3 dec 2019

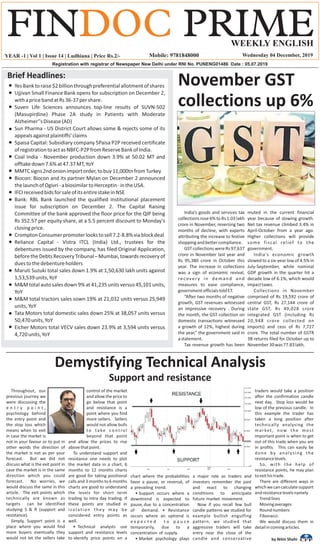

- 1. YEAR -1 | Vol 1 | Issue 14 | Ludhiana | Price Rs.2/- Wednesday 04 December, 2019 Brief Headlines: YesBanktoraise$2billionthroughpreferentialallotmentofshares Ujjivan Small Finance Bank opens for subscription on December 2, withapricebandatRs36-37pershare. Suven Life Sciences announces top-line results of SUVN-502 (Masupirdine) Phase 2A study in Patients with Moderate Alzheimer''sDisease(AD) Sun Pharma - US District Court allows some & rejects some of its appealsagainstplaintiffs’claims 5paisa Capital: Subsidiary company 5Paisa P2P received certificate ofregistrationtoactasNBFC-P2PfromReserveBankofIndia. Coal India - November production down 3.9% at 50.02 MT and offtakedown7.6%at47.37MT,YoY MMTCsigns2ndonionimportorder,tobuy11,000tnfromTurkey Biocon: Biocon and its partner Mylan on December 2 announced thelaunchofOgivri-abiosimilartoHerceptin-intheUSA. IFCIreceivedbidsforsaleofitsentirestakeinNSE Bank: RBL Bank launched the qualified institutional placement issue for subscription on December 2. The Capital Raising Committee of the bank approved the floor price for the QIP being Rs 352.57 per equity share, at a 5.5 percent discount to Monday's closingprice. CromptonConsumerpromoterlookstosell7.2-8.8%viablockdeal Reliance Capital - Vistra ITCL (India) Ltd., trustees for the debentures issued by the company, has filed Original Application, beforetheDebtsRecoveryTribunal–Mumbai,towardsrecoveryof duestothedebentureholders Maruti Suzuki total sales down 1.9% at 1,50,630 lakh units against 1,53,539units,YoY M&Mtotalautosalesdown9%at41,235unitsversus45,101units, YoY M&M total tractors sales sown 19% at 21,032 units versus 25,949 units,YoY Tata Motors total domestic sales down 25% at 38,057 units versus 50,470units,YoY Eicher Motors total VECV sales down 23.9% at 3,594 units versus 4,720units,YoY India’s goods and services tax collections rose 6% to Rs 1.03 lakh crore in November, reversing two months of decline, with experts attributing the increase to festive shoppingandbettercompliance. GSTcollectionswereRs97,637 crore in November last year and Rs 95,380 crore in October this year. The increase in collections was a sign of economic revival, recovery in demand and measures to ease compliance, governmentofficialstoldET. “After two months of negative growth, GST revenues witnessed an impressive recovery . During the month, the GST collection on domestic transactions witnessed a growth of 12%, highest during the year,” the government said in astatement. Tax revenue growth has been muted in the current financial year because of slowing growth. Net tax revenue climbed 3.4% in April-October from a year ago. Higher collections will provide some fiscal relief to the government. India’s economic growth slowed to a six-year low of 4.5% in July-September, while nominal GDP growth in the quarter hit a decade low of 6.1%, which would impacttaxes. Collections in November comprised of Rs 19,592 crore of central GST, Rs 27,144 crore of state GST, Rs 49,028 crore integrated GST (including Rs 20,948 crore collected on imports) and cess of Rs 7,727 crore. The total number of GSTR 3B returns filed for October up to November30was77.83lakh. Throughout, our previous journey we were discussing the e n t r y p o i n t , psychology behind the entry point and the stop loss which means when to exit in case the market is not in your favour or to put in other words the direction of the market is not as per your forecast. But we did not discuss what is the exit point in case the market is in the same direction which you could forecast. No worries, we would discuss the same in this article. The exit points which technically are known as targets can be identified studying S & R (support and