Dept Repayment Settlement Services Agents - Cross Canada - CTL Law

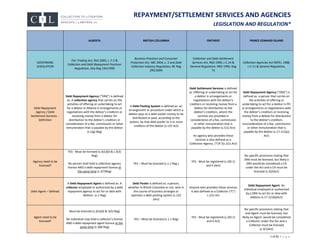

- 1. DEBT 1 of 8| P a g e REPAYMENT/SETTLEMENT SERVICES AND AGENCIES LEGISLATION AND REGULATION* ALBERTA BRITISH COLUMBIA ONTARIO PRINCE EDWARD ISLAND GOVERNING LEGISLATION Fair Trading Act, RSA 2000, c. F-2 & Collection and Debt Repayment Practices Regulation, Alta Reg 194/1999 Business Practices and Consumer Protection Act, SBC 2004, c. 2 and Debt Collection Industry Regulation, BC Reg 295/2004 Collection and Debt Settlement Services Act, RSO 1990, c C.14 & General Regulation, RRO 1990, Reg 74 Collection Agencies Act RSPEI, 1988, c C-11 & General Regulation, Debt Repayment Agency / Debt Settlement Services - Definition Debt Repayment Agency (“DRA”) is defined as: A collection agency that carries on the activities of offering or undertaking to act for a debtor in Alberta in arrangements or negotiations with the debtor’s creditors or receiving money from a debtor for distribution to the debtor’s creditors in consideration of a fee, commission or other remuneration that is payable by the debtor (s.1(g) Reg) A Debt Pooling System is defined as: an arrangement or procedure under which a debtor pays to a debt pooler money to be distributed or paid, according to the system, by that debt pooler to 3 or more creditors of the debtor (s.125 Act) Debt Settlement Services is defined as: Offering or undertaking to act for a debtor in arrangements or negotiations with the debtor’s creditors or receiving money from a debtor for distribution to the debtor’s creditors, where the services are provided in consideration of a fee, commission or other remuneration that is payable by the debtor (s.1(1) Act) An agency who provides these services is also defined as a Collection Agency (“CA”)(s.1(1) Act) Debt Repayment Agency (“DRA”) is defined as: a person that carries on the activities of offering or undertaking to act for a debtor in PEI in arrangements or negotiations with the debtor’s creditors or receiving money from a debtor for distribution to the debtor’s creditors inconsideration of a fee, commission or other remuneration that is payable by the debtor (s.17.1(1)(a) Act) Agency need to be licenced? YES - Must be licensed (s.3(1)(b) & s.3(3) Reg) No person shall hold a collection agency licence AND a debt repayment licence at the same time (s.3(7)Reg) YES – Must be licensed (s.1.1 Reg.) YES - Must be registered (s.2(0.1) and 4 (Act) No specific provisions stating that DRA must be licenced, but likely a DRA would be considered a CA under the Act and a CA must be licensed (s.3(2)Act) Debt Agent – Defined A Debt Repayment Agent is defined as: A collector employed or authorized by a debt repayment agency to act for or deal with debtors. (s.1 Reg) Debt Pooler is defined as: a person, whether in British Columbia or not, who in the course of business arranges or operates a debt pooling system (s.125 (Act) Anyone who provides these services is also defined as a Collector (“C”) s.1(1) Act Debt Repayment Agent: An individual employed or authorized by a DRA to act for or deal with debtors (s.17.1(1)(b)Act) Agent need to be licensed? Must be licenced (s.3(1)(d) & 3(5) Reg) No individual may hold a collector’s license AND a debt repayment agent licence at the same time (s.3(8) Reg) YES – Must be licensed (s.1.1 Reg) YES - Must be registered (s.2(0.1) and 4 Act) No specific provisions stating that and Agent must be licenced, but likely an Agent would be considered a Collector under the Act and a Collector must be licensed (s.3(1)Act)

