Core Banking Systems for Microfinance Institutes.docx

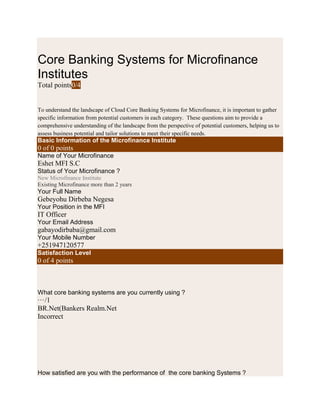

- 1. Core Banking Systems for Microfinance Institutes Total points0/4 To understand the landscape of Cloud Core Banking Systems for Microfinance, it is important to gather specific information from potential customers in each category. These questions aim to provide a comprehensive understanding of the landscape from the perspective of potential customers, helping us to assess business potential and tailor solutions to meet their specific needs. Basic Information of the Microfinance Institute 0 of 0 points Name of Your Microfinance Eshet MFI S.C Status of Your Microfinance ? New Microfinance Institute Existing Microfinance more than 2 years Your Full Name Gebeyohu Dirbeba Negesa Your Position in the MFI IT Officer Your Email Address gabayodirbaba@gmail.com Your Mobile Number +251947120577 Satisfaction Level 0 of 4 points What core banking systems are you currently using ? ···/1 BR.Net(Bankers Realm.Net Incorrect How satisfied are you with the performance of the core banking Systems ?

- 2. ···/1 Very much Satisfied . It is good . Incorrect Moderately Satisfied . Not Satisfied . The Systems needs improvement. Not Satisfied . I prefer to change the Core systems completely with better Core systems We are new Microfinance Institute Other: No correct answers Are you considering transitioning to other Core Banking System, and if so, what factors are driving this consideration? 0/1 We are new MFI and Planning to Select Technology Yes , I am considering to transition to other core Banking Systems Incorrect No , I am not considering to transition to other core Banking Systems Correct answer No , I am not considering to transition to other core Banking Systems Feedback Options 1 and 3 are wrong because x, y, z If you are considering transitioning to other Core Banking System or Select a Core Banking Systems , and if so, what factors are driving this consideration? 0/1 Support and Training: Incorrect Payment Integration Correct

- 3. Scalability Incorrect Data Security: Ensuring data security is critical, Integration with Third-party Services Flexibility and Customization: Incorrect Mobile and Field Operations Incorrect Upfront Investment to acquire the Technology Incorrect Regulatory Compliance Incorrect Other: Correct answer Payment Integration Feedback Options 1 and 3 are wrong because x, y, z Budget & Investment Plan 0 of 0 points Do you have budget allocation for technology adoption, specifically for core banking systems, in the next fiscal year? Yes , We have budget allocation for Technology adoption. Yes , We are looking for help for estimated budget & Options and will allocation for Technology adoption. No . We do not have any planned budget allocation for technology adoptions .

- 4. Do you plan technology adoption, specifically for core banking systems, in _______________ year? Next fiscal Year 2 Years time 3 Years Time 5 Years Time How do you prioritize technology investments within your organization? Urgent Priority Low Priority Middle Priority Competition Landscape 0 of 0 points Are there specific competitors or peers in the microfinance sector that you closely monitor or benchmark against? Yes , I have a competitor microfinance that I am benchmarking . No , I am follow my strategic plan for Technology adoption . How do you perceive the competitive advantage of Core Banking Systems over traditional solutions? Simplify Banking Operation Improve customer Services Stay ahead of market expectations. Streamlines process automation. Expand operations both physically and digitally. Regulatory Consideration 0 of 0 points What are the key regulatory requirements that influence your technology choices in the microfinance industry? Financial Regulation and Reporting Standards Data Privacy and Security Regulations Know Your Customer (KYC) Anti-Money Laundering (AML) Regulations: Accessibility and Financial Inclusion Requirements Digital Payment and Mobile Banking Regulations Consumer Protection Regulations Other: Cash Withdrawal limitation How do you foresee regulatory changes impacting your adoption of Core Banking Systems? Compliance Cost : Regulatory changes often come with updated compliance requirements. Operational Changes : Regulatory changes may necessitate alterations in operational processes and reporting standards. Data Management and Privacy: Changes in data protection and privacy regulations may impact how microfinance institutions handle customer data. Risk Management: Regulatory changes may introduce new risk management guidelines. Flexibility and Scalability: Microfinance institutions may find that regulatory changes necessitate more flexibility and scalability in their operations. Interoperability Requirements: Some regulatory changes may emphasize interoperability between financial institutions.