resistance). Simply, Support point is a place where you would find more buyers eventually they would not let the sellers take control of the market and allow the price to go below that point and resistance is a point where you find more sellers. Sellers would not allow bulls to take control beyond that point and allow the prices to rise abovethatpoint. To understand support and resistance one needs to plot the market data in a chart, 6 months to 12 months charts are good for taking positional calls and 3 months to 6 months charts are good to understand the levels for short term trading to intra day trading. If these points are studied in isolation they may be considered entry points as well. • Technical analysts use support and resistance levels to identify price points on a chart where the probabilities favor a pause, or reversal, of a prevailing trend. • Support occurs where a downtrend is expected to pause,due to a concentration of demand. • Resistance occurs where an uptrend is e x p e c t e d t o p a u s e temporarily, due to a concentration of supply. • Market psychology plays a major role as traders and investors remember the past and react to changing conditions to anticipate future market movement. Now if you recall few bull candle patterns we studied for example bullish engulfing pattern, we studied that aggressive traders will take entry near the close of the candle and conservative traders would take a position after the confirmation candle next day. Stop loss would be low of the previous candle. In this example the trader has taken a long position after technically analysing the market, now the most important point is when to get out of this trade when you are in profits. This can easily be done by analysing the resistancelevels. So, with the help of resistance points, he may plan toexithistrade. There are different ways in which we can calculate support andresistancelevelsnamely Trendlines Movingaverages Roundnumbers Fibonacci. We would discuss them in detailincomingarticles. by Nitin Shahi Demystifying Technical Analysis Support and resistance November GST collections up 6%

- 2. Wednesday 04 December, 2019 STOCK REPORT RBI expected to cut rates on December 5 The central bank is likely to cut interest rates for the sixth straight time on 5 December despite a surprise spike in inflation, as the Reserve Bank of India (RBI) seeks to reverse a protracted growth slowdowninAsia’sthird-largesteconomy. Eight out of 10 economists and treasury heads surveyed by Mint expect RBI’s monetary policy committee (MPC) to cut the repo rate, at which RBI lends to banks, by 25 basis points (bps) to 4.9%, while maintaining an accommodative stance. Two expect the RBItocutratesby15bps. Economic growth has slowed to 4.5% in the September quarter, its weakest pace since 2013, despite a cumulative 135bps cut in policy rates this year. Indian banks, saddled with record bad loans, have failed to transmit theratecutstoborrowers. Output of capital goods, which indicates investment activity in manufacturing, contracted 20.7% in September against a 6.9% expansion in the year-ago period. After the October MPC meeting, governor Shaktikanta Das said the central bank will maintainitsaccommodativestanceaslongas it is necessary to revive growth, even as it ensuresthatinflationremainswithintarget. “Completely in line with our expectation, GDP in Q2 printed a 26 quarter low with most sectors showing a decline. Core GVA (gross value added) excluding agriculture and government services has printed a low of 3.4%. Thisfurtheremphaticallyunderscoresthe need of policy focus shifting to reviving growth.WecontinuetoexpectRBItoexecute another rate cut in December of 25bps," Shubhada Rao, chief economist at Yes Bank, saidinaresearchnote. HDFC Bank, the