- 2. DEBT 2 of 8| P a g e REPAYMENT/SETTLEMENT SERVICES AND AGENCIES LEGISLATION AND REGULATION* ALBERTA BRITISH COLUMBIA ONTARIO PRINCE EDWARD ISLAND Lawyers Exempt? Lawyers exempt only from from “Collection Practices” Part 11 of Act if acting in the practice of their profession (s.110 (2) Act) (Does not specifically state that lawyers are exempt from the Regulation dealing with DRAs) Lawyers exempt from Act and Reg if in regular practice of their profession (s.3 Reg) Act does not apply to a barrister or solicitor in the regular practice of his or her profession or to his or her employees (s.2(1)(b) Act) NO - These sections of the Act and Regs apply to solicitors and barristers who are engaging in the business of debt repayment agents & agencies (s.17.1(9) Act) Contact and Identification Cannot collect a debt without providing the agent’s name and name of debt repayment agency (s.12.1(1)(a)Reg) Cannot communicate information about debt to any person except the debtor, a guarantor, the debtor’s representative or a creditor of the debtor without debtor’s written consent (s.29(9) Reg) Must provide information on how to contact the CA Or C during business hours (s.29(10) Reg) Must respond to debtor’s’ communications within a reasonable time (s.29(11) Reg) Any WEBSITE that requests debtor’s personal information must clearly display CA name, business address, phone number, fax number, email and registration number Any ADVERTISEMENT must set out CA’s registered name and number (s.26(3) Reg) Communication with Others Cannot communicate information about the debt with anyone other than the debtor, a guarantor of the debt, the debtor’s representative OR the creditor of the debt (s.12.1(1)(m) Reg) Cannot obtain a debtor’s contact information from a 3rd party UNLESS debtor explicitly consented to the contact information being shared with the CA or C (s.29(12) Reg) Cannot communicate information about the debt or existence of debt with any person except the debtor, guarantor, representative or creditor of the debtor (s.17.1(2)(l) Act)

- 3. DEBT 3 of 8| P a g e REPAYMENT/SETTLEMENT SERVICES AND AGENCIES LEGISLATION AND REGULATION* ALBERTA BRITISH COLUMBIA ONTARIO PRINCE EDWARD ISLAND Amount Collected Cannot collect any amount greater than prescribed by regulation for acting for the debtor in making arrangements or negotiations on behalf of the debtor (s.12.1(1)(b) OR Cannot make any arrangement with debtor to accept LESS than the amount of the balance and owing to creditor UNLESS express consent of creditor is provided (s.12.1(1)(c) Cannot collect an amount greater than that set out in Act and Regulations (s.2 (a)Act) Cannot make an arrangement with debtor to collect amount that is LESS than balance due to creditor without prior express creditor approval (s.2(b)Act) Written Agreement Requirements Cannot collect fee, commission or disbursement from debtor unless, before providing service, it has entered into a signed written Agreement or written authorization and debtor has a copy (s.12.1(2) Reg) The written Agreement must be: a) dated and signed by DRA and debtor, b) include name, address and phone number of DRA and debtor, c) describe all services provided under agreement, d) state all fees that are to be paid by debtor, e) list all creditors as disclosed by debtor and f) total amount owed, payment amount, schedule of payments and total number of payments for each listed creditor (s.12.1(3) Reg) Cannot make a claim for breach of contract against a debtor who cancels a debt repayment agreement (s.12.1 (k)(Reg) Must inform a debtor within 30 days after the creditor has notified the DRA that it has decided to withdraw from a debt repayment program (s.12.1(l) Reg) A contract between a debt pooler and a debtor MUST be in writing and signed by the debtor (s.127 Act) No CA shall provide debt settlement services to a debtor UNLESS the CA has entered into a written debt settlement services agreement, had provided a copy to the debtor, and disclosed to the debtor in the agreement all information necessary to explain the sources of the CA’s funding (s.16.5 (1) Act) No CA can enter into more than one agreement with the same debtor while there is an agreement between the parties that has not expired and any other agreement shall be deemed to be part of the debt settlement services agreement (s.16.5 (2) Act) In a debt settlement services agreement, the CA must indicate which of the following methods of negotiating the settlement of the debtor’s debt the CA will pursue: i) a proposed schedule of payments in respect of each debt ii) the CA will put forward to each creditor on or before a specified date an offer to settle with a one-time payment that is less than the amount of debt (s.27 (1)(Reg) If CA proposes scheduled payments the agreement SHALL include the A written agreement MUST be dated and signed by the DRA and debtor; must include name and phone number of debtor and name, address, phone number and fax and email address of DRA; describe all services to be provided; state all fees, separately itemized that are to be paid by debtor; list all creditors as disclosed by debtor to whom payments will be made under Agreement; state the total amount owed, the payment mount, the schedule of payments to be made and the total number of payments for each listed creditor. (s.17.1(4) Act) Must provide a written report, containing a) gross amount received by DRA from or on behalf of debtor b) amount and date of payments and to whom they were made; c) any fee commission or disbursement retained by the DRA (s.17.1(2)&(7)Act) This written report must be provided without charge once every 60 days that the DRA is acing for the debtor (s.17.1(8) Act) Cannot make claim for breach of contract against a debtor who

