Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

Annuities: Stabilize and Boost Retirement Income, Bobby M Collins #AnnuityEdu...

Annuities: Stabilize and Boost Retirement Income, Bobby M Collins #AnnuityEdu...

Survivor universal life insurance 4088541883 san jose california connie dello...

Survivor universal life insurance 4088541883 san jose california connie dello...

Different types of Life insurance products with real.pptx

Different types of Life insurance products with real.pptx

Investing in annuities a little at a time(finished)

Investing in annuities a little at a time(finished)

A Simple Guide to Understanding Whole Life and Term Life Insurance

A Simple Guide to Understanding Whole Life and Term Life Insurance

Can’t pay your life insurance premiums? These are your options

Can’t pay your life insurance premiums? These are your options

How can you choose the right type of Life Insurance?

How can you choose the right type of Life Insurance?

Viewers also liked

The Indian Dental Academy is the Leader in continuing dental education , training dentists in all aspects of dentistry and offering a wide range of dental certified courses in different formats.

Indian dental academy provides dental crown & Bridge,rotary endodontics,fixed orthodontics,

Dental implants courses.for details pls visit www.indiandentalacademy.com ,or call

00919248678078Growth of maxilla /certified fixed orthodontic courses by Indian dental acad...

Growth of maxilla /certified fixed orthodontic courses by Indian dental acad...Indian dental academy

Viewers also liked (18)

ENJ-100 Presentación de Informe No. 5 Modificado de Ordinario - Taller Requer...

ENJ-100 Presentación de Informe No. 5 Modificado de Ordinario - Taller Requer...

Growth of maxilla /certified fixed orthodontic courses by Indian dental acad...

Growth of maxilla /certified fixed orthodontic courses by Indian dental acad...

Escritores Da Liberdade - Versao Para DistribuiçãO

Escritores Da Liberdade - Versao Para DistribuiçãO

Similar to Nest Funding One Pager

Similar to Nest Funding One Pager (20)

BARRIERS ENCOUNTERED BY APARTMENT RENTAL BUSINESS in manila

BARRIERS ENCOUNTERED BY APARTMENT RENTAL BUSINESS in manila

BARRIERS ENCOUNTERED BY APARTMENT RENTAL BUSINESS in manila

BARRIERS ENCOUNTERED BY APARTMENT RENTAL BUSINESS in manila

BARRIERS ENCOUNTERED BY APARTMENT RENTAL BUSINESS in manila

BARRIERS ENCOUNTERED BY APARTMENT RENTAL BUSINESS in manila

BARRIERS ENCOUNTERED BY APARTMENT RENTAL BUSINESS in manila

BARRIERS ENCOUNTERED BY APARTMENT RENTAL BUSINESS in manila

What is Fractional Ownership in Real Estate and How Does it Work

What is Fractional Ownership in Real Estate and How Does it Work

Yaser Nasser Alulait tells How to invest in Real Estate?

Yaser Nasser Alulait tells How to invest in Real Estate?

Which is a better investment- Fixed Deposits vs. Real Estate (1).pdf

Which is a better investment- Fixed Deposits vs. Real Estate (1).pdf

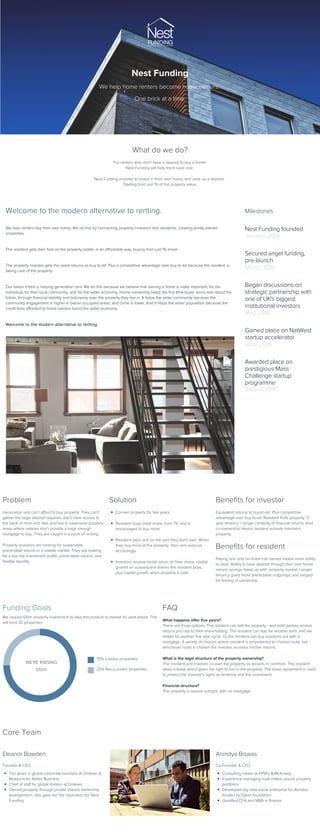

Nest Funding One Pager

- 1. Nest Funding We help home renters become home owners. One brick at a time. What do we do? For renters who don't have a deposit to buy a home, Nest Funding will help them save one. Nest Funding enables to invest in their own home, and save up a deposit. Starting from just 1% of the property value. Problem Generation rent can't afford to buy property. They can't gather the large deposit required, don't have access to the bank of mum and dad, and live in expensive property areas where salaries don't provide a large enough mortgage to buy. They are caught in a cycle of renting. Property investors are looking for sustainable, predictable returns in a volatile market. They are looking for a low risk investment profile, predictable returns, and flexible liquidity. Solution Co-own property for five years Resident buys small share, from 1%, and is encouraged to buy more Resident pays rent on the part they don't own. When they buy more of the property, their rent reduces accordingly Investors receive rental return on their share, capital growth on subsequent shares the resident buys, plus capital growth when property is sold Benefits for investor Equivalent returns to buy-to-let. Plus competitive advantage over buy-to-let: Resident finds property. 5 year tenancy = longer certainty of financial returns. And co-ownership means resident actively maintains property. Benefits for resident Paying rent only on share not owned means more ability to save. Ability to save deposit through their own home means savings 'keep up with' property market. Longer tenancy gives more predictable outgoings, and longed- for feeling of ownership. Funding Goals We require £10m property investment to take this product to market for pilot phase. This will fund 30 properties. WE'RE RAISING £10m 75% London properties 25% Non-London properties FAQ What happens after five years? There are three options. The resident can sell the property - and both parties receive returns pro rata to their shareholding. The resident can stay for another term, and we restart for another five year cycle. Or the resident can buy investors out with a mortgage. A variety of choices where resident is empowered to choose route; but whichever route is chosen the investor receives his/her returns. What is the legal structure of the property ownership? The resident and investor co-own the property as tenants in common. The resident takes a lease which gives the right to live in the property. The lease agreement is used to protect the investor's rights as landlord, and the investment. Financial structure? The property is owned outright, with no mortgage. Core Team Eleanor Bowden Founder & CEO Ten years in global corporate business at Unilever & Blueprint for Better Business Chief of staff for global division at Unilever Owned property through private shared ownership arrangement - this gave her the inspiration for Nest Funding Anindya Biswas Co-Founder & CFO Consulting career at KPMG & McKinsey Experience managing multi-million pound property portfolios Developed big data social enterprise for Ashoka, funded by Gates foundation Qualified CFA and MBA in finance Welcome to the modern alternative to renting. We help renters buy their own home. We do this by connecting property investors and residents, creating jointly-owned properties. The resident gets their foot on the property ladder in an affordable way, buying from just 1% share. The property investor gets the same returns as buy to let. Plus a competitive advantage over buy to let because the resident is taking care of the property. Our raison d'etre is helping generation rent. We do this because we believe that owning a home is really important, for the individual, for their local community, and for the wider economy. Home ownership helps the first time buyer worry less about the future, through financial stability and autonomy over the property they live in. It helps the wider community because the community engagement is higher in owner occupied areas, and crime is lower. And it helps the wider population because the credit lines afforded to home owners boost the wider economy. Welcome to the modern alternative to renting. Milestones Nest Funding founded January 2016 Secured angel funding, pre-launch March 2016 Began discussions on strategic partnership with one of UK's biggest institutional investors May 2016 Gained place on NatWest startup accelerator June 2016 Awarded place on prestigious Mass Challenge startup programme August 2016