most valuable Indian lender, sees signs of revival in rural areas HDFC Bank Ltd., India’s most valuable lender by market capitalization, sees tentative signs of a revival in rural areas at a time when thewidereconomyissputtering. “The recent loan outreach programs underway in rural areas have given us the sense that the consumption in rural and semi-urban areas is turning more positive,” HDFC Bank Executive Director Kaizad Bharucha said in an interview last week. The rural and semi-urban sector,whichaccountsforatleasthalf of India’s output, got 48% of the bank’s total loans as of end- September. Prime Minister Narendra Modi’s government has unveiled several steps to boost the economy, which is growing at its weakest pace in more than six years, including a surprise $20 billion corporate tax cut. The Reserve Bank of India is expected to cut interest rates again this week, after Friday’s report that gross domestic product growth slowed to 4.5%intheSeptemberquarter. For HDFC Bank, the weaker economy had led to a slowdown in loan growth, which eased to 15% in the September quarter from 23% a year earlier. But it remained healthy compared with the overall banking system which saw credit growth slowing to a two-year low just above 8%. “As a bank we are well positioned to offset a slowdown in either the consumption or investment side as we are present across the spectrum,” Bharucha said. “The demand for credit is not going away. It may just be subdued He’s also cautiously optimistic about the outlook for corporate investment, based on the bank’s soundingswithIndianexecutives. Muted loan growth has hardly dented the upward march in HDFC Bank’s shares, which are about 20% higher so far this year. Now valued at about$96billion,thecompanytrades around 26 times projected 12 month earnings. That’s almost three times more expensive than the Bloomberg World Banks Index and is the biggest valuationpremiumonrecord. Meanwhile, non-bank lenders from Dewan Housing Finance Corp Ltd. to Reliance Capital Ltd. have been reeling under a 17-month credit crisis after Infrastructure Leasing & FinancialServicesLtd.defaultedonits debt last year. In a further blow to confidence, the Securities and Exchange Board of India placed curbs on operations of Karvy Stock Broking Ltd. after finding evidence it misused clientfunds. Finance minister Nirmala Sitharaman said therecentcorporatetaxratecutwasaimedat attracting investments and creating jobs while clarifying that the reduction in minimum alternate tax was applicable from thebeginningofthecurrentfinancialyear. “We think we will attract investment by reducing tax rate,” she told Parliament, while adding that several countries had done the same. She was speaking during the debate on the Taxation Laws (Amendment) Bill that was passed by the Lok Sabha, replacing a September 20 ordinance. The MAT clarification would have come as a relief as the text of the bill had said the relief would be applicable from the next financial year rather than the current one as mentioned in the ordinance. Tax rate cut aimed at attracting investments: Finance Minister Derivative Analysis Owner & Publisher FINDOC CAPITAL MART PRIVATE LIMITED, Printed by Rakesh Kumar Prop. of Bhagotra Printers , 111 Sukhdev Market, Back Side Kailash Cinema, Nr. Petrol Pump, Civil Lines, Ludhiana and Published by 5th Floor, Kartar Bhawan, Nr. PAU Gate No.1, Ferozepur Road, Ludhiana. By the Nitin Shahi, Editor of Findoc Prime. Name Current Price Market Capitalizatio Return on capital employed Price to Earning Sales growth K E C Intl. 278.3 7154.77 28.63 13.28 10.67 Kajaria Ceramics 522.05 8298 23.87 29.96 6.98 Kalpataru Power 449.55 6955.23 22.18 15.52 25.44 Metropolis Healt 1374.65 6897.81 43.98 50.47 17.62 Minda Inds. 349.55 9165.79 21.57 37.29 7.01 Natl. Aluminium 43.45 8106.11 25.99 12.52 -11.84 NBCC 37.35 6723 31.99 38.24 -0.58 NIIT Tech. 1462.1 9126.12 29.83 21.84 20.37 Persistent Sys 681.2 5243.53 20.09 15.21 6.18 Proc. Gam. Heal. 4331.95 7191.04 78.16 8.6 8.63 Rites 280.25 7006.25 31.8 11.66 36.73 Sheela Foam 1310 6390.55 27.7 36.67 0.85 Solar Inds. 1060.25 9594.21 26.5 32.46 12.68 Sterlite Tech. 125.2 5056.58 31.25 8.27 62.44 Sundram Fasten. 