- 4. DEBT 4 of 8| P a g e REPAYMENT/SETTLEMENT SERVICES AND AGENCIES LEGISLATION AND REGULATION* ALBERTA BRITISH COLUMBIA ONTARIO PRINCE EDWARD ISLAND proposed schedule of payments for each debt, the maximum payment that the CA may accept for services provided under the agreement is 15% of every payment made by the debtor AND the first page of the agreement shall be the document entitle “Repaying Debt and Credit Counselling – What You Need to Know” (found on the Government of Ontario’s Website).(s.27(2) Act) If CA proposes to settle debt with an offer of a one-time payment the agreements SHALL state for each debt the date on which an offer to settle will be made and the amount; the maximum amount a CA may accept for services is 10% of the amount of each debt at the time the agreement is signed, that is settled through the CA AND the first page of the agreement shall be the document “Settling Debt – What You Need To Know” (found on the Government of Ontario’s Website) (s.27(3) Act) The Agreement shall disclose whether or not the CA received or will receive funding from creditor in exchange for entering into the Agreement (s.27(1)(5) Reg) The Agreement must also include: the name and address of the debtor, the CA’s registered name, business address, phone and fax number, email address, website address and registration number; the names of any collectors who negotiated or concluded the Agreement and their registration numbers; the date entered into; proposed termination date; itemized list of all services provided; details of all debts cancels an Agreement (s.17.1 (2)(j) Act) Must inform a debtor within 30 days after a creditor has notified that it has decided not to participate in or has withdrawn from a debt repayment program (s.17.1(2)(k) Act)

- 5. DEBT 5 of 8| P a g e REPAYMENT/SETTLEMENT SERVICES AND AGENCIES LEGISLATION AND REGULATION* ALBERTA BRITISH COLUMBIA ONTARIO PRINCE EDWARD ISLAND including each creditor’s name, amount owing and interest rates; total amount owed to ALL creditors; any restrictions, limitation and conditions; a statement that debtor is entitled to receive a written report on performance of Agreement within 15 days of requesting same; date and signature of debtor, CA and C (s.27(1)(6) Reg) Agreement may be amended by express agreement of debtor and CA (s.27(2)Reg) If amended, the debtor may without reason cancel agreement at any time form the date that the amendment is agreed until 10 days after receiving the written copy of the amended agreement (s.27(3) Reg) Amendments must meet requirements of Act and Regulations and does not retroactively affect rights and obligations of debtor (s.27(4) & (5)Reg) Cancellation of Agreement Unless the agreement provides for an earlier termination date, the agreement terminates 18 MONTHS after the later of i) the date entered into, ii) the last day on which a payment was made iii) if any debts are settled, the last day on which the settlement occurred (s.27(1)(4) Reg) A debtor who is a party to a debt settlement agreement may without any reason, cancel the agreement at any time from the date of entering into it until 10 days after receiving a written copy (s.16.7(1) Act)

- 6. DEBT 6 of 8| P a g e REPAYMENT/SETTLEMENT SERVICES AND AGENCIES LEGISLATION AND REGULATION* ALBERTA BRITISH COLUMBIA ONTARIO PRINCE EDWARD ISLAND Additionally, a debtor may cancel the agreement within ONE YEAR after the date of entering if the debtor has not received a copy that meets the requirements set out in the Act (s.16.7(2) Act) A debtor who cancels the agreement must do so in accordance with ss.92 & 94 of the Consumer Protection Act and section 16.9 of the Act Restrictions on Fees / Payments Cannot charge a debtor a fee that EXCEEDS the SUM OF a) a one-time administration fee that is NOT higher than the average monthly payment as set out in the Agreement; AND b) 15% of the scheduled payment amount OR (where there are no scheduled payments) 10% of the debt owing and this fee can only be charged to the debtor after an acceptable settlement has been negotiated(s.12.1(4) & (5)) Cannot charge a fee for a dishonoured cheque unless the fee was included in the written agreement (s.12.1(1)(f) Reg) Cannot charge or receive a fee in the form of a promissory note or other negotiable instrument other than a cheque or draft (s.12.1(1)(g) Reg) Cannot lend money or provide credit to a debtor (s.12.1(h) Reg) Cannot offer, pay or give any bonus, premium or award to a debtor for entering into an agreement (s.12.1(i)(Reg) Cannot collect any fee for referring, advising, assisting etc. a debtor in getting any extension of credit from a lender, creditor or service provider (s.12.1(j) Reg) A debt pooler MUST NOT charge fees or disbursements in excess of the prescribed amount (s.127(3) Act) A CA shall not accept payment for services UNTIL the debtor has entered into an agreement with the creditor regarding the amount to be paid to creditor to settle debt; the debtor has made at least one payment; the CA has written evidence of such payment (s.28(1) Reg) The amount a CA may accept as payment for services from debtor SHALL NOT EXCEED: [TOTAL AMOUNTS CA MAY ACCEPT FOR ALL DEBTS OWED AS SET OUT IN AGREEMENT] X [AMOUNT OF DEBT OWED TO CREDITOR] / [TOTAL AMOUNT OF DEBT OWED TO ALL DEBTOR’S CREDITORS] (s.28(3) Reg) If CA proposes to negotiate a settlement by scheduled payments the CA may also charge a one-time fee of no more than $50 (s.28(4) Reg) A CA may charge a debtor a fee for a dishonoured cheque BUT cannot be greater than the actual amount charged to the CA by FI that dishonoured the cheque (s.28(5)Reg) Cannot charge a fee for a dishonoured cheque unless the fee was included in Agreement with debtor (s.17.1(2)(e) Act) Cannot charge or receive any fee in the form of a promissory note or other negotiable instrument other than a cheque or draft (s.17.1(2)(f) Act) Cannot collect any fee for referring, advising, procuring, arranging for or assisting a debtor in obtaining any extension of credit from a lender, creditor or service provider (s.17.1(2)(i) Act) Cannot collect or retain a fee, commission or disbursement for services unless before providing service DRA has EITHER entered into a written agreement signed by the DRA and the debtor OR obtained written authorization signed by the debtor to provide service AND delivered a copy of the agreement or authorization (s.17.1(3) Act) Cannot charge a fee that EXCEEDS (in the case of scheduled payments) the sum of $50 as a one time set-up fee AND 15% of the scheduled