- 5. Digital Transformation Initiatives: Regulatory changes may align with broader industry trends towards digital transformation. Customer Protection and Transparency: Regulatory changes often focus on enhancing customer protection and transparency. Adoption Timelines: The timeline for adopting new Core Banking Systems may be influenced by regulatory deadlines. Technology Trends 0 of 0 points What emerging technology trends do you believe will have the most significant impact on microfinance operations? The rise of digital payments and mobile banking Artificial Intelligence (AI) and Machine Learning (ML): Biometric authentication, including fingerprint and facial recognition, can enhance security in MFI transactions. Cloud computing allows MFI to access scalable and cost-effective IT infrastructure. How open is your organization to adopting new technologies, especially cloud-based core banking solutions? Our Organization is ready to adopt cloud-based core banking Solutions Our organization is ready to adopt non-cloud based core banking Solutions Our organization is ready to adopt technology but we need support to select the appropriate technology Operational Challenges 0 of 0 points What are the primary operational challenges your organization faces in the microfinance sector? Limited Access to Loanable Funding & investment in Technology Risk management : Assessing and managing risks associated with MFI operations, Embracing Technology Adoption & digital financial Services , Limited technical expertise , Financial Sustainability: Achieving financial sustainability while serving low-income clients can be challenging. Capacity Building and Training: Building the capacity of staff and clients is essential for effective microfinance operations. Regulatory Compliance: MFI operate in a highly regulated environment. Client Outreach and Engagement: Reaching and effectively engaging with potential clients in remote or underserved areas Data Management and Security: Managing and securing sensitive customer data is a paramount concern. Market Competition: MFI may face competition from traditional financial institutions, fintech startups, or other microfinance providers. Economic fluctuations and external factors can impact the ability of clients to repay loans. Demonstrating and measuring social and environmental impact is a challenge Other: How do you see technology addressing or exacerbating these challenges Technology addresses the limitation of of Access to Loanable Funding Technology addresses the challenge from Risk management Technology addresses digital financial Services , the limitation of access to technical expertise , Technology address the challenge financial sustainability while serving low-income clients Technology address the challenge of Capacity Building and Training Technology address the regulatory Compliance

- 6. Technology enable us reaching and effectively engaging with potential clients in remote or underserved areas Technology address the challenges of Managing and securing sensitive customer data. Technology help Microfinance institutions to be competitive in technology advancement . Technology address the concern of Economic fluctuations and external factors can impact the ability of clients to repay loans. Technology enable the MFI to demonstrating and measuring social and environmental impact Collaborative Opportunity 0 of 0 points Are there existing collaborations or partnerships within the microfinance industry for shared technology services? Yes , there is a shared Technology Services in Ethiopia I have no information . How receptive is your organization to collaborative solutions in the context of core banking systems? Our organization is ready for Shared Core Banking Solutions I am not sure .I do not understand the benefits of Shared Core Banking Solutions How do you currently manage risks associated with microfinance operations, and how does technology play a role in this? Our organization manage risks traditional Methods I believe that technology plays a pivotal role in enhancing the efficiency and effectiveness of risk management in microfinance operations Are there specific risk factors related to technology adoption that concern your organization? Ensuring the security and privacy of sensitive client data is a primary concern. The adoption of new technologies, especially during the transition phase, may lead to operational disruptions. Integrating new technologies with existing systems can be challenging. Changes in technology may necessitate adaptations to comply with evolving regulatory requirements. Technology adoption often involves upfront costs, and there's a risk of exceeding budgeted expenses. Introducing new technologies may require a set of skills that staff members do not currently possess. Dependence on external vendors for technology solutions introduces the risk of vendor-related issues, such as service interruptions, financial instability, or failure to meet contractual obligations. Resistance from staff or clients to adopt new technologies can hinder successful implementation. Industry Benchmark 0 of 0 points What benchmarks or performance indicators do you use to measure the success of your microfinance operations? Portfolio Quality: the percentage of the loan portfolio that is overdue by a specified number of days Financial Sustainability: how efficiently an institution utilizes its assets to generate profits. Client Outreach and Growth: Number of Active Clients or Borrowers Repayment Rates: Portfolio Yield measures the total interest and fees earned on the loan portfolio. Cost Efficiency: Operational Expense Ratio Profitability: the return generated on shareholders' equity Social Impact: Number of New Clients in Underserved Areas Loan Portfolio Diversification: Diversification of the loan portfolio across different products Savings Mobilization: The total amount of savings deposits Customer Satisfaction: Regular surveys or feedback mechanisms can provide insights into clients' satisfaction