467.8 9828.48 27.45 24.87 18.24 Symphony 1131.45 7915.28 21.62 56.14 35.82 Timken India 884.3 6651.59 21.67 36.16 14.85 TTK Prestige 5684.6 7879.65 26.8 36.25 8.59 Tube Investments 488.95 9182.9 20.73 32.36 -0.38 V I P Inds. 425.45 6012.35 37.81 41.22 13.66 V-Guard Inds. 232.2 9930.7 25.98 48.99 9.58 VST Inds. 4223.35 6520.85 56.27 25.03 11.24 Name Current Price Market Capitalization Return on capital employed Price to Earning Sales growth Aegis Logistics 195.05 6625.2 20.92 48.56 35.22 Ajanta Pharma 989.9 8637.99 23.85 22.29 3.8 Akzo Nobel 1921.2 8749.21 24.15 36.93 0.02 Astrazeneca Phar 2811.6 7029 26.51 93.91 35.95 Avanti Feeds 495.3 6748.25 36.49 19.11 15.45 Bharat Dynamics 332.15 6087.69 31.6 12.57 -23.32 Blue Star 797.35 7679.59 24.94 37.99 14.56 Bombay Burmah 1083.65 7560.83 40.47 8.36 11.58 Carborundum Uni. 330.7 6259.5 21.45 26.33 7.65 Cochin Shipyard 400.1 5262.93 22.24 9.48 20.08 DCMShriram 336.4 5345.23 28.56 6.23 7.6 Engineers India 104 6571.88 24.61 17.48 35.71 ERIS Lifescience 445.45 6125.82 26.43 19.69 9.64 Escorts 662.5 8120.93 24.26 18.14 23.77 Fine Organic 1793.3 5498.25 43.16 35.51 23.9 Finolex Cables 365 5582.29 23.16 15.27 4.67 Finolex Inds. 586 7272.26 20.74 21.06 11.68 Galaxy Surfact. 1460.05 5176.57 30.28 29.77 1.94 Godrej Agrovet 485.55 9324.59 20.55 36.09 15.74 Graphite India 299.75 5857.12 118.56 3.28 -18.94 Grindwell Norton 583 6454.98 23.47 36.17 3.68 High Open Increase Low Interest (%) 7.95 6.95 63.3 60.15 467.3 454.5 39.45 38.3 52.2 51.2 13.3 12.15 105.5 104.05 379.6 367.55 Symbol 1,26,00,000 2.28% YESBANK 60.5 -2 -3.20% 23,42,53,800 Chg (%) Last Price Increase in OI IDEA 7.1 -0.75 -9.55% 56,50,68,000 18,93,573 4.96% SAIL 38.5 -1.15 -2.90% 7,41,84,000 21,03,200 0.91% BHARTIARTL 457.5 -3.15 -0.68% 4,00,64,895 -6.49% 8,93,62,000 15,72,000 2.16% BHEL 51.3 -0.2 -0.39% 4,28,40,000 10,24,800 6.41% Chg (Rs) 11,02,500 1.66% RBLBANK 369.3 -4.7 -1.26% 1,70,23,200 12,18,000 1.38% BANKBARODA 104.3 -0.75 -0.71% 6,74,95,500 14,10,000 3.40% DISHTV 12.25 -0.85 High Open Increase Low Interest (%) 298 288 343.5 340.7 107.75 105.2 283.5 279.25 159.4 156.8 1,635.55 1,600.00 549.8 533 4,013.95 3,915.15 Symbol Last Price Increase in OI BIOCON 289 3.95 1.39% 8,89,32,000 15,00,000 1.72% EQUITAS 106.25 1.05 1.00% 1,17,73,800 20,28,600 20.82% SBIN 342.3 1.75 0.51% 1.95% 1,91,01,000 4,74,000 2.54% MANAPPURAM 157.85 0.4 0.25% 1,29,08,000 6,44,000 5.25% PETRONET 280.25 1.4 0.50% 80,28,750 2,12,250 2.72% 25,29,800 2,31,000 10.05% BAJFINANCE 3,996.65 34.5 0.87% 22,26,000 2,35,500 11.83% JUSTDIAL 546.95 7.15 1.32% 1,66,92,000 2,76,000 1.68% JUBLFOOD 1,627.35 31.15 Chg (Rs) Chg (%)

- 3. Wednesday 04 December, 2019 Shiv Sena Chief Uddhav Thackeray was sworn in as Maharashtra Chief Minister at a grand ceremony in Mumbai’s Shivaji Park onThursday. Along with Uddhav, six ministers — Eknath Shinde and Subhash Desai from the Shiv Sena; Jayant Patil and Chhagan Bhujbal from the NCP and Balasaheb Thorat and NitinRautfromtheCongress—tookoath. Maharashtra Governor Bhagat Singh Koshyari administered the oath to Thackerayandhisministers. Many in the massive crowd at Shivaji Park were in tears when the saffron-clad Uddhav bowed down before them after taking the oath. Shivaji Park has been at the centre of Shiv Sena’s politics for over five decadesnow. It was here in 1966 that Uddhav’s father Bal Thackeray addressed his