4,000 4,000 workmen compensation 7,500 7,500 Balance c/d 39,500 14,500 18,000 65,000 40,000 18,000 65,000 40,000 18,000 Chitra ‘s capital =39,500+14500=54,000 x 4/3x1/4=18,000 ================================================================== ADJUSTING OLD PARTNER’S CAPITAL BASED ON NEW PARTNER’S CAPITAL 77/5.104/TSG/2021 Revaluation Account Building 15,000 Badal’s capital 12,000 stock 3000 Bijili’s capital 8,000 20,000 Provision for doubtful debt 2000 20,000 20,000 Capital account 77/5.101/TSG/2020 badal Bijili Raina badal Bijili Raina Current account 30,000 10,00 0 Balance b/d 1,50,000 90,000 Balance c/d 1,20,000 80,000 40,000 cash 40,000 1,50,000 90,000 40,000 CAPITALADJUSTMENT 1/6 capital=40,000 so 1=40000x6/1=2,40,000 divide in new ratio 3:2:1= 120,000:80,000:40,000 Capital Adjustment Abhay's capital= 39,500 old ratio=Abhay:Binay=1:1 Binay's capital= 14500 Abhay new ratio=3/4x1/2= 3/8 For 3/4th capital 54,000 Binay=3/4x1/2=3/8 ¾==54,000 ¼= 54000X4/3x1/4=18000 20

- 21. Raja’sT op p e r s’A ccou n ts 77/5.101/TSG/2020 Current account badal Bijili Raina badal Bijili Raina Balance b/d 2000 Balance b/d 12,000 Revaluation 12,000 8000 Premium for Goodwill 3:2 7200 4800 Balance c/d 51,600 14400 Investment flct fund 3;2 14,400 9600 Capital account 30,00 0 10,00 0 63,600 24,400 63,600 24,400 Balance sheet Liablities Assets Badal’s capital 120,000 Cash a/c 74,000 Bijili’s capital 80,000 building 1,35,000 Raina’s capital 40,000 2,40,000 stock 40,000 Badal’s current a/c 51,600 debtors 20,000 Bijili’s current a/c 14,400 66,000 Less provision 2000 18,000 creditors 26000 investment 73,000 Bills payable 8000 3,40,000 3,40,000 ================================================================================= 78/5.102/TSG/2020 Revaluation Account provision for Debtors 8,000 Stock 70,000 Machinery 21,000 Furniture 5,000 Gautam capital 3/4 27,000 Yashica capital 1/4 9,000 36,000 70,000 70,000 Balance sheet Liabilities Assets Gautam capital 2,10,000 Cash a/c 3,50,000 Yashika capital 1,40,000 Furniture 55,000 Asma capital 2,10,000 5,60,000 stock 2,10,000 77/5.104/TSG/2021--Bank Account Bal b/d 22,000 Balance c/d 74000 Raina’s capital 40,000 premium /G.will 12,000 74,000 74,000 21

- 22. Raja’sT op p e r s’A ccou n ts creditors 50,000 Debtors 80,000 Bills payable 30,000 Less provision 8000 72,000 Gautham’s current a/c 2,67,000 machinery 1,89,000 Yashika’s current a/c 31,000 9,07,000 9,07,000 78/5.104/TSG/2021 Capital account Gautam Yashika Asma Gautam Yashika Asma Current account 2,67,000 Balance b/d 4,00,000 1,00,000 Balance c/d 2,10,000 1,40,000 2,10,000 Revaluation 27,000 9,000 Bank 2,10,000 premium for Gwill 50,000 Nil Current account 31,000 4,77,000 140000 2,10,000 4,77,000 109000 2,10,000 3/8 =2,10,000 TOTAL CAPITAL =210000X8/3=5,60,000 DIVIDE IN3:2:3ie. 210,000:140000:210000 Gautam3/4-3/8=3/8 SR, Yashika 1/4-2/8=0 ================================================================= Admission- Objective type questions with answers ================================================================= i. TRUE/FALSE 1. At the time of admission of partners accumulated profit/loss are transferred to revaluation account. 2. Unrecorded assets & liabilities are transferred to partner’s capital account 3. Undistributed profit and General reserves are transferred to partner’s current account if the capital accounts are maintained under fixed capital method TRUE 4. Ram & shyam are partners sharing profit in the ratio of 7:5. They admitted Mohan for 1/5th share the new profit-sharing ratio is 2:2:1 5. Old profit-sharing ratio plus new profit sharing ratio is sacrificing ratio. 6. At the time of admission if the profit-sharing ratio among old partners does not change then sacrificing ratio will be their old profit sharing ratio. TRUE 7. At the time of admission general reserve will be transferred to old partners capital account in old ratio. 8. Raj is admitted for 1/4th share for which he has to bring in 30,000 as goodwill. It will be taken by old partners in gaining ratio. TRUE 9. Revaluation account will be debited to transfer gain on revaluation to old partners capital account in their old profit-sharing ratio. TRUE 22

