Vat computation

•

0 likes•244 views

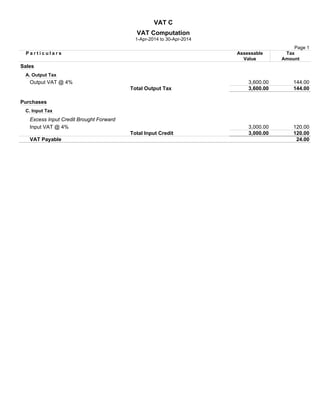

This document summarizes the VAT computation for a company from April 1-30, 2014. It shows the company had Rs. 3,600 in output tax on sales at a 4% VAT rate. The company also had Rs. 3,000 in input tax on purchases at a 4% VAT rate. After accounting for input tax, the company's VAT payable is Rs. 24.

Report

Share

Report

Share

Download to read offline

Recommended

Sales tax numerical format,Comprehensive format for sales tax numerical,sales...

Sales tax numerical format,Comprehensive format for sales tax numerical,sales...Muhammad Shafique Javed

EU Fiscal Representation Services vis our Antwerp port office

EU Fiscal Representation Services vis our Antwerp port officeUnited Shipping Services. India - Benelux

Recommended

Sales tax numerical format,Comprehensive format for sales tax numerical,sales...

Sales tax numerical format,Comprehensive format for sales tax numerical,sales...Muhammad Shafique Javed

EU Fiscal Representation Services vis our Antwerp port office

EU Fiscal Representation Services vis our Antwerp port officeUnited Shipping Services. India - Benelux

How foreign investors can adapt to Brazilian systems: overview of taxation, t...

How foreign investors can adapt to Brazilian systems: overview of taxation, t...Moura Tavares Advogados

More Related Content

What's hot

How foreign investors can adapt to Brazilian systems: overview of taxation, t...

How foreign investors can adapt to Brazilian systems: overview of taxation, t...Moura Tavares Advogados

What's hot (13)

How foreign investors can adapt to Brazilian systems: overview of taxation, t...

How foreign investors can adapt to Brazilian systems: overview of taxation, t...

French Law Matters - Family Matters Involving French Property

French Law Matters - Family Matters Involving French Property

What every attorney needs to know about their clients doing business in Europe

What every attorney needs to know about their clients doing business in Europe

Passcard - Chapter 11: Returns and Payments | Taxation & VAT - UAE | Skillmou...

Passcard - Chapter 11: Returns and Payments | Taxation & VAT - UAE | Skillmou...

Vat computation

- 1. VAT C VAT Computation 1-Apr-2014 to 30-Apr-2014 Page 1 P a r t i c u l a r s TaxAssessable AmountValue Sales A. Output Tax Output VAT @ 4% 144.003,600.00 Total Output Tax 144.003,600.00 Purchases C. Input Tax Excess Input Credit Brought Forward Input VAT @ 4% 120.003,000.00 Total Input Credit 120.003,000.00 VAT Payable 24.00