- 7. Operational Efficiency : Loan Officer Productivity Regulatory Compliance : Tracking the institution's adherence to regulatory requirements and standards How do you see Cloud -Core Banking Systems contributing to these benchmarks? Cloud-based Core Banking Systems enable streamlined and automated processes, reducing manual interventions and operational bottlenecks. Cloud-based solutions often offer a more cost-effective alternative to traditional on-premise systems. Cloud-based systems provide the flexibility to scale operations rapidly. Cloud Core Banking Systems often come with advanced analytics capabilities. Cloud-based systems facilitate real-time data management and reporting. Cloud solutions contribute to financial sustainability by reducing upfront capital expenditures on hardware and software. Cloud Core Banking Systems often come with user-friendly interfaces and improved customer service capabilities. Cloud-based systems can support the creation and management of savings accounts more efficiently. Cloud systems provide the flexibility to introduce and manage various loan products efficiently. Core Banking Systems often come with built-in security features and compliance tools Cloud solutions can enhance data analytics capabilities, allowing microfinance institutions to measure and report on social impact more effectively. Cloud-based systems often include robust security features and data encryption protocols. Other: Industry Trend 0 of 0 points Are there specific trends within the microfinance industry that you believe will impact the adoption of Cloud Core Banking Systems? The global push for digital transformation and increased financial inclusion. Rise of Fintech. The growing importance of data analytics . The surge in mobile banking and digital payments is reshaping the way MFI interact with clients Regulatory requirements are becoming more stringent, necessitating advanced reporting capabilities. The trend toward remote work and flexible work arrangements is influencing technology choices. With the increasing digitization of financial services, cybersecurity has become a top concern Microfinance institutions may experience fluctuating demand for their services. The microfinance industry is placing a greater emphasis on Environmental, Social, and Governance (ESG) considerations Other: How are successful microfinance institutions leveraging technology to gain a competitive edge? Digital platforms enhance customer engagement, enable remote transactions, and contribute to financial inclusion by reaching clients in remote or underserved areas. Technology contribute to operational efficiency, real-time data management, and the ability to scale operations as needed Improved decision-making, accurate risk assessments, and personalized services contribute Enhanced customer experience, reduced transaction costs, and improved financial access, To stay at the forefront of technological advancements, Enhanced security, reduced fraud, and improved customer trust in digital transactions. Improved customer engagement, personalized services,

- 8. Faster loan processing, reduced administrative overhead, and improved efficiency in managing loan portfolios. Reduced compliance risks, efficient reporting Enhanced trust, reduced risks of data breaches, Transparent reporting on social impact Improved staff competency, reduced resistance to technology adoption Other: Specific Customer Pain Points 0 of 0 points What are the specific pain points or challenges your organization faces in managing core banking functions? We are new MFI .But expect the the pain points or challenges We are existing MFI . We have the following specific pain points or challenges . Legacy Systems , difficult to integrate with modern technologies. Inefficient scalability can result in performance issues, increased response times, and challenges in meeting the demands of a growing customer base. Poor integration can lead to data discrepancies, operational inefficiencies, and difficulties in providing a seamless customer experience. Non-compliance can result in legal consequences, financial penalties, and damage to the organization's reputation. Security breaches can lead to financial losses, reputational damage, and loss of customer trust. Failure to meet customer expectations may result in customer dissatisfaction, attrition, and loss of market share to more digitally advanced competitors. Operational inefficiencies result in increased costs, longer processing times, and a potential decline in customer satisfaction. Inability to harness data for informed decision-making can hinder strategic planning and limit the ability to offer personalized services. Vendor-related issues may result in service disruptions, lack of timely updates, and challenges in aligning with the organization's evolving needs. Poor user adoption can lead to errors, reduced productivity, and suboptimal utilization of the core banking system's capabilities. Other: How do these challenges impact your overall business operations? Operational Inefficiencies Customer Dissatisfaction Compliance Risks Security vulnerabilities Inability to scale operations efficiently Difficulty in integrating core banking systems with other internal and external applications Lack the flexibility needed to adopt new technologies Reliance on a single vendor or outdated technology Inefficient data management Resistance from staff members who are accustomed to existing processes. Adoption Readiness 0 of 0 points How ready is your organization to adopt Shared Cloud Core Banking Systems?

- 9. Our organization is ready for adopting shared Cloud Core Banking Systems Our organization additional information about shared cloud Core Banking Systems . Our Organization is ready for On-premised Core Banking Systems Other: What factors, such as infrastructure, skills, or organizational culture, influence this readiness? Technological Infrastructure with in the MFI such as current core banking systems , availability of internet connectivity Digital Maturity and Skills with in the MFI such as Levels of IT Skills and Expertise , readiness of staff to adapt to digital tools Data security measures in place to safeguard sensitive information and Awareness of regulatory requirements and compliance standards is crucial. The process of risk assessments & mitigation culture in place The organizational culture, including its openness to change, can impact the adoption of new technologies. Adequate financial resources are necessary for investing Conducting a thorough cost-benefit analysis A supportive regulatory environment and clear guidance Scalability Requirements Vendor Selection and Partnerships Customization Requirements 0 of 0 points Are there specific customization requirements or features that you consider crucial for your organization's core banking system? The ability to modularize and customize components. Scalable to accommodate growth Seamless integration with other internal and external systems Support for multiple currencies Advanced reporting capabilities Regulatory Compliance Tools Advanced Security Features Mobile Banking Capabilities Customer Relationship Management (CRM) Integration Automated Workflows An intuitive and user-friendly interface for both staff and customers to ensure ease of use. Customer Self-Service Options Integration with AI and machine learning capabilities for advanced analytics, fraud detection, and personalized customer insights. How important is flexibility and scalability in your technology solutions? Flexibility and Scalabilities are key in Technology Solutions . It is our top priority It does not matter for flexibility and Scalabilities as far as the technology solution works basic functionalities Other: User Satisfaction 0 of 0 points

- 10. Can you provide feedback from users regarding their satisfaction with the current core banking solutions? yes What are the key areas where improvements are desired? Providing service for remote area customers Future Growth Strategy 0 of 0 points What are your organization's strategies for future growth in the microfinance sector? one of the top ten in ethiopia How does technology, particularly Shared Cloud Core Banking Systems, fit into these growth plans? Better data security. Lowered infrastructure cost. Greater operational efficiency. Access to software applications. Contributes towards business continuity. Usage- based payment. Perception of Current Supplier 0 of 0 points If applicable, what has been your experience with existing core banking system suppliers? Core banking systems typically include deposit, loan, and credit-processing capabilities, with interfaces to general ledger systems and reporting tools. Core banking applications are often one of the largest single expenses for banks and legacy software is a major issue in terms of allocating resources. What factors do you consider when evaluating the performance of technology suppliers? Price, Quality. Reliability. Communication. Financially stable. Capacity. Payment terms Technology Stack Requirements 0 of 0 points What specific technology stack requirements does your organization have for core banking systems? it may be their government rule impact How important is interoperability with existing systems in your technology procurement? give public service Security and Compliance Needs 0 of 0 points How do you prioritize security and compliance features when selecting a technology supplier for core banking systems? Communicate to staff that protecting the system is not only in the organization"s interests, but also in the best interest of users. Increase staff awareness of security issues. Provide for appropriate staff security training. Monitor user activity to assess security implementation. Are there specific regulatory compliance requirements that your organization must adhere to? yes

- 11. Services Level Expectation 0 of 0 points What are your expectations regarding service levels and support from a technology supplier? is a contract between a service provider and its customers that documents what services the provider will furnish and defines the service standards the provider is obligated to meet. A service-level commitment (SLC) is a broader and more generalized form of an SLA. How crucial are service level agreements (SLAs) in your decision-making process? SLAs play a crucial role in business and I.T. services for several reasons: Clear Expectations: SLAs provide clear and measurable expectations for both service providers and customers. They define the scope of services, response times, and performance benchmarks, reducing misunderstandings and conflicts Cost Structure Preferences 0 of 0 points How do you typically evaluate the cost structure of technology solutions, and what pricing models align with your organization's preferences? One -Time -Purchase and pay for Support and additional Services Subscription Base Services Developing the Technology Jointly with Other Partners We are Open to new ideas of the Cost Structure and Price model for decision . Are there budgetary constraints or considerations that influence your choice of technology suppliers? No This content is neither created nor endorsed by Google. - Terms of Service - Privacy Policy Forms