- 23. Raja’sT op p e r s’A ccou n ts 10. Newly admitted partner does not have the right on the assets of the firm. 11. Admission of the partners means reconstitution of a firm as existing agreement comes to an end and new agreement comes into effect. TRUE 12. Partners capital account will be credited with his share of gain on revaluation. TRUE 13. Partners’ capital account will be Debited with his share of loss on revaluation. 14. Increase in the value of assets is credited to Revaluation account. TRUE 15. At the time of admission of partner Revaluation account. Is credited to record the increase in the value of plant & machinery. TRUE 16. At the time of admission of partner Revaluation account. Is debited to record increase in provision for doubtful debts TRUE 17. The ratio in which all partners including incoming partner share future profit & losses is known as old profit-sharing ratio. 18. The ratio in which old partners agreed to forego their share in profit in favor of new partner is known as sacrificing ratio. TRUE 19. A&B were partners sharing profit in the ratio of 3:2. They admitted C for 1/3rd share. The new ratio is 6;4;5 TRUE 20. At the time of admission of partner, unrecorded assets and liabilities transferred to p&L account ii- Fill in the blanks 1. Gaining partners the sacrificing partners fot the sacrifice in share of profit. 2. In the absence of agreement as to who will contribute to new partners share of profit , it is assumed that old partners will contribute in their 3. When a new partner brings in his share of goodwill in cash the amoun id debited to 4. Profit &loss on the revaluation of assets & liabilities on admission of partner is transferred to old partners capital account in their 5. Ram and Mohan are sharing profit in the ratio of 3;2. They admitted shyam for 1/3rd share .He gets 3/5 from Ram and 2/5 from Mohan. New profit sharing ratio will be. 6. X&Y were sharing profit in the ratio of 3:2 with the capitals of 1,00,000 and 50,000 respectively. Z is admitted for 1/5th share .The amount z brings in as capital will be 7. Alpha and beta are sharing profit in the ratio of 2:3. They admitted Gama for 1/4th share. The sacrificing ratio of Alpha and beta are 8. On admission the share sacrificed by a partner is the excess of his profit share over profit share 9. Decrease in the value of assets at the time of admission will be debited to 10. increase in the value of liabilities assets at the time of admission will be to revaluation account 11. Decrease in the value of liabilities assets at the time of admission will be debited to 12. A,B,C are partners sharing profit in the ratio of 3;2;1 D is admitted as a partner for 1/7th share which he gets from A . new profit sharing ratio is 13. X is admitted for 1/4th share . total capital of the firm is 36,000. If cpitals are to be proportionate to profit sharing ratio X should bring in Rs. 14. On admission the General reserve is transferred to capital account of partners in their 15. On admission balance in the investment fluctuation fund after meeting oss onrevaluation investment is transferred to of in their 16. A,B, are partners sharing profit in the ratio of 7;3 C is admitted as a partner for 1/5th share, If the new ratio is 14;6;5 Sacrificing ratio is 17. At the time of admissuion of partner the blance in p&L account transferred to capital account of in their ratio. 23

- 24. Raja’sT op p e r s’A ccou n ts 18. Raj is admitted for 1/4th share for which he brings in 30,000 as goodwill it will be credited to old partners capital account in their 19. P&q were partners having czapitals of 15,000 each .R is admitted for 1/3rd share for which he has to bring in 20,000 as capital. The amount of goodwill will be 20. The amount written off as bad now received is in revaluation account. ==================================================================== Answers;-1). Compensate, 2). Old profit sharing ratio, 3). Cash account, 4). Old profit sharing ratio,5). 6;4;5, 6). 37500, 7). 2;3, 8). Old, New 9). Revaluation account, 10). Debited, 11). Credited, 12) 15;14;7;6, (13) 12,000, (14). Old profit sharing ratio, (15)capital accounts, old partners, old profit sharing ratio, (16) 7;3, (17)old partners, old ratio (18). Sacrificing ratio, (19)10,000,(20). credited ==================================================================== MCQ 1. X& Y sharing profit in the ratio of 3;2. They admitted Z for 2/10th share. The new profit sharing ratio will be a. 12;8;5 b. 3:2;2 c. 3:2:5 d. 2;1:2 2. Siva & mohan sharing profit in the ratio of 5;3. They admitted jea for 3/10th share which he gets 1/5th from shiv and 1/10from mohan. The new profit sharing ratio will be a. 5;6;3 b. 2;4:6 c. 17:11;12 d. 18;24;38 3. Profit or loss on revaluation of assets & liabilities is transferred to partner’s capital account in their a. Capital ratio b. B. Equal ratio c. Old profit sharing ratio d. Gaining ratio 4. Adithya and shiv were partners with the capitals of 3,00,000 and 2,00,000. Naina was admitted for 1/4th share with a goodwill of 1,20,000 and capital of 2,40,000. The premium for goodwill will be credited to Adithya will be a. 40,000 b. 30,000 c. 72,000 d. 60,000 5. Un recorded assets & liability are transferred to a. Partner’s capital account b. Revaluation account c. Profit &bloss account d. Partner’s current account 6. X&y sharing profit in the ratio of 3:2 and capitals 1,00,000 50,000 respectively. Z is admitted for 1/5th share the amount z will contribute as capital is a. 50,000 b. 35,000 c. 37500 d. 60,000 24