first rally; it was in the very same place that he was cremated,in2012. Senior Congress leaders, including Madhya Pradesh Chief Minister Kamal Nath, Ahmed Patel and Kapil Sibal, attended the ceremony. MK Stalin, TR Baalu, Shankarsinh Vaghela and Uddhav’s estranged cousin Raj Thackeray marked their presence. NCP President Sharad Pawar, who is the architect of the new alliance, was welcomed with applause whenhecameonthedais. Gross Domestic Product growth falls to 4.5% in Q2 of 2019-20 The Gross Domestic Product continued its downward spiral for the seventhconsecutivequarter,fallingto4.5 per cent in the second quarter (July- September) of the year 2019-20. This is a fall of 0.5 per cent points compared to the last quarter. Compared to the second quarter of the year 2018-19, it is a fall of 2.6 per cent points. In the second quarter of the previous year, the GDP growth stoodat7.1percent. The GDP growth seen in the last quarter was slowest in more than six years. The previous low was recorded at 4.3 per cent in the final quarter (January- March)of2012-13. India's GDP growth for the previous quarterwasthelowestinoversixyears The GDP numbers were released along with the data for the eight core infrastructure industries, which showed output delcining by 5.8 per cent in October. As many as six of eight core industries saw a contraction in output in October. Coal was the worst hit, declining steeplyby17.6percent. The GDP numbers for the July- September quarter today come after six consecutive quarters of falling GDP growthrate. The GDP growth rate for the first quarter of 2019-20 settled at 5 per cent, a six-year low. The slowdown in economic growth has taken away from India the tag of world's fastest growing major economy to China. India's growth rates in the Q4 2018-19 and Q1 2019-20 were slowerthanthatofChina,whichisamuch biggereconomy. India's economic growth has taken a hit due to a number of factors - including slowdown in private consumption, investment and export - but the key indicator is lack of credit (money to produce goods) growth and demand in themarket. The Narendra Modi government has taken a slew of reforms in recent months to boost credit in the market - focusing on offering incentives to banks to increase lending-buttolittleavail. These measures include slashing of the lending rate (the rate that is linked to banks' interest rates) by the Reserve Bank of India five times this year, withdrawal of 'super-richsurcharge'imposedonforeign investors, exemption of start-ups from 'angel tax', an infusion of Rs 70,000 crore inpublicsectorbanksandasignificantcut inthecorporatetaxrate. However,analystsandexpertswereof the view that the government did not do enough to address the issue of slowdown in demand. They argued that declining demand is among the prime reasons for economicslowdown. The concern expressed by economists is in sync with what Union Finance Minister Nirmala Sitharaman said earlier this month. She had ruled out revival of economy any time soon while asserting that the government was doing everythingpossible. "It is too presumptive of me to say it [economic slowdown] has bottomed out," Sitharaman had said speaking to reporters earlier this month, fueling speculation that India's economy is yet to seetheworstoftheongoingdownturn. Govt makes hallmark for Gold jewellery and artefacts mandatory from 2021 to ensure purity of precious metal Hallmarking for Gold jewellery and artefacts will be mandatory from 15th January 2021. Briefing reporters in New Delhi, Consumer Affairs Minister Ram Vilas Paswan said, notification in this regard will be issued by 15 of January next year, giving a period of one year for implementation. He said, JewellersandRetailerswillgetoneyear time for clearing their old or existing stock. Mr Paswan said, more than 26 thousand jewellers have taken the Bureau of Indian Standards, BIS (Hallmarking)registrationtillnow. Our correspondent reports that if anyone is found violating the set rules after 15th January 2021, they may attract a fine of minimum one lakh rupees or five times the value of the itemsorajailtermofoneyear. Uddhav Thackeray sworn in Maharashtra CM FPIs remain net buyers for third month; invest Rs 22,872 cr in Nov Foreign investors remained net buyers in the Indian capital market for the third straight month in November this year, putting in 22,872 crore rupees on a net basis. Analysts said expectations of a trade deal between the US and China, and more relief measures, as well as disinvestment drive by the government among other factors, helped keep FPIs stuck on the capitalmarkets. A net sum of 25,230 crore rupees was flowed into equities by FPIs in November. However, they pulled out around 2,358 crore rupees from the debt segment, translating into a total investment around 22,872crorerupeesbyFPIsinNovember. FPIs had invested around 16,038 crore rupees in October and around 6,558 crore rupeesinSeptemberthisyear. At ₹3,600 crore, its offer is twice asmuchasAirtel’s Reliance Jio Infocomm (RJio) has emerged as the highest bidder for Reliance Communications’ (RCom) tower and fibre assets, with the company controlled by Asia’s richest person Mukesh Ambani placing a ₹3,600-crore bid. Bharti Airtel’s bid for the same assets, housed under RCom subsidiary Reliance Infratel, is at₹1,800crore,accordingtosources. RJio, which did not bid for the entire assets put out for auction, has committed to making the payments within 60 days adding that the evaluation process by SBI Caps is currently on. Bids submitted by other bidderscouldnotbeascertained. Bharti Airtel has made a conditional bid for RJio’s assets, which excludes all properties and datacentres,sourcessaid. The process of finalising the bids will take a minimum of one to two weeks as the Committee of Creditors (CoC) will have to meet every bidder and negotiate a final price. Following the negotiations, the CoC will have to finalise a bidder based on voting by the members, sources added. When contacted, spokespersons of RJio and Airteldeclinedtocomment. According to media reports on Thursday, Bharti Airtel has submitted conditional bids of about ₹9,500 crore for RCom assets, including spectrum, mobile towers and optical fibre. Lastdateforresolution Thelastdateforcompletionofthe resolution process is January 10, 2020, following an extension received from National Company Law Tribunal (NCLT) earlier. However, the process is likely to overshoot this deadline,thesourcesadded. BeleagueredtelecommajorRCom had received a total of 11 bids from four companies for assets housed under various subsidiaries. Apart from RJio and Sunil-Mittal backed Bharti Airtel, PE firm Varde Partners and UV Asset Reconstruction Company (UVARCL) were the others inthefray. Rjio emerges top bidder for RCom tower, fibre assets Scheme Name AuM (Cr) 1Y 2Y 3Y 5Y 10Y Axis Small Cap Fund - GrowthSmall Cap Fund 1,199.83 20% 6% 14% 11% - HDFC Small Cap Fund - GrowthSmall Cap Fund 9,137.06 -8% -6% 10% 9% 12% Kotak Small Cap Fund - GrowthSmall Cap Fund 1,300.23 6% -5% 7% 8% 13% DSP Small Cap Fund - Regular Plan - GrowthSmall Cap Fund 4,905.06 -2% -12% 1% 8% 17% Franklin India Smaller Companies Fund - GrowthSmall Cap Fund 7,030.82 -4% -10% 3% 7% 15% Mutual Fund Section About a billion mobile phone subscribers will pay up to 40% or so more to make calls and use data from this month, with private operators Reliance Jio Infocomm, Bharti Airtel and Vodafone Idea increasing prices for the first time since2016toshoreupfinances. While loss-making Vodafone Idea and Airtel face a Januaryend deadline to pay up thousands of crores in additional statutory dues, Jio on Sunday said it took the step “to help sustain” the telecom industry, which is burdened with over Rs 7 lakh crore of debt and the world’s lowestaveragerevenueperuser(ARPU). Analysts said the increases would be the biggest in India’s telecom industry, with pricing of voice services back for most plans. The government nudged the three telcos to bite the bullet after a prolonged price war since 2016 damaged industry finances and heavily hurt revenues. Vodafone Idea, which had over 311 million users in September, and Bharti Airtel (about 280 million subscribers), as per company data, also scaled down data offers or tweaked prices to force customers to spend more to continue getting the same benefits, the two operators said in separate statements on Sunday. Both increased rates only for prepaid subscribers, who account for over 90% of their user base, starting December 3. Price increases by Jio, which caters to 355 million customers, will be effective from December6. Low tariff regime over, telcos up rates by 40-50 per cent

- 4. Wednesday 04 December, 2019 Should NRIs File Income Tax Return in India The successful leader is one who has knowledge and is a leader by virtue of knowledge and should lead as an example. He should also value relationship no matter how successful he becomes. A man died leaving behind his wife and his son. After his death, family had to face financial crisis. His wife sent his son to sell a necklace which was given to her by the man when he was alive. She asked to go to one of the goldsmithswhowasfriendofher husband. The son went to the goldsmith who was friend of his father and in that sense his uncle, to sell the necklace, his uncle told that the markets are down and he should not sell the necklace, but to help the family, he gave some money to boy and also told him to come to his shop tolearnthebusiness. In months the boy learned to examine jewels and pearls. He slowly became an expert valuer. His uncle told him that the markets are now booming and now he can get the necklace valued. He went to his mother and asked for the necklace and he wassurprisedtoknowthatitwas an artificial jewellery. Surprised, he went back to his uncle and told that it was artificial and you didnottellme. His uncle told that they were in need of money and if I had told you that time, you must have thought bad of him. To retain relationship I gave you some money and taught you the business now you are renowned valuer and can examine jewels and pearls himself. Now you are selfdependent. The uncle was praised and respected like a mentor by the family. Thus this short story gives two lessons that Knowledge is powerRespectrelationship. By Nitin Shahi In the last 3 decades, Indian economy has integrated itself with the global economy which has led to increased immigration from India and increase in Indian diaspora across the world. These Indians who have now acquired NRI status often face challenges in complying with Income Tax Laws in India. This is due to lack of awareness and misconceptions about what constitute Income in India. NRIs who havenot been filingIncome Tax Return in India can be broadly categorizedinthreecategories: o Having Income in India above the taxablelimit oHavingassetsbutnoIncomeinIndia o Having income below the threshold limitofwhatconstitutestaxableincome Indian government over the past few years have been gradually pushing for linkage of all assets (including properties and its transactions) and sale/purchase of all financial assets with PAN card and Aadhar Card. NRIs falling in the last two categories as mentioned above will face challenges at the time of repatriation or claiming back TDS deducted at thetimeofsaleofproperty. Majority of NRIs have either not filed Income Tax Returns in India or they have been filing I n c o m e Ta x R e t u r n s erroneously as Resident Indians. Then there are NRIs who are non-compliant as perIncomeTaxLawsinIndiaisconcerned as inspite of having income in India. This oversight or carelessness can be attributed to some of the commonly held misconceptionsbythesepeople: 1. They don’t need to file Income Tax Returns as they do not earn a salary or ownabusinessinIndia. 2. Banks and other financial institutions have already deducted TDS, so there is no need to pay tax in India, hence filing of tax returns in India is not necessary. 3. Based on their residency in a tax-free country and their income in India is below the threshold limit, therefore, they need not file an income taxreturninIndia. 4 . T h e y o w n a fe w propertiesinIndiaandhaveno other source of income in India, so why should they file an Income- taxreturninIndia? 5. Rental income is their only source of income and it is belowthe threshold limit therefore they are not required to file a taxreturn. NRIs must file Income Tax Return in Indiaif: 1. NRIs have an income above the thresholdlimitofINR2,50,000lakhs 2. TDS has been deducted by banks or anyfinancialinstitutions 3. TDS has been deducted at the time ofsaleofpropertyinIndia 4. NRIs have Long Term Capital Gains Tax on account of sellingof any assets like Mutual Funds, Equity, Private Equity or propertyinIndia 5. If they have an Indian credit card in their possession and they made few transactions 6. If there have been cash deposits in theiraccount 7. If NRIs want to claim the benefits of DTAA 8. If they own more than two propertiesinIndia Many a times, by not Filing Income Tax Returns NRIs end up losing the benefit of getting a refund for TDS, especially in case of sale of property (as the TDS is 20%+surcharge + cess) which had been deductedatahigherrate. In conclusion, NRIs must file Income Tax Returns in India even if their income is below the taxable income to avoid future assessment notices and peace of mind. by Shammi Khanna The Wisdom Tooth INDEX OPEN CLOSE NET CHANGE %age NIFTY 12110.20 12048.20 -62.00 -0.51% BANK NIFTY 31692.85 31871.45 178.60 0.56% NIFTY IT 15174.65 14852.00 -322.65 -2.13% NIFTY AUTO 8197.35 8012.75 -184.60 -2.25% NIFTY PHARMA 8242.80 8128.95 -113.85 -1.38% NIFTY FMCG 31137.80 30889.50 -248.30 -0.80% NIFTY METAL 2614.60 2632.65 18.05 0.69% NIFTY REALITY 281.75 281.05 -0.70 -0.25% INDEX OPEN CLOSE NET CHANGE %age DOW JONES 28,080.75 27,783.04 -297.71 -1.06% S&P 500 3,134.85 3,113.87 -20.98 -0.67% NASDAQ 8,635.40 8,567.99 -67.41 -0.78% CAC 5,927.41 5,786.74 -140.67 -2.37% DAX 13,256.40 12,964.68 -291.72 -2.20% HANG SENG 27,183.90 26,361.74 -822.16 -3.02% OPEN CLOSE NET CHANGE %age USDINR 71.6840 71.6350 -0.0490 -0.0684% EURINR 78.9640 79.3430 0.3790 0.4800% GBPINR 92.4780 92.6990 0.2210 0.2390% JPYINR 0.6578 0.6571 -0.0007 -0.1064% OPEN CLOSE NET CHANGE %age COPPER 433.70 432.10 -1.60 -1.22% NICKEL 1064.90 1009.90 -55.00 -5.16% ZINC 186.00 182.20 -3.80 -2.04% ALUMINIUM 131.00 134.60 3.60 2.75% CRUDE 4151.00 4008.00 -143.00 -3.44% LEAD 152.85 152.35 -0.50 -0.33% GOLD 37696.00 37952.00 256.00 0.68% SILVER 44110.00 44344.00 234.00 0.53% PRECIOUS METALS Weekly Capsule 26/11/2019-02/12/2019 INDEX PERFORMANCE GLOBAL INDICES CURRENCIES COMMODITIES Date EQUITY DEBT 28-Nov-19 -122.65 2,620.08 27-Nov-19 434.01 4,054.42 26-Nov-19 -3,673.45 990.16 Value in Crores Date EQUITY DEBT 29-Nov-19 -751.15 190.97 28-Nov-19 1,627.69 -1,864.78 27-Nov-19 -1,053.51 506.59 26-Nov-19 4,515.33 -1,219.03 Value in Crores -5000 -4000 -3000 -2000 -1000 0 1000 2000 3000 4000 5000 26-Nov-19 27-Nov-19 28-Nov-19 EQUITY DEBT -3000 -2000 -1000 0 1000 2000 3000 4000 5000 EQUITY DEBT MF SEBI FII SEBI