- 7. DEBT 7 of 8| P a g e REPAYMENT/SETTLEMENT SERVICES AND AGENCIES LEGISLATION AND REGULATION* ALBERTA BRITISH COLUMBIA ONTARIO PRINCE EDWARD ISLAND payment amount received from or on behalf of debtor by the DRA OR (in the case of a one time payment – or an agreement to negotiate) 10% of the debt owing and this fee can only be charged after a settlement acceptable to the debtor has been successfully negotiated (s.17.1(5) & (6) Act) Legal Proceedings Cannot give any person any false or misleading information including references to the police, a law firm, prison, credit history, court proceedings or a lien or garnishment (s.12.1(e)Reg) Cannot give any person any false or misleading information including references to police, a law firm, prison, credit history, court proceeding or a lien or garnishment (s.17.1(2)(d) Act) Prohibited Practices If under a debt pooling system a debtor pays money to a debt pooler for distribution to creditor, that debt pooler MUST NOT act for or represent any of the creditors AND is deemed to act for and represent the debtor (s.127 Act) CA cannot make the following representations regarding a debt settlement agreement: the services are non-profit or charitable basis if they are not; the CA’s program is run by the Government if they are not; any references to registration under the Act (other than CA’s registration); any claim of savings or other results that are not typical results (meaning the average results over a period of six months and no longer than 12 months in preceding calendar year); any misrepresentations such as using the services may deter efforts of creditor; or that using the services will or may prevent legal action or garnishment (s.26(1) & 2 Reg) CANNOT restrict debtor from having Cannot lend or provide credit to a debtor (s.17.1(2)(g) Act) Cannot offer, pay or give any gift, bonus or other compensation to a debtor for entering into an Agreement (s.17.1(2)(h) Act)

- 8. DEBT 8 of 8| P a g e REPAYMENT/SETTLEMENT SERVICES AND AGENCIES LEGISLATION AND REGULATION* ALBERTA BRITISH COLUMBIA ONTARIO PRINCE EDWARD ISLAND access to consumer report; stop debtor from communicating with creditors; provided settlement services under a name other than registered name; fail to give written report to debtor on performance within 15 days of request; offer or pay compensation to a debtor in exchange for entering into Agreement; accept any money for assisting a debtor to obtain an extension of credit other than an extension of time for debtor to repay debt; fail to inform the creditors that the CA or C is authorized to negotiate a schedule of payments or one-time payment on debtor’s behalf within 15 days of authorization; Fail to inform debtor of a refusal by creditor to negotiate within 15 days of refusal; (s.29 (1-8) Reg) Cannot misrepresent time needed to achieve results promised (s.29(13) Reg) Cannot enter into an agreement if apparent creditors would not enter into agreement to settle debt (s.29(14) Reg) Cannot enter into Agreement with a debtor if it is apparent that debtor is not able to protect his or her interests because of disability, illiteracy or inability to understand the agreement (s.29(15)Reg) Cannot give any person false or misleading information (s.29(16) Reg)