- 25. Raja’sT op p e r s’A ccou n ts 7. X&Y sharing profit in the ratio of 3:2 and capitals 1,00,000 50,000 respectively. Z is admitted for 1/5th share he brings in 150,000 as capital if the capitals are proportionate to profit sharing ratio the respective. capitals are a. 3,00,000, 3,00,000,1,50,000 b. 3,60,000,, 2,40,000, 1,50,000 c. 1,50,000,1,50,000,1,50,000 d. 1,50,000, 2,00,000, 4,00,000 8. Goodwill brought in by incoming partner will be distributed among old partners in their a. Old profit-sharing ratio b. new profit-sharing ratio c. sacrificing ratio d. gaining ratio 9. At the time of admission Goodwill existed in the books is written off in a. Old profit-sharing ratio b. new profit-sharing ratio c. sacrificing ratio d. gaining ratio 10. A&B sharing profit in the ratio of 2;3. They admitted C for 1/4 share the sacrificing ratio of A&B will be a. 2:3 b. 1;1 c. 3;2 d. 2;1 11. At the time of admission General reserve appearing in the balance sheet is credited to a. P&L appropriation account b. Capital account of all partners c. Capital account of old partners d. Revaluation account 12. Anita and babita were partners shsring profit in the ratio of 3;1 avitha was admitted for 1/5th share . she was unable to bring goodwill in cash. The journal entry to record goodwill is given below;- Savitha current a/s Dr …………..24,000 To Anita current account………………….8,000 To babita’s current a/c……………………16,000 The new profit-sharing ratio of Anita and babita were a. 41;7;12, b. 13;12;10 c. 3;1;1 d. 5;3:2 13. Increase in the value of liabilities at the time of admission of a partner is a. Debited to revaluation account b. Credited to revaluation account c. Credited to partner’s capital account. d. Debited to partner’s capital account. 14. For which of the following situations old profit sharing ratio of partners is used at the time of admission of new partner. a. When a partner brings only a part of his share of Goodwill. b. When a new partner not able to bring his share of Goodwill. c. When at the time of admission goodwill already exist in the balance sheet d. When a new partner brings his share of goodwill in cash 25

- 26. Raja’sT op p e r s’A ccou n ts 15. A& B were partners havin a capital of 54,000 and 36,000 respectively . They admitted C for 1/3rd share he brought proportionate amount of capital . The capital brought in by C would be a. 90,000 b. 45,000 c. 5400 d. 3600 16. P&Q were partners having a capital of 15,000 each. R is admitted for 1/3rd share for which he has to bring in 20,000 for his share of Goodwill. The amount og goodwill will be a. 8,000 b. 10,000 c. 9,000 d. 11,000 17. When new partner brings cash for goodwill the amount is credited to a. Revaluation account b. Cash account c. Premium for goodwill account d. Realization account 18. New partner can be admitted in to partnership a. With the consent of any one partner b. With the consent of majority of partners c. With the consent of all partners d. With the consent of 2/3rd of partners. 19. X &Y are partners sharing profits in the ratio of 2;1they admitted z for 1/4th sharefor which he brings 20,000 as his share of hence the adjusted capitals of X &Y will be a. 40,000 and 20,000 respectively b. 32,000 and 16,000 respectively c. 60,000 and 30,000 respectively. d. 20,000 and 40,000 respectively 20. At the time of admission if the profit sharing ratio among old partners does not change then the sacrificiung ratio will be a. Equal b. According to capital contribution c. Their old profit sharing ratio d. According to new partner. ======